Promised 400% returns on Beldex staking?

Wait before you invest.

Because behind the shiny marketing and big numbers, there’s a story most people never hear, and it could save you from a costly mistake.

Let’s break down what’s really going on.

Is Beldex Legal or Not in India?

Beldex Coin is a privacy cryptocurrency. Launched in 2018. Currently trades around ₹6-7 per coin.

The coin promises anonymous transactions. Uses advanced encryption. Built on Monero’s framework.

Sounds technical, right?

But here’s the reality. Privacy coins face global scrutiny. Many countries ban them outright.

Why?

Money laundering concerns.

According to IQ.wiki, Afanddy B Hushni is a co-founder and Chairman of Beldex International.

He’s based in Malaysia with 20+ years in traditional finance.

According to Coinpedia, Beldex was founded in 2018 with headquarters in Victoria, Beau Vallon, Seychelles. Offshore jurisdiction. Red flag number one.

The founders claim expertise in privacy systems.

According to Bitget, Beldex International launched in March 2018, led by Afanddy B. Hushni, with Kim as CEO, having extensive knowledge in privacy systems and cryptographic protocols.

What does it indicate?

The company has no Indian presence. No local office. Everything offshore.

So, is it legal?

Simple answer? No.

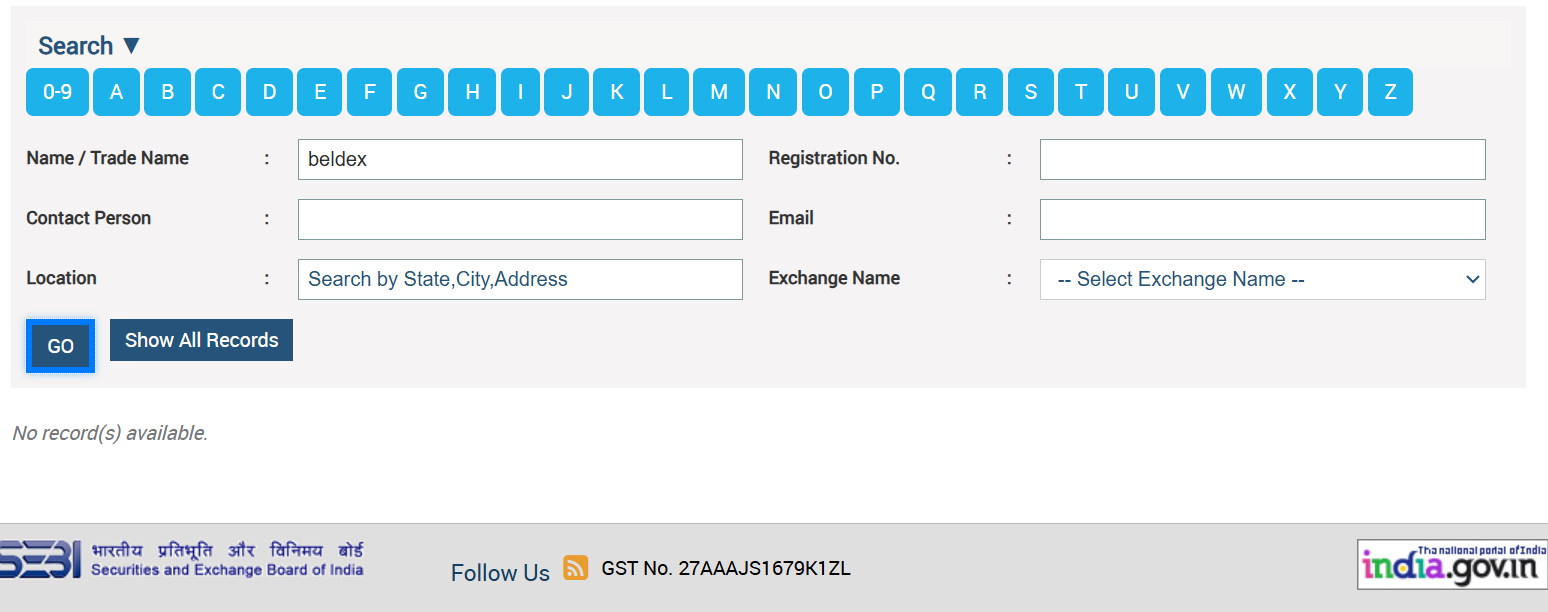

No RBI authorisation. No SEBI registration. No Financial Intelligence Unit approval.

According to Reserve Bank of India statements, the RBI has not given any licence or authorisation to any entity to operate schemes or deal with Bitcoin or any virtual currency. This applies to Beldex, too.

What does this mean?

- No legal protection for investors

- No regulatory oversight

- No complaint redressal mechanism

- Zero accountability

The company operates from Seychelles. A known tax haven. Perfect for avoiding scrutiny.

According to BuyUcoin, Beldex is legal in India, and users can purchase it, with the government introducing a 30% tax on crypto profits, showing adoption rather than banning.

The 30% tax doesn’t validate projects. It simply acknowledges that crypto exists. Big difference.

Is Beldex Safe or Not?

Here’s where things get murky.

Beldex is not a fair investment option but functions like a Crypto Ponzi Scheme in reality.

Aarman operates as Beldex’s staking platform. Previously called GCCHUB. Before that, Belcrypto.

The Rebranding Trail: Belcrypto to GCCHUB and then to Aarman

Three names in a few years? Classic scam tactic.

Aarman’s Disclaimer Policy

This is where things get interesting.

According to Aarman’s own website, BC Global Exchangers (Aarman) takes no responsibility for anything.

- Not your trades.

- Not your investment actions.

- Not your mistakes.

- Not even their own errors.

In simple terms? You’re on your own.

The same disclaimer also says that none of their employees, founders, advisors, or affiliates is investment or trading advisors.

And none of the information they provide is a recommendation to buy or sell anything.

So they promise up to 400% returns, but also say they’re not responsible for anything that happens.

Contradictory?

Absolutely.

Beldex Coin Ponzi Scam

No doubt, there is real crypto, Beldex Coin, but in India, scammers are using its name to run a Beldex scam.

According to BehindMLM, Aarman runs a basic staking-model MLM crypto Ponzi, where:

- New people join.

- They invest in BDX.

- They’re promised passive returns paid out in more BDX.

The Millionaire Drive Blog breaks it down even further.

Aarman offers:

- 5,000–50,000 BDX investment tiers

- 4%–3.25% monthly returns

- 200%–450% lump-sum payouts

- 250% after 3 years or 400% after 5 years

Huge promises. Zero transparency.

And the biggest questions:

Where does a “400% return” come from?

According to BehindMLM, the only real money entering Aarman is new investor money. There’s no proven external revenue. No real business activity.

If new deposits are used to pay old investors, that fits the classic definition of a Ponzi scheme.

New money pays old money. Eventually, it collapses.

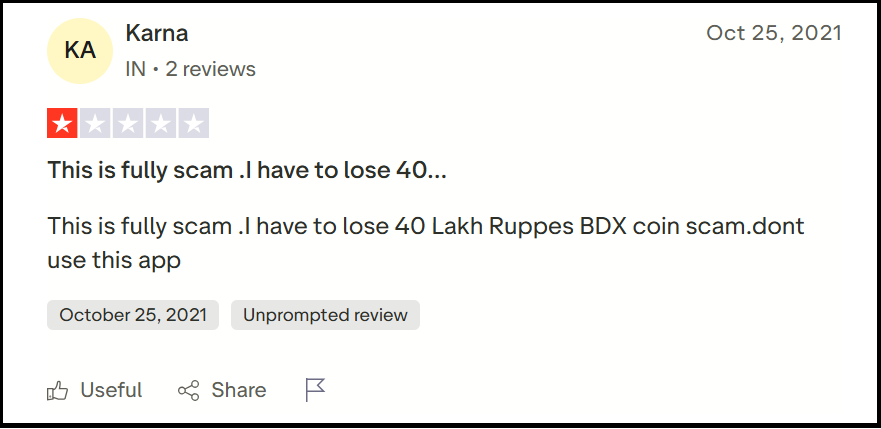

Beldex Coin Complaints

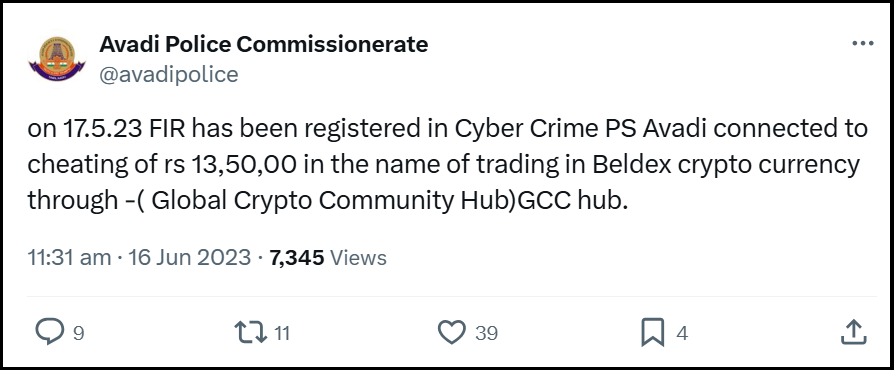

Critical Evidence: According to Avadi Police (Tamil Nadu), on 17.5.23 FIR has been registered in Cyber Crime PS Avadi.

The complaint was connected to the cheating of Rs 13,50,00 in the name of trading in Beldex cryptocurrency through Global Crypto Community Hub (GCC hub).

That’s ₹13.5 lakh. Real money. Real victim. Real police case.

Let’s categorise the cryptocurrency complaints in India as per the problems faced by Indian users:

1. Price Manipulation Concerns

According to Trustpilot, one user warned that all reviews are from Tamil Nadu, India only, questioning why an international Hong Kong-based company has no reviews from other countries.

Coordinated fake reviews? Suspicious.

According to another Trustpilot review, users warned about Beldex operating as a “Multi Marketing cheating Business” and advised people to keep their money safe and not invest in this scam.

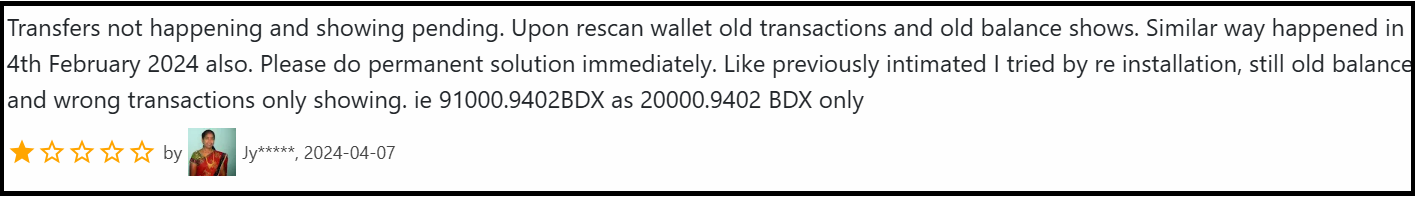

2. Beldex Withdrawal Problems

According to Reviews.io, one investor’s account was suddenly placed “under review” when trying to withdraw earnings, and they were pressured to pay additional “clearance” fees before losing contact with the broker altogether.

Additional fees to withdraw your own money?

3. The Rank System Problem

According to The Millionaire Drive Blog, Aarman boasts forty ranks with names ranging from “Deciders” to “Lambo Elite”. Forty ranks. More than military organisations.

Moreover, according to the same source, half of the commissions must be reinvested back into the scheme.

They force reinvestment. Trapping your money.

How to Report a Ponzi Scheme in India?

If you’ve lost money or are facing issues, act immediately.

File a Cyber Crime complaint online.

- Upload evidence

- Track status

Reserve Bank of India:

- Visit the RBI complaint portal

- Report unauthorised schemes

- Financial fraud section

Financial Intelligence Unit (FIU-IND):

- Money laundering complaints

- Suspicious transaction reports

- Offshore entity reports

Need Help?

Lost money in Beldex or Aarman? You’re not alone. Hundreds face similar situations.

For your complaints, register with us. We assist in:

- Documentation preparation

- Legal guidance navigation

- Authority coordination

- Recovery process support

Early reporting improves recovery chances. Don’t delay. Don’t stay silent.

The longer you wait, the harder recovery becomes. Financial fraud is time-sensitive. Act now.

Conclusion

Is Beldex legal in India?

Technically, buying crypto isn’t illegal. But Beldex and Aarman operate without Indian regulatory approval.

The police FIR, MLM structure, impossible returns, forced reinvestment, and offshore registration all point toward the risks of crypto fraud in India.

According to multiple watchdogs, Aarman having a purported Kuala Lumpur marketing office and Beldex founder Afanddy B Hushni also being based out of Kuala Lumpur is suspicious.

Legal doesn’t mean safe. The 30% crypto tax doesn’t validate specific projects. It simply acknowledges crypto’s existence.

Protect your money. Research thoroughly. Question impossible promises. Trust mathematics over marketing.

If something promises 400% returns with zero risk? Run.