With the rise of “instant loan” apps in India, getting money quickly has become easier than ever. But with convenience comes a big problem: loan scams and predatory lending practices.

If you’ve come across the True Balance app and are wondering:

- “Is True Balance safe?”

- “Why are people complaining?”

- “Should I apply for a loan here?”

Then this simple, conversational guide will help you understand everything clearly.

Let’s break it down.

True Balance Loan App Review

Before jumping into True Balance specifically, let’s clarify the term “balance loan” itself.

A balance loan (or balance transfer) typically means shifting your existing loan, such as a personal or home loan, to another lender that offers a lower interest rate.

When done through a trusted bank or RBI-regulated NBFC, this is considered very safe and can actually help you save money.

But here’s the twist!

The word “balance loan” is now being used loosely in many loan apps to market small, quick loans, and scammers know people are looking for fast money. So they use the term to attract users and sometimes misuse their data.

So the real question isn’t “Is a balance loan safe?” It’s “Who is providing the balance loan?”

Is True Balance App Safe in India?

True Balance is a popular digital lending app in India, and it does work with RBI-approved NBFC partners. That means it is not an illegal or fake loan app.

However, and this is where things get tricky, being “not fake” doesn’t automatically mean “customer-friendly.”

Many users across review platforms have complained about:

- high interest rates

- hidden charges

- poor communication

- aggressive follow-up calls

So while True Balance isn’t a scam in the traditional sense, your experience may vary depending on how well you understand the terms before borrowing.

True Balance App Complaints

Let’s talk honestly.

Before downloading any loan app, most of us look at reviews, because that’s where the real picture emerges.

Here are some common complaints users have shared about True Balance, along with a fair and balanced point of view for each one.

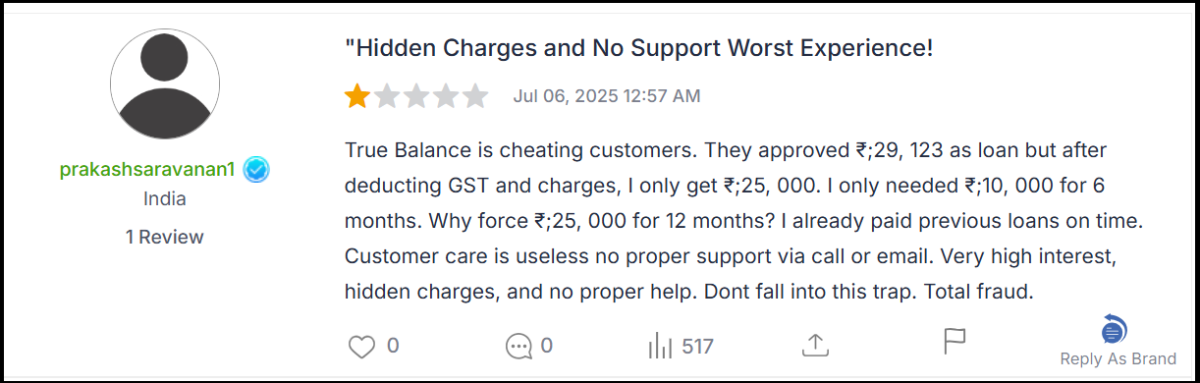

- “They approved a higher loan amount but gave much less after deductions.”

A user said they were approved for around ₹29,000 but received only about ₹25,000 after GST and other charges. They also needed a 6-month loan but were forced into a 12-month plan.

Now, don’t you think charging over fees is a type of fraud?

Charging processing fees and GST deductions are normal, but they should never surprise the user.

If borrowers feel cheated, it means the app didn’t show the final numbers clearly enough.

Transparency is key, and this is where many instant-loan apps fall short.

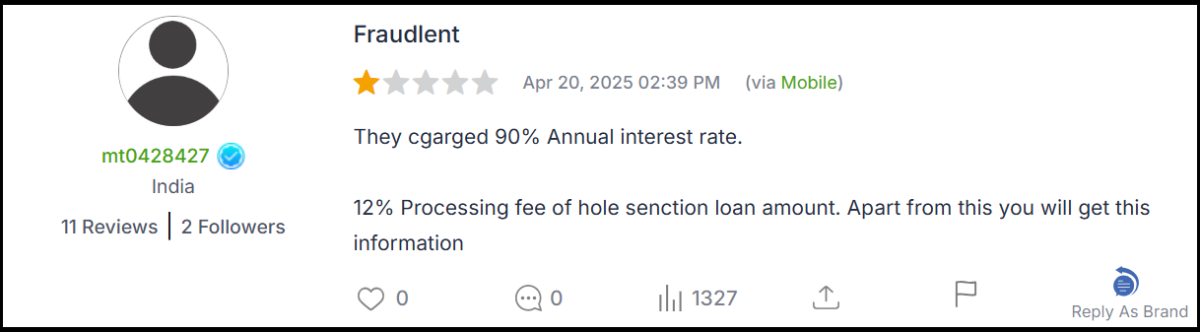

- “The interest rate is insanely high, almost 90% annually!”

Another reviewer complained about extremely high effective interest rates plus a heavy processing fee.

Now, most of the loan apps often highlight the “monthly interest” so it looks small (like 2–4%), but when converted to actual APR, it becomes huge.

This doesn’t technically make the app illegal, but it can make the loan very expensive. Borrowers must calculate the real cost before accepting.

- “They keep calling every day trying to force new loans.”

One user said they repaid their loan, yet the app kept calling from multiple numbers to push new loans.

This is where the harassment begins.

Many small-loan apps rely on active borrowing to stay profitable, so they use aggressive marketing. It’s not illegal, but it is annoying and unprofessional.

A responsible lender shouldn’t pressure you every day.

- “Customer care is useless, no proper help at all.”

Several reviewers said they got automated or unhelpful replies and couldn’t resolve their issues.

Another red flag of poor customer support is one of the biggest red flags for any financial service.

When money is involved, people need fast answers, not generic messages.

This is something True Balance clearly needs to improve.

So… Is True Balance Safe or Not?

Here’s the most honest answer:

Although True Balance is not an illegal or fake app but many users report high charges, confusing terms, and poor support often make such apps riskier for use.

How to Report Loan Frauds in India?

If you suspect any kind of fraud or harassment from a loan provider, act fast:

- Inform your bank so they can secure your account or block your card if needed.

- File a complaint in Cyber Crime through the national cyber crime reporting channels.

- Visit your local police station or cyber cell with all evidence like screenshots, chats, or transaction details.

- Report the lender to RBI through their complaint portal if you feel their practices are unethical.

The earlier you take action, the better your chances of stopping further damage.

Need Help?

If you’ve already faced a problem. Whether with True Balance or any other digital lender, don’t panic.

Register with us and get help immediately to report such loan app scams in India.

Many people manage to resolve issues once they take the right steps quickly.

Conclusion

The digital lending world in India can be useful, but it’s also risky if you’re not careful.

Apps like True Balance can offer quick financial help, but before borrowing:

- stay alert

- stay informed

- And most importantly, stay safe

Borrow wisely, as your financial peace matters more than quick cash.