Over the past few months, we’ve shared many blogs and videos exposing the truth about Infinite Beacon — a company that promised big returns and fooled many investors. Now, there’s a new update that makes the situation even more serious. Let’s break down the latest Infinite Beacon news.

Infinite Beacon News India

Even as Infinite Beacon’s Ponzi scheme appears to be on the verge of collapse, evident from reports of Agast Mishra absconding, the company is still trying to trap new investors or keep existing ones engaged with false hopes.

In a surprising move, they have shifted their payout system from Indian currency to cryptocurrency, specifically USDT on the TRC20 network.

This change not only raises fresh concerns but also makes it harder for investors to trace or recover their money.

It’s high time for investors to stay alert and act with caution before it’s too late.

Agast Mishra Reportedly Absconding

Agast Mishra, believed to be the key figure behind the Infinite Beacon operation, is reportedly absconding.

Investor complaints have increased, and sources suggest that legal heat has pushed Mishra into hiding.

With mounting pressure from defrauded investors and growing regulatory attention, this disappearance further supports suspicions that the scheme is collapsing under its weight.

Infinite Beacon’s New Strategy: Crypto Payments

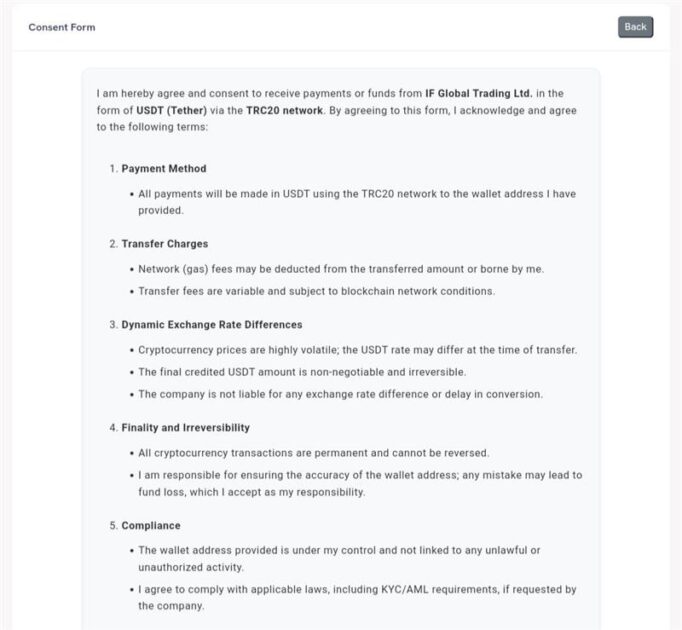

In a recent move, Infinite Beacon has begun issuing consent forms for investors to accept payments in USDT (Tether) using the TRC20 blockchain network.

The consent form shifts all liability onto the investor, from wallet address accuracy to gas fees, exchange rate fluctuations, and the irreversibility of the transaction.

This development raises a serious question: Is this a legitimate evolution of a tech-driven platform, or simply a new method to stall investors and escape accountability?

Why This Shift is Concerning

This transition to cryptocurrency allows the company to:

- Avoid banking oversight and traditional KYC/AML scrutiny.

- Make investor payouts irreversible and untraceable.

- Introduce a new layer of complexity to delay complaints and avoid recovery efforts.

- Create the illusion of operational continuity, buying time to recruit more investors or exit quietly.

This change comes at a time when the company is facing more public attention and legal pressure, which suggests it’s not about helping investors, but about finding a way to escape.

Where India Stands on Crypto Regulation

In India, the legal framework around cryptocurrencies remains limited.

While the Supreme Court lifted the RBI’s banking ban on crypto in 2020, the government and financial regulators like SEBI have not recognized cryptocurrencies as legal tender.

This means that any investment scheme operating through crypto, especially those promising fixed returns, is outside the reach of traditional investor protection laws.

Additionally:

- SEBI does not regulate crypto-based investment products.

- The RBI has repeatedly warned users of the risks of virtual currencies.

- No formal dispute resolution system exists for failed or fraudulent crypto transfers.

By shifting to USDT payments, Infinite Beacon is taking its operations beyond the jurisdiction of Indian regulators, making it significantly harder for investors to seek justice.

Patterns That Match Other Ponzi Crypto Scams

Crypto-based Ponzi schemes have a few things in common:

- Unrealistic return promises (8–10% monthly or more).

- Dependency on new investor inflows to sustain payouts.

- A complex, often opaque fund flow process.

- Platforms that suddenly stop responding when withdrawal requests peak.

Infinite Beacon checks all these boxes. Initially, many investors received returns, which built trust and word-of-mouth credibility. But as with all Ponzi schemes, these returns were reportedly funded by newer investor deposits, not from any real trading or investment strategy.

Investor Experiences and Warning Signs

Several investors have already raised concerns online about:

- Sudden migration to unfamiliar crypto dashboards.

- Delays in withdrawal or total loss of access to funds.

- Poor communication or silence from company representatives.

- Requests for new wallet registrations and complex consent agreements.

One look at the consent form provided by IF Global Trading Ltd. reveals how the company is attempting to eliminate any future liability.

Terms such as “irreversible,” “non-negotiable,” and “not liable” appear multiple times, essentially warning investors that once the money is sent, they are on their own.

What You Can Do

If you’ve invested with Infinite Beacon, here’s what we recommend:

- Do not send any more money, in any form.

- Document all communication, dashboards, transfers, and consent forms.

- Complaint in SEBI, the Enforcement Directorate (ED), and your local Cyber Crime Cell.

- Share this information to prevent others from getting trapped.

Need help? Register with us and submit all the proof of payments done to date, and we will guide you with the complaint process.

Conclusion

The move to cryptocurrency does not indicate that Infinite Beacon is evolving; it shows that the company is trying to hide.

With their key operator reportedly missing, and the entire platform shifting to an unregulated, irreversible system of payment, the intent seems more aligned with evasion than innovation.

Investors must remain cautious. This is not an upgrade in service; it’s a sign of collapse.

Disclaimer

This article is based on independent research, publicly available documents, investor reports, and regulatory information.

It is intended to inform and alert, not serve as financial or legal advice. Readers are encouraged to conduct their due diligence and consult professionals for specific guidance.