Ever been promised easy stock profits through a new trading app?

If yes, the GTS-C app may already sound familiar.

Many users say it looked professional at first. However, things reportedly changed once real money was deposited.

This blog breaks down what GTS-C claims, what Indian users experienced, and what official sources indicate, so you can decide if it’s legit or a risk you should avoid.

What is GTS-C App?

At first glance, GTS-C presents itself as a stock trading or investment app. Users are usually added through Telegram or WhatsApp groups.

The pitch sounds attractive.

“Expert tips”, “pre-IPO shares”, and “quick profits” are commonly promised.

However, such offers often raise red flags. Why? Because genuine platforms don’t chase users through private groups.

Above all, GTS-C is mainly promoted through Telegram and WhatsApp groups.

These groups are often introduced as “exclusive stock tip communities.”

Once inside, users notice aggressive messaging.

Admins push members to deposit quickly. Meanwhile, doubts are ignored.

Common observations include:

- Telegram admins are disabling replies

- Fake screenshots of profits

- Removal of users asking about withdrawals

According to SEBI’s Fake Trading App advisory, such closed messaging platforms are frequently used in investment scams.

This strongly suggests manipulated communication and controlled narratives.

Is GTS-C Registered With SEBI?

This is the most important question for Indian investors.

According to SEBI’s official investor awareness documents, only SEBI-registered platforms are allowed to offer investment services in India.

- No SEBI registration for GTS-C was found.

- No verified company details or licence information are publicly available.

This means users have no regulatory protection.

GTS-C App Complaints

Multiple user complaints show similar patterns. Coincidence? Unlikely.

Commonly reported issues include:

- Money collected in personal or mule bank accounts.

- Profits are shown only inside the app.

- Withdrawals are blocked after large deposits.

- Admins are disappearing from Telegram groups.

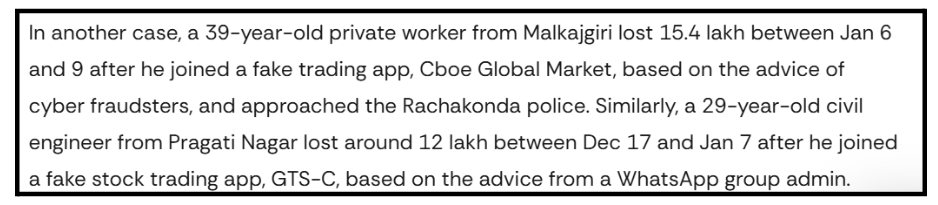

According to The Times of India, Hyderabad cybercrime police reported several cases where victims lost money through fake trading apps using similar methods, including apps named GTS-C.

This indicates a repeating scam structure, not isolated incidents.

Many Indian users describe a similar experience after joining GTS-C.

Most reviews appear on forums, Telegram complaint channels, and social platforms. This feedback indicates a pattern-based issue, not a one-time technical glitch.

- Reddit User – Lost ₹30 Lakh

One person shared on Reddit that they lost nearly ₹30 lakh after depositing savings on GTS-C, with WhatsApp group contacts turning out to be bots and fake withdrawal screens.

This shows a tip-of-the-iceberg pattern where scammers use social engineering before the money disappears.

- Reported Scam Cases in Hyderabad

In recent cybercrime reports from Hyderabad, victims lost between ₹2.75 lakh and ₹12 lakh after joining a fake stock trading app named GTS-C based on WhatsApp recommendations.

Law enforcement is seeing repeated fake trading app frauds using names like GTS-C.

Similarly, a 29-year-old civil engineer from Pragati Nagar reportedly lost around ₹12 lakh after investing through the GTS-C fake trading app, following advice shared by a WhatsApp group admin, and later approached the police.

How to Report Investment Scams?

If you suspect fraud, acting fast matters. Delayed reporting often reduces recovery chances.

Start by collecting basic details.

Keep screenshots, payment proofs, chat records, and app details ready.

You can report the issue on the following platforms:

- File a complaint in Cyber Crime: File a complaint under “Online Financial Fraud”.

- Local Cyber Crime Police Station: Submit a written complaint with transaction details and timelines.

- Bank and Payment Apps: Inform your bank, UPI app, or wallet provider to flag the transaction.

According to Indian cybercrime authorities, early reporting helps track mule accounts and may support recovery efforts.

Need Help?

If you or someone you know is affected by GTS-C or similar fake trading apps, you don’t have to deal with it alone.

If you’re facing this issue, register with us now. Our specialized team provides:

- Legal consultation for fraud victims

- Cybercrime complaint filing assistance

- Documentation preparation for authorities

- Connection with law enforcement agencies

Staying alert today can prevent bigger losses tomorrow.

Conclusion

After reviewing available information, GTS-C raises multiple warning signs. There is no publicly verifiable SEBI registration or company disclosure.

Moreover, Indian user complaints and police reports show losses in lakhs of rupees. Most cases involve WhatsApp or Telegram-based advice and blocked withdrawals.

While investigations in similar cases are ongoing, the existing evidence suggests that GTS-C should be treated as a high-risk platform.

Caution is strongly advised before trusting any app promising fast or guaranteed profits.

For Indian investors, the safest approach is simple.

Always verify SEBI registration and avoid investment advice from private groups.

Staying alert today can prevent serious losses tomorrow.