Are you thinking about installing the Farm Wealth app to make some extra income? With a name like “Farm Wealth,” it sounds like something related to farming, agriculture, or maybe earning money through farm-based products.

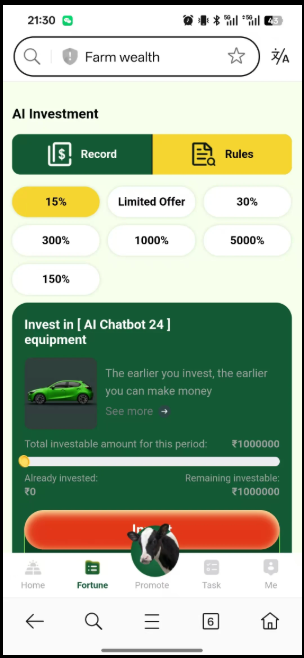

But once you actually look inside the app, things start to look very different. Instead of anything related to farming, the app shows AI robots, digital investment packages, and high daily earnings that seem too good to be true.

This raises concern is Farm Wealth App safe?

Is Farm Wealth App Safe in India?

In today’s world of easy-money apps, it’s important to pause and question what you’re really dealing with.

While a few platforms are genuine, many others are designed to pull users in with attractive earnings, only to misuse their time, data, or even hard-earned money.

Now, when it comes to the Farm Wealth app, before digging deepe,r let’s have a look at the image below:

Now, the app claims super high returns, which itself raises a lot of red flags.

Such unrealistic profits are not possible in most legitimate, regulated financial institutions.

And when it comes to legitimacy, there is:

- Absence of Regulation

Regulated by such agencies as RBI (Reserve Bank of India) or SEBI (Securities and Exchange Board of India) are real investment platforms (banks, mutual funds, brokerages).

Unless Farm Wealth is registered with them, it is a law-abiding operation, and you have no protection at all. - The Classic Ponzi Scheme Model

The app gives assurance of returns and bonuses on inviting others, which resembles the classic Ponzi model.

It all seems okay until the time there are not sufficient new people to join, and all of a sudden, they close down, taking all the money in the process.

In a sentence, according to typical modalities of unchecked, high-rate investment schemes, there are high chances that the Farm Wealth app is not a safe betting area and may be a SCAM. Be extremely cautious!

Farm Wealth App Complaints

Many users claimed that they felt it was a Fraud/Cheating App. Sign up, Login bonus mentioned was not given, and in the task, only the Recharge 70000/100000 options are available.

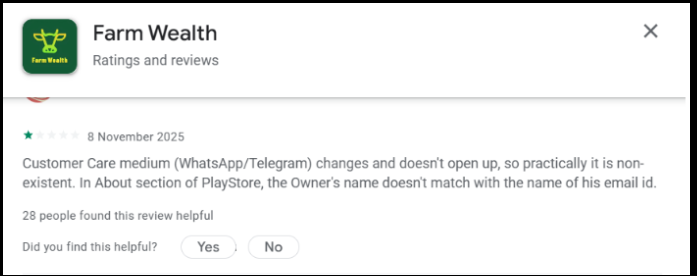

One of the users reports that the app’s customer care channels (WhatsApp/Telegram) frequently change or fail to open. They also mention that the name shown in the Play Store’s “About” section does not match the name used in the developer’s email address.

This could suggest inconsistency in support communication, making it difficult for users to seek help when needed. The mismatch in names may also create doubt about the app’s transparency or credibility.

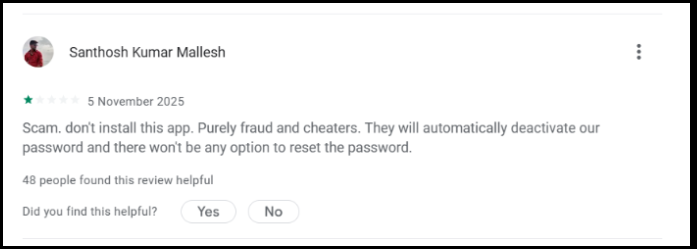

Another user claims that the app is a scam and alleges fraudulent activity. They mention that their password was deactivated without warning, and they were not provided with any option to reset it, leaving them locked out of their account.

If multiple users experience account access issues without proper support or recovery options, it can be a potential red flag. This type of feedback usually indicates reliability problems, poor customer service, or possibly risky app behaviour.

Also, some mentioned that, 99% scam app because if you download & register to deposit rupees 599, but your payment will be debited from your bank account, but not credited in the Farm Wealth app, that 1st scam & fake customer support & scam withdrawal, but you will not receive.

How to File a Complaint Against Farm Wealth App?

If your money has been taken from you by the Farm Wealth app or any similar financial scams, you must not waste time and act immediately!

- File a Complaint in Cyber Crime: The next most important step after this is to report the incident immediately on the official cybercrime portal.

- Contact Your Bank: Your bank should be notified about the unauthorised transaction at the earliest possible time. If the transaction is very recent, they may even be able to stop it or reverse it.

- Local Police: Lodge a written complaint detailing the incident at your nearest police station along with the affidavits, photos, bank statements, and the app’s URL or ID.

- Regulator Notifications: You may inform financial regulators, e.g., RBI or SEBI, about investment fraud so that they can help in the eradication of such activities.

Need Help?

If you are struggling with the process of reporting a financial scam or need help navigating the official portals, register with us. We can certainly guide you with the general steps.

Conclusion

The best defence against Farm Wealth-style scams is education and scepticism. If an investment promises you returns that sound too good to be true, it almost certainly is. Always stick to platforms that are properly licensed and regulated by the government.