There are a lot of fake loan apps like Asan Loan App that trick people in need of money by offering them instant loans without requiring a lot of paperwork.

But this is a trap that will eventually harm you very much.

Just think of a person who is at a loss to make both ends meet, and yet she/he download the Asan Loan App.

The user is asked to give the app permissions that allow it to access the user’s contacts, gallery, and other personal information.

A very small amount of money is given to the user almost right away, but with outrageously high-interest rates and an incredibly short repayment period, sometimes only seven days.

Asan Loan App Safe or Not

When we look at the instant loan market, the pattern is usually the same.

Users lured in by quick cash often find themselves facing a nightmare. Here’s what makes many of these apps, including those using names like Asan Loan, highly suspicious:

- Exorbitant interest and hidden charges: Users are deceived into accepting loans with outrageously high-interest rates and hidden fees, thus making the repayment process almost impossible.

- Data and privacy invasion: The app takes your personal information, such as your contacts and photos, which it then uses to threaten and intimidate you and your family.

- Harassment and blackmail: If you fail to make the repayment, the agents in charge of the recovery will threaten, intimidate you and your family and deeply upset you mentally.

- No legal protection: Asan Loan App is not a registered Non-Banking Financial Company (NBFC) in India, hence you do not have any legal recourse or protection against their unethical practices.

Asan Loan Scam Complaints

Just like several other risky loan apps, Asan Loan has also been repeatedly reported in user complaints for serious issues such as harassment, data theft, threatening phone calls, and excessive charges.

These patterns show up across multiple reviews and highlight why borrowers need to be extremely cautious before interacting with such platforms.

Complaint 1: Harassment by Asan Loan

One of the instances that can be cited from the reports is that of a lady named Bhoomi, who had been subjected to a horrendous experience by the Asan loan app while she was struggling with multiple loans from different apps.

- Once she had cleared all her debts, the agents from the Asan Loan app kept harassing her.

- A colleague looked into it and found that the app had fabricated a pornographic image of Bhoomi by photoshopping her face on a different body in a very low-quality manner. This telephone morphed image was sent to everyone in her contact list.

- Such an event caused Bhoomi to feel extreme shame and suffer from trauma to such an extent that she attempted to take her own life.

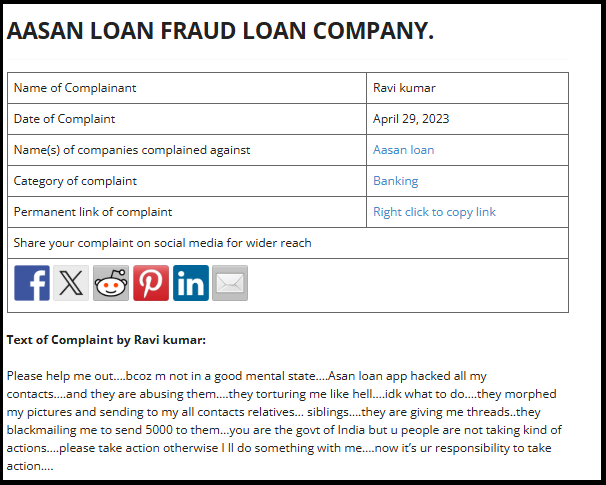

Complaint 2: Hacking & Data Stealing

One of the most alarming complaints circulating online comes from a user who reported a deeply distressing experience with the Asan Loan app.

According to the complaint, after taking a loan, the app allegedly accessed the user’s contacts and began harassing them.

The borrower claimed that their pictures were edited and sent to family members and relatives as a form of pressure.

They also reported being threatened and blackmailed to pay money they couldn’t afford, which pushed them into a very fragile mental and emotional state.

This type of behaviour is not only unethical, but it is also illegal in India. No digital lender is allowed to threaten borrowers, shame them publicly, or misuse their personal data.

How to Report Loan Frauds in India?

These steps should be taken immediately if you or someone you know has been victimised by an illegal lending app like Asan Loan:

- Gather evidence: Besides the app screenshots, also gather the transaction details, messages, and take screenshots of any other communication with the fraudsters.

- File a Cyber Crime Complaint: Access the National Cyber Crime Reporting Portal

- In case of a request for immediate action on financial fraud, dialling the national helpline number is recommended.

- File a police complaint: Based on the cybercrime committed against you, take the evidence to your local police station or cyber cell and lodge an official First Information Report (FIR).

- Inform your bank: If you are a victim of fraud, it is wise to inform your bank without any delay of the fraudulent transactions and request that they freeze your account so that no more unauthorised debits can take place.

- Report to RBI Sachet Portal: If you feel the need, file a complaint on the RBI Sachet Portal to let the central bank know about the fraud.

Need Help?

In case you do not know the steps to write your complaint and manage the report process:

Make a registration with us right away, and we will be the support that victims need through the correct preparation of the files, writing of the complaint, and direction to the officials for filing the fraud report to the cyber police and the local police.

Conclusion

When in urgent need of a loan, always turn to legitimate banks or RBI-approved NBFCs. Do your research and never risk your safety and privacy for the promise of easy money.

While the need for quick cash is real, using an unverified, illegal instant loan app like the many clones of Asan Loan puts your privacy, reputation, and peace of mind at extreme risk.