As per the latest CloudSEK data, over 100,000 cases of investment scams were reported in India in 2023, and more than 4,599 investment scam cases emerged in just the first four months of 2024.

The total loss value of such scams in 2024 alone is equal to ₹120 crores.

That’s huge.

And to your surprise, this data is only of the reported cases. No doubt, if we get into the unreported cases, the value of scams would be unimaginable.

Now here come a few questions that need to be addressed:

- Why are such scams on the rise?

- How scammers are able to meet their objectives?

- And last but not least what people can do to protect themselves from such scams.

Let’s get into more to find the breakup of these scams, the types of scams, and the ways to protect yourself from such scams.

Why Investment Scams Are on the Rise?

The answer is crystal clear: the shift in focus to social media

Gone are the days when scammers relied only on cold calls and email phishing.

Today they deploy sophisticated tactics to lure victims into fraudulent investment schemes through social media platforms and other messaging apps like WhatsApp & Telegram.

The report indicates that scammers are impersonating reputable financial experts, fund managers, and influencers to create fake investment groups.

These groups promise quick and substantial returns by showing fake PnLs and luxurious lifestyles, which make it easier for them to trap viewers who eventually end up losing their hard-earned money.

Breaking Down the Stats

Now, if we look deeper into CloudSEK’s findings, it reveal some surprising data and loss value.

- As per the data, over 100,000 investment scams were reported in the year 2023.

- In just the first four months of 2024, digital fraud resulted in losses exceeding ₹ 120 crores across 4,599 reported cases.

- Authorities received around 62,687 complaints related to investment scams during this period, amounting to losses of ₹ 222 crores.

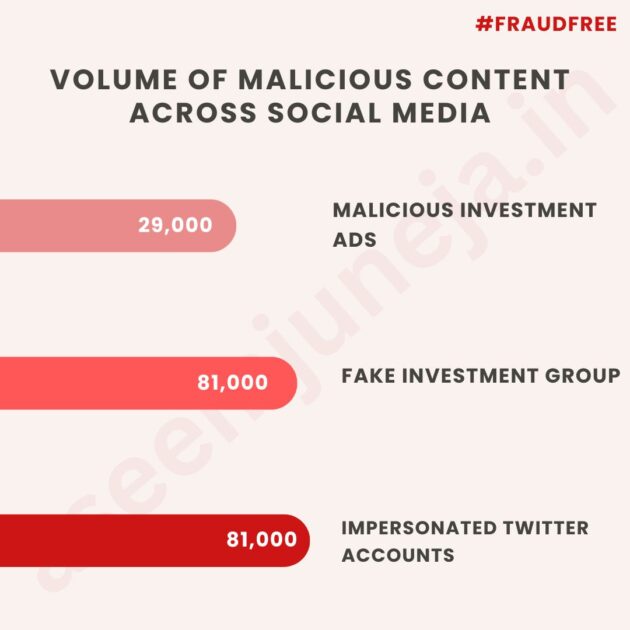

The report further highlights the high volume of malicious content trending on social media:

- More than 29,000 malicious investment ads have been detected on Facebook.

- 81,000 fake investment groups have been identified on WhatsApp.

- Additionally, 81,000 impersonated accounts on Twitter.

What Kind of Investment Scams Are the Most Common?

Investment scams involve fraudsters posing as legitimate financial professionals and creating fake investment groups on platforms like WhatsApp and Telegram. They lure unsuspecting individuals with promises of high returns, creating an illusion of security and trust.

Now as per the report, the two most common types of investment scams are running on at larger scale. This includes:

- Crypto Scams in India: Fraudsters persuade victims to invest in fake cryptocurrency platforms, often presenting attractive returns that never materialize.

- Stock Trading Scams: Scammers lure victims by making false promises of high returns that lead to significant financial losses.

Here is the Modus Operandi of Scammers:

- Scammers create fake profiles that mimic real financial advisors, create fake platforms, or use social media to mis-influence to target potential victims.

- They collect data through targeted social media ads, direct messages, and fake investment groups and make initial contact with potential victims.

- They develop fake apps or websites to run their fake training programs just to trap large groups of people.

- By leveraging pre-scripted messages and creating a sense of urgency, scammers manipulate victims into investing more money. Techniques like FOMO (fear of missing out) play a significant role in their strategies.

How to Protect Yourself from Such Scams?

With the increasing number of investment scams, it become more important for financial firms and government authorities to become more proactive and implement some advanced monitoring systems.

Establishing dedicated teams to monitor social media and messaging platforms can help identify and remove fraudulent content before it reaches potential victims.

Furthermore, to safeguard against these fraudulent schemes, it’s crucial to:

- Verify Credentials: Always check the legitimacy of the investment firm and the individuals contacting you before making any investments.

- Use Reputable Platforms: Stick to well-known and regulated trading platforms to ensure your investments are secure.

- Be Skeptical of High Returns: Remain cautious of unsolicited investment opportunities that promise extraordinary returns with little to no risk.

Conclusion

The findings from CloudSEK’s report serve as a stark reminder of the growing threat posed by investment scams on social media platforms.

Awareness, vigilance, and informed decision-making are key to protecting yourself in this digital age.

As the landscape of investment continues to evolve, staying informed and cautious can help you navigate the risks and secure your financial future.