If you’ve been scrolling through trading Twitter lately, you’ve probably seen influencers flaunting massive profits, calling it prop desk trading.

It sounds exciting, right? Trade using a firm’s capital, share profits, and skip the risk.

But lately, that dream has started to look like a trap.

A new wave of “prop desk” accounts has popped up online, promising mentorship, funded trading, and massive returns. And now, one of them, iTrade DJ (@ITRADE191), is under fire after multiple users accused him of scamming traders.

Let’s understand what’s really happening, why prop desk trading is being misused, and what you can do to stay safe.

iTrade191 Prop Desk Trading Fraud

ITrade191, run by a social media trader known as “iTrade DJ”. It drew massive attention from retail traders after several posts surfaced on X (formerly Twitter) alleging large-scale fraud and fund mismanagement.

According to multiple online reports, iTrade191 reportedly raised funds from several traders and dealers under the banner of prop desk trading, promising high returns, access to capital, and professional trading setups.

But as the screenshots below show, what followed was chaos, blame, and vanished funds.

A verified Twitter user called this the “Jainam Prop Scam”, alleging that a Delhi-based trader, iTrade DJ, lost nearly ₹35 crores, with total losses reportedly touching ₹60 crores.

The post highlights how dealers who had deposited money for leverage ended up losing everything, with neither the broker Jainam nor the individual behind iTrade taking responsibility.

This post set the stage for wider public outrage, as it indicated that what began as a trading partnership spiraled into a full-blown financial mess, leaving retail traders stranded.

Another user shared alleged call details involving @ITRADE191, claiming that the trader discouraged others from escalating the matter, warning that refunds wouldn’t be processed if more people got involved.

The tweet further points out that he wasn’t officially a director in his own company, DJ iTrade Capital, suggesting premeditated intent.

It even names others who might have promoted him, implying a deeper network of influencers and collaborators who helped push the scheme.

This one went viral. The post claimed that iTrade DJ disappeared after misusing or losing nearly ₹60 crore of investor funds.

Sources alleged that he placed risky shorts on Nifty and wiped out client capital, while others said he used “charity-themed videos” to build public trust before vanishing.

The post ends by stating that authorities are verifying the claims, but for the affected traders, the damage had already been done.

Telegram Channel “Inner Circle Wizards”

Much of iTrade191’s activity reportedly took place inside a Telegram group called “Inner Circle Wizards.” It was marketed as an exclusive trading circle where members could learn, access capital, and trade under iTrade DJ’s guidance.

Many traders say they were asked to deposit small amounts as “security” or “funding fees,” only to see the admins disappear later.

As per the discussions in the Telegram group, the following sequence of events appears to have taken place:

- Funds were collected from multiple members under the promise of high leverage and returns.

- The collected money was transferred to a third party for trading activities.

- The third party allegedly disappeared with the funds, leaving investors without clarity or refunds.

Now, what does this chat suggest?

Simply, the investment or trading operation involved pooling investor funds through intermediaries.

“Y” (Darshan Joshi) acted as a front or collector for “X” (Jainam Broking), from “Z” (investors) who actually managed or traded the funds.

This appears to be a basic prop desk operation, but what’s missing is transparency. Investors didn’t know who was managing their money.

This pattern matches how informal prop-desk-style trading pools work, where one person fronts the capital and another trades it, without regulatory structure or written agreements. It hints at misrepresentation and unregistered fund pooling.

Hence following violations have been made in the system:

- Unregistered Collective Investment Scheme (CIS): pooling investor money and promising returns without SEBI registration violates Section 12(1B) of the SEBI Act, 1992, and Regulation 3 of the CIS Regulations, 1999.

- Unregistered Portfolio Management / Prop Desk: taking funds from others to trade on their behalf without a PMS or AIF license violates SEBI (Portfolio Managers) Regulations, 2020.

- Misrepresentation & Lack of Disclosure: Investors (Zs) were unaware of who actually controlled their money, violating SEBI’s Code of Conduct and Fair Disclosure norms.

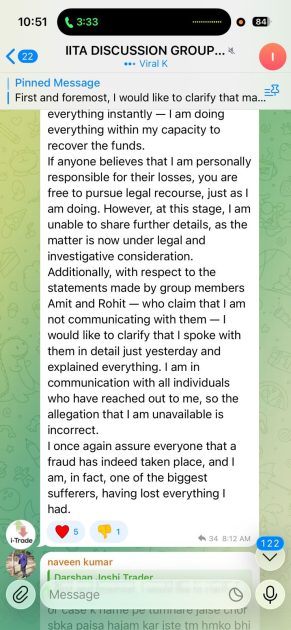

In response to the above message, Darshan Joshi (Mr. X) issued a detailed statement within the group, acknowledging the situation.

He clarified that:

- He assured members that he remains in communication with those who reached out to him and denied allegations of avoiding contact.

- He is not absconding and continues to operate from his office.

- A fraud had also been committed against him, for which he claims to have filed an FIR in Surat and lodged a local complaint.

- He is pursuing legal action and has requested time to resolve matters.

- He mentioned facing personal threats and stated that he is doing everything within his capacity to recover the funds.

Darshan Joshi’s message comes across as a way to calm the situation and protect his image.

He’s basically saying he hasn’t run away and that he’s a victim too. By claiming he was also defrauded, it feels like he’s trying to shift some of the blame off himself.

But at the same time, he indirectly admits that he was handling or managing people’s money, which means he was involved in collecting and using those funds, even if he calls it “prop desk trading.”

His explanation also makes it clear that there wasn’t any official setup or SEBI registration behind all this. It sounds more like a personal arrangement than a regulated trading operation.

His statement clearly indicates that he may have violated certain SEBI regulations.

Below is the list of the possible SEBI violations:

- Operating an Unregistered Investment Scheme – Managing or investing client funds without SEBI approval breaches Section 12(1) of the SEBI Act, 1992.

- Failure to Maintain Transparency and Risk Disclosure – SEBI mandates clear, written disclosure of investment risks and responsibilities. The lack of contracts or formal acknowledgment of liability breaches these norms.

- False Representation as a Prop Desk – Claiming to be a “prop desk” while accepting client money implies misleading investors about the nature of operations, violating SEBI’s prohibition on fraudulent and unfair trade practices (PFUTP Regulations, 2003).

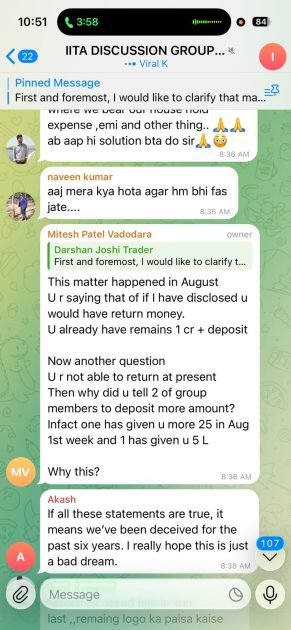

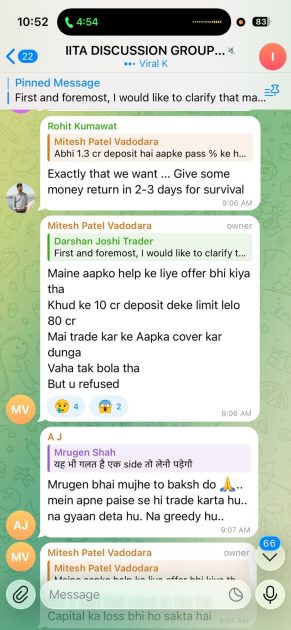

After Darshan Joshi posted his clarification message claiming that he was also a victim of fraud and had filed an FIR, several members of the Telegram group responded strongly.

Mitesh Patel questioned Darshan’s statements and pointed out contradictions.

He mentioned that even after the supposed fraud occurred in August, Darshan had asked members to deposit additional amounts.

Mitesh implied that if Darshan was aware of the fraud earlier, collecting more funds later was inappropriate.

He also claimed that some members had deposited substantial sums (₹25 lakh and ₹5 lakh) after the issue surfaced, raising doubts about Darshan’s transparency.

The group’s reaction makes it clear that traders no longer trust Darshan’s explanation.

They point out inconsistencies, for example, that he continued to collect funds even after supposedly discovering a fraud. Some members ask for at least partial repayments, while others express regret for ever joining the group.

Overall, the discussion reflects growing anger and disbelief, as people realize their investments might be lost.

How to Spot a Prop Desk Trap?

The iTrade191 episode isn’t an isolated case; it’s a reminder that even smart traders can fall for a polished pitch. Most scams start with trust, not greed. Here’s how to spot the early signs before your money’s gone:

- Too good to be true profits: If someone promises consistent returns or “risk-free” trading, it’s not trading, it’s bait.

- Private Telegram or WhatsApp groups: Legitimate trading firms never operate solely on encrypted chat apps.

- No verified registration: Always check if the company is registered with SEBI or has a valid broker affiliation.

- Pressure to deposit upfront: Real prop firms evaluate skills before funding you, they don’t ask for fees just to “join.”

Trading education and mentorship are fine, but the moment it involves unverified fund transfers or vague “capital pools,” it’s a red flag. Stay alert, do your due diligence, and never confuse popularity with credibility.

How to Report iTrade DJ?

If you’ve lost money to iTrade191 or any similar prop desk trading setup, don’t ignore it. Reporting these cases helps prevent others from falling for the same trap.

Here’s how you can take the first step:

- File Cyber Crime Complaint: File an online complaint under the financial fraud category in the cyber crime official portal. Keep screenshots, chat proofs, and payment details ready; they’ll help strengthen your case.

- File a Complaint in SEBI: You can also inform market regulators if the platform or trader falsely claims to be registered or affiliated with any licensed firm.

- Bank Dispute: If you made a transfer, alert your bank’s fraud department immediately; they can flag or trace suspicious transactions.

Need Help?

If you’ve been misled by a prop desk trading group like iTrade191 or lost money to a fake mentorship scheme, you’re not alone.

Register with us and let our team assist you in tracing the issue and protecting your future trades

We will guide you on how to take the next steps toward reporting or recovery.

Conclusion

The iTrade191 saga is a reminder that not every trading “opportunity” comes from a genuine desk.

What began as a promise of mentorship and funded trading turned into one of the most talked-about prop desk frauds online, leaving hundreds questioning who to trust next.

Prop desk trading, when done through licensed firms, can be a legitimate career path.

But when it happens in closed Telegram groups or under flashy social media names, it’s usually a trap waiting to spring. Stay alert, verify every claim, and never transfer money to unverified individuals.