ICICI Securities complaints happen more often than you’d expect. From trading errors to slow customer service, it can mess with your investments.

If you’re dealing with payout delays, platform glitches, or unfair charges with this popular broker, you’re not alone.

Millions of investors use ICICI Securities, but issues pop up.

This blog shares a clear path to fix them fast and some tips to protect your money.

What is ICICI Securities?

ICICI Securities is basically a powerhouse in India’s financial world. It was started back in 1995 as part of ICICI Bank, with its HQ in Navi Mumbai.

It operates as a full-service brokerage and wealth platform.

It offers retail and institutional broking, financial product distribution, private wealth management for HNIs, portfolio management services, margin trading, loans, and investment banking, including ECM, M&A advisory, and structured products.

- Active clients: 1987901

- No of complaints: 408

- Resolved complaints: 370

ICICI Securities Complaints Type

ICICI Securities Limited has faced several types of complaints from customers, including:

- Type I: Delays or non-receipt of payments, such as refunds and unsettled accounts.

- Type II: Delays or issues with the delivery of securities and margin deposits.

- Type III: Non-receipt of important documents like contract notes and account statements.

- Type IV: Unauthorised trades or misappropriation of client funds or securities.

- Type V: Service-related issues, including excess brokerage, order execution problems, and system glitches.

- Type VI: Unauthorised closing out of positions and disputes over auction values.

- Type IX: Other miscellaneous complaints.

These cover the main areas where customers have raised concerns with the company.

All these complaints were made because they led to real losses. Various arbitrations were filed against the company, and some of them were escalated for arbitration.

Here are a few cases registered for arbitration.

ICICI Securities Arbitration

Arbitration on Liability for Delayed PAN Update and Forced Trade Squaring

ICICI Securities landed in an NSE appellate arbitration after investor Deep Joshi challenged a 2023 award. He claimed losses of over ₹1.87 crore, arguing that ICICI mishandled his account and triggered huge, avoidable trading losses.

What went wrong?

Joshi had submitted his updated PAN–Aadhaar linking documents in March 2022—well before the NSE’s March 31 deadline. But ICICI Securities allegedly failed to update the details on time, despite repeated submissions and government mandates.

Because of this delay, his account became non-compliant, and ICICI forcibly squared off his margin positions between

- March 30–31, 2022, and

- April 4–8, 2022

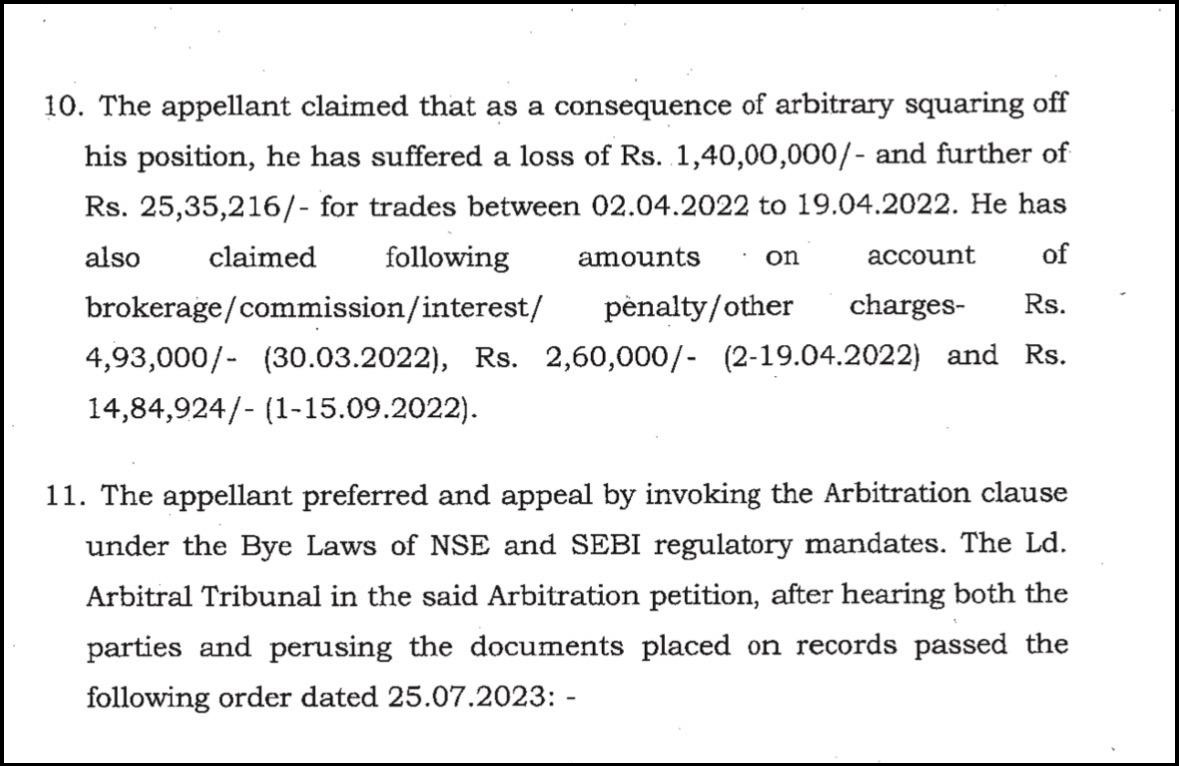

These forced closures allegedly caused:

- ₹1.40 crore loss from premature square-offs

- ₹25.35 lakh in costs to rebuild positions

- ₹22.37 lakh in charges and expenses

However, the first arbitration tribunal felt some of the evidence—like trade books and calculations—was not fully verifiable, so they acknowledged negligence but awarded limited compensation.

Unhappy with the partial relief, Joshi filed an appeal, requesting a panel of experts to recalculate and award the complete damages he believed were justified.

Penalty Imposed

Appeal dismissed December 22, 2023, ICICI was ordered to pay only Rs 3,41,096 (brokerage, fees, taxes on key dates) with 6% interest from April 1, 2022, plus Rs 1,11,094 filing fees.

No big loss compensation, as claims were “approximate and notional” without cross-referenced proof.

Key Takeaways

- Always check your own PAN–Aadhaar linking.

Don’t depend on your broker or RM to handle it. A small delay can lead to forced square-offs and big losses. - Compliance mistakes can cost you money.

Even if it’s the broker’s fault, you may not get the full amount back if you can’t prove the exact loss. - Tribunals want clear proof.

If you’re claiming a big amount, you must show proper documents—contract notes, ledgers, margin statements, etc.

Simple Excel sheets or rough figures won’t work. - Calculate your losses properly.

Take help from an expert so your numbers are accurate and acceptable in arbitration. - Don’t rely fully on relationship managers.

Keep track of your account, save all records, and follow compliance rules yourself.

It will protect you from future problems and help you get justice faster if something goes wrong.

Dispute Over Excess Brokerage Fees

Kariabettan Sugumar filed this NSE arbitration case against ICICI Securities after discovering years of overcharging.

Back in 2012, the broker had promised him a low intraday brokerage rate of 0.02%, but instead continued charging higher rates, sometimes 0.05% or more, without informing him.

Over time, this added up to ₹33 lakh in excess brokerage and nearly ₹29 lakh in taxes on those inflated charges.

Despite sending more than 50 emails and even receiving apology acknowledgements from the broker, Sugumar never got a proper refund—leading him to take the matter to arbitration.

Penalty Imposed

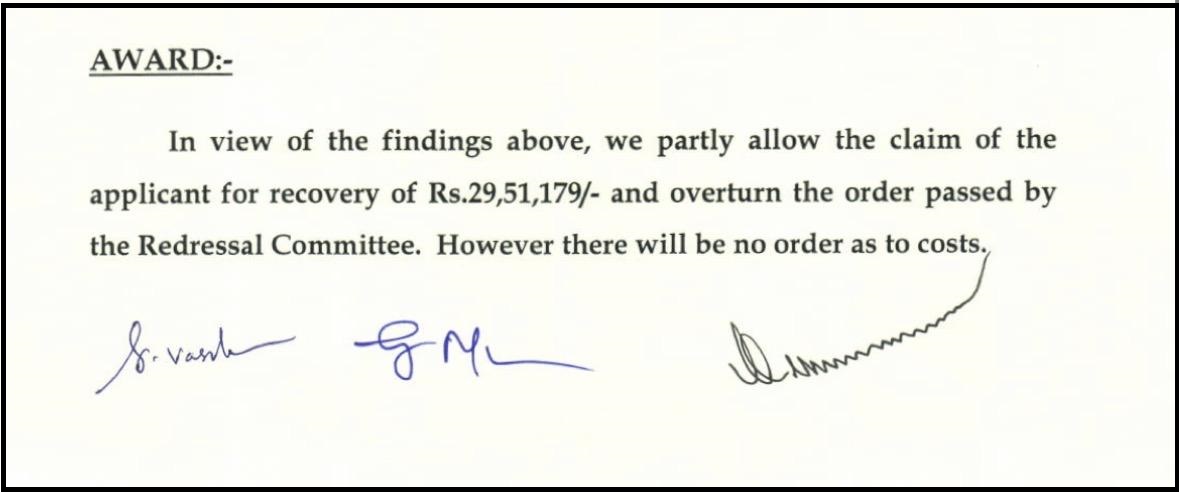

The tribunal partly agreed with him on. ICICI was asked to pay back Rs 29,51,179 for extra charges and taxes from 2016 on.

Key Takeaways

Always insist on a written confirmation of your brokerage plan—not just verbal assurances. Keep an eye on your monthly statements so you can spot unusual or higher charges before they pile up.

If you notice a problem, raise a complaint immediately, because very old disputes often get restricted during arbitration.

Maintain all emails, screenshots, and call records; strong documentation makes it far easier to recover wrongly charged amounts.

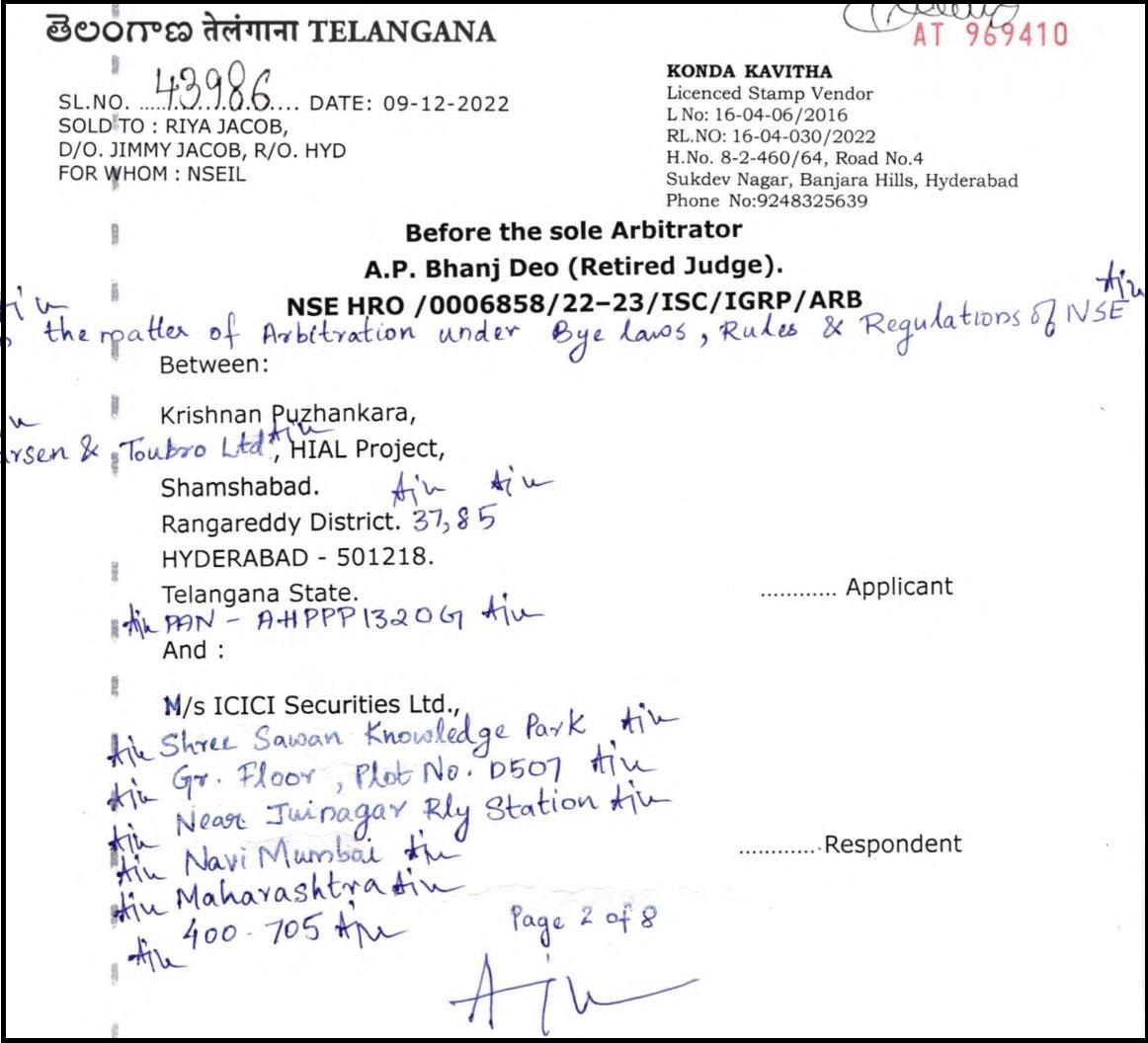

Client Claims Premature Trade Closure

Krishnan Puzhankara filed this arbitration against ICICI Securities after the broker allegedly squared off his Axis Bank futures position without a proper reason.

He had bought 1,200 Axis Bank futures on April 28, 2022, at ₹782.95 with plans to hold them until June 30, 2022.

His margin, over ₹9.96 lakh through cash and pledged securities, was confirmed as sufficient by customer care at 9:48 AM on the same day.

However, around noon, ICICI suddenly squared off its position, claiming “insufficient limits.” By then, the price had fallen to ₹663.65, leading to a loss of ₹1,77,960.

Krishnan argued that the broker didn’t issue any prior alert, demand for funds, or give him a chance to rectify the situation.

This led him to seek compensation through arbitration for what he believes was an unjustified and premature square-off.

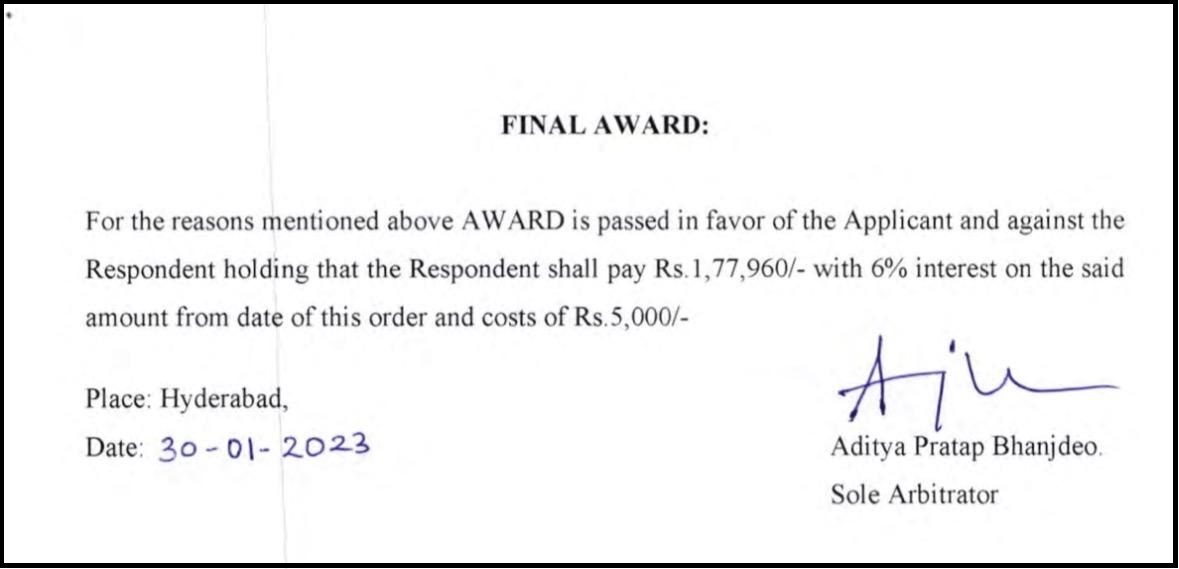

Penalty Imposed

The sole arbitrator ruled in the applicant’s favour on January 30, 2023, holding ICICI liable for Rs. 1,77,960 plus 6% interest from the award date and Rs. 5,000 costs.

NSE regulations 3.10(a)-(b) required margin demands before squaring, which ICICI ignored despite confirmed adequacy, making the closure illegal.

Key Takeaways

If you’re trading F&O, don’t rely only on verbal confirmations; always save your margin status in writing.

Brokers must count both cash and pledged securities before closing their positions, so challenge any sudden square-off with proper records.

If a broker exits your trade without warning, raise it immediately through customer care, document the entire conversation, and then take it forward to GRC and arbitration if needed.

SEBI Order Against ICICI Securities

Now, arbitration cases are one side of the story, but that’s not all.

Apart from these disputes filed by investors, SEBI itself has stepped in a few times and released official orders against ICICI Securities.

And when the market regulator gets involved, it usually means the issues were serious enough to affect investor trust or market fairness.

So before we go further, let’s take a quick look at what SEBI found and why these orders matter to regular traders like us.

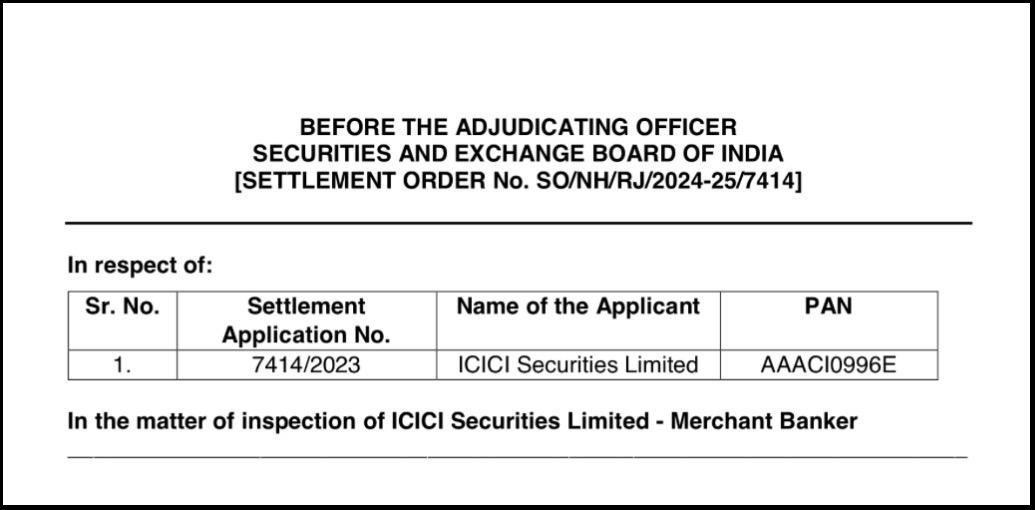

Regulatory Non-Compliance by ICICI Securities Limited

SEBI checked ICICI Securities’ work as a merchant banker from April 2020 to March 2022 and found some mistakes in how they handled company share issues.

They had shaky reports from site visits, and did not properly check if the reasons for raising money had proof.

They made conflicting statements in documents compared to news reports. These broke SEBI’s rules on due diligence and disclosures for merchant bankers.

SEBI Verdict

ICICI Securities got a notice to explain, but chose to settle instead of fighting.

They paid about 70 lakh rupees and warned their staff who messed up. SEBI closed the case on August 20, 2024, without saying they admitted guilt.

ICICI Securities Ended Up Paying ₹80.46 Lakh

SEBI conducted a joint inspection with NSE on ICICI Securities as a stockbroker in September 2023. They found issues like:

- not selling off unconfirmed pledged shares for margin trading on time

- keeping them in a pool account instead

- a software glitch that stopped automatic selling and wasn’t reported

- shifting shares between accounts to dodge penalties

- Serving wrong data to regulators

These broke stockbroker rules, SEBI circulars on margins, and the code of conduct.

SEBI Verdict

ICICI got a show-cause notice in June 2024 to explain.

They replied, got a hearing chance, then filed for settlement in August 2024. After talks with SEBI committees, they agreed to pay Rs 80.46 lakh and report the glitch to the exchanges with details. SEBI approved this in February 2025 after payment.

Thus, these orders and arbitrations show that any violation committed by a registered broker can go against them.

But it also teaches us that investors must be very careful when investing their money. Your safety is in your own hands.

How to Register an ICICI Securities Complaint?

If you’re facing issues with your broker and don’t know where to complaint against stock broker , you can register with us, and we’ll guide you through every step of the process.

Here’s what we specifically help you with:

- Documentation Assistance

We help you gather, organise, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence. - Drafting Your Complaint

Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR.This ensures your complaint is understood properly and not rejected due to formatting issues. - Platform Filing Support

Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays. - Escalation Guidance

If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage. - Case Management from Start to Finish

Once you’re registered with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges. - Support During Counselling & Arbitration

If your case moves to counseling or arbitration, we assist you in preparing your statements and documents so you feel confident and ready.

By registering with us, you don’t have to struggle with complicated procedures, drafting confusion, or paperwork stress.

We make the process smoother, clearer, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

ICICI Securities is a trusted broker that many rely on for their investments. But mistakes can happen to anyone, and those errors can impact your savings deeply.

The good news is, when complaints are valid, people do get their money back. Step one is always to file that complaint.

If you face any issues with ICICI Securities or any other broker, don’t wait around. Act quickly to protect your investments.

If the complaint process feels too complicated or you don’t know how to complaint in SEBI, remember, we’re here to make it easier for you.