“Looking for an investment scheme with a fixed return every month? If yes, then here is the best offer for you. Just give me your money, and I will give you a 7% return every month. Yes, every month! “

That’s quite attractive, isn’t it?

Investing in this scheme can make you rich in a short time. You can fulfill all your dreams.

So, how many of you are ready to invest in this scheme?

Almost all of you.

Great! Congratulations, by investing in such schemes, you kickstart a Ponzi Scheme.

And the bad news is that it wouldn’t be you, but the company or individual who introduces it that becomes rich.

Disappointed?

But this disappointment is better than the sadness and grief you will experience on losing your entire capital.

Let’s get into the details to learn how a Ponzi Scheme works, but first, let’s understand its meaning.

Ponzi Scheme Meaning

A Ponzi Scheme is one type of financial fraud where a company or an individual promises high returns with little risk to investors.

The Ponzi scammer uses the funds of new clients to provide returns to old & existing clients.

With time, when he failed to add new investors, he fled with all your capital.

You can easily relate to one of the Bollywood Movies, ‘Phir Hera Pheri‘, and the context ‘21 din me paisa double’‘. All this is something that you will hear from scammers promoting such schemes.

Let’s now learn how it works.

How Does a Ponzi Scheme Work in India?

Ponzi scammers generally reach out to people who live in rural areas and have little knowledge of investment regulations or groups of retired people who have enough money to invest.

Here are the steps of how a Ponzi scheme works and leads to financial distress:

Step 1: The Lure of Easy Money

Picture this: someone comes to you with a shiny new investment opportunity.

“Put in ₹10,000, and I’ll return ₹5,000 every month.”

Tempting, isn’t it?

The promise of high returns with little risk is enough to make anyone sit up and listen.

The people behind these schemes know exactly how to pull you in. They’re experts at selling “too good to be true” offers.

Step 2: Collecting the Cash

Once you’re convinced, you invest your money.

Everything may look professional, but here’s the truth: your ₹10,000 isn’t being invested anywhere. It’s simply being used to pay returns to earlier investors.

There are no real profits. Just new money paying old investors.

And that cycle continues.

Step 3: The First Taste of Profit

Soon after investing, you start receiving the promised returns.

Your ₹10,000 becomes ₹15,000. The payments arrive on time. It feels real. Legitimate.

You begin to trust the system, and maybe even invest more. But those “profits” aren’t coming from any business activity.

They’re simply being paid from the money brought in by newer investors. That early payout builds confidence.

And confidence keeps the scheme alive.

Step 4: It Starts to Grow

Now that you’ve experienced the easy returns, you’re all in.

The person behind the scheme encourages you to bring others in.

You’re now actively recruiting friends, family, or anyone who will listen, promising them the same returns you got. More and more people invest, and the cycle continues.

The scheme grows exponentially.

More people invest, which allows the scheme to pay out returns to older investors. Everyone’s happy, for now.

Step 5: The Collapse

But no cycle like this can last forever.

One day, new investors slow down. The inflow of money dries up. And suddenly, payments stop.

Withdrawals are delayed. Calls go unanswered. Excuses begin.

Then silence.

By the time authorities step in, the money is often gone, and so is the person who promised those guaranteed returns.

Why Do Ponzi Schemes Work?

It all boils down to human psychology. People want to believe that easy money is possible.

When someone presents an opportunity that looks too good to pass up, it’s tempting to take a leap of faith.

And once the scheme starts showing returns, it becomes self-sustaining as more people join in. But the reality is, it’s a ticking time bomb.

Ponzi schemes thrive because they play on people’s greed and fear of missing out (FOMO).

The allure of quick profits blinds individuals to the risks involved.

Ponzi Scam Real Cases

Many people assume Ponzi schemes are rare or dramatic scams that only make headlines.

In reality, they often operate quietly in plain sight, through professional-looking websites, confident presentations, and sometimes even through acquaintances or trusted referrals.

Let’s look at two real cases that show how these schemes unfold in real life:

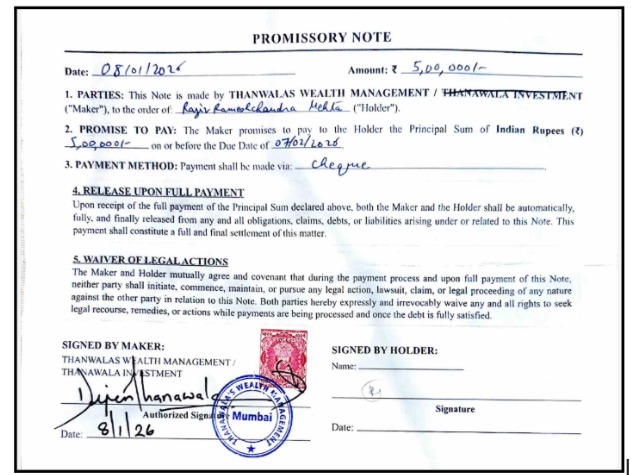

Thanawala Wealth Management

Recently, an investor shared his experience with us. He was introduced to Thanawala Wealth Management / Thanawala Investment through a family relative who spoke highly of their returns.

He invested in a “prop desk algo” plan promising 2% monthly returns and was also offered an IPO investment in Vikram Solar shares with assured profits.

For the first two to three months, he received the promised 2% payouts. That built trust, and he invested more.

Then suddenly, payments stopped. The IPO shares were never delivered. His principal was not returned.

In total, he lost around ₹30,00,000.

Within his network alone, collective losses were reportedly as high as ₹150 crore.

The pattern appeared similar to a Ponzi-style structure, early returns to build confidence, followed by silence when withdrawal demands increased.

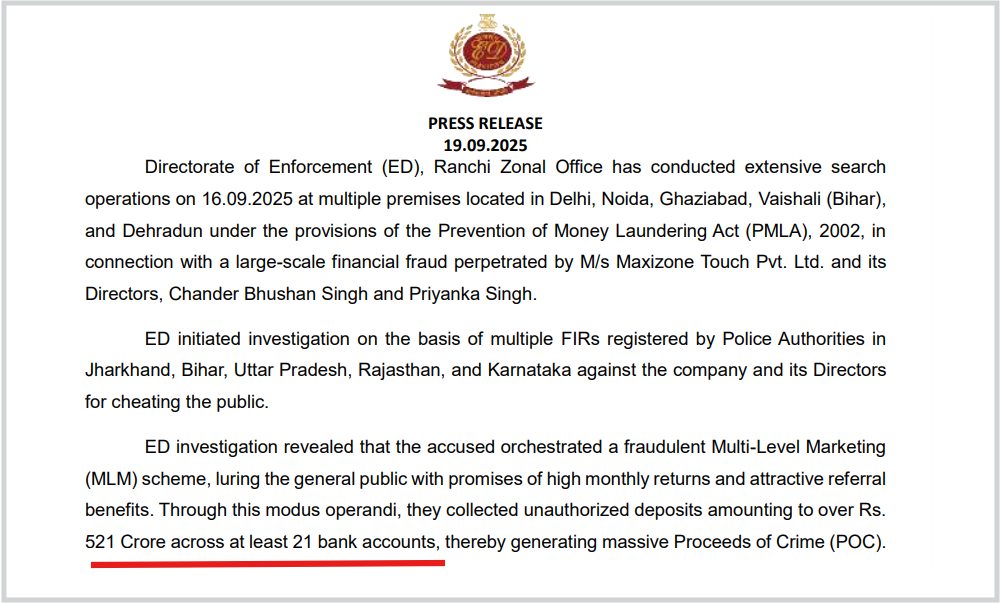

Maxizone Ponzi Scam

Maxizone Touch, headed by Chandrabhusan Singh and Priyanka Singh, started around 2019 by presenting itself as a marketing company.

Over time, it shifted focus and started attracting people with promises of extraordinarily high monthly returns, ranging from 10% to 20%.

Many people invested, attracted by promises of fast profits and even earnings in dollars. Initially, some returns were paid, which built trust and encouraged more investments.

However, after January 2022, payouts reportedly stopped.

Complaints were filed, and following an FIR in Jamshedpur, the Enforcement Directorate (ED) began investigating the matter under money laundering laws.

Investigations revealed that approximately ₹521 crore had been collected through multiple bank accounts.

The promoters were later taken into custody, and authorities conducted raids across several cities to trace funds and gather evidence.

What appeared to be a high-return opportunity ultimately unfolded into a large-scale Ponzi-style operation, leaving many investors facing heavy losses.

How to Identify a Ponzi Scheme?

Now that you know how they work, you’re probably wondering how to spot one.

Here are some warning signs:

- Unrealistic returns: If something promises returns that are too high with little risk, it’s probably a scam.

- No clear investment strategy: If they can’t explain how the money is being invested or used, be cautious.

- Difficulty withdrawing money: Ponzi schemes often make it hard for you to take out your investment, especially when new investors are hard to come by.

- Over-reliance on new investors: The scheme depends on the constant influx of new people to stay afloat.

How to Report a Ponzi Scheme?

If you suspect a Ponzi scheme, it’s crucial to report it immediately.

To get assistance, you can register with us, and we will help you in filing a complaint and in proper follow-ups with the respective bodies.

Here’s how we assist:

1. Case Evaluation and Document Review: We carefully examine your investment documents, payment proofs, agreements, emails, and communication records to understand the full scope of the issue.

2. Evidence Structuring and Organisation: All supporting documents are organised in a structured format to strengthen the credibility and impact of your complaint.

3. Identifying the Appropriate Authority: Based on the nature of the scheme, we determine whether the complaint should be filed with authorities such as SEBI, the Economic Offences Wing (EOW), local police, or other regulatory bodies.

4. Drafting a Strong, Fact-Based Complaint: We prepare a clear and detailed complaint outlining misrepresentation, fund flow, and financial losses to reduce the chances of technical dismissal.

5. Filing and Regulatory Follow-Ups: We assist in submitting the complaint through official channels and conduct regular follow-ups to ensure timely action.

6. Strategic Legal and Regulatory Guidance: If the matter escalates, we guide you on further legal remedies, including collective complaints or additional regulatory action where applicable.

Taking action may feel overwhelming, especially after financial loss. But structured reporting backed by proper documentation can make a significant difference.

The key is simple: don’t stay silent. The earlier you report, the stronger your position becomes.

Conclusion

Understanding how does a Ponzi scheme work, it is clear that such schemes are seductive, but they’re built on deception and greed.

They may promise you the world, but in the end, it’s just a game of smoke and mirrors.

The only real “winners” are the people running the scam, and they’re usually long gone by the time the scheme collapses.

So, the next time you come across an investment opportunity that promises high returns with little effort or risk, remember: it’s probably too good to be true.

Keep your eyes open, stay informed, and never let greed cloud your judgment.