If someone says, “I’m SEBI registered,” your next question should be, “Show me where.”

Because screenshots can be faked, but SEBI’s database cannot.

This guide shows you how to verify – Online, in two minutes, with real examples and common traps.

How to Check SEBI-Registered Investment Advisor Online?

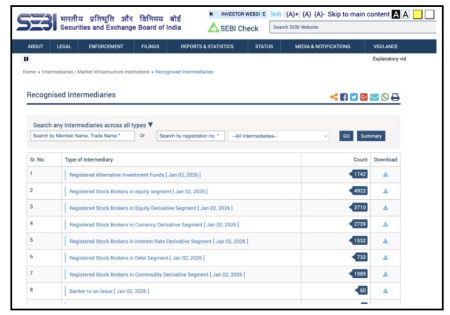

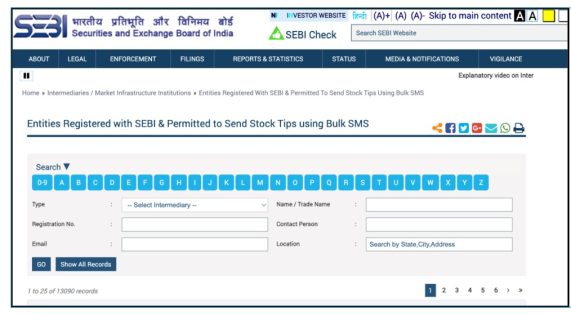

Start with the official SEBI “Recognised Intermediaries” page. This is SEBI’s public searchable directory.

- From there, choose Investment Adviser. Then search by registration number.

- If you don’t know the registration number, search using the adviser’s name. Also, try the company name. And try the city as a filter.

- Still nothing? Ask them for their exact registration number. Not a certificate photo. The number itself. Then re-check on SEBI’s site. Because fake advisors often stall here.

- When the entry is genuine, you’ll usually see: name, registration number, email, address, contact person, and validity status.

SEBI Registered Investment Advisor Checklist

Here’s the quick rule: visit the SEBI website and check the following parameters:

- Check the Registration Prefix:

- INA: Investment Adviser

- INH: Research Analyst

- INP: Portfolio Manager

If someone claims to be an IA but uses INH or INP, that’s a red flag.

- Confirm Active Status on SEBI Website:

- The adviser or firm must appear as “Active” in SEBI’s official directory

- If the name or number doesn’t show up, don’t proceed

- Verify the Firm AND the Person:

- A company may be registered, but the caller might not be

- Check:

- Firm name in SEBI’s IA list

- Contact person’s name listed with SEBI

- Match Contact Details:

- Compare:

- SEBI-listed email ID

- SEBI-listed phone number

- With what’s used on WhatsApp / calls

- Any mismatch = danger sign

- Compare:

- Watch for Role Confusion:

- Research Analysts give research, not personalized advice

- Portfolio Managers manage money, not just give tips

- Role mismatch = compliance violation

SEBI’s IA page shows entries such as name, Registration No (INA…), email, phone, address, and validity. So if someone claims “SEBI registered,” but refuses to share a registration number, that’s not normal.

And if the SEBI listing email is “[email protected]” but they contact you from a random Gmail, pause right there.

SEBI explicitly warns about fake profiles claiming to be SEBI-registered, offering assured returns, and engaging in manipulated activity. So if you see “risk-free 5% daily,” treat it like a fire alarm.

People also Google the advisor’s name and see a few positive comments. Then they relax.

But here’s the truth. Reviews can be planted. And complaints can be buried. So don’t rely on reviews first. Use reviews only after you verify SEBI registration.

Verification comes before vibes.

What if The Advisor is Not SEBI-Registered?

If the name doesn’t appear in SEBI’s directory, they are not a SEBI-registered Investment Adviser.

At least not under that name.

In that case:

- Don’t pay.

- Don’t share PAN.

- Don’t share OTP.

- And don’t install “trading apps” they send.

- If you have already paid, start collecting evidence immediately.

How to File Complaint Against SEBI Registered Investment Advisor?

If you or someone in your family has already paid for stock tips, “multibagger” promises, or joined WhatsApp or Telegram groups that claim SEBI registration but feel suspicious, you still have options.

And you don’t have to navigate them alone.

If you register with us, we guide you through the entire process, step by step and clearly.

Here’s how we help in practical terms:

- We start by organising evidence. Most cases fail because the proof is scattered. We help you collect and structure payment receipts, bank statements, ledgers, contract notes, call recordings, chat screenshots, and emails so your complaint is strong from the beginning.

- Next, we handle complaint drafting. We prepare clean, well-structured complaints that meet the exact format and requirements to file a complaint in SEBI.

- If your complaint needs to move further, we offer escalation guidance. We help you understand when and how to escalate, whether that means approaching the exchange, regulator, or preparing for the next formal stage.

- Once filed, we handle case tracking and follow-ups. We monitor timelines, remind you of deadlines, and help you respond if regulators or exchanges request clarification.

Conclusion

Knowing how to check whether an investment advisor is SEBI-registered is one of the simplest ways to avoid scams.

Use SEBI’s official intermediary directory.

Verify the INA number and matching contact details. And take SEBI’s scam warnings seriously.

Two minutes of verification can save months of regret.