Choosing a stock market mentor is crucial. Your money and financial future depend on it.

But what if the person teaching you is not profitable themselves? Let’s examine Vishal Malkan’s actual trading records.

Who is Vishal Malkan?

Vishal Malkan is a stock market trainer who claims 15 years of experience in teaching trading. He operates primarily through:

- Stock Market Institute (his training platform)

- ₹1 webinars (entry-level promotional events)

- Upsells premium courses (₹25,000 – ₹1,50,000)

- Offers mentorship programs

- Social media marketing (Instagram, Telegram, YouTube)

During his webinar, he reportedly claimed: “There is no one in this room I cannot turn into a stock market trader.”

Notice the careful wording-“trader,” not “profitable trader.” That’s a significant difference.

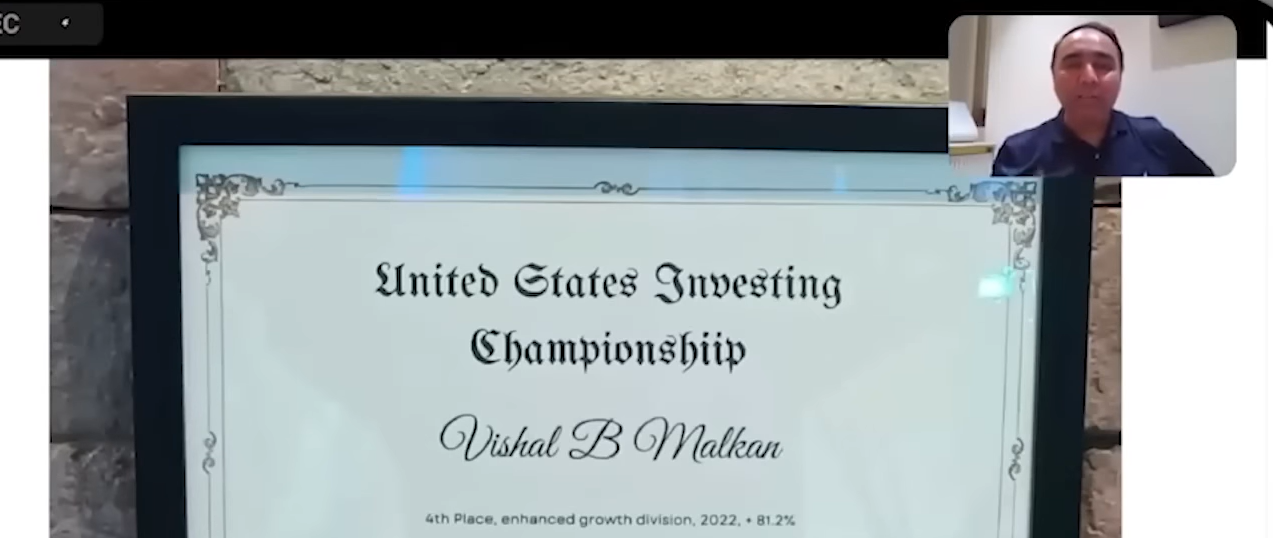

According to his promotional content, he positions himself as a consistently profitable trader. He has claimed participation in the United States Investing Championship in the F&O category.

Impressive credentials, right?

However, public documents tell a different story.

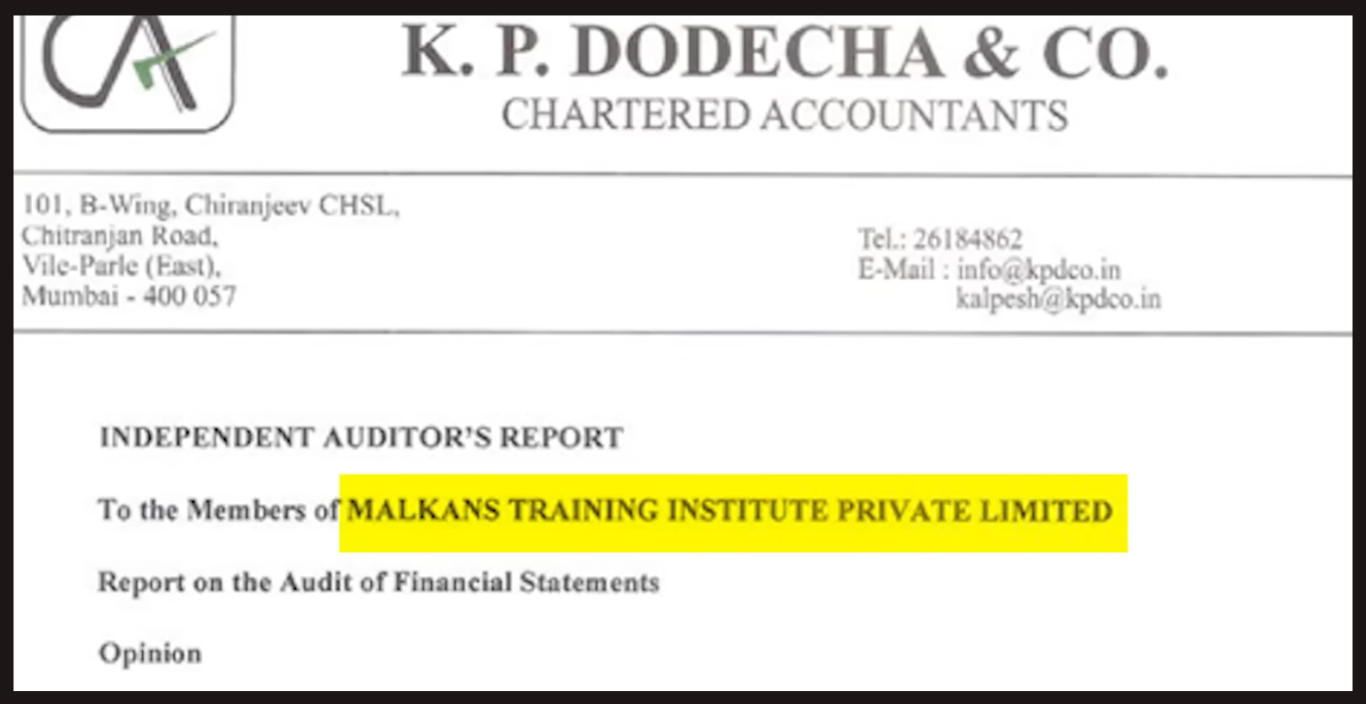

What MCA Documents Reveal About Vishal Malkan

Here’s where reality differs from marketing.

According to Ministry of Corporate Affairs (MCA) public records, Vishal Malkan operates through two main companies:

1. Malkan Training

2. Malkan View

These documents are publicly accessible and legally filed. Let’s examine what they show.

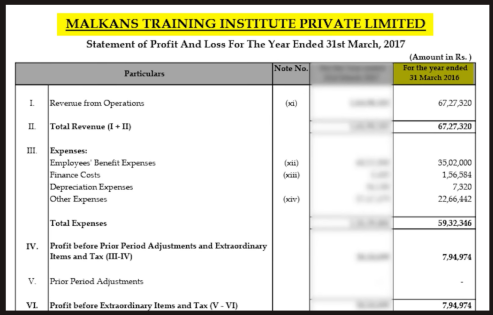

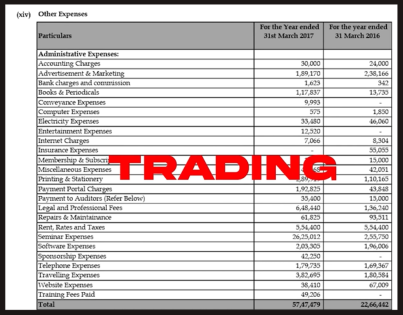

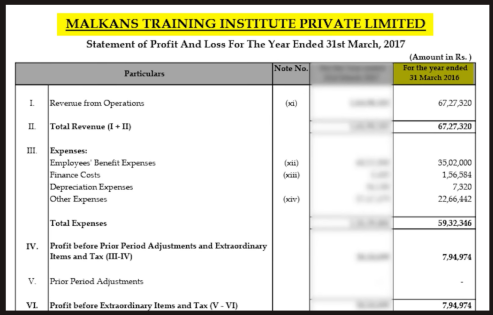

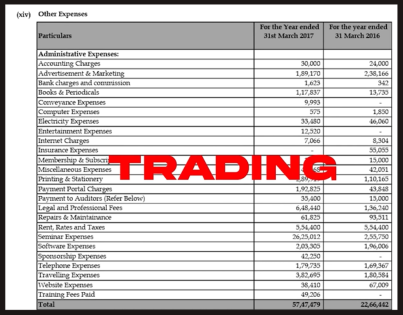

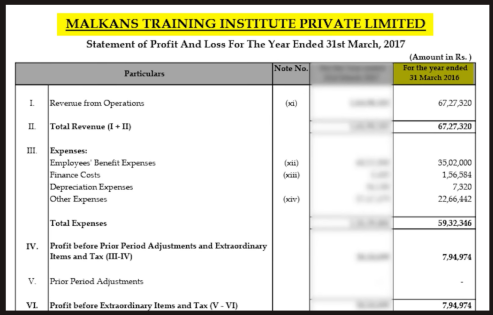

Malkan Training Financial Record

According to MCA filings, here’s the year-wise breakdown:

Financial Year 2015-16:

| Training revenue: Around ₹7 lakh | Trading activity: None |

|

|

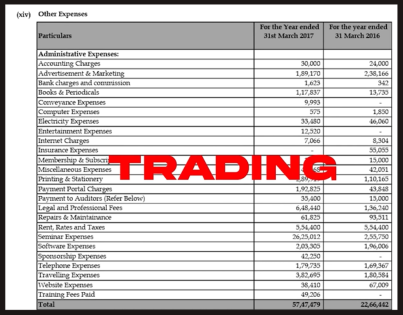

FY 2016-17:

| Training revenue: ₹1.65 crore | Trading revenue: None |

|

|

FY 2017-18:

| Training revenue: ₹3.51 crore | Trading revenue: None |

|

|

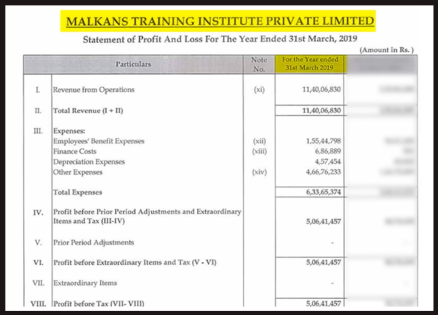

FY 2018-19:

| Training revenue: ₹1 crore | F&O trading loss: ₹6 lakh (first recorded loss) |

|

|

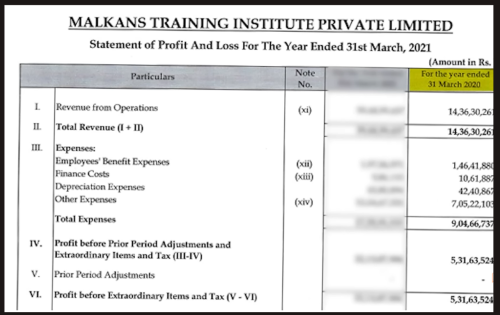

FY 2019-20:

| Training revenue: ₹14.36 crore | F&O trading loss: ₹97 lakh |

|

|

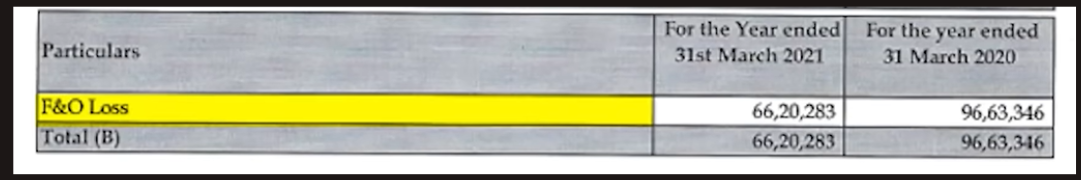

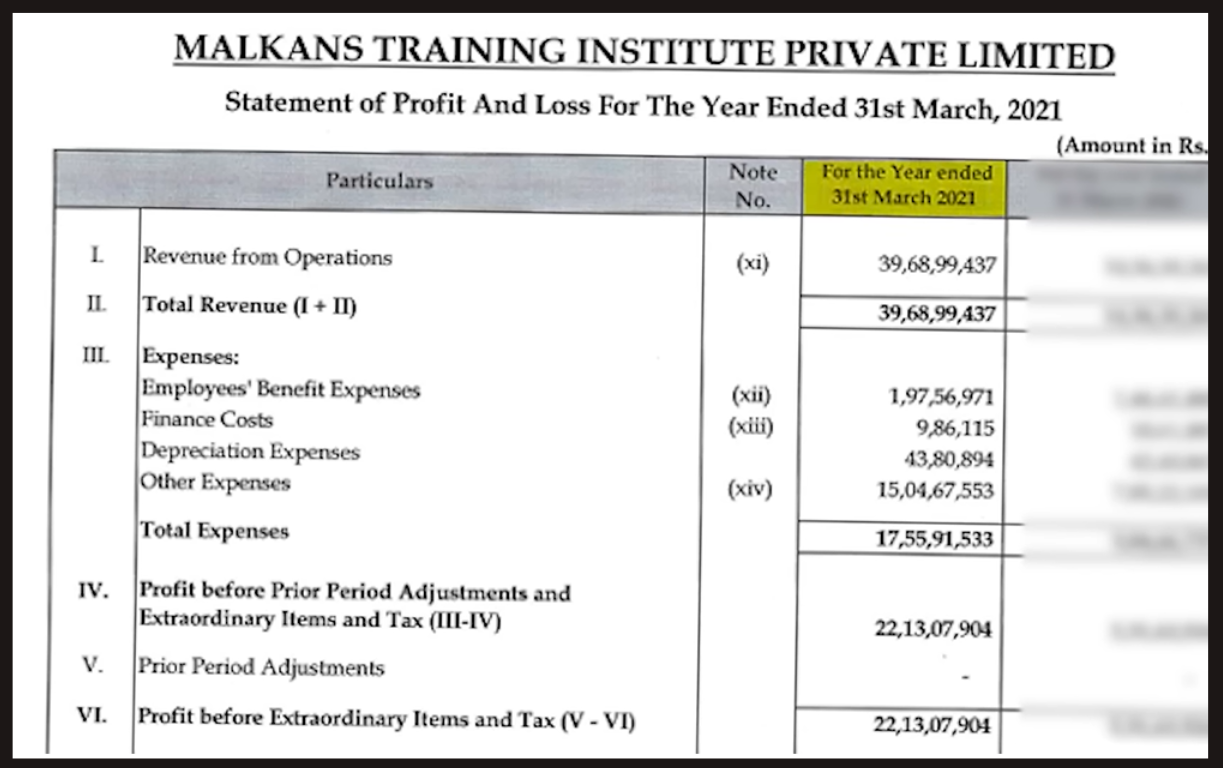

FY 2020-21:

| Training revenue: ₹39.77 crore (massive growth) |

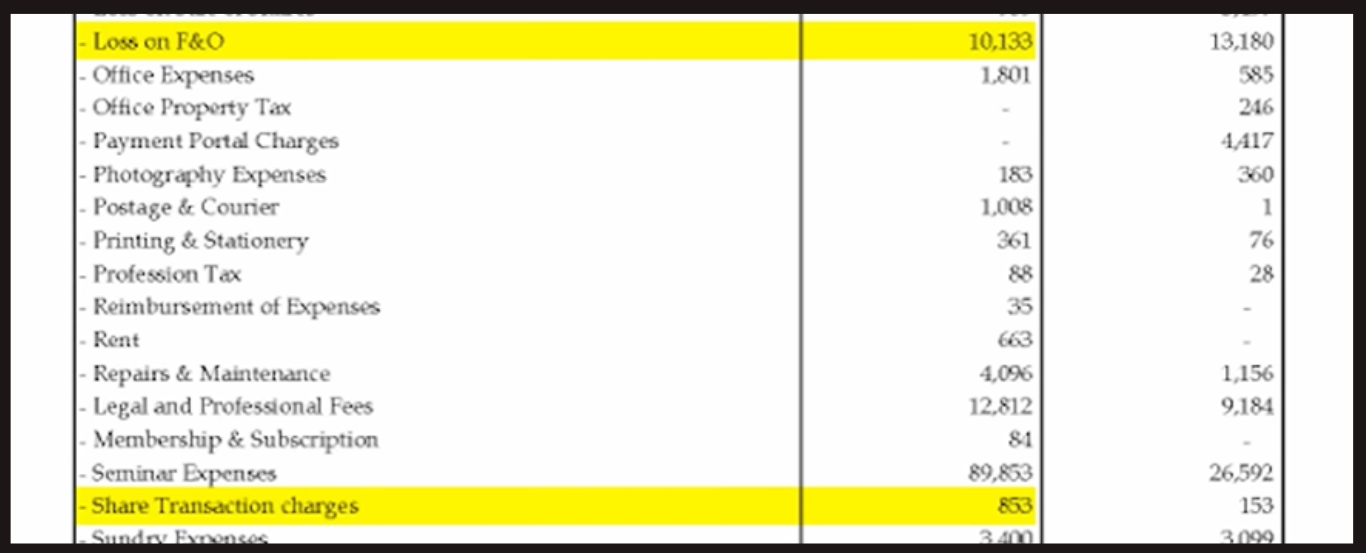

Total trading loss: ₹66 lakh (F&O + share trading expenses) |

|  |

FY 2021-22:

- Training revenue: ₹9.23 crore

- Trading profit shown: ₹1.87 crore

- However, actual losses:

- F&O loss: ₹1.32 crore

- Share sale loss: ₹35 lakh

- Net trading loss: ₹43 lakh

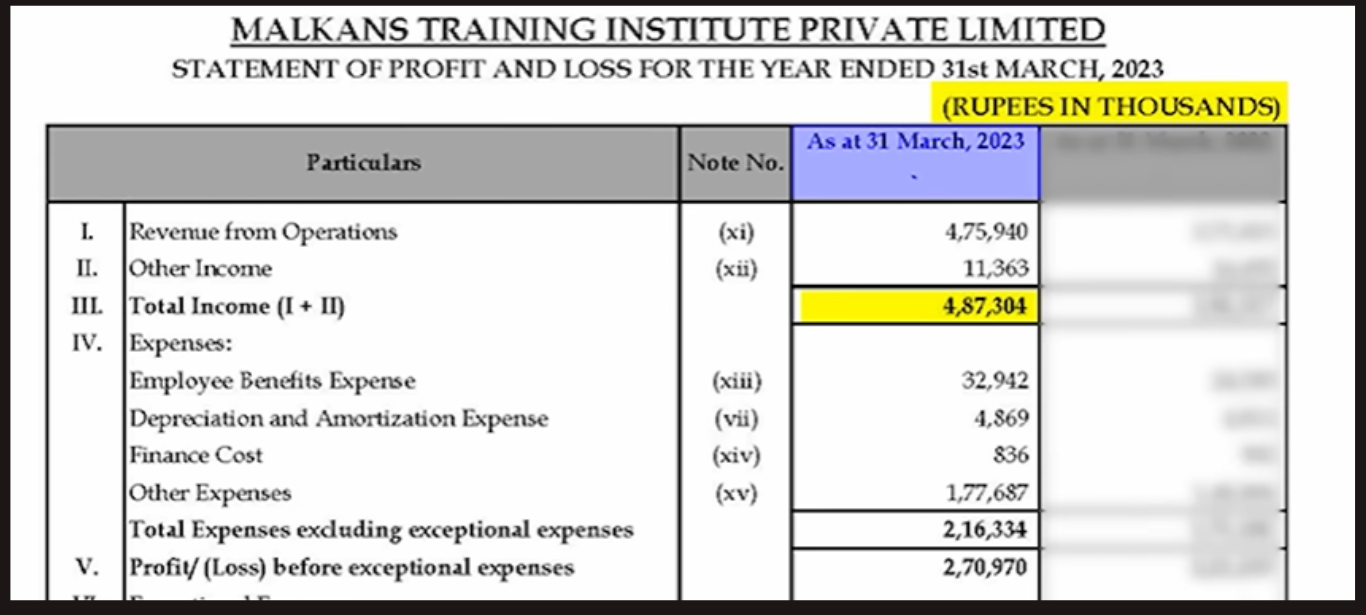

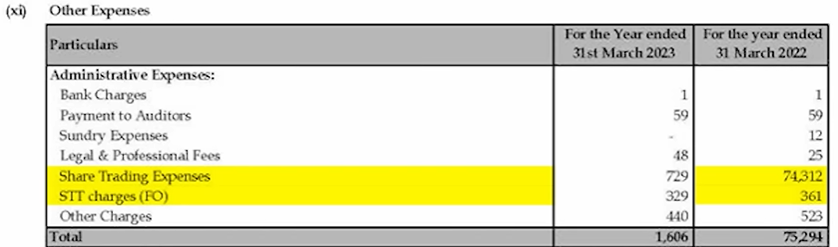

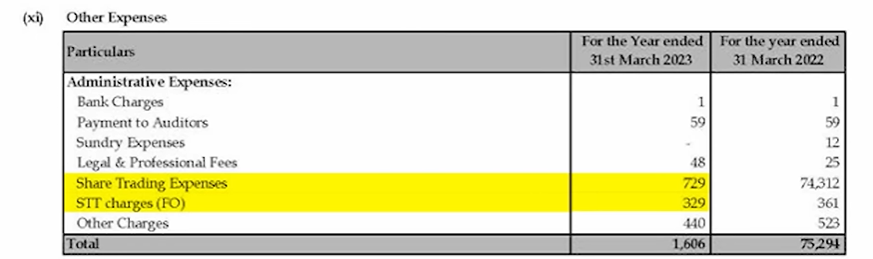

FY 2022-23:

- Training revenue: ₹48.6 crore

- Trading profit: ₹74 lakh

- Trading loss: ₹1.21 crore

- Net loss: ₹8 lakh

Summary (Malkan Training)

Over 5 years of active trading, total losses = ₹2.9 crore approximately.

Shocking, isn’t it?

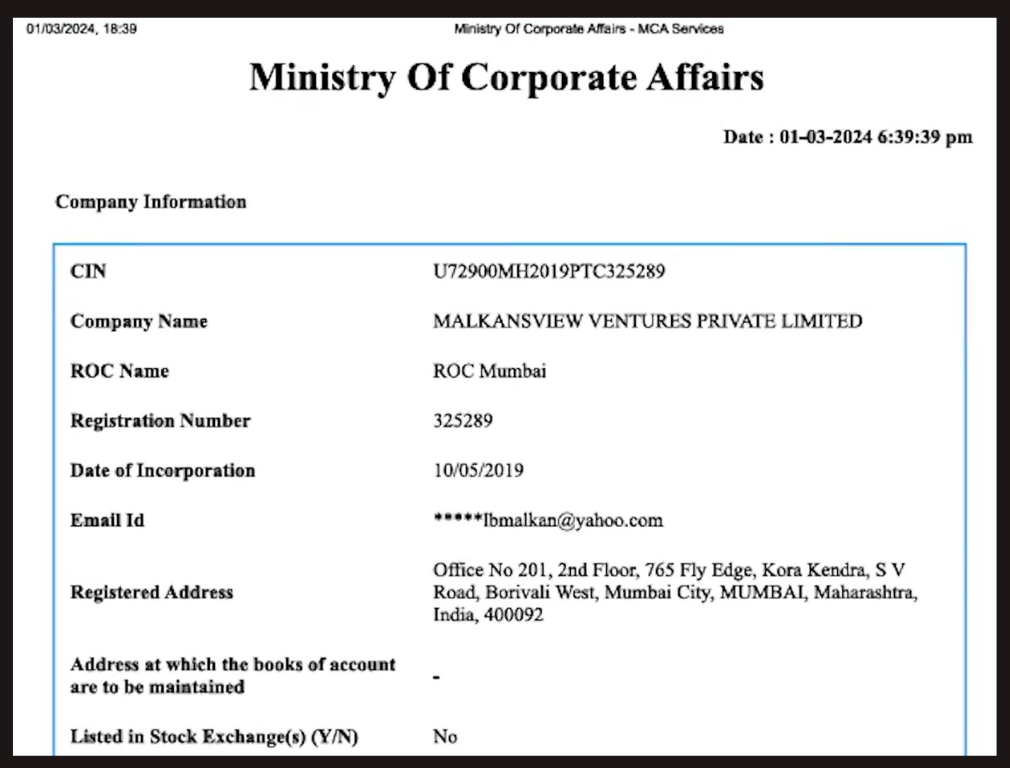

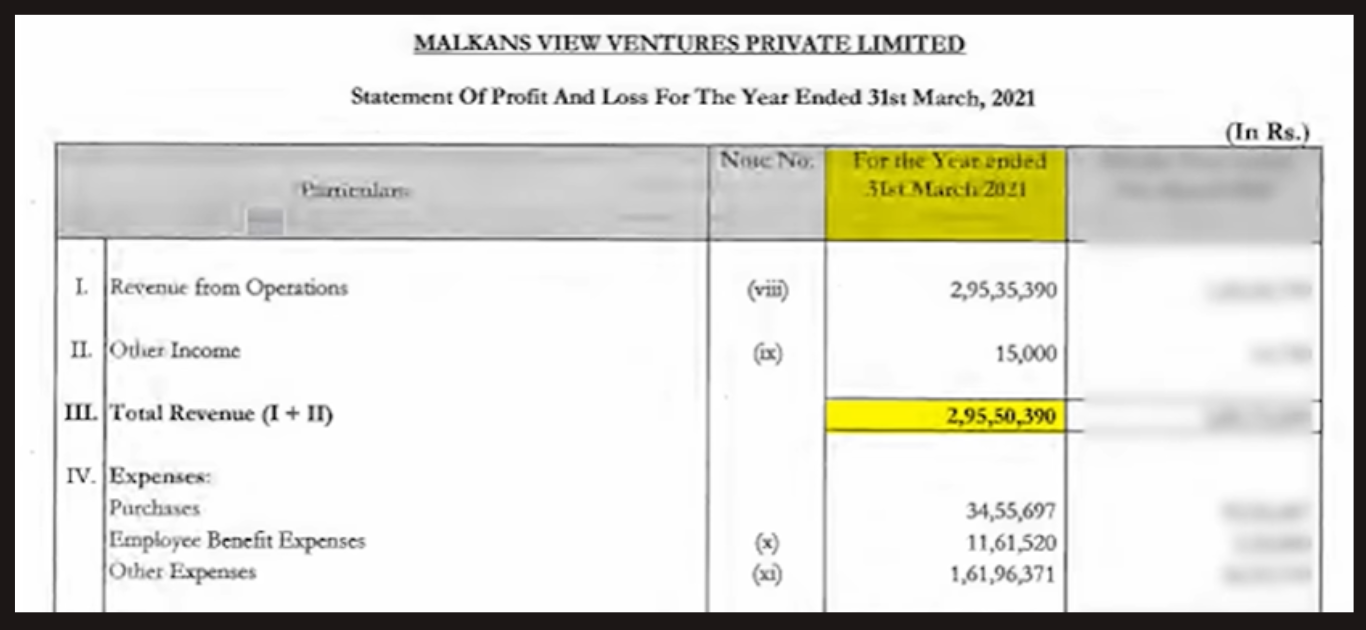

Malkan View: 4-Year Performance Analysis

According to MCA records:

FY 2018-19:

- No revenue reported

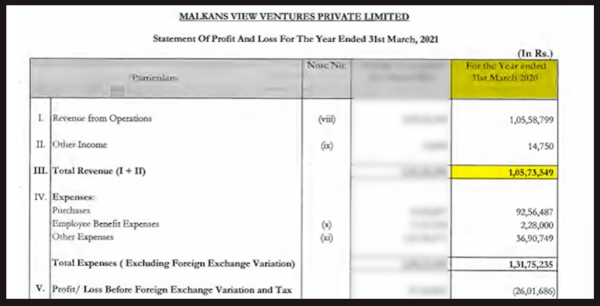

FY 2019-20:

| Training revenue: ₹1.06 crore | F&O trading loss: ₹36 lakh |

|  |

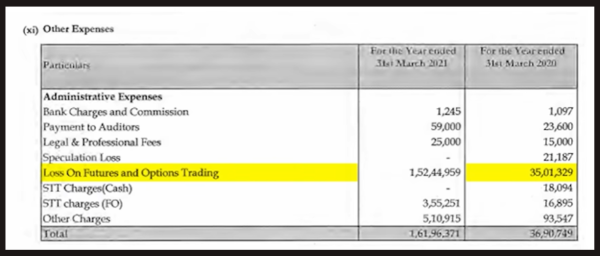

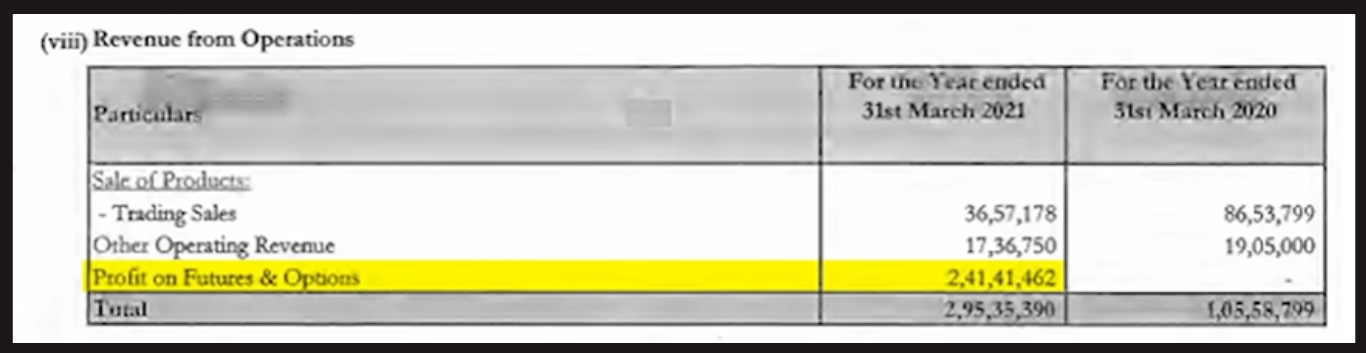

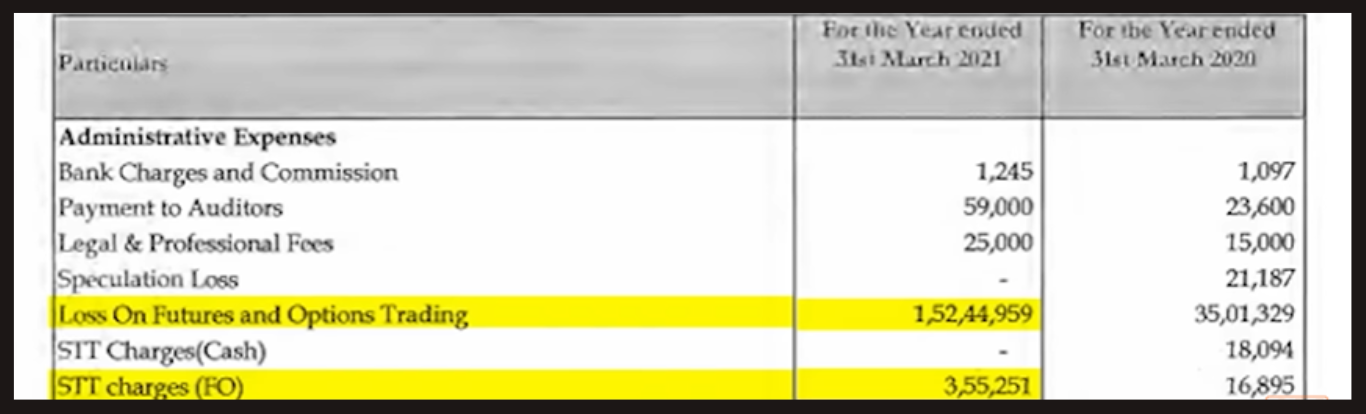

FY 2020-21:

- Training revenue: ₹2.66 crore

- Trading profit: ₹2.41 crore

- Trading loss: ₹1.56 crore

- Net trading profit: ₹85 lakh (only profitable year)

FY 2021-22:

- Training revenue: ₹4.28 crore

- Trading profit: ₹4.12 crore

- Trading loss: ₹7.47 crore

- Net loss: ₹3.35 crore (massive loss)

FY 2022-23:

- Training revenue: ₹3.27 crore

- Trading profit: ₹2.42 crore

- Trading loss: ₹1 lakh

- Net profit: ₹2 crore

In short, over 4 years, net trading loss is equal to ₹53 lakh approximately.

Also, when we combine both companies:

Total trading losses over 7-9 years: ₹3.43 crore approximately

Meanwhile, training revenue? Over ₹100 crore cumulatively.

| Financial Year | Malkan Training (Revenue) | Malkan View (Revenue) |

| 2018–19 | -27 lakh | – |

| 2019–20 | -97 lakh | -36 lakh |

| 2020–21 | -75 lakh | 85 lakh |

| 2021–22 | -43 lakh | -3.35 crore |

| 2022–23 | -48 lakh | 2.31 crore |

| Total Profit / Loss | -2.9 crore loss | -53 lakh loss |

This raises serious ethical questions.

Can someone with consistent trading losses ethically teach profitable trading?

Why Vishal Malkan’s Trading Profitability Matters

When choosing a stock market mentor, profitability is not a minor detail, it is the core qualification.

Trading is a performance-based skill where real-world results matter more than theoretical knowledge or motivational claims.

For aspiring traders, especially beginners, the mentor’s own trading outcomes serve as an important reference point for three reasons:

1. Trading Is Learned Through Execution, Not Just Theory

Stock market trading is not like academic teaching, where concepts alone are sufficient. It requires:

- Risk management under pressure

- Emotional discipline during losses

- Consistent decision-making in live market conditions

A mentor who actively trades profitably is more likely to have firsthand experience managing these challenges in real time.

If the trading performance reflected in publicly available records shows recurring losses, it raises questions about whether the strategies being taught are effective in live markets.

2. Students Are Taking Financial Risk, Not Just Buying Knowledge

Most Vishal Malkan courses students enrolling in trading are not wealthy investors. They often:

- Invest personal savings

- Trade with limited capital

- Lack alternative income sources to absorb losses

If a mentor’s primary income comes from selling courses rather than from trading itself, the risk asymmetry becomes significant.

Losses that may be financially manageable for a high-revenue training business can be devastating for individual students following the same strategies.

This makes transparency around trading performance especially important.

3. Marketing Claims Create Expectations of Profitability

Public webinars, social media promotions, and paid courses often emphasize:

- Consistent profits

- Trading mastery

- Competitive achievements

Such claims naturally create an expectation that the mentor has demonstrated long-term trading success.

When company-level disclosures show inconsistent or loss-making trading activity, prospective students deserve to be aware of this gap so they can make an informed decision.

This is not about questioning anyone’s intent, it is about aligning verifiable data with marketing narratives.

4. Ethical Disclosure Is Critical in Financial Education

Unlike many other professions, trading education directly influences how people deploy real money in high-risk instruments such as F&O and derivatives.

Ethically, this places a higher responsibility on educators to:

- Clearly distinguish between teaching income and trading income

- Avoid implying guaranteed or consistent profitability

- Allow students to independently verify claims where possible

Profitability, therefore, is not just a personal achievement — it is a material factor in evaluating credibility in financial education.

5. Public Data Enables Informed Decision-Making

The availability of MCA filings allows the public to examine company-level financial disclosures objectively.

While such data has limitations and does not reflect personal trading accounts, it still provides valuable context about how trading activities have performed within entities associated with a trading educator.

Prospective students can use this information as one of several inputs, alongside course content, teaching methodology, and risk disclosures, before committing time and capital.

In summary, Vishal Malkan’s profitability matters not because losses are unacceptable in trading, but because claims of expertise, consistency, and mastery must be evaluated against verifiable evidence.

In a field where financial consequences are real, informed choice is essential.

Key Considerations Before Enrolling in Vishal Malkan’s Trading Course

When asked about his trading losses in a podcast, Vishal Malkan said: “Losses don’t matter when I have years of experience with knowledge and even a US Investing Championship rank.”

However, we could not independently verify this claim from publicly available championship records.

Now this makes it unethical too, as a person who claims to be a stock market mentor has a trading loss of ₹3.43 crore, how can he teach or give lessons on profitable trading?

You can’t teach what you haven’t mastered just for the sake of experience.

- The US Investing Championship Claim

Vishal Malkan claims success in the United States Investing Championship during webinars. This justifies his high course fees.

The logic doesn’t work. Championship traders should show consistent profits. His ₹3.43 crore loss contradicts this claim completely.

- The Business Model: Course Sales, Not Trading Profits

Training Revenue: ₹39.77 crore (FY 2020-21), ₹48.6 crore (FY 2022-23). Over ₹100 crore total.

Trading Performance: ₹3.43 crore in losses.

The real profit is from selling courses, not trading. If you market yourself as a trading expert but your trading loses crores while courses earn crores, that’s misleading.

- The F&O Trading Pattern Shows Poor Risk Management

According to MCA documents, most losses came from F&O trading. This requires strict discipline and risk management.

The pattern is concerning. Consistent losses year after year. Only 1-2 profitable years out of 7-9 years total.

What You Can Do If You Have Concerns About Vishal Malkan’s Trading Course

If you have enrolled in Vishal Malkan’s trading course and feel that the experience, outcomes, or representations did not align with your expectations, it is important to know that there are structured and lawful options available to you.

Taking informed and documented steps can help you better understand your rights as a consumer of financial education services.

1. Organize Your Documentation

Start by compiling all relevant records, including:

- Course payment receipts or invoices

- Promotional materials or webinar recordings

- Emails, messages, or Telegram communications

- Course curriculum or written promises, if available

Clear documentation is essential before approaching any redressal mechanism.

We help individuals who are facing concerns related to stock market training programs, including those associated with Vishal Malkan, by providing:

- Process-level guidance on available complaint mechanisms

- Support in organizing and reviewing documentation

- General consumer-rights information related to financial education services

Our role is to inform and assist, so that individuals can take responsible and well-considered steps.

Conclusion

Is Vishal Malkan profitable? According to publicly available MCA documents, the answer is clear: His trading has resulted in losses of ₹3.43 crore over 7-9 years, while training revenue exceeds ₹100 crore cumulatively.

This means his profit comes from course sales, not trading expertise. His statement deflecting losses and highlighting student success raises serious ethical concerns.

Moreover, consistent F&O losses indicate fundamental issues with risk management and trading psychology, the very things he claims to teach.

Before enrolling in any trading course, remember: Your trainer should be profitably doing what they’re teaching. If their own companies show massive trading losses, how can they ethically teach profitable trading?

Based on MCA company filings, the trading performance does not appear to support claims of consistent profitability, raising questions for prospective students.

The glamorous lifestyle marketed on social media is funded by course sales, not trading profits.

Stay informed. Question everything. And remember, if someone’s own trading loses crores, should you trust them with your financial education?