If you are new to forex trading, XM may look attractive at first. Low minimum deposit, flashy education, global branding, it checks all the boxes beginners search for.

But once you look beyond marketing, XM carries structural and legal risks that beginners are usually not equipped to handle, particularly in India.

This article explains why XM is generally unsuitable for beginners in simple terms.

XM Broker

XM Broker is one of the world’s most widely used online brokers, founded in 2009 and headquartered in Limassol, Cyprus.

The company serves over 15 million clients.

That’s massive, right?

XM runs through different regulated entities worldwide. The XM Group is regulated by several major offshore regulatory bodies, including CySEC, DFSA, and FSC (Belize).

But here’s the catch for Indians. XM is not registered with SEBI, nor regulated by the Reserve Bank of India (RBI). This creates complications.

Let’s understand why.

Is XM Legal in India?

1. No Legal Protection for Indian Traders

This is the biggest issue.

Indian brokers are regulated by SEBI. If something goes wrong, you can file a complaint and expect regulatory support.

With XM:

- No SEBI oversight

- No RBI jurisdiction

- No guaranteed grievance redressal in India

If your account is blocked, funds are delayed, or trades are disputed, Indian laws cannot help you. Beginners usually assume “regulated” means “safe”, but offshore regulation does not protect Indian users.

2. Trading Through XM Puts Beginners in a FEMA Grey Zone

XM allows trading in global forex pairs (EUR/USD, GBP/JPY, etc.).

Under FEMA rules, Indian residents are not officially permitted to trade these pairs via offshore platforms.

What this means for beginners:

- Your bank transactions can be questioned

- Accounts can be frozen

- You carry full legal responsibility, not the broker

Beginners should not be learning trading while also navigating regulatory uncertainty.

3. XM Only Offers High-Risk Instruments

XM does not offer real stock investing for beginners.

Instead, it focuses on:

- CFDs

- Forex

- Leveraged products

These are complex, fast-moving, and highly risky instruments.

According to independent broker reviews, XM is often rated as not suitable for beginners, specifically because CFDs amplify losses.

A small mistake can wipe out your account within minutes.

4. High and Preset Leverage Increases Beginner Losses

Leverage works against beginners.

XM offers high leverage, and leverage settings are often preset.

Beginners:

- Don’t fully understand margin

- Can’t react fast during volatility

- Lose accounts due to overexposure

One bad trade, one news event, and the account is gone. Beginners need low leverage and strict risk limits, which XM does not prioritise.

5. Trading Platforms Are Not Beginner-Friendly

XM uses MT4 and MT5 platforms. These are powerful, but not designed for first-time traders.

Beginners face:

- Complex interfaces

- Overwhelming indicators

- No guided, simplified environment

Most new traders make mistakes not because strategies fail, but because platforms are too advanced too early.

6. Conflict of Interest Risk

Multiple broker review platforms indicate XM primarily operates as a dealing desk broker, not a true ECN/STP broker.

This means:

- The broker may act as the counterparty to your trades

- A potential conflict of interest exists

- Price execution is controlled by the broker

Beginners are least equipped to detect or handle these situations.

XM Broker Complaints

Let’s examine actual complaints. Categorised by problem type, real voices, real frustrations.

Beginners should keep these in mind to avoid losses.

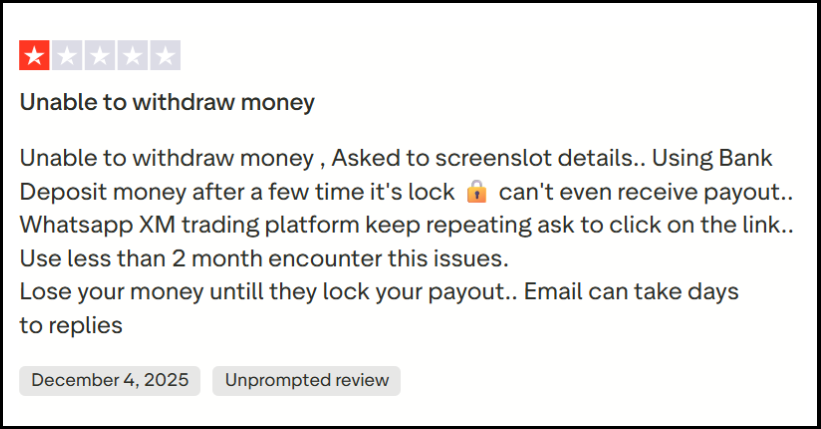

Category 1: Withdrawal Delays & Rejections

The most common complaint from XM users worldwide.

User 1:

” I made a withdrawal on the 21st March 2024, but until now (28 March 2024) I have not received any payment”

Analysis: Seven days waiting for withdrawal. Money stuck. Support giving generic responses. This creates stress and distrust.

User 2:

“I had a withdrawal 8th of September. The system forced me to withdraw through online banking. It was approved the same day and cut off the trading account. Until today, I haven’t received it yet”

Analysis: Withdrawal approved, but the money never arrived. Funds are deducted from the trading account immediately. The bank account is still empty.

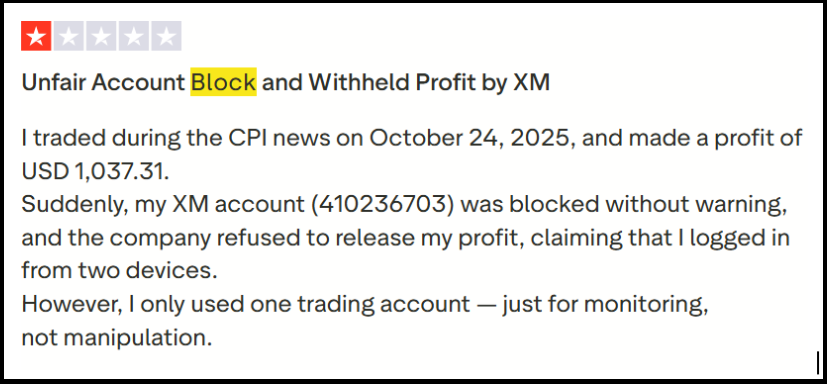

Category 2: Account Blocks Without Warning

User 3: Traders are suddenly finding accounts frozen after becoming profitable.

Analysis: Account blocked immediately after withdrawal request. Most of the balance mysteriously disappeared. Customer support couldn’t explain why.

Category 3: Profit Restrictions & Leverage Changes

Successful traders are facing sudden restrictions.

User 4: Review on Trustpilot

“Once they became profitable, XM changed their leverage forbidding use above 1:100, then all bonuses were taken, and withdrawal authorisation was refused.”

Analysis: Making profits triggers restrictions. Leverage reduced. Bonuses removed. Withdrawals blocked. Suspicious pattern targeting winners.

How To File Forex Trading Complaints?

Facing problems? Here’s what to do.

Step 1: Document Everything

- Screenshot all transactions

- Save email conversations

- Download account statements

- Record withdrawal requests

- Keep deposit receipts

Step 2: File a Complaint in Cyber Crime

- Register on the cyber crime portal

- Choose the category

- Draft your complaint

- Upload proof

- Submit the complaint

Step 3: Notify Your Bank

Immediately inform your bank about:

- Unauthorized transactions

- Suspicious activities

- Disputed charges

- Failed transfers

Need Help?

Are you stuck with XM-related issues?

XM Broker withdrawal not processed? Account frozen without explanation? Deposits vanished? Leverage changed unfairly?

Register with us for expert guidance.

We help victims of trading disputes:

- Prepare evidence-backed legal complaints

- Draft proper documentation

- Guide through cyber crime filing process

- Improve chances of fund recovery

- Connect with legal professionals

Don’t fight alone. Get professional support today.

Conclusion

So, is XM good for beginners?

The answer isn’t simple. XM offers genuine advantages. Low entry barrier. Great education. Established reputation. Easy deposits for Indians.

But massive disadvantages exist. No SEBI protection. FEMA grey zone. Zero domestic legal recourse. Dangerous high leverage. Mixed user experiences.

If you’re a complete beginner? Start with SEBI-registered Indian brokers. Learn the basics. Understand risk management. Practice extensively.

Once you’re experienced and understand the risks? XM becomes an option for global market access. But only with proper knowledge and strict risk management.

XM can be a good choice for beginners because of its low entry cost, simple account setup, and extensive learning resources. But always remember: 75.18% of retail investor accounts lose money when trading CFDs with XM.

Trade smart. Stay safe. Never risk more than you can afford to lose.