You must have probably heard someone near you speak about issues with brokerage platforms out there. Mainly, if you trade or invest in India regularly, then you must have faced this too. It seems like these issues are part of trading nowadays. Even well-known companies are not immune.

Yes, you heard it right. One of the biggest brokerage companies in India, HDFC Securities, has also faced technical glitch reporting. These issues have left customers irritated and occasionally out of pocket.

In this blog, we’ll discuss some actual instances of technical glitches that happened with the traders on the HDFC Securities platform. Will also discuss the importance of these bugs, how to report them, and all other important things. But before that, let us have a sneak peek into HDFC Securities.

HDFC Securities Not Working

HDFC Securities Ltd. is a prominent retail stockbroker in India. They are members of the HDFC Group, a reputable financial company with millions of customers. They mainly provide a comprehensive range of investment services.

However, there are a few instances where the broker’s app stops working and a technical glitch in the Stock Market, leading to losses.

Unfortunately, problems are not merely hypothetical; they have occurred on several occasions. These are examples that have been documented:

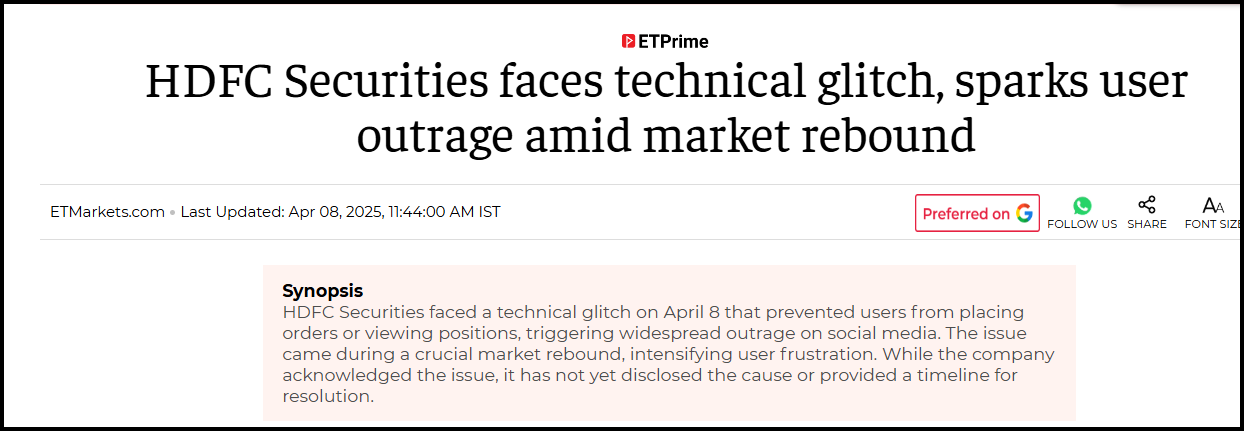

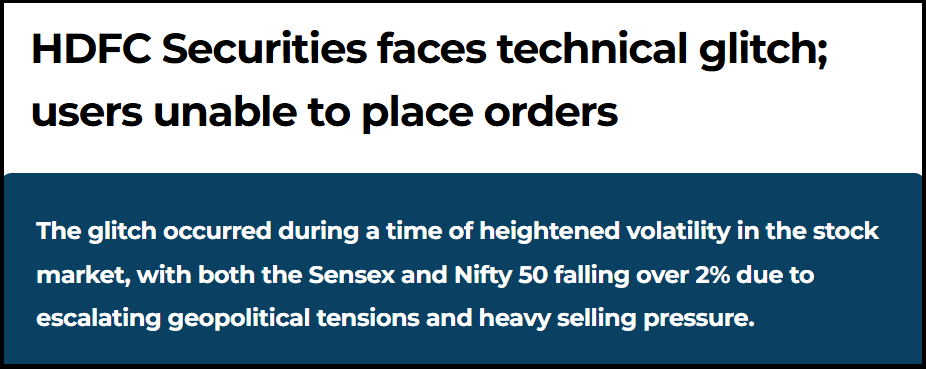

1. Trading App Outage During Market Rebound on April 8, 2025

On April 8, 2025, users of the HDFC Securities trading app and web platform experienced a temporary service disruption during a crucial trading session. The issue occurred as Indian equity markets were recovering strongly after a previous decline, drawing heightened participation from traders looking to re-enter positions, book profits, or rebalance portfolios.

During the outage, several users reported difficulty accessing the platform, viewing positions, or placing orders. For some, the app failed to load key account details, while others faced interruptions in executing trades. The disruption lasted for a limited period but coincided with active market movement, making it especially challenging for traders relying on timely execution.

The timing of the issue amplified its impact. Market rebound sessions typically see increased volumes and rapid price changes, where even brief technical interruptions can affect trading decisions. Active traders, in particular, depend on uninterrupted access to respond quickly to shifting momentum.

HDFC Securities later confirmed that the issue had been resolved and acknowledged the inconvenience caused to customers. However, the episode renewed broader discussions around the reliability of digital trading platforms during high-traffic periods and the importance of infrastructure readiness when markets turn volatile.

Overall, the April 8 incident highlighted the growing dependence on technology in modern trading and reinforced the need for robust systems that can withstand sudden surges in activity—especially on days when market sentiment changes sharply.

2. October 3, 2024: Mid-Market Drop in Order Placement

On October 3, 2024, traders using the HDFC Securities trading app and web platform faced difficulties placing orders during a highly volatile market session. The issue surfaced at a time when Indian equity markets were witnessing sharp declines, prompting many investors to actively manage positions and limit losses.

Several users reported that buy, sell, and stop-loss orders were not being processed as expected, particularly in the NSE derivatives (F&O) segment. The disruption made it challenging for traders to respond quickly to rapid price movements, increasing anxiety during an already stressed market environment.

According to updates shared by the brokerage, the problem was linked to a technical malfunction, and teams were engaged with their technology partners to stabilize the platform. While the issue was described as intermittent, it affected enough users to draw widespread attention across trading communities and social media.

The timing of the disruption amplified its impact. During volatile sessions, traders rely heavily on smooth order execution to manage risk, especially in leveraged instruments such as futures and options. Even short-lived platform issues in such conditions can lead to missed exits, delayed entries, or unintended exposure.

This episode highlighted a broader challenge faced by digital brokerage platforms: maintaining system reliability during peak market stress. As trading volumes surge during sharp market moves, platforms are tested for scalability and resilience. For active traders, platform stability becomes as important as pricing or research tools.

Overall, the October 3 incident served as a reminder of the critical role technology plays in modern trading and the importance of robust infrastructure to support investors during periods of extreme market volatility.

3. The App Displays a Blank Portfolio on February 3, 2025.

On February 3, 2025, some HDFC Securities users reported an issue where their portfolio failed to load on the mobile app, appearing completely blank.

Notably, the same accounts displayed accurate holdings and balances when accessed through the web platform, indicating that the problem was limited to the mobile interface rather than the underlying account data.

While no trades or funds were actually missing, the visual absence of portfolio information caused concern among users, particularly those who rely on mobile devices for real-time tracking and quick decision-making. For active traders, not being able to view open positions—even temporarily—can create uncertainty and disrupt trading plans.

Incidents like this highlight how partial platform issues, where one channel works and another does not, can still significantly affect user confidence. Even when core systems remain intact, gaps in visibility can lead to stress and hesitation during live market hours.

How to File a Complaint Against HDFC Securities?

Here’s what to do if you have issues like order failures, login problems, or data not appearing:

- Detailed Reporting

- Open a support ticket via the HDFC Securities app or website.

- Take screenshots of mistakes so you can quickly fix problems with visual proof.

- If the issue is not resolved, you can escalate it by using the NSE/BSE grievance redressal process or by filing a complaint with SEBI.

Need Help?

When money is involved, technical issues can be very unpleasant and stressful for traders. Get in touch if you have questions about how to properly escalate a grievance, write a clear complaint about your issue, or file a grievance. We can provide you with step-by-step instructions on recording the problem, sending the appropriate emails with complaints, conversing with support groups, and bringing it up with exchanges or SEBI if necessary.

Don’t let technological setbacks go unaddressed; your investments should be treated fairly in nature. We are here to be with you in your hard times.

Conclusion

Overall, we can say that even major players can experience system problems, as demonstrated by technical issues at brokerage platforms like HDFC Securities.

These instances, which range from trading app failures and unsuccessful order placements to regulatory fines for IT errors, highlight the importance of reliable technology and prompt help in the financial markets.

If you’ve encountered such technical problems, be sure to properly report them, collect supporting documentation, and escalate the situation appropriately. And keep in mind that assistance is available; you don’t have to do it on your own if you are confused.