“Sir, someone added me to a Whatsapp group where they displayed high PnL screenshots to lure me. I ended up losing my entire life saving of 50 lakh.”

“I saw one Instagram ad and submitted my details. He added me to a telegram group and asked me to do some high-return prepaid telegram tasks. Now, my ₹1 lakh capital is blocked.”

“He promised me high returns and convinced me to download one investment app. Later he invested my capital in an IPO. Now I am not able to withdraw my capital.”

What’s common in all the above concerns raised by one or the other victim almost every day?

High profit, guaranteed returns!

Now, if we talk about how investment scam works, this is the main entry gate, and if someone steps in it is almost impossible to escape without facing loss.

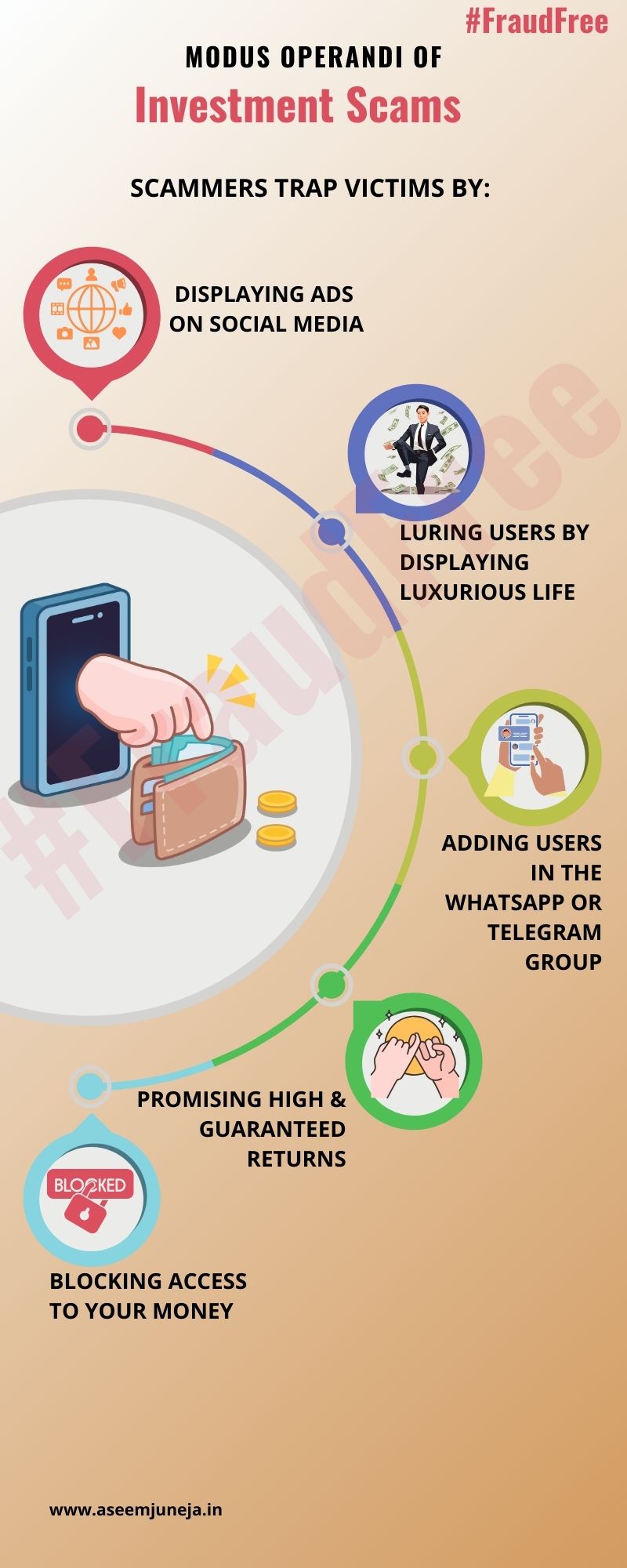

Whether these are WhatsApp group scams, Crypto scams, or Investment scams on YouTube, the modus operandi of every investment scam is almost similar.

Understanding the Modus Operandi of Investment Scammers!

In this digital age, most of the scams start with social media and messaging apps like WhatsApp and Telegram.

Every day, thousands of people fall prey to Instagram Investment Scams and other social media scams, often losing their life savings in the process. Here are the step-by-step how these scams are operated:

1. Luring the Audience Through Social Media

The majority of modern investment scams begin on social media platforms, where scammers lure users by showcasing fake profit screenshots, luxurious lifestyles, and money.

These images are designed to make potential victims believe that they too can achieve financial success with minimal effort.

Once someone shows interest, they are directed to click on a link. These links often lead to WhatsApp or Telegram groups, where the real manipulation begins.

2. Creating Greed and FOMO in Messaging Groups

Once inside these groups, scammers work to create more greed among victims. They start adding daily updates of fake returns they claim to have earned through activities like trading, completing simple tasks, or investing in crypto and forex.

Seeing such profits and value many users crave similar returns and success. Soon enough, they are offered entry into an “exclusive” premium group, by paying a membership fee to the scammer.

3. Promising High and Guaranteed Returns

Once victims are lured into these premium groups, scammers start manipulating them.

They provide expert trading tips and sometimes ask the victims to download apps that appear to be legitimate investment platforms but are fake apps called clone trading apps entirely controlled by the scammer.

Victims are instructed to transfer money to the scammer’s bank account to begin investing.

To build trust and encourage larger investments, the scammer may even allow them to withdraw small amounts initially. This tactic gives the victim false confidence that their investment is safe.

Eventually, the victims feel secure enough to invest more, sometimes even their entire life savings, in hopes of multiplying their money.

4. Pressure Tactics and Prepaid Tasks

Scammers often use high-pressure tactics to push victims into adding more funds. Some claim to have special opportunities like IPO investments, while others introduce prepaid tasks that promise sky-rocket returns if completed.

Regardless of the method, the outcome is always the same: the victim transfers more money into the scammer’s account, believing they are on the verge of becoming rich.

5. High Commissions and Taxes

The moment the victim tries to withdraw their money, they realize something is wrong. The withdrawal fails, and when they contact the scammer for help, they receive a series of excuses:

- “You need to pay a 30% commission on your profits.” Since the profits displayed on the fake apps are high, this amount can be even higher than your initial investment.

- “You must pay platform fees.” This fee is generally in lakhs.

- “Your credit score has dropped due to a missed target, so you need to invest more before you can withdraw any funds.”

At this point, the victim begins to suspect they’ve been scammed. Unfortunately, by the time they realize this, it is often too late. The money is already gone, and recovering it can be next to impossible.

Investment Scam: Real Case

Every single day, we hear news about someone losing lakhs, sometimes even crores, of their hard-earned savings to investment scams that promise quick profits with little or no risk.

What starts as a simple message or advertisement often turns into a financial nightmare. These real cases show just how convincingly scammers build trust before disappearing with the money.

Case 1: Judge Duped of ₹6 Lakh in ‘Doubling Money’ Scam

In Hamirpur, Himachal Pradesh, a judicial officer came across a social media advertisement claiming his money could nearly double. It sounded like a promising opportunity.

After being contacted by individuals posing as representatives of a reputed investment firm, he invested ₹6 lakh in instalments. Everything seemed professional at first.

But when he tried to withdraw his investment along with the promised returns, the fraudsters stopped responding and vanished. A police case was later registered.

Case 2: Cholamandalam Investment Fraud

In another case, a victim was added to a WhatsApp group claiming to be linked with the “Chola Investment Group.”

The group was filled with people sharing screenshots of impressive profits, making everything appear genuine.

The victim first invested ₹50,000 and ₹20,000 and was even allowed small withdrawals, which created trust. Feeling confident, the victim later transferred ₹1,86,613 to an account named “Liknowa Trade.”

But when attempting to withdraw larger profits, the scammers demanded ₹2,39,000 as “commission and tax.” After the victim refused, all communication stopped.

The total loss came to ₹2,29,613, a painful reminder of how impersonation and fake profit stories are used to manipulate investors.

Case 3: Chandigarh Resident Loses Over ₹15 Lakh in Online Investment Scam

In October 2025, a man from Chandigarh received a Telegram message offering daily trading profits. He initially invested a small amount and even saw returns credited to his account, which built his confidence.

Encouraged by this, he continued investing larger sums over time, eventually transferring ₹15.17 lakh. When he finally tried to withdraw his money, the platform demanded an extra ₹2.44 lakh as a “verification fee.”

That was the moment he realised he had been trapped. No funds were ever returned.

Can Investment Scams be Reported?

In India, there are different types of investment scams, and those that occur on unregulated platforms like those discussed above need to be reported on different platforms.

With the right guidance, you can recover losses.

Register with our experts and we will personally assist you in getting back on track, safely and confidently.

Now, scammers are working harder to trap you by giving you fake promises. It is therefore important for you to become smarter and learn how to identify investment scams.

By following the right practices, you can avoid falling victim to these investment scams and protect your savings from fraudsters who prey on greed and trust.