Buying cryptocurrency with a credit or debit card can be tricky, especially if you’re worried about security and fraud. That’s where Simplex comes in.

It’s a payment processor that acts as a bridge between your bank and the crypto platform, handling transactions, verifying payments, and preventing fraud.

Millions of users around the world, including in India, encounter Simplex whenever they purchase Bitcoin, Ethereum, or other cryptocurrencies.

But with so many mixed reviews online, it’s natural to wonder:

Is Simplex Legit?

Can you trust it with your money?

This guide takes a close look at what Simplex does, how it works, and what Indian users need to know before using it.

Is Simplex Safe?

Simplex positions itself as a trusted global crypto payment processor. It’s licensed as an Electronic Money Institution (EMI) by the Central Bank of Lithuania, which allows it to operate across the EU.

Here’s the catch for Indian users:

- Simplex operates outside Indian jurisdiction.

- It is not regulated by the RBI or any Indian financial authority.

- Disputes and refunds can therefore be very difficult to resolve from India.

So while it’s legally registered in Europe, the mix of offshore licensing and India-specific risks makes it a platform to approach with caution.

Also, according to reviews on Scam Detector and Sitejabber, multiple users reported duplicate charge fraud:

- Same Transaction Number: Users claimed the same transaction was charged twice (same date, same time, same number).

- Company Response: Simplex insists that “you approved the payments” even if users authorised only one.

- Financial Damage: Many reported overdrafts, bank fees, and unauthorised deductions.

- No Accountability: Simplex allegedly refuses to acknowledge technical glitches or errors.

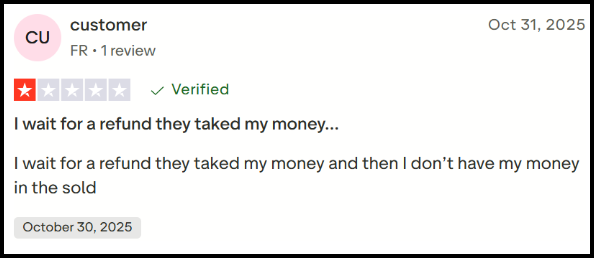

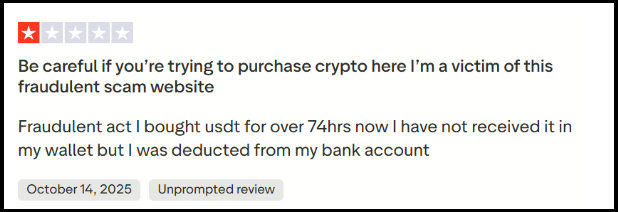

Simplex Complaints

Along with this, there are multiple complaints from different regions of India, in which users have raised concerns about the fraudulent activities on the platform:

These reviews involve money being taken without permission or unexpected deductions.

Verified Indian users have shared multiple concerning incidents:

1. Unauthorised Transactions & Account Misuse

- Thane, Maharashtra: ₹31,640 ($380) deducted without permission. The user called it a scam.

- Faridabad, Haryana: Unauthorised access through Edge Wallet, repeated deductions, negative bank balance.

2. Frozen Funds & Non-Delivery of Crypto

- Tiruchendur, Tamil Nadu: ₹75,000 ($900) paid through RockItCoin was never credited to the user.

3. Company Misleads Banks

- Several users reported that banks were told they never reached out to Simplex, blocking chargeback attempts.

How to Report Simplex Fraud?

If Simplex has scammed you, take immediate action:

File Chargeback Immediately:

- Contact your bank/card provider within 72 hours

- State: “Unauthorised transaction” or “Services not delivered”

- Provide all email evidence of non-delivery

- Reference transaction numbers and dates

Report to Indian Authorities:

- File Complaint in Cyber Crime

- Report to RBI

- File a case in the District Consumer Forum for amounts up to ₹50 lakhs.

Need Help?

If you’re facing any kind of Simplex issues like unauthorized charges, undelivered cryptocurrency, duplicate billing, or an account breach, register with us.

We will help you in reporting the complaint to recover losses.

Conclusion

The evidence from verified user reviews, regulatory checks, and complaint platforms paints a concerning picture of Simplex.com:

- While the company has legitimate EU licensing, Indian users face systematic issues, including duplicate charges, undelivered crypto, frozen funds, and unresponsive support.

- Small, successful transactions seem to build false confidence, while larger transactions often fail or remain unresolved.

- The offshore licensing creates a jurisdictional barrier, making fund recovery extremely difficult.

Bottom line: For Indian users, Simplex is high-risk. Avoid using it, and if you’ve been scammed, take immediate legal and banking action. Protect your money before it’s too late.