Imagine losing lakhs in the stock market because your broker, IDBI Capital, delayed your funds or mishandled your trades.

IDBI Capital complaints like these are more common than you think, leaving everyday investors like you feeling stuck and frustrated.

If you’ve ever felt trapped by slow refunds, buggy apps, or ignored emails from this broker, you’re not alone.

This guide breaks it all down simply.

Here, we will talk about real arbitration cases and SEBI orders that will help you in making the decision process easy.

IDBI Capital Review

IDBI Capital Markets & Securities Ltd, often just called IDBI Capital, is a full-service stock broker backed by IDBI Bank, one of India’s well-known public sector banks.

They hold SEBI registration number INZ000179035 as a stock broker, which means they’re officially licensed to handle your trades in equities, derivatives, currencies, commodities, mutual funds, and even IPOs.

With over 100 branches across 17 cities and a team focused on retail and high-net-worth clients, they offer tools like research reports, mobile apps, and 3-in-1 accounts linking your bank, demat, and trading seamlessly.

What draws many to IDBI Capital is the trust factor from its banking roots, promising secure transactions and expert advice. They cater to beginners with simple online interfaces and pros with advanced charting.

But, as with any broker, the real test comes when things go wrong, like during market volatility or payout delays. Knowing their setup helps you spot if their promises match reality.

Details of IDBI Capital Complaints

IDBI Capital currently serves 57,924 active clients. Out of these, the broker has received 10 complaints, which is just 0.017% of its active client base.

The positive part is that all complaints have been fully resolved, maintaining a 100% resolution rate.

Seeing the NSE/BSE data, the IDBI capital complaints can be grouped under the following types:

Type I: Non-receipt / Delay in Payment

These complaints arise when a client does not receive their payout on time. It includes delays in fund withdrawals or pending payments after selling securities. Clients generally expect faster processing, so delays trigger complaints.

Type II: Non-receipt / Delay in Securities

This happens when shares bought are not credited to the client’s demat account on time. It also includes delays in transferring or delivering securities. Such issues often affect trading continuity and create trust concerns.

Type V: Service Related

These complaints cover problems with customer support, platform usability, or response delays. It may involve poor communication, unresolved queries, or difficulties in using the broker’s trading tools.

These issues usually impact the overall user experience.

Type IX: Others

This category includes all complaints that don’t fit into the standard listed types. It may involve technical glitches, administrative errors, or miscellaneous issues unique to specific cases. It acts as a general bucket for rare or exceptional concerns.

Thus, these are some of the common types of issues faced by the clients of IDBI Capital. Now, let us have a look at some of the arbitration cases and SEBI orders on the broker.

IDBI User Complaints

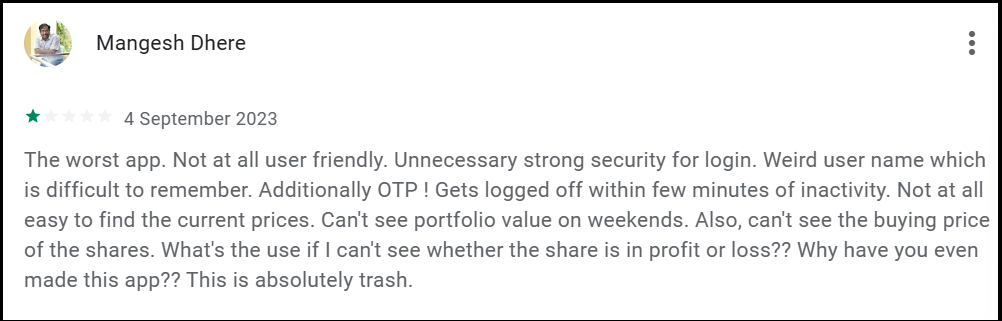

Multiple users have raised serious concerns about IDBI’s reliability.

One user reported that the app is extremely unfriendly and difficult to use.

The review highlights confusing login security, frequent OTPs without activity, and missing basic features like portfolio value on weekends, buying price, and a clear profit or loss status.

The user questioned the purpose of the app and described the overall experience as extremely poor.

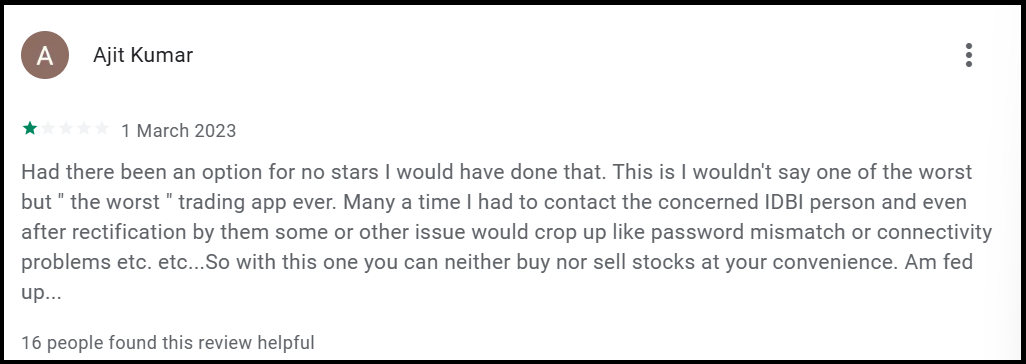

Another user reported that the trading app is among the worst they have experienced. The user stated that repeated technical issues forced them to contact IDBI support multiple times, yet problems continued even after rectification.

Frequent login failures, password mismatches, and connectivity errors reportedly made it impossible to buy or sell stocks smoothly, leaving the user frustrated and fed up.

These repeated complaints point to serious operational and reliability issues, raising concerns about whether the platform is fit for everyday investor use.

IDBI Capital Arbitrations

The first step when you face any problem is to contact the customer care service of your broker. Still, if you don’t get a solution, then clients can file arbitration cases.

Let us have a look at some of the arbitrations filed against IDBI Capital.

Mrs. Shanthi Sivadass filed this arbitration appeal against her broker, IDBI Capital Markets Securities Limited. Her trading account was blocked automatically after no trades for a year, which follows NSE rules.

But when she asked to reopen it soon after, the broker delayed by asking for extra papers like fresh KYC, even though the rules said a simple request should work.

Penalty Imposed

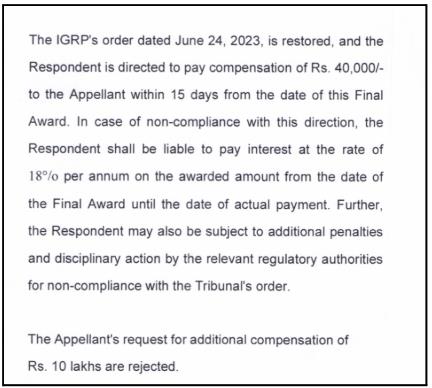

The tribunal sided with Mrs. Sivadass and brought back the earlier order from NSE’s grievance team.

That order made the broker pay her Rs. 40,000 as compensation for the delay and hassle, which lasted over four months. No extra penalty beyond this was added, and both sides paid their own costs.

Key Learnings for Investors

- Brokers must follow NSE rules. The accounts inactive for 12 months get flagged without notice, but quick reactivation needs no new full paperwork.

- If your broker drags their feet or demands too many documents, complain to their grievance cell, then NSE, and push for arbitration if needed.

- Always keep records of your requests and broker emails; this helped prove the delay here and win fair pay for lost trading time.

IDBI SEBI Order

SEBI, the market guardian everyone trusts, has cracked down on IDBI Capital for serious lapses. One of the orders was passed in 2024, in which the company violated some major rules and had to pay a huge penalty amount.

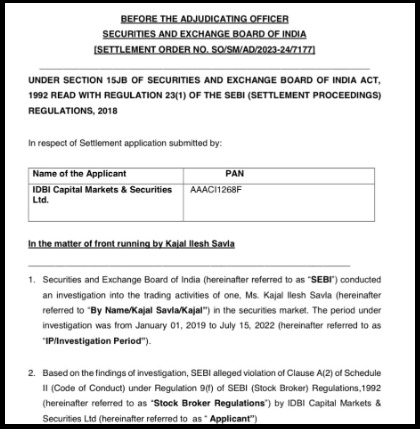

SEBI investigated trading from January 2019 to July 2022 and found serious issues at IDBI Capital’s office. Their chief dealer, Gaurav Girish Dedhia, used his work computer to place “front-running” trades.

This means buying or selling stocks ahead of big clients’ orders he knew about, through his sister Kajal Ilesh Savla’s account at another broker.

This unfair edge lets them profit from client info, breaking broker rules on honesty and client protection. IDBI Capital failed to monitor their own employees or enforce policies like no personal trading from the dealing room, allowing the scam to run for years.

What SEBI Did?

SEBI issued a Show Cause Notice in February 2023, alleging violations of the Stock Brokers Code of Conduct.

Instead of a full trial, IDBI Capital applied for settlement in March 2023, agreeing to fix its systems without admitting guilt.

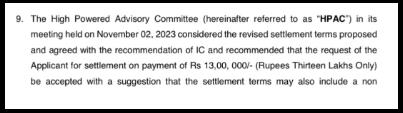

After reviews by SEBI’s Internal Committee, High Powered Advisory Committee, and Whole Time Members, they approved it in January 2024. BSE checked and found no ongoing issues. IDBI Capital paid a penalty of Rs 13 lakhs on March 6, 2024, closing the case on March 15, 2024.

Key Lessons for Investors

Investors should always pick brokers with strong oversight and report odd trade delays to SEBI’s SCORES portal early.

This case shows even bank-backed firms like IDBI Capital face real penalties, pushing the industry toward better trust and fairness for everyday traders like you.

Where to Report Stock Broker Complaints?

If you face issues with your broker, there are clear steps you can take to protect your investments and seek a resolution.

You can register with us, and we will help you in the following ways:

1. Evidence Compilation

Our team organises every essential document, trade statements, contract notes, ledgers, screenshots, emails, and call logs to build a solid foundation for your case.

2. Complaint Drafting

We prepare professionally written drafts that comply with NSE, BSE, SCORES, and SMART ODR requirements so your complaint is properly structured.

3. Portal Submission Assistance

We help you navigate the filing systems step-by-step to avoid delays or errors.

4. Escalation Guidance

If the issue persists, we explain the correct escalation path, from exchange-level processes to IGRP and arbitration.

5. Complete Case Oversight

Once registered, we continually track your complaint, manage timelines, and help you respond to regulatory queries.

6. Hearing Preparation

For counseling or arbitration, we support you in preparing complete evidence bundles and structured statements.

Conclusion

IDBI Capital has a relatively low number of complaints compared to its active client base. Most reported issues relate to delays, service gaps, or technical concerns that are commonly seen across brokers.

The important part is that the broker has maintained a strong complaint resolution record, addressing all cases with a 100% resolution rate.

Isolated disputes and regulatory cases highlight areas where processes can improve.

The overall complaint data suggests that IDBI Capital functions as a stable and responsive broker. It offers better transparency, communication, and system strengthening to avoid future grievances.