Every few months, a new “revolutionary” trading app shows up promising to change your financial life. Right now, that spotlight is on the Mahatrade app, a platform claiming AI automation, effortless profits, and guaranteed monthly returns.

Investors are curious. WhatsApp groups are buzzing. Screenshots are flying everywhere.

But here’s the twist, behind all that excitement, people are also getting nervous. Is Mahatrade the next big opportunity, or the next big mistake?

Let’s walk through the truth together.

What is Mahatrade App?

Mahatrade is an AI-based trading platform that claims to automate trading across multiple asset classes including stocks, cryptocurrencies, forex, commodities, and indices.

According to their official website, users need to deposit a minimum of ₹10,000, complete KYC verification, and the app’s AI technology will supposedly trade on their behalf.

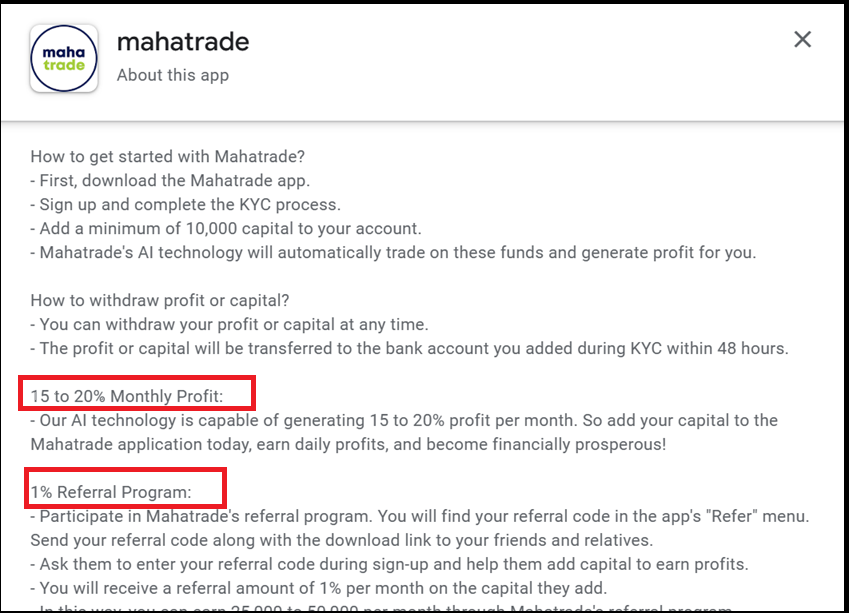

The platform promises 15-20% monthly profits with daily profit crediting and 24-48 hour withdrawals.

Guaranteed returns?

If you’re familiar with SEBI regulations, you already know this is a major red flag.

Promising fixed profits is strictly prohibited, and any platform doing so immediately raises doubts about its legitimacy.

But even after that, the app is available on the Google Play Store and operates from a physical office located at Thorat Estate, Deccan, Pune.

Is Mahatrade App Safe?

The legitimacy of the Mahatrade app is highly questionable due to several critical factors.

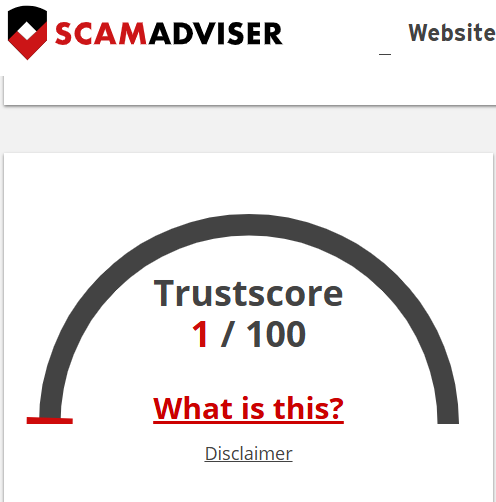

According to ScamAdviser, the website received a very low trust score when first analyzed in August 2024.

The domain was registered only in July 2024 with hidden ownership details-a major red flag for any financial platform.

Most importantly, Mahatrade is not SEBI registered.

The Securities and Exchange Board of India (SEBI) mandates registration for all legitimate trading platforms operating in India.

Without this crucial regulatory approval, investors have no legal protection if the platform fails or disappears with their funds.

Mahatrade App Real or Fake

No doubt, the app actual exist but the business model, claims and guaranteed returns give a strong signal of scam.

Multiple warning signs suggest the Mahatrade app poses significant risks to investors:

1. Unrealistic Return Promises

The platform guarantees 15-20% monthly returns, which translates to 180-240% annually.

Financial experts universally recognize such promises as mathematically unsustainable and characteristic of Ponzi schemes.

No legitimate investment can guarantee such consistently high returns.

2. Pyramid Structure

Mahatrade operates a 1% monthly referral commission program on deposits made by referred users.

This referral-based income model resembles pyramid schemes that rely on new investor funds to pay existing users rather than generating legitimate trading profits.

3. Data Security Concerns

According to the Google Play Store listing, the app collects personal information but the data isn’t encrypted, a serious security vulnerability for any financial application handling sensitive user data and funds.

So, based on these points, Mahatrade is running a high-risk investment scheme.

The review notes that platforms like Mahatrade often function as long as new users keep depositing funds, but when recruitment slows, payouts typically stop entirely.

The combination of unrealistic returns, lack of regulatory compliance, hidden ownership, pyramid-style referrals, and absence of transparency about trading strategies matches the profile of fraudulent schemes that have previously defrauded Indian investors.

While the app has accumulated over 10,000 downloads and displays positive reviews, these metrics can be manipulated and don’t guarantee legitimacy, especially for newly launched platforms.

MahaTrade App Complaints

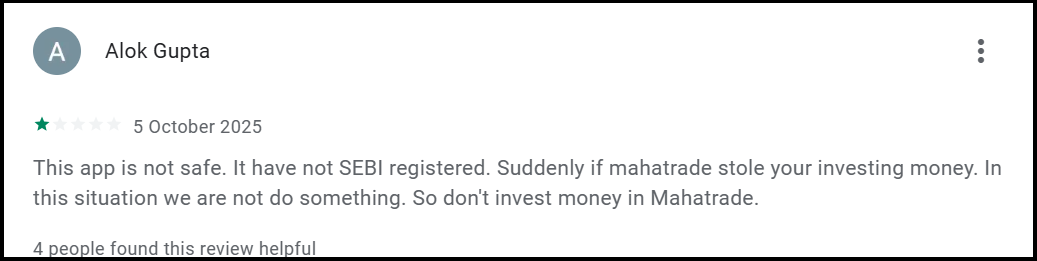

Recent user feedback on Google Play Store reveals troubling patterns that confirm many of the red flags identified by financial experts.

Actual customer experiences paint a concerning picture of the platform’s operations:

1. Increasing Loss Frequency

Rohit Khade reported a disturbing trend where losses are becoming more frequent. He complained: “Pahale apka loss month mai ek bar hota tha ab every week mai ek baar ho raha hai” (Previously losses happened once a month, now they’re happening every week).

Rohit expressed suspicion that the platform might be profiting from customer losses and deliberately showing one day’s profit as a loss to benefit the company, adding: “isko apko bahot fayada hota hoga. i know ap iska reply nahi denge” (This must be very beneficial for you. I know you won’t reply to this).

This pattern suggests the AI trading system is either not functioning as advertised or the platform is manipulating profit/loss displays to extract more money from users.

2. Withdrawal and Customer Service Issues

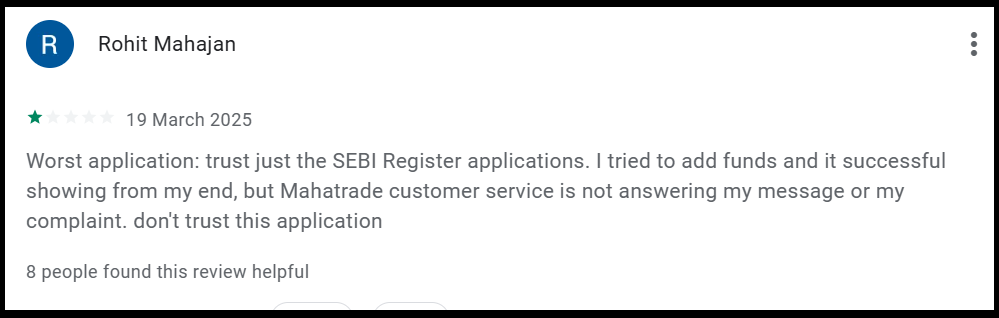

Alok Gupta shared a serious complaint about fund deposits and complete lack of customer support response.

He reported: “I tried to add funds and it successful showing from my end, but Mahatrade customer service is not answering my message or my complaint.”

He strongly warned others with a simple message: “Worst application: trust just the SEBI Register applications. don’t trust this application.”

When customer funds are at stake and support teams become unresponsive, it’s a classic warning sign of a platform preparing to shut down operations or deny withdrawals.

5. The “Registration Coming Soon” Excuse

When confronted about their lack of SEBI registration, Mahatrade’s official response states: “Mahatrade is currently in the process of obtaining all required registration. We assure you that user funds and data security are our top priorities. Our existing customers are fully satisfied with our transparent and consistent services. Once the registration process is complete, we will notify it officially.”

Critical Analysis: This response is highly problematic for several reasons:

- Operating illegally while “processing” registration – Legitimate companies obtain regulatory approval BEFORE accepting customer funds, not after

- Vague timeline – They provide no specific dates or proof of actual registration application with SEBI

- Contradictory claims – They claim existing customers are “fully satisfied” while actual user reviews show the opposite

- Delayed promises – The platform has been operating since July 2024 and still hasn’t obtained registration, suggesting they either haven’t applied or have been rejected

The pattern is clear: Unregistered platforms often use the “registration in process” excuse indefinitely to continue collecting deposits while avoiding regulatory scrutiny.

When withdrawal issues intensify, they typically disappear with customer funds before any registration materializes.

How to Report the Mahatrade App?

If you feel that Mahatrade has misled you, blocked withdrawals, promised guaranteed returns, or shown any suspicious activity, don’t wait.

Reporting early increases your chances of recovering funds and helps authorities take action against fraudulent platforms.

Here’s exactly what you should do:

1. File a Cyber Crime Complaint

This is India’s official platform for reporting online fraud.

- Visit the cyber crime portal

- Click on “Report Other Cybercrime”

- Select “Financial Fraud”

- Provide screenshots, payment proofs, chat logs, and app details

Once submitted, you’ll receive a complaint ID for tracking your case.

2. File a Complaint with Your Bank

If you made any payments to Mahatrade using:

- UPI

- Bank transfer

- Debit card

- Wallet apps

Contact your bank’s fraud department and request:

- A freeze on suspicious transactions

- A chargeback (if applicable)

- An official complaint number

Banks often cooperate quickly in cases involving unregistered financial apps.

3. File a Complaint in SEBI

Since Mahatrade:

- Promised guaranteed returns

- Claimed to offer investment products

- Showed fake SEBI registration

- Used misleading financial promotions

You can report it to SEBI under “Unregistered Investment Advisory/Violation” by sending an email with all the proof.

Need Help?

If you’ve already deposited money into Mahatrade and are facing issues, time is critical. Register with us now to receive expert support and step-by-step guidance on how to recover your funds and take legal action against fraudsters.

Conclusion

The evidence against Mahatrade app is overwhelming and points unmistakably toward a high-risk investment scheme that exhibits classic characteristics of financial fraud.

From the moment of its suspicious launch in July 2024 with hidden ownership and no regulatory approval, to the mounting user complaints about increasing losses and unresponsive customer support, every aspect of this platform raises serious concerns.

The promise of 15-20% monthly returns defies financial logic and market realities, no legitimate investment vehicle can guarantee such astronomical returns consistently.

Protect yourself by only investing through SEBI-registered platforms that are transparent about risks, provide proper legal protections, and operate under regulatory oversight.