Recently, news about the Jainam Prop Desk scam has been trending everywhere, from social media platforms to major news portals.

What began as a seemingly legitimate high-leverage trading opportunity in Surat, Gujarat, has snowballed into one of India’s most significant unregulated proprietary trading collapses.

According to NiftyTrader, SEBI Order on Jainam Broking, the estimated losses have now crossed ₹150 crore, affecting hundreds of retail traders across multiple Indian cities.

Jainam Prop Desk Scam Review

Before looking at the sequence of events, it helps to understand what a prop desk actually is.

A proprietary trading desk, or prop desk, is a setup where traders use the company’s own capital to trade in the market, and profits are shared between the trader and the firm.

In a legitimate prop desk, traders go through strict evaluations, risk controls, and transparent payout structures.

This model attracts many newcomers because it promises “high earning potential with no personal capital at risk.”

Unfortunately, this same structure is easy for fraudulent groups to imitate.

They create fake trading environments, collect fees, and disappear, exactly what is alleged in the Jainam Prop Desk case.

Yes, Jainam, one of the registered stock brokers in India, whose name is involved in the scam.

Let’s unfold it layer by layer.

November 2024 – July 2025: The Trust-Building Phase

According to The Blunt Times, between November 2024 and August 2025, Green Wall Enterprise systematically built investor confidence through timely payments.

Investors were offered the opportunity to trade ₹50 lakh against a deposit of just ₹5 lakh, along with monthly interest payouts between 6% and 18%.

The scheme appeared legitimate as Green Wall prominently displayed Jainam Stock Broking’s branding on hoardings and promotional materials, leading traders to believe it was an official Jainam branch.

August 14, 2025: The Collapse

According to multiple sources, including NiftyTrader, on August 14, 2025, the entire operation came crashing down.

Trading terminals were suddenly disabled, investors lost access to their accounts, and the key operators, Nimit Shah and Hiren Jadav, vanished without a trace.

Jainam Prop Desk Scam: Key Players

1. Green Wall Enterprises (Greenvol Enterprises)

- Location: Surat, Gujarat

- Key Accused: Nimit Shah and Hiren Jadav

- Operating Model: According to TradingView News, Green Wall asserted it was partnered with Jainam Stock Broking, yet no SEBI-approved documentation exists, making it a clear warning sign in the Jainam broking scam.

- Current Status: According to NiftyTrader, Hiren Jadav has been arrested by Surat Police’s Economic Offences Wing (EOW), while Nimit Shah remains absconding

2. iTrade Associates / iTrade Capital

- Operator: Darshan Joshi (known as “DJ”)

- Location: Greater Noida, Uttar Pradesh

- Network Coverage: According to TradingView News, DJ had exposure and clients across Delhi NCR, Jaipur, Ranchi, Kolhapur, and other pockets

3. Jainam Broking Limited

- Official Position: According to NiftyTrader, Jainam Broking has categorically denied any association with Green Wall Enterprises, stating: “Green Wall Enterprises was not our agent. Green Wall is not associated with us in any manner, and no transaction was done with them”.

- SEBI Actions: According to Moneylife, in a separate matter unrelated to this scam, SEBI levied a penalty of ₹6 lakh on Jainam Broking for regulatory violations, including poor supervision of Authorized Persons (APs)

Modus Operandi of Jainam Prop Desk Scam

Here is how people involved in the scam misused the name of the broker to mislead investors and to operate the scheme:

Step 1: Brand Misuse and False Legitimacy

According to Finshots, if you walked past Green Wall’s office, you would see Jainam Stock Broking’s boards everywhere.

People casually called it “the Jainam branch,” and nobody questioned its authenticity. This brand misuse created a false sense of security among investors.

Step 2: The Leverage Promise

According to Finshots, traders were offered “crazy leverage”, the kind where a ₹1 crore deposit turned into over ₹7 crore of trading firepower in the F&O (futures and options) markets.

This 7x to 10x leverage violated SEBI’s peak margin rules implemented since 2021.

Step 3: Money Collection Through Intermediaries

According to TradingView News, former merchant navy captain Krishan Yadav, one of the victims, explained the complex money flow:

Money Routing Structure:

- iTradeDJ Associates arranged F&O trading terminals

- Collected margin money on behalf of Green Wall

- Allegedly deposited money through DB Wealth and Ashapura Commodities to Jainam Stock Broking

- However, Jainam denied any links with Green Wall

The Telegram Network: “Inner Circle Wizards”

According to the investigation, much of iTrade DJ’s activity took place inside a Telegram group called “Inner Circle Wizards.” It was marketed as an exclusive trading circle where members could:

- Learn trading strategies

- Access capital with high leverage

- Trade under iTrade DJ’s guidance

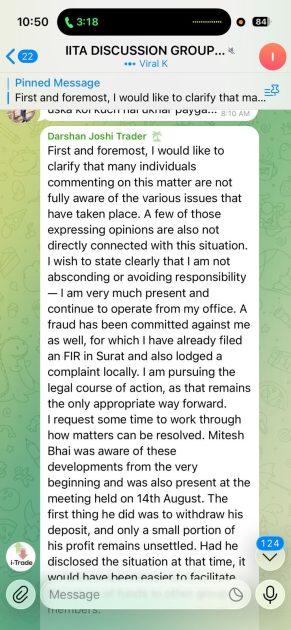

Post-Collapse Group Reactions

After Darshan Joshi posted his clarification message, several Telegram group members responded strongly:

Mitesh Patel’s Statement: He questioned DJ’s claims and pointed out that even after the supposed fraud occurred in August, DJ had asked members to deposit additional amounts of ₹25 lakh and ₹5 lakh.

Mitesh implied that if DJ was aware of the fraud earlier, collecting more funds later was highly inappropriate.

Jainam Prop Desk Scam: Real Stories from Indian Traders

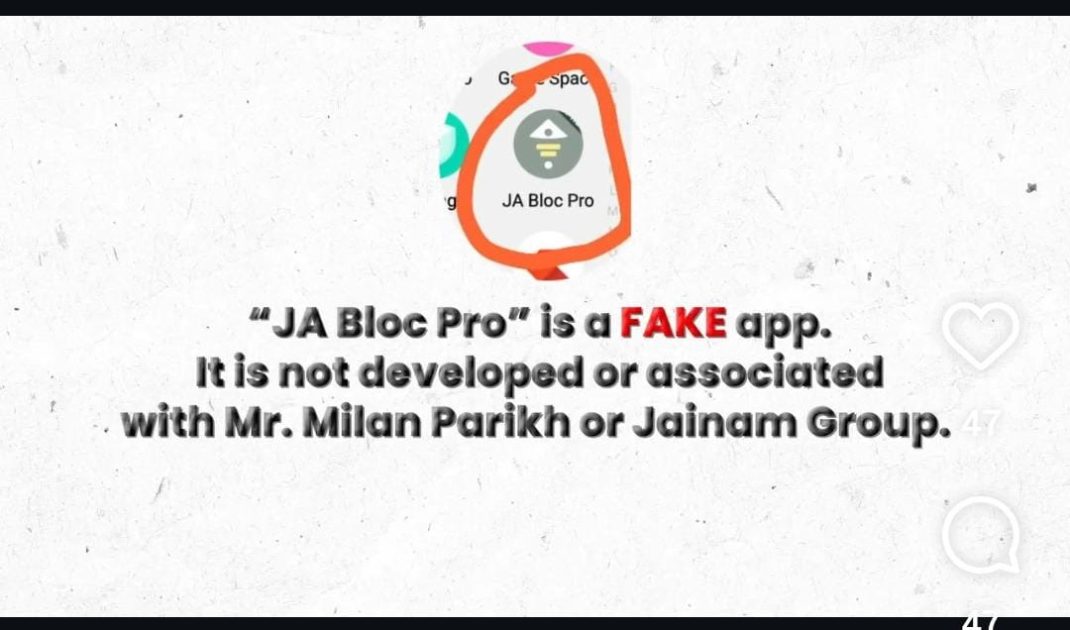

Although Jainam’s name is on the headlines, there is certain evidence where Jainam posted on its official channels to aware people about the scam running in their name.

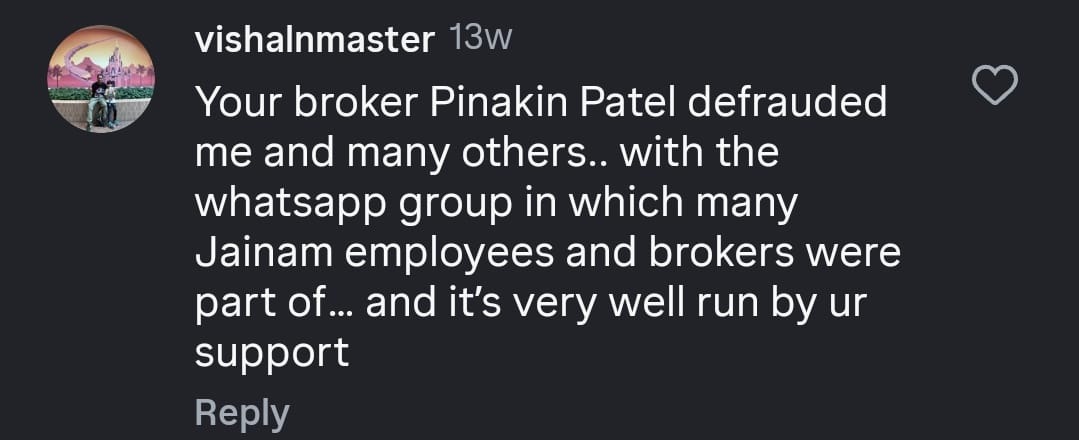

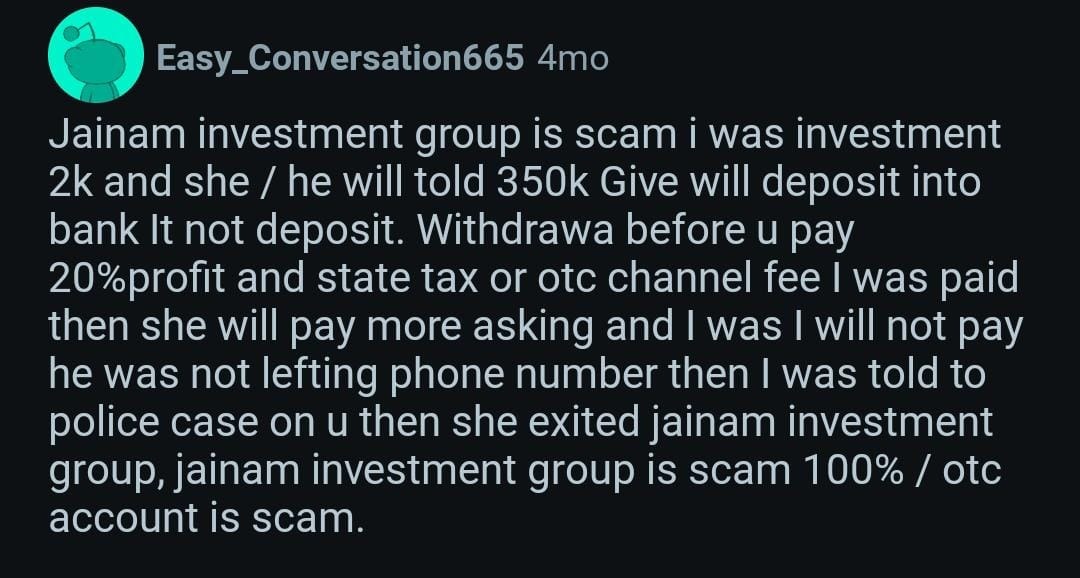

But at the same time, we cannot avoid looking at victims’ complaints:

Other than this, many news reports covered victims’ grievances that include:

- Captain Krishan Yadav – Former Merchant Navy Officer

According to TradingView News, Captain Krishan Yadav came forward to speak about his ordeal:

“I invested all my life savings there, but now not only my capital evaporated, but the trading-dependent income stream is also gone.”

According to the same source, Krishan explained that iTradeDJ Associates tried to manage the situation for a few weeks by arranging trading limits from other sources.

They assured victims they would pay dues by liquidating portfolios, but eventually, everything stopped.

- Rutvij Kothari – Broker Who Introduced 25 Clients

According to The Blunt Times, broker Rutvij Kothari stated:

“I trusted them because they claimed to be working through Jainam Broking. My clients and I believed our money was safe. Now everything is gone.”

Between November 2024 and August 2025, Kothari’s clients transferred ₹2.53 crore, while 29 other investors deposited an additional ₹2.11 crore.

- Anonymous Reddit Users

According to Reddit discussions on r/IndianStockMarket:

User Testimony 1:

“Traders believed it was a genuine broker setup … until one day access was cut and funds got stuck.”

User Testimony 2:

“Is Jainam OTC a scam … they are saying that he cannot withdraw the money without undergoing some training … it will take around 6 months.”

The Reality Verdict: Even though there is less evidence for Jainam Broking to be involved in the scam, it still feels suspicious after going through the reports and the reviews available.

Jainam Prop Desk Scam: Estimated Losses

Here is the estimated official and actual amount that victims lost in the scam:

| Source | Estimated Loss Amount | Status |

| Initial Police Reports | ₹4.84 crore (54 investors) | According to Business Standard |

| iTrade Associates FIR | ₹22.06 crore | According to Angel One |

| Market Sources (iTrade) | ₹40 crore | According to TradingView News |

| Industry Insiders (Total) | ₹150 crore+ | According to NiftyTrader, The420.in, Finshots |

How to Identify Prop Desk Scams?

Every scam comes with certain red flags.

In this case, too, there were some warning signs that victims ignored and ended up losing their money:

1. Too-Good-To-Be-True Leverage

- According to Finshots, promises of 7x to 10x leverage

- Ability to trade ₹7 crore with just ₹1 crore deposit

2. Brand Misuse

- According to Angel One, Green Wall used Jainam’s branding without authorization

- Official-looking hoardings created false legitimacy

3. Unregistered Intermediaries

- According to Business Standard, operators were not registered with SEBI

- No proper Authorized Person (AP) certification

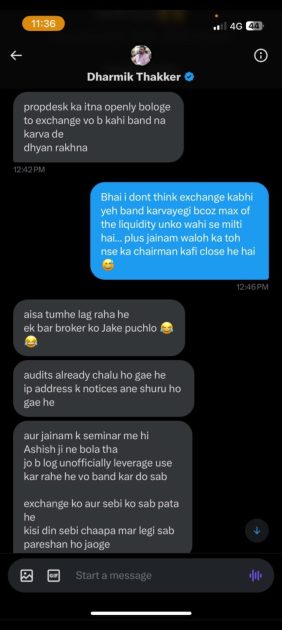

4. Private Communication Channels

- Operations conducted through Telegram groups

- WhatsApp groups for fund collection

- No official company email communications

Is Jainam Pro Desk Scam a Ponzi Scheme?

According to The Blunt Times, the scheme exhibited classic Ponzi traits:

Early Payment Strategy:

- Initial payments were made on time to build credibility

- Created a false sense of security among investors

- Encouraged word-of-mouth marketing

Recruiting New Investors:

- According to The Blunt Times, brokers like Rutvij Kothari began recommending the scheme

- Network effect brought in more investors

Collapse When New Money Stops:

- According to Finshots, when new deposits couldn’t sustain payouts, the system collapsed

- Operators vanished on August 14, 2025

How to Report the Jainam Prop Desk Scam?

Step 1: File FIR with Local Police

- Visit your nearest Economic Offences Wing (EOW) or Cyber Crime Cell

- Carry all documents: bank statements, transaction receipts, WhatsApp/Telegram screenshots

- Mention the connection to the Surat case for coordination

Step 2: File a Complaint with SEBI

- Visit the SCORES portal.

- Register and file a complaint against Green Wall Enterprises, iTrade Associates, or relevant parties

- Quote any reference numbers from police complaints

Mandatory Details Required:

- Name, PAN, Address, Mobile Number, Email ID

Step 3: File a Cyber Crime Complaint

- File an online complaint for financial fraud.

- Attach all evidence and provide a complete detail of the scam.

Need Help?

Are you a victim of the Jainam Prop Desk, iTrade DJ, or Green Wall Enterprises scam?

If you’re facing issues in recovering your funds or need guidance on the legal complaint process, register with us.

Take action today; every day counts in financial fraud recovery.

Conclusion

According to comprehensive reporting from NiftyTrader, Finshots, Angel One, TradingView News, and The420.in, the Jainam Prop Desk scam represents one of India’s largest unregulated proprietary trading collapses, with estimated losses exceeding ₹150 crore.

The investigation reveals a sophisticated operation involving brand misuse, false legitimacy through Jainam’s name, excessive leverage promises, Ponzi-style monthly payouts, and a complex network spanning multiple cities.

According to Finshots, SEBI has now stepped in to tighten regulations, including mandatory MAC and IP address mapping to track who’s actually sitting behind trading terminals.

But as investigations continue and Nimit Shah remains absconding, hundreds of Indian families are left grappling with devastating financial losses, a stark reminder that in the world of trading, there are no shortcuts to wealth.