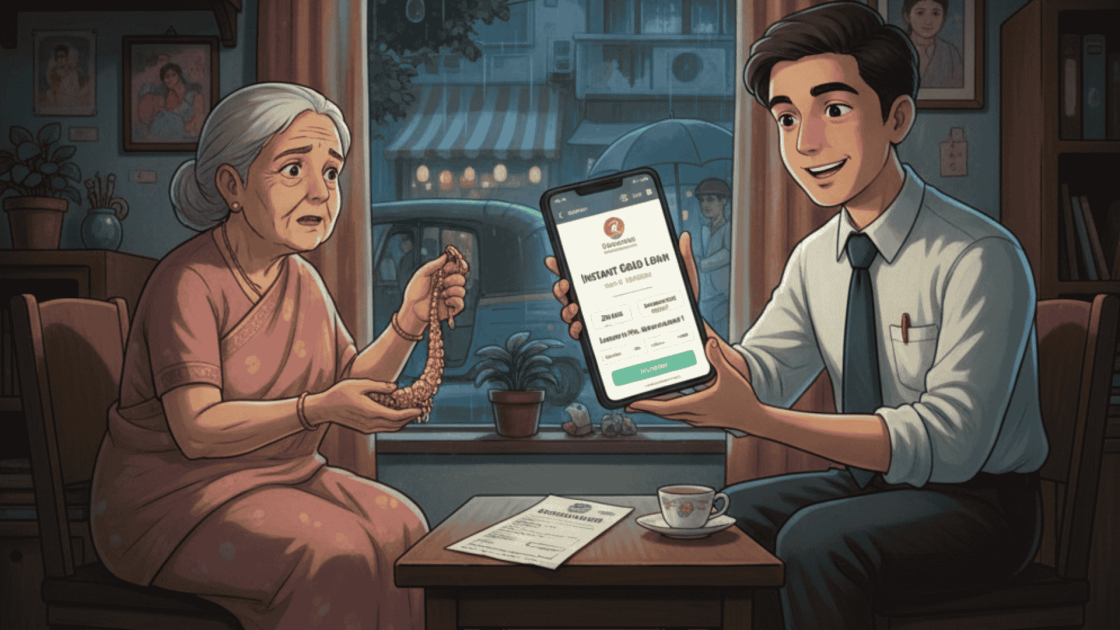

You’ve probably seen ads or online apps promising instant cash against gold. It sounds convenient, right? But not all that glitters is gold; sometimes, it is a scammer’s tactic to trap you in gold loan scams.

Gold loan scams are becoming increasingly common in India, targeting unsuspecting borrowers with fake companies, fraudulent apps, or even insiders misusing their positions.

In this blog, we’ll uncover how these scams work, show you the types of fraud, and guide you on how to spot a scam and report it safely. If you’ve ever considered pledging your gold, reading this could save you from a huge loss.

Gold Loan Frauds in India

A gold loan is a legitimate way to get money by pledging your gold, like jewelry, coins, or bars, as collateral.

The lender, usually a bank or NBFC, gives you a loan based on the current market value of your gold. You pay interest on the loan and get your gold back once you repay. It’s simple, fast, and widely used in India.

However, not every gold loan service provider is genuine.

Here’s how these frauds usually work — and what you should watch out for:

1. Fake Gold Loan Companies and Websites

Fraudsters set up fake gold loan portals or offices claiming to be associated with reputed NBFCs like Muthoot Finance, Manappuram, or IIFL.

They promise:

- Extremely low interest rates (as low as 5%)

- Zero processing fees

- Instant approvals without documentation

Once victims share personal details or make small “processing” payments, the fraudsters disappear — often after stealing KYC data or money.

To stay safe, always verify the company’s registration number (RBI/NBFC) on the RBI website before applying.

2. Gold Collection & Theft Scams

In some cases, scammers pose as bank representatives who offer to collect gold from your home for valuation or loan disbursal.

Victims hand over their jewelry, thinking it’s an official doorstep service, only to discover later that the so-called representatives were fraudsters.

This method is especially common in tier-2 and tier-3 cities, where doorstep banking is less common and trust plays a big role.

Banks and NBFCs rarely collect gold from your home. You must always visit the branch in person for valuation and documentation.

3. Employee or Insider Fraud

Some gold loan scams happen inside legitimate institutions.

There have been cases where employees tampered with pledged gold, replaced original ornaments with fake ones, or forged documents to approve fake loans in customers’ names.

For instance, in 2023, a gold loan branch manager in Kerala was arrested for swapping genuine gold with imitation jewelry worth ₹60 lakh.

Always ask for a proper acknowledgment receipt, purity certificate, and weigh-in confirmation before leaving your gold with any lender.

4. Fake Recovery Agents & Extortion Calls

Fraudsters sometimes call borrowers claiming to be from a gold loan company, saying there’s an outstanding balance or a delay fee.

They threaten legal action or auction of the gold if payment isn’t made immediately, then share fake UPI or bank details for “urgent clearance.”

If you ever receive such a call, contact your bank’s official helpline; never pay through links or numbers sent via WhatsApp or SMS.

5. Phishing and Data Theft

Some scams don’t involve physical gold at all. Fraudsters send emails or ads for “digital gold loans,” asking users to verify PAN, Aadhaar, or bank details.

These phishing sites mimic real NBFCs and collect sensitive data to commit identity theft or financial fraud later.

Gold Loan Scam Cases in India

Gold loan scams aren’t just theoretical—they’re happening across the country, sometimes even involving trusted banks or employees. Here are some examples that show how these scams unfold:

- Telangana (2025): In Chennur, SBI employees were caught sanctioning 42 fake gold loans under their family members’ names, totaling ₹1.58 crore. This shows that even bank insiders can sometimes be part of fraudulent schemes.

- Odisha (2025): In Berhampur, a few individuals pledged fake gold ornaments to private banks, managing to secure over ₹20 lakh in loans before the fraud was detected.

- Andhra Pradesh (2025): At a Union Bank branch in Tirupati, investigators found fraudulent gold loans issued using fake gold ornaments, targeting unsuspecting borrowers.

- Maharashtra (2024): A man from Maharashtra lost over ₹5 lakh after applying for a gold loan through a fake website that copied Manappuram Finance’s branding.

The site offered quick disbursal and asked him to transfer “insurance and processing fees.” Once the payments were made, the website went offline.

These real incidents highlight a key point: gold loan scams can happen anywhere, whether it’s a public-sector bank, private lender, or even an online platform.

Being aware of such cases helps you stay alert and avoid falling victim.

How to Spot Fake Gold Loan Scammers?

Not every gold loan offer is genuine, and scammers are getting smarter every day.

Here’s how you can tell if a lender might be a fraud:

- Check Their Credentials: Make sure the lender is registered with the RBI or a recognized financial institution. Unregistered lenders are a major red flag.

- Too-Good-to-Be-True Offers: If the interest rate is suspiciously low or the loan amount unusually high, pause and think. Scammers lure people with unrealistic deals.

- Upfront Fees: Legitimate lenders don’t ask for processing fees or charges before giving the loan. If someone is asking for money first, be wary.

- High-Pressure Tactics: Beware of lenders who push you to pledge gold quickly or claim the “offer expires today.” A real lender will never rush you.

- Documentation Matters: Always ask for loan agreements, receipts, and repayment schedules. If they avoid paperwork, it’s a warning sign.

- Gold Verification: Make sure your gold is properly tested and valued. Fake gold or undervaluation is a common trick in scams.

- Suspicious Online Apps or Websites: Poorly designed apps, unverified contact details, or requests for personal documents beyond standard KYC can indicate a scam.

Remember: if it feels off, it probably is. Taking these precautions can save you from huge losses.

How to Report a Gold Loan Scam?

If you suspect that you’ve been targeted by a gold loan scam, acting quickly is key. Here’s what you should do:

- File a Police Complaint (FIR): Report the fraud to your local police station as soon as possible. An FIR is the first step in initiating an official investigation.

- File a complaint in Cyber Crime: If the scam happened through an online platform or app, reach out to the cyber crime department. They specialize in handling digital fraud.

- Inform the Bank or RBI: If the scam involves a bank employee or an unregistered lender, alert the bank immediately. You can also escalate the matter to the Reserve Bank of India if necessary.

- Keep All Evidence Safe: Save receipts, loan agreements, messages, emails, and any communication with the lender. These documents are crucial for investigations and improving your chances of recovering money.

- Stay Calm and Act Quickly: The faster you report, the higher the chances of tracing the scammer and recovering your funds.

Remember, gold loan scams are illegal, and authorities are equipped to help victims. Acting immediately and following the right channels makes a big difference.

Need Help?

If you’ve been a victim of a gold loan scam, don’t panic—you’re not alone. You can register with us to report the fraud and get professional assistance.

Conclusion

Gold loans can be a quick and convenient way to get funds, but scams are real and can happen to anyone. From fake lenders to insider fraud, the risks are everywhere.

The key to staying safe is awareness and caution. Always verify the lender, check the gold, avoid upfront fees, and keep proper documentation. If something feels off, don’t ignore it—acting fast can protect both your gold and your finances.

Remember, staying informed and vigilant is your best defense against gold loan scams. Protect your gold, protect your money, and report any suspicious activity immediately.