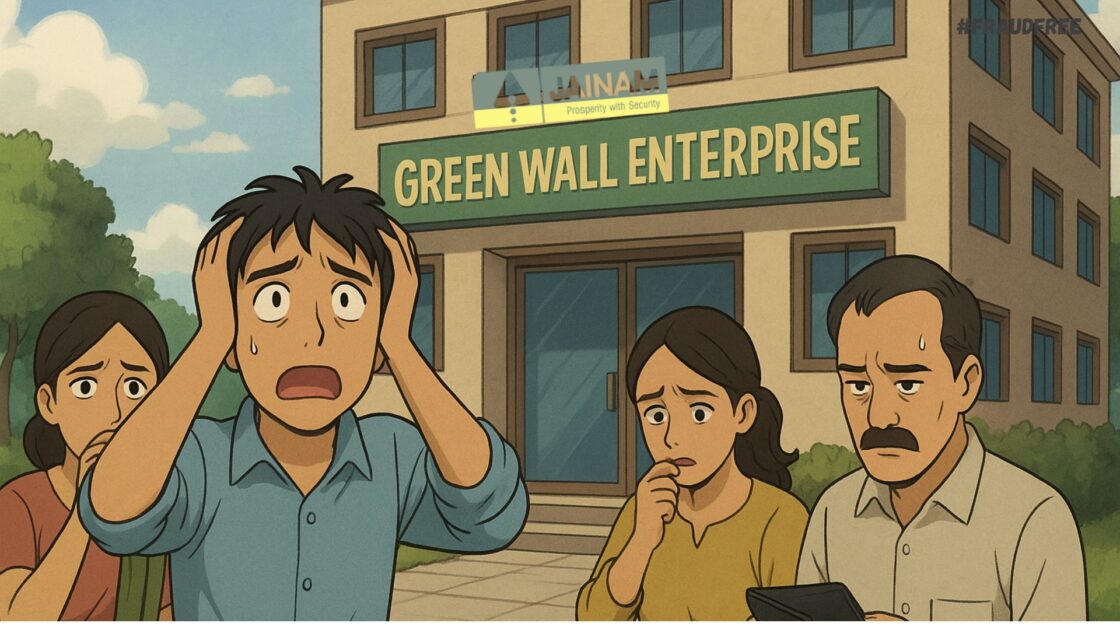

It always starts with a promise. In late 2024, dozens of investors in Surat were introduced to a scheme that looked like a golden ticket. Through a firm called Green Wall Enterprise, anyone could deposit just ₹5 lakh and trade with a capital of ₹50 lakh. On top of that, they were promised fixed returns between 6% and 18% per annum.

The setup looked legitimate enough. After all, Green Wall was said to be operating “on behalf of” a well-known brokerage, Jainam Broking Ltd.

But by August 2025, the dream collapsed, exposing what police now call a multi-crore fraud and SEBI has Order on Jainam Broking.

The Mechanics of the Scam

As complaints poured in, investigators found some disturbing patterns:

- Excessive leverage: Investors were allegedly offered a 10X margin on trades. That may sound attractive, but under SEBI’s peak margin rules (effective since 2021), such blanket leverage is no longer permitted. Brokers can’t just hand out 10X exposure across the board.

- Interest charges disguised as facilities: On this “borrowed margin,” investors were charged up to 18% per annum, a practice that would require a formal Margin Trading Facility (MTF) agreement. Without that, it directly violates SEBI’s framework.

- Fixed monthly credits: Some investors reportedly received ₹50,000 per month, credited to their accounts under the narration of “salary.” This was shocking because they were not employees. In fact, their trading balances weren’t being reduced at all, meaning these “returns” were not profits, but payouts funded by fresh deposits, a hallmark of a Ponzi-style scheme.

At first, these payouts reassured investors. It felt like proof that the system worked.

But when accounts were suddenly disabled in August 2025 and funds blocked, the mask fell off.

The Aftermath in Surat

So far, over 50 investors across Surat, Ahmedabad, Mumbai, Rajkot, and even Delhi have been identified as victims, with losses totalling ₹4.84 crore.

Police have arrested Hiren Jadav, one of the operators of Green Wall Enterprise.

His partner, Nimit Shah, remains absconding.

The case has now been transferred to the Economic Offences Cell, which is examining charges of cheating, breach of trust, and criminal conspiracy.

Why the Violations Matter?

To understand why regulators will look at this case closely, it helps to break down the core red flags:

- 10X leverage – not compliant with SEBI’s margin rules after 2021.

- 18% interest on borrowed funds – possible only under a formal MTF arrangement, not through informal side deals.

- Fixed ₹50,000 payouts labelled as “salary” – completely outside the scope of what a broker or its authorised persons can do for clients.

- Client funds routed through a sub-broker/Authorised Person – since 2018, SEBI recognises only Authorised Persons (APs), and the broker is fully responsible for an AP’s actions.

Put together, these practices mirror a Ponzi operation dressed as a brokerage service.

Is Jainam Broking Responsible?

This is the big question.

Jainam Broking’s name is all over the FIR because Green Wall Enterprise was reportedly operating accounts “on its behalf.”

Legally, if Green Wall were registered as an Authorised Person, the broker carries responsibility for supervision and compliance.

That said, no regulator or court has yet confirmed whether Jainam itself was complicit or whether this was a rogue arrangement run by its agents.

The broker is also linked to what media outlets are calling the Jainam Prop Desk Scam, a case that casts doubt on the broker’s supervision, adherence to regulations, and the safety of investors’ funds.

Whether Jainam Broking was directly involved or merely oversaw rogue agents will be clarified in the coming months by SEBI, NSE/BSE, and law enforcement.

Lessons for Investors

Stories like the Jainam Broking–Green Wall scam keep repeating in India’s markets. The playbook hardly changes, but the victims always do. Here’s how to protect yourself:

- No free lunch in markets: If someone offers you guaranteed fixed returns (whether monthly, quarterly, or annual), be sceptical.

- Ask for paperwork: Every leverage facility must have a signed SEBI-compliant agreement. No agreement = no deal.

- Check SEBI/NSE/BSE websites: Verify if the firm or “sub-broker” is listed. Many scams hide behind fake or expired registrations.

- Watch account narrations: If your bank shows “salary” when you’re an investor, that’s a flashing red light.

- Act fast: If access is blocked or payouts stop, immediately file complaints with SEBI SCORES, NSE/BSE, and the police Economic Offences Wing.

Final Thoughts

At its heart, this scam wasn’t about exotic trading strategies or complicated derivatives. It was about exploiting trust, the promise of easy leverage, regular payouts, and a brand name that gave people false confidence.

Whether Jainam Broking ends up being held liable or whether the blame sticks solely to Green Wall Enterprise, the Surat case is another painful reminder:

If it sounds too good to be true, it probably is.