Sagar, a young and eager novice trader, had always been curious about the stock market. Like many beginners, he believed that he could turn his small savings into big profits with the right guidance.

One afternoon, while browsing Facebook, a message popped up from a company that claimed to be a SEBI-registered stockbroker. The message was well-crafted, full of enticing words about easy trading and expert guidance.

To Sagar, it seemed like the perfect opportunity to begin his trading journey.

He responded, thinking he had found the mentorship he needed. The company seemed professional, asking for his contact details and offering to guide him step-by-step.

Soon, they were in touch with Sagar over WhatsApp, sending him links to a website that looked legitimate. It all seemed authentic to someone like Sagar, who lacked deep market awareness.

And this led him to fall in the trap where he lost more than ₹60,000. Later our team, with the right action helped him in recovering 100% capital.

Here is the complete detail of how our team worked on this scam and took necessary actions.

From Trust to Losses: How Sagar Got Trapped?

The representatives at the company wasted no time. They convinced Sagar to open a demat account under their supervision, ensuring him that they would handle everything.

The first real red flag came when they asked him to transfer money directly into their bank account—a move that would alarm more experienced traders.

But Sagar, trusting the apparent expertise of the platform, didn’t question it. He started small, transferring ₹5,000, which seemed like a safe initial step.

For the first few days, everything felt smooth. The company tried to build trust and consulted Sagar before placing trades. Over time, though, they began to convince him to invest more. “The market is in your favor,” they would say. “Add more capital, and you can make even bigger profits.”

Convinced by their promises, Sagar transferred more funds, ₹10,000, then ₹20,000, and eventually, his total investment reached to more than ₹60,000.

Unfolding the Scam

At first, it seemed like a good decision. Sagar was making profits, or so he thought. But when he tried to withdraw some of his earnings, things took a turn.

The company provided vague reasons about a “settlement period” and told him to wait.

When that period passed, Sagar eagerly checked his account but was puzzled to see no amount available for withdrawal. Without any delay he contacted the company.

The response was shocking: “We’ve opened a new trading position for you.”

Sagar was stunned.

How could they place trades without his permission?

He immediately demanded that they stop all trading activities, but the company ignored his pleas. Despite his growing frustration and anxiety, they continued making excuses, delaying his withdrawals further.

Feeling helpless, Sagar scrolled through YouTube one evening. That’s when he came across one of our YouTube Shorts based on Unauthorized Trading.

The content spoke directly to his situation, outlining how fraudulent companies manipulate and control novice traders. At that moment, it clicked—Sagar realized he had been scammed.

Without wasting time, he decided to file a complaint. But faced another challenge as he was not aware of how to report online frauds in India.

One of our video helped, and Sagar reached out to our team.

Our team guided him step by step, advising him to file a complaint on the respective platform. With their support, Sagar documented his experience and presented a strong case against the fraudulent platform.

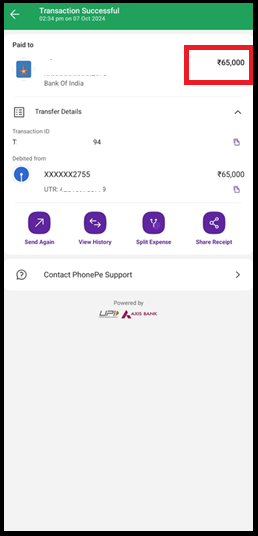

Finally, Our Team Helped Him Recover ₹65,000.

Filing the complaint set things in motion. After several phone calls and persistent follow-ups, Sagar received the news he had been waiting for—the fraudulent company was forced to return his money.

In the end, Sagar recovered ₹65,000. The feeling of relief was overwhelming.

Though the journey had been stressful and emotionally draining, Sagar’s story ended in victory and finally helped him realize the importance of knowledge and awareness when it comes to investment in the securities market.

What New Traders Can Learn From This Incident?

Sagar’s story is a cautionary tale for anyone entering the world of trading.

The lure of quick profits can blind even the most well-meaning individuals, leading them into the hands of fraudulent platforms.

But Sagar’s experience also highlights the importance of awareness and taking swift action when things feel wrong.

In today’s fast-moving world of online trading, it’s crucial to always verify credentials, control your funds, and avoid transferring funds to third-party accounts without complete knowledge and understanding.

Most importantly, remember that it’s never too late to act—just like Sagar, you can always reclaim control with the right information and support.

In the end, Sagar not only recovered his money but also gained the most valuable asset in trading: knowledge.