Maybe you came across the Fly Cash Loan App while searching for a quick solution to a financial emergency. At first glance, it looks promising: fast approval, minimal documentation, and instant money. Sounds like the perfect fix, right? But is the Fly Cash loan app legit?

No doubt these apps seem to be visually appealing, but remember appearances can be deceiving. With hundreds of apps claiming to offer “easy loans,” understanding which ones are legitimate and which ones are dangerous is more important than ever.

So the real question lies the same: Is the Fly Cash Loan App legit, or is it a risk to your financial safety? This blog walks you through the truth, the red flags, and how to stay safe from digital lending scams.

Is Fly Cash Loan App Legit in India?

The Fly Cash Loan App presents itself like many quick-loan apps in India: simple, attractive, and extremely fast. It claims that you can get a loan in minutes, often by submitting only your Aadhaar and PAN details.

Money directly in your account with almost no checks? It sounds convenient. But convenience at this level should immediately make you pause.

These types of apps typically target people facing financial stress or those with low credit scores who may not qualify for traditional bank loans. The interface is kept clean and appealing, which helps build trust. But behind that friendly appearance lies a far more serious issue:

How can any platform offer instant loans with almost no verification? If the process seems too easy, you need to question why.

Here are a few more concerns that make the app risky for use:

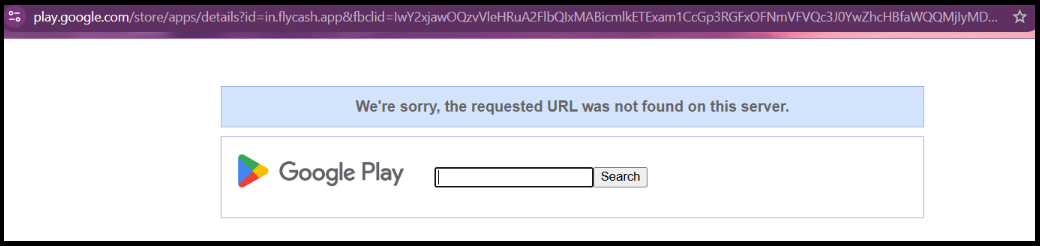

1. It is not available on the Google Play Store

Although the app claims to offer loans, it does not appear on the Play Store—only unrelated apps with similar names show up. A genuine loan app will always be available on verified app stores.

2. The official website raises major red flags

On its website (flycashlending.com), you’ll find a “Download App” button, but clicking it only leads to a blank page. No app. No APK. Nothing.

Scam loan platforms often create fake download buttons to appear legitimate, even when no real app exists.

3. No RBI registration

Fly Cash is not an RBI-registered NBFC, nor does it partner with any licensed NBFC. This means it has no legal authority to lend money in India.

4. No transparency

Legitimate financial apps clearly disclose:

- Loan amount

- Interest rate

- Fees

- APR

- Penalties

- NBFC partner details

Fly Cash provides none of these.

5. Suspicious claims

The app claims it does not check your credit score, which might sound good, but it is actually a trap.

Skipping credit checks is common among scam apps that hide extremely high interest rates or misuse personal data.

6. RBI crackdowns on similar apps

The RBI has already cancelled licenses of several NBFCs involved in predatory lending.

Apps like Fly Cash have been frequently mentioned in discussions around unsafe, illegal, or misleading loan practices—often linked with:

- Overcharging

- Violating fair practices

- Harassing borrowers

- Misusing personal information

If you fall victim to such an app, you have very limited legal protection, because these platforms operate outside the law.

Fly Cash Loan App Complaint

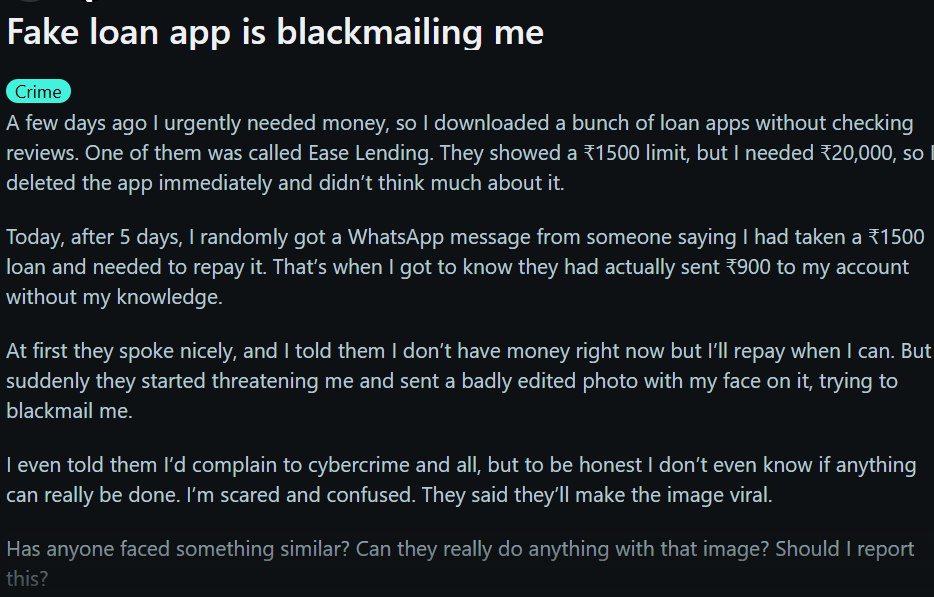

To understand how dangerous these unregulated lending apps can be, here’s a real incident shared by a victim online:

A user urgently needed money and installed several loan apps without checking whether they were legitimate. One of the apps showed a high loan limit, but since the person did not take a loan, they deleted the app and moved on.

Days later, they received a WhatsApp message claiming they had taken a ₹1,500 loan—and shockingly, the scammers had deposited ₹900 into their account without consent. When the user said they couldn’t repay immediately, the scammers turned aggressive.

They began to threaten them and even sent a poorly edited, fake image with the victim’s face pasted on it, attempting to blackmail them into paying.

This is a common tactic used by illegal lending apps:

- They send unsolicited money

- Then accuse you of “taking a loan.”

- Then harass you until you pay far more than the amount sent

- And attempt to scare you with fake, edited photos or threats of making images “viral”

Such intimidation is meant to create panic—but legally, these threats hold no power, especially when the images are clearly fabricated.

If anything like this happens, do not give in. Collect evidence and report it immediately to the cybercrime portal.

How to Report Loan App Scams?

If you or any other person is such that you cannot think twice, and you must take a firm and bold step.

Do not give any money to the blackmailer.

- File a complaint in Cyber Crime.

- Lodge an FIR at the local police station

- File a complaint on the RBI Sachet Portal

Need Help?

Cybercrime reporting can be complicated and stressful under pressure.

We will help gather evidence and file a complaint on the national cyber portal.

Conclusion

Can we say Fly Cash Loan App is legit? The answer is definitely No.

In fact, these apps are designed to take advantage of the most vulnerable people, hijack your personal information, and frighten you into giving them money.

Emphatically, do not sacrifice your money, safety, and inner peace for the sake of a quick loan. Make sure that you only deal with lenders approved by the RBI, whose authorisation you can check on the official RBI site.