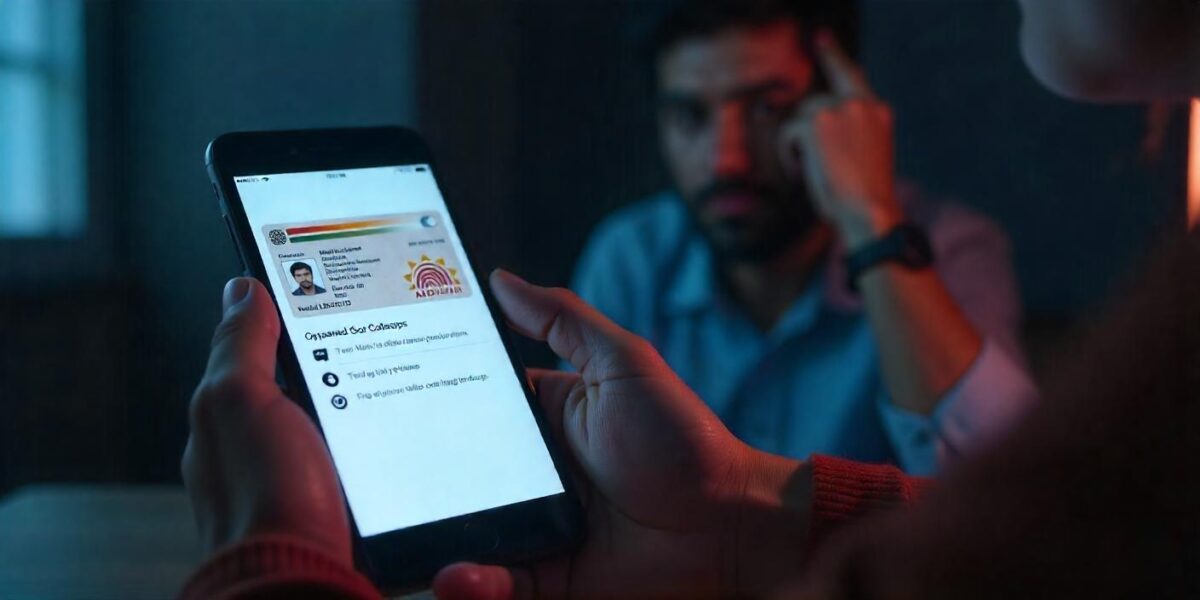

Imagine waking up one day to find out that someone has taken a loan in your name, emptied your bank account, or even committed fraud using your details.

Scary, right? The effects of identity theft could be worse.

Unfortunately, identity theft is more common than you think, and scammers are getting smarter every day.

In a world where our personal information is linked to everything—bank accounts, social media, and even online shopping—it only takes one weak spot for fraudsters to exploit.

But don’t worry! With the right precautions, you can protect yourself from identity theft and avoid financial and legal troubles.

Here’s everything you need to know about how to prevent identity theft and keep your personal information secure.

Types of Identity Theft

Identity theft occurs when someone steals your personal information (such as your PAN card, Aadhaar number, bank details, or passwords) and uses it to commit fraud.

This could mean taking using it for fake loan scams, making purchases, or even committing crimes in your name.

Here are different types of identity theft that can cost you big and drag you to face legal consequences

- Financial Identity Theft – Fraudsters take loans, open credit cards, or withdraw money from your account.

- Criminal Identity Theft – Someone commits a crime using your details, leading to legal trouble for you.

- Medical Identity Theft – Scammers use your identity to get medical treatment or claim insurance benefits.

- Synthetic Identity Theft – Fraudsters create a fake identity using a mix of real and fake details to commit fraud.

How to Protect Yourself from Identity Theft?

If there are problems, then there are solutions, too. A little alertness and attention to detail can prevent you from facing any consequences because of identity theft.

1. Protect Your Personal Information

- Never share your PAN card, Aadhaar number, or bank details with unknown sources.

- Avoid sending sensitive documents via email or WhatsApp to unverified contacts.

- Be cautious when filling out online forms.

- Stay away from instant loan apps, these could be loan app scams that can cost you big.

2. Use Strong & Unique Passwords

- Create strong passwords with a mix of letters, numbers, and symbols.

- Use different passwords for banking, social media, and email accounts.

- Enable two-factor authentication (2FA) for extra security.

3. Monitor Your Financial Activity

- Regularly check your bank statements and credit card transactions for any unauthorized activity.

- Track your CIBIL score to ensure no unknown loans have been taken out in your name.

- Set up bank alerts to get notified of all transactions.

4. Beware of Phishing Scams

- Never click on suspicious links from unknown emails, SMS, or WhatsApp messages.

- Verify calls claiming to be from your bank, insurance, or government offices before sharing any details.

- If an offer looks too good to be true, it probably is!

5. Secure Your Devices & Data

- Keep your phone and laptop password-protected and encrypted.

- Use a trusted antivirus to protect against malware and cyber threats.

- Avoid using public WiFi for financial transactions. If necessary, use a VPN.

6. Be Cautious with Social Media

- Avoid sharing personal details like your date of birth, address, or financial status online.

- Be mindful of the information you post. Scammers can use it to guess your security questions.

- Set your profiles to private to limit access to strangers.

7. Destroy Old Documents

- Destroy old bank statements, credit card bills, and any document with sensitive information before discarding.

- Avoid leaving important documents lying around in public spaces.

8. Report Lost or Stolen Documents Immediately

- If your PAN card, Aadhaar, or passport is lost or stolen, report it to the authorities immediately.

- Inform your bank if you lose your debit/credit card and block it immediately.

- File a cyber crime complaint if you suspect any fraudulent activity. Do not forget to note the acknowledgement number to check cyber crime complaint status later.

How to Report Identity Theft?

Unfortunately, cyber frauds are becoming more common, but that doesn’t mean you’re helpless. If you’ve been affected, immediate and informed action can make all the difference.

Register with us and get access to experts who understand the situation and will guide you with a personalized approach to recover your losses and protect your future.

Your recovery starts here and take the first step today.

Conclusion

Identity theft is a growing threat, but with awareness and the right precautions, you can prevent identity theft.

Keep your personal data secure, monitor financial activities, and stay cautious of online fraud.

If you ever suspect identity theft, take immediate action to minimize losses.