Thinking about trying PayTub to make some quick, effortless cash? Pause right there. Is PayTub safe platform?

On the surface, PayTub looks like a dream. You watch a few videos, tap through some tasks, and money magically appears in your balance.

Easy. Fast. Fool-proof.

At least, that’s what it claims.

But behind that smooth interface and flashy earning promises, there’s a side of PayTub most users don’t see until it’s too late.

And trust us, you’ll want to know the truth before you sign up.

What is PayTub App?

PayTub claims to pay users for simple online activities. Watch YouTube videos. Take surveys. Download apps.

According to Futureficial, the platform promises up to Rs 22-23 per video watched. New users reportedly receive a ₹250 welcome bonus upon registration.

The minimum withdrawal threshold is ₹5,000. Payment options include Paytm, PhonePe, PayPal, and bank transfers.

Great, right?

Like watching videos in your free time and making money is an easy solution to earn income.

But, as mentioned, things are not as straightforward as they seem to be.

Let’s give you a reality check.

Is PayTub App Safe in India?

According to Scam Detector, PayTub.com received a low trust score of 29.1 out of 100, with tags describing it as “Risky. Dubious. Perilous.”

The domain registration uses privacy protection services, with registrant details hidden through Super Privacy Service LTD via Dynadot in California, USA.

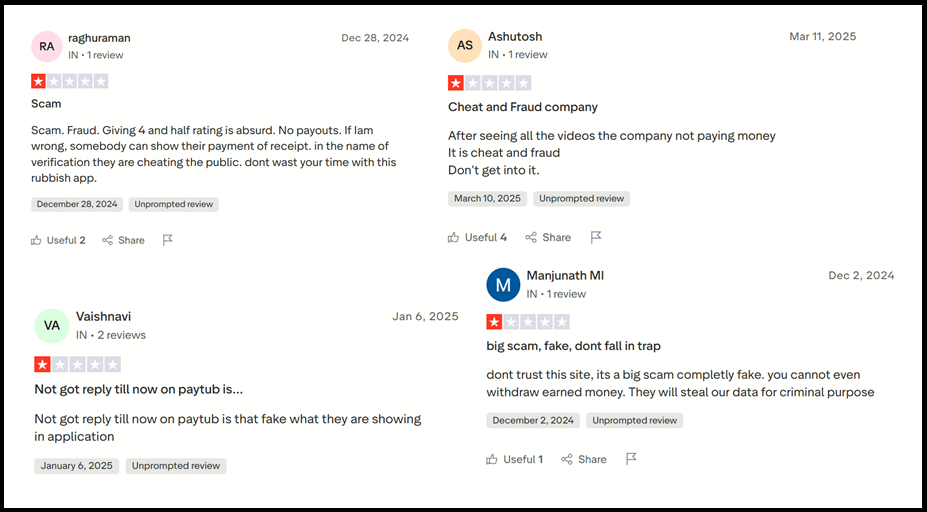

PayTub Complaints

Real feedback from actual users reveals troubling patterns.

These screenshots show exactly what players are facing: blocked withdrawals, false promises, and a growing list of scam reports.

1. Withdrawal Problems

According to a Trustpilot review from September 2024, one user watched 560 videos over a month to reach the ₹5,000 target. When attempting a PayPal withdrawal, the platform demanded additional tasks and targets, which, after completion, still didn’t result in payment.

Another user reported on Trustpilot: After withdrawal approval, funds were never reflected in the account despite waiting several days with no updates.

2. Referral Issues

According to Trustpilot, users report inconsistent referral tracking. One user stated that referrals joined through their link in their presence but were never credited to their account.

3. Changing Requirements

Initially, platforms may require 10 referrals. According to Trustpilot reviews, some users found they needed 25 referrals plus additional verification steps after reaching withdrawal thresholds.

This indicates a pattern. Requirements keep changing. Users invest time and data. But payments remain elusive.

4. Technical Problems

According to Trustpilot, some users report that the app stops opening after reaching withdrawal thresholds. Others experience error messages when attempting to withdraw funds.

Does PayTub Ask for Real Money?

Based on available public information and user reviews, PayTub does not ask for direct real-money investments or deposits the way scam investment apps typically do.

However, and this is important, that doesn’t automatically make it safe.

Here’s what most “earn money by watching videos” apps (including PayTub-type apps) actually do:

They don’t ask for deposits

You’re not required to invest ₹500, ₹1,000 or any amount.

BUT they do something else:

They delay, block, or deny withdrawals until users give up. Some apps eventually force users into indirect “payments” like:

- paying withdrawal fees,

- buying VIP levels,

- paying processing charges,

- asking for KYC documents (risk of data misuse),

- forcing ads or referrals to “unlock withdrawal”.

Even if PayTub doesn’t take money up front, it can still be risky due to:

- Data Harvesting

Apps like this often collect:

- contact access

- device info

- email/phone data

- Used later for spam or targeted scams.

- Fake Earnings / Impossible Withdrawal

Your in-app balance goes up, but when you try to withdraw, you face:

- minimum thresholds like ₹5,00

- “pending approval” forever

- system errors

- KYC requests

- app suddenly disappearing

So what’s the verdict?

No, PayTub does not appear to ask for direct money investment

BUT

It still shows several indicators of a reward scam model designed to never pay real money.

How to Report PayTub Issues?

If PayTub is not paying, blocking withdrawals, or misusing your data, don’t wait; report it immediately.

Quick action increases the chances of investigation and platform takedown.

1. File A Complaint at Cyber Crime

- If the app misled you, denied payouts, or misused your information:

- Visit the Cybercrime Portal

- File a report under “Online Financial Fraud / Fraudulent App”

- Upload:

- Screenshots of earnings

- Withdrawal attempts

- Error messages

- Chat or email records

- App details and links

The more evidence you provide, the stronger your case.

2. Report to RBI Complaint Portal

If PayTub used any third-party payment gateway or asked for fees, then file a complaint through the RBI CMS Portal

Useful for reporting unauthorised financial activity or apps mimicking financial platforms.

3. Raise it to the National Consumer Helpline

File online via the consumer helpline portal. Report issues such as:

- False advertising

- Unfair business practices

- Misleading earnings claims

Need Help?

Stuck with PayTub or similar platforms? You’re not alone.

Register with us to file your complaint if you’ve invested significant time or lost money.

Your experience matters. It helps protect others from similar situations.

Don’t stay silent. Share your story.

Conclusion

According to Futureficial, PayTub appears to be a legitimate platform with detailed team information and company registration.

However, the critical issue is that earnings drastically reduce after initial tasks.

Your time is valuable. Your data is precious. Invest them in verified platforms with consistent payment records instead.

Remember: If a platform keeps moving goalposts, that’s your signal to exit.

Stay informed. Research thoroughly. Choose wisely.