If you’re seeing ads for Finadexa everywhere or getting messages from “analysts” promising easy profits, you’re not alone.

A lot of Indians have recently come across this platform, and the big question is the same everywhere: Is Finadexa legit, or is something shady going on behind the scenes?

Is Finadex Regulated in India?

Finadexa claims to be a “global online trading broker” offering forex, commodities, indices, and shiny market-analysis tools. Sounds impressive, right?

They even flash a Mauritius MISA license and an Indian support number, just enough to make Indian traders feel safe and seen.

At first glance, everything looks smooth, professional, and trustworthy.

But here’s the real question. Is it actually what it appears to be?

Because sometimes, a polished website is just the wrapping paper, not the gift inside.

The deeper you dig into independent reviews, the louder the alarm bells get. And we’re not talking about small bugs or harmless glitches — these are big, flashing red flags.

Let’s start with the biggest one: their so-called “regulation.”

Have you noticed how platforms love throwing licence numbers at you to look legitimate?

Well, here’s the twist.

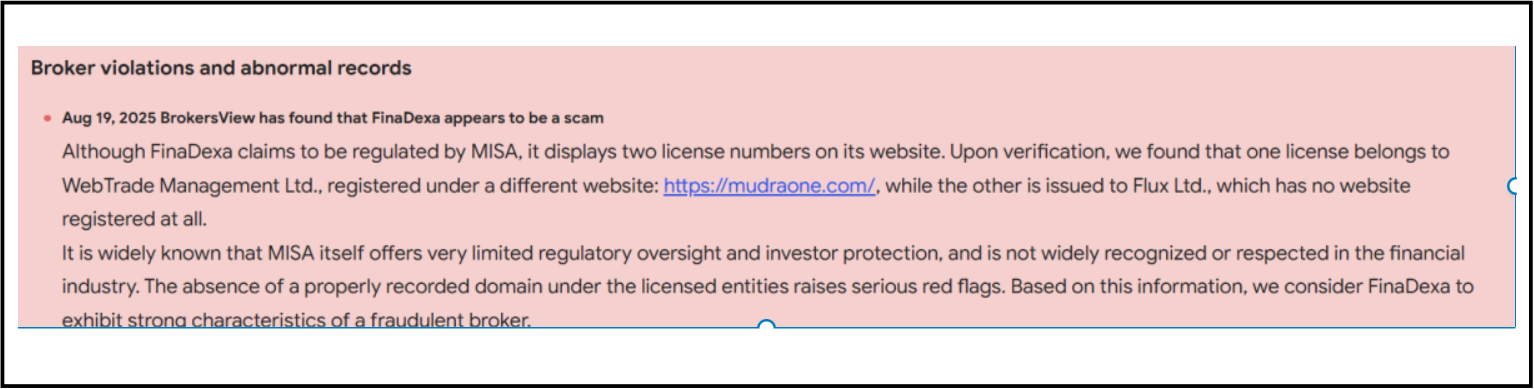

According to multiple broker-review sites, the licence numbers Finadexa proudly displays don’t even match their company name.

One licence reportedly belongs to a completely different business, and another is linked to a company that doesn’t even have an active website anymore.

So what does that mean for you?

They’re essentially borrowing someone else’s credentials to look regulated.

Shocking? Yes.

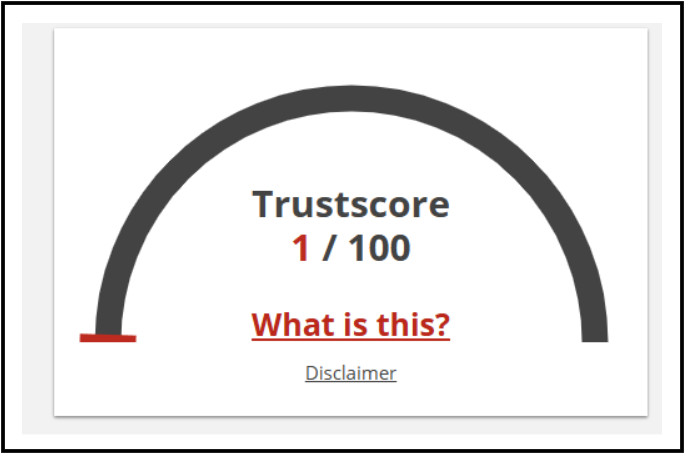

Security scanners also don’t like what they see. Gridinsoft, an online trust scanner, gives Finadexa a 1/100 trust score, calling the domain suspicious and unsafe, raising another question in the mind is Finadexa app real or fake?

ScamAdviser reports similar issues because the company hides ownership details and doesn’t offer verifiable corporate information.

Finadexa Complaints

Trustpilot reviews paint a very concerning picture. Finadexa has a rating of 2.5 out of 5, and a large portion of those reviews are from frustrated or distressed users. Some Indians say they lost money after being convinced to deposit more by their account managers.

Others claim their accounts stopped working or that support simply vanished.

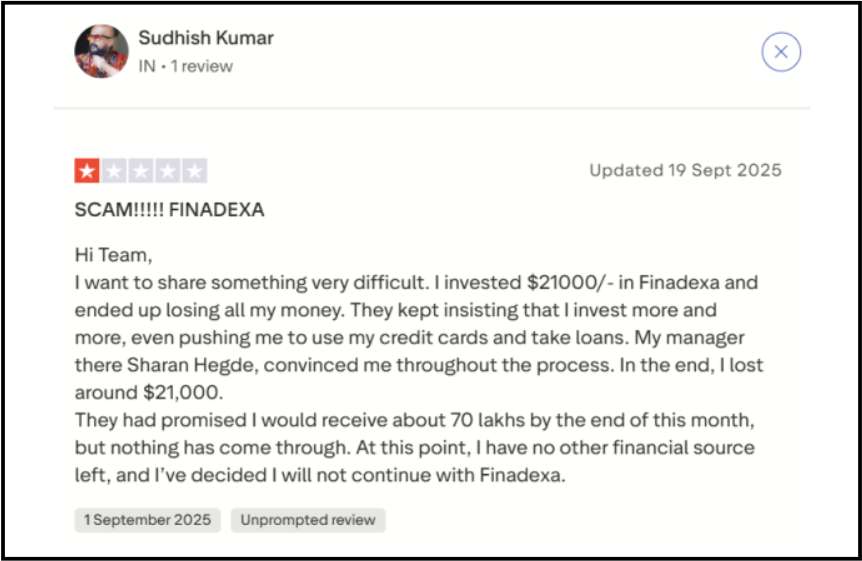

A user from India reported investing $546 and later found out that the platform’s support email stopped working. Another person reported losing over $21,000 after being pressured to take loans and invest “just a little more” because the manager promised high returns.

This review describes several high-severity red flags commonly associated with aggressive or potentially fraudulent online trading schemes.

The user reports losing $21,000 (≈ ₹17.5 lakh). This is a large loss, indicating high-pressure investment escalation.

He mentions a specific individual, “Sharan Hegde,” who guided him throughout.

This implies the presence of a dedicated handler, a common feature in platforms that rely on psychological persuasion to extract maximum deposits.

Despite the promises, he states, “nothing has come through.”

This indicates classic behaviour where profits are shown in-app but never actually released.

How To File a Complaint Against Finadexa?

If you have already sent money to Finadexa and are now worried you’ve been scammed, don’t panic; just act quickly and document everything to file forex trading complaints in India.

Start by collecting proof such as payment receipts, conversations with account managers, email communication, withdrawal attempts, and login screenshots.

- File a Cyber Crime Complaint at the National Cybercrime Portal

- Contact your local police station.

If significant financial loss is involved, consulting a legal expert in cyber fraud can help you understand recovery options. Some banks are also able to block or reverse suspicious transfers if you notify them early enough.

Need Help?

If you or anybody you know is facing issues with Finadexa, you can register with us.

Our team of experts will help you file a complaint and get the required documents ready. Remember that you are not alone in this.

Conclusion

After going through real-user reviews, regulatory checks, independent broker analysis, and security reports, the conclusion is quite clear. Finadexa does not appear to be legitimate or safe for Indian investors.

Between the fake or mismatched licenses, near-zero trust scores, hidden ownership, aggressive sales pressure, and widespread withdrawal complaints, the platform raises too many red flags to ignore.

If you’re thinking about investing, pause and reconsider. And if you’ve already invested, you should immediately begin documenting your case. Lastly, you should report the issue through the proper Indian authorities.

Your money is too valuable to risk on a platform surrounded by this many warning signs.