In the fast-paced world of digital payments, Google Pay (GPay) has become as essential as the wallet in your pocket. However, with over 150 million monthly active users in India, it has also become the primary hunting ground for cybercriminals.

In 2024–2025 alone, thousands of Indians have lost their savings to clever digital traps.

This guide is designed to help you spot Google Pay scams before they spot you. Let’s dive into the most common tactics used in India today.

How UPI Cyber Crime Scams Work?

Fraudsters often pretend to be trusted people – sellers, buyers, delivery agents, customer care, or even bank officials. Here’s how they trick users:

- Fake marketplace transactions (OLX, Facebook Marketplace, Quikr)

- Scammers pretending to “pay you” but ask you to scan a QR code – which actually sends them money

- Fake customer support numbers found on Google search

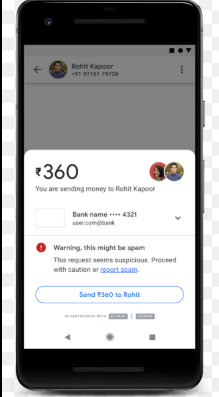

- Payment request scams using the “Request Money” feature

- Job offer scams asking for registration fees

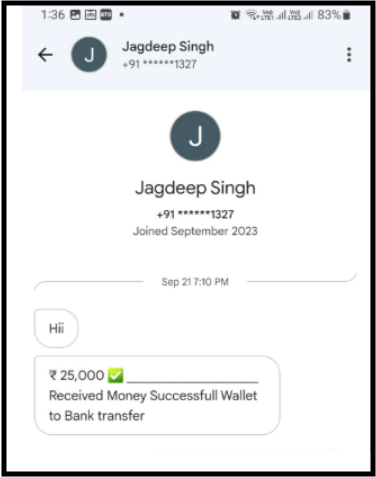

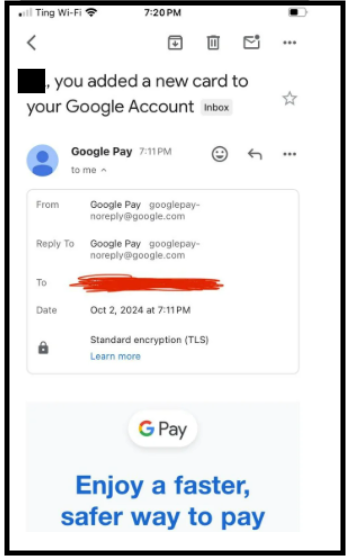

- Fake payment screenshots to show a successful transaction

Common Google Pay Scams in India

These are some frequently used tricks:

- QR code scam – You scan it thinking you will receive money, but the money leaves your account.

- Phishing links – Scam links asking you to “verify account”.

- Screen sharing apps – Like AnyDesk or TeamViewer – are used to capture your PIN.

- UPI fraud message – “Money deducted twice, please send back the extra amount.”

- Impersonation scams – Scammers act as gas agency, courier service, bank staff, etc.

- Fake UPI App Scam -Scammers create counterfeit applications that imitate legitimate payment platforms like Google Pay to create fake UPI app scams.

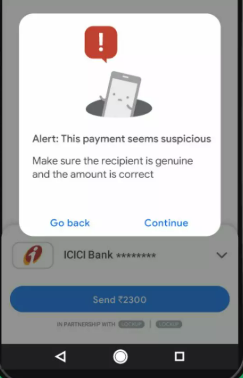

Warning Signs You Should Never Ignore

- Asking for UPI PIN, OTP, or confidential details

- Second payment requests after a failed transaction

- Urgency like Do it right now, or the offer will expire

- Poor grammar or unprofessional messages

- Random phone numbers claiming to be customer care

If any of this happens – stop immediately. Genuine companies never rush users for UPI transactions.

How to Protect Yourself from Future Google Pay Scams?

To stay safe:

- Never scan QR codes to receive money

- Don’t believe random customer care numbers from Google search

- Never share UPI PIN or OTP

- Enable app lock & SMS alerts

- Avoid using Google Pay for high-value, unknown transactions

- Verify phone numbers & identities before sending money

How to Report UPI Frauds?

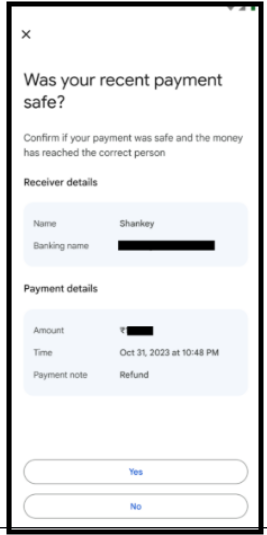

If you’ve been targeted by a scammer on Google Pay (GPay), acting fast is the single most important factor in potentially recovering your money.

Digital transactions move instantly, so follow these steps immediately.

- If you lost money within the last 24 hours, file a report at the National Cybercrime Helpline

- Reporting the user within the app helps Google block their account and prevents them from scamming others.

Open Google Pay

- Tap the Specific Transaction you want to report.

- Scroll to the bottom and tap “Having issues?” or “Report a problem.”

- Follow the prompts to describe the scam

- Contact Google Pay Support Directly

-

File a Local Police FIR (If Possible). Especially if the transaction amount is high.

Need Help?

If you want step-by-step support in filing your complaint, you can register with us.

Our support includes:

- Evidence documentation guidance – Proper documentation significantly improves potential recovery outcomes

- Authority reporting assistance – Navigate SEBI, Cybercrime Portal, and EOW processes effectively

- Recovery strategy development – Each situation requires specific approaches based on your circumstances

- Legal expert connections – Access verified professionals specialising in crypto fraud cases

- Follow-up guidance– Guide you throughout the follow-up process

Don’t suffer alone. Don’t trust “guaranteed recovery” services demanding upfront payments.

Can You Recover the Money?

Recovery is possible, but it depends on how fast you act.

UPI scams are traced using the transaction ID and UTR number. If the receiving account is frozen early, your money may be recoverable.

However, if the fraudster quickly transfers it further, recovery becomes difficult. That’s why reporting within hours – not days – is crucial.

Conclusion

Google Pay scams can happen to anyone. These frauds are designed to exploit trust and urgency, not a lack of intelligence. What truly matters is how fast you act after the incident.

Reporting within hours can greatly increase the chances of freezing the fraudster’s account and possibly recovering your money.

Equally important is awareness. Understanding common scam tactics, never sharing your UPI PIN or OTP, and staying cautious with unknown requests can prevent future losses.

If you’ve been scammed, don’t feel embarrassed; report it, seek help, and learn from it.

UPI is safe when used wisely. Stay alert, act quickly, and spread awareness so others don’t fall into the same trap.