Are you concerned about the safety of the Loan Gram app? You’re not alone, and it’s completely valid to feel that way.

With so many instant loan apps available today, it can be hard to tell which ones are genuine and which ones could put you at risk.

Taking a moment to understand the facts is a smart first step toward protecting your finances and your peace of mind.

Loan Gram App Review

There isn’t a real app “Loan Gram” that is provided by a financially safe and secure institution.

It is an association of fraudulent and illegal loan operations that wreck your personal information, give you exorbitant rates, and use harassment methods to get their money back.

Police all over India have investigated the case of illegal online loans taking place in apps such as Loan Gram.

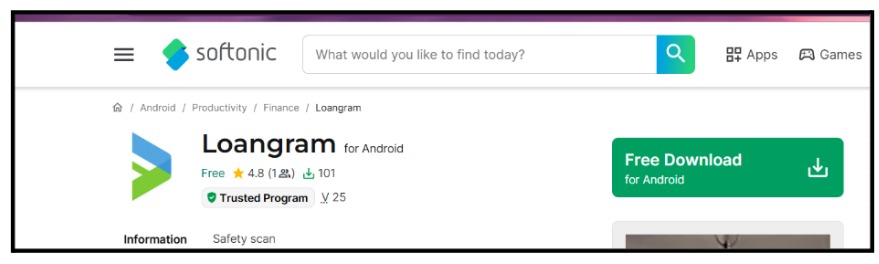

If you are searching for this app on legitimate platforms like the Google Play Store, then you might get disappointed because there is no such app on that platform.

Rather, you have to download the app through APK or from other non-trusted sources.

Is Loan Gram App Real or Fake?

Since no real app exists, the Loan Gram app is fake.

This makes it unsafe and exposes your data for:

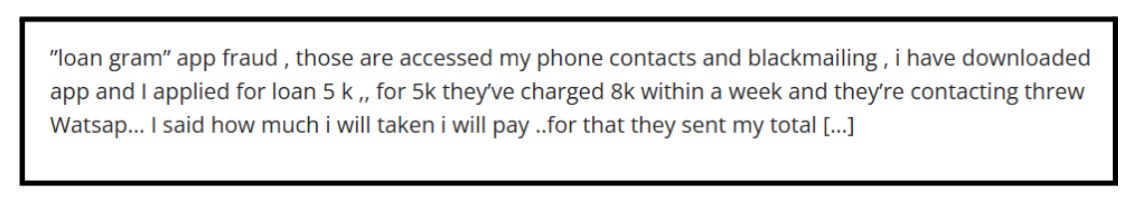

- Data theft: The app requests an excessive number of permissions, for example, access to your contacts, camera, and photo gallery. Later, it is blackmail.

- Short repayment period: The loan is given with an extremely short repayment period, sometimes only seven days.

- High charges: The app charges high-interest rates and processing fees to the users, which forces them into a debt trap.

- Harassment tactics: When borrowers fail to repay, the operators use the stolen personal data to intimidate and abuse the borrowers and their contacts. They can send threatening messages, disclose the borrower’s personal information, and contact the borrower’s family and friends to shame him/her.

Loan Gram App Complaints

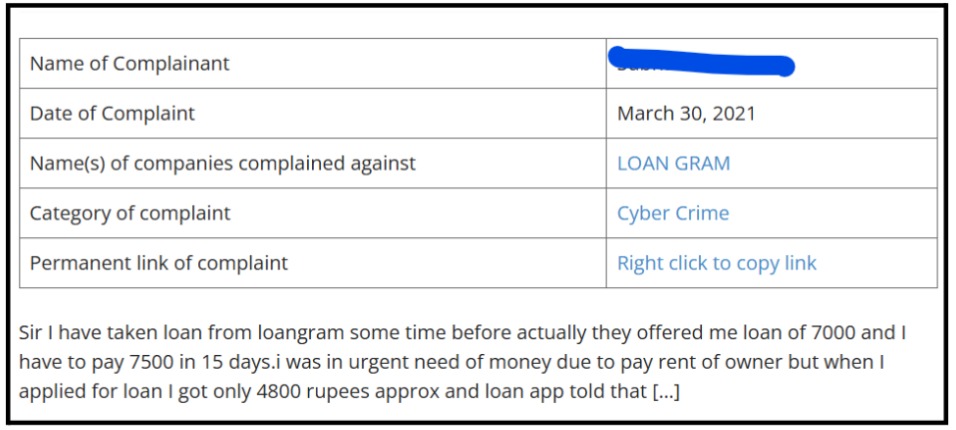

Several complaints have been filed against this app, where victims reported being scammed.

Here is one such complaint reported on a consumer forum.

As per the complaint, the user raised concerns about the data theft and threatening calls to the user who applied for a loan of ₹5000. Later, the platform charged more interest and started blackmailing and sending continuous messages on WhatsApp.

Now, such frauds not only lead to financial losses but also the mental distress.

How to Report Loan Frauds in India?

If you have been a victim of such loan app scams, you should report it immediately.

Here are the steps to file a complaint against online loan app:

- Make sure you have in your possession all the evidence. For instance, take screenshots of the messages and the transaction details.

- File a cyber crime complaint.

- By dialling the national cyber fraud helpline number, you may also report financial fraud.

- If you plan on uninstalling the app, make sure to stop it from having access to your phone by revoking all its permissions in your phone’s settings.

- In case the scam is related to an unregistered or criminal entity, you can submit a complaint to the Reserve Bank of India (RBI) through their Sachet portal.

Need Help?

If fraudulent apps have targeted you or if you have been a victim of any online scam, do not hesitate to sign up with us and get assistance.

By registering with us, you will have a team at your disposal to coordinate your complaint, gather your proof, and figure out the next steps to shield your personal information.

We have had the pleasure of supporting a great number of victims in their recovery and reporting process, and we are ready to offer the same help to you.

Conclusion

Stay Smart, Stay Safe! Never let desperation cloud your judgment.

Always choose lenders that are transparent, follow the rules, and treat you with respect.

Your financial safety is worth more than a quick, risky loan!