Dreaming of a 15–20% monthly return from an AI trading app? It sounds like a fast track to wealth, doesn’t it?

But amidst the hype surrounding platforms like MahaTrade, experts are waving major red flags. Before you risk a single rupee, let’s ask the crucial questions every Indian investor needs answered- Is Mahatrade SEBI Registered?

This is the first and most important question you must ask any trading platform operating in India. The allure of high profits shouldn’t outweigh the need for financial security.

Let’s find out the truth behind the curtain.

Is the MahaTrade App Legal?

MahaTrade does not appear to be a SEBI-registered stockbroker, Investment Advisor (IA), or Research Analyst (RA). The MahaTrade App description often features marketing claims that are highly unusual and often illegal for an SEBI-regulated entity.

SEBI-regulated entities are legally prohibited from promising fixed or guaranteed returns, as trading inherently involves risk.

Any platform guaranteeing such high, consistent returns is using a tactic common in pyramid schemes or Ponzi schemes, not legitimate trading.

Registration Details:

- SEBI Registration Number: Not displayed/Not found

- Exchange Membership: No NSE or BSE membership visible

- Regulatory Compliance: No evidence of SEBI approval

- Domain Age: Registered approximately 1.3 years ago (as of 2024)

Hence, what do you understand from this? It is an unregistered platform, and investing can be highly unsafe.

Other than this, there are multiple warning signs that indicate MahaTrade operates outside India’s regulatory framework:

- No Regulatory Authorisation: The platform provides no proof of SEBI registration, which is mandatory for any entity offering trading services in Indian securities markets.

- Prohibited Trading Assets: According to their website, MahaTrade claims to offer trading in “stocks, cryptocurrencies, forex, commodities, and indices.” However, international forex trading and cryptocurrency trading through such platforms are heavily restricted in India and require specific regulatory approvals.

- Account Handling Model: MahaTrade states users cannot place trades themselves – the platform trades “on behalf of users.” According to SEBI regulations, such portfolio management services require separate licensing as a Portfolio Management Service (PMS) provider.

Is MahaTrade App Safe?

While the platform displays glowing testimonials on its website, independent verification reveals concerning patterns:

1. Hidden Owner Identity: According to Scamadviser, the website owner’s identity is completely hidden – a common tactic used by fraudulent platforms.

2. HYIP Characteristics: The platform exhibits classic High Yield Investment Program indicators, which Scamadviser warns are “extremely high-risk investments where 80% of investors usually lose money.”

3. Questionable Reach and Service: According to Gridinsoft analysis, the website has “limited website popularity” and low visitor numbers despite claiming to serve “thousands of traders.”

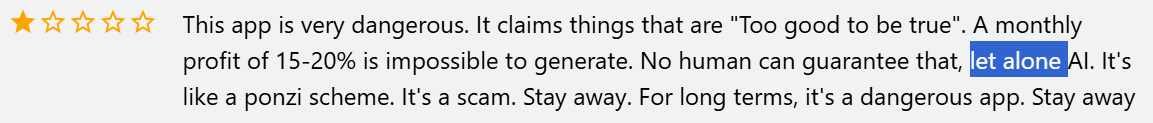

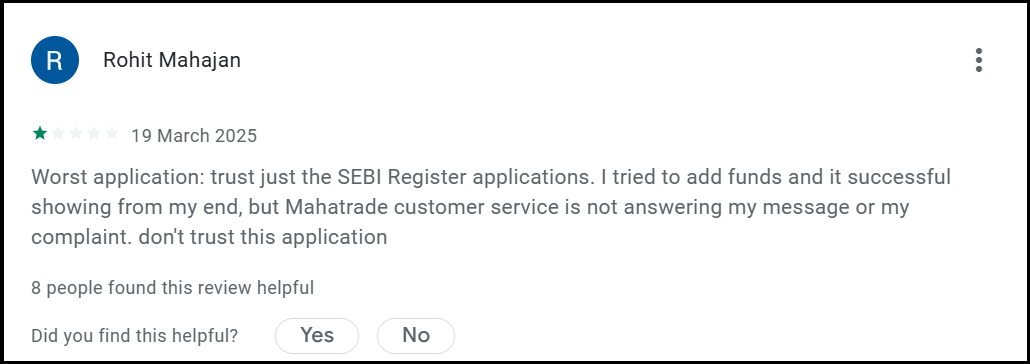

Mahatade App Complaints

MahaTrade users have raised serious concerns about fund management, withdrawal delays, and unresponsive customer support, with many questioning the app’s legitimacy and transparency in operations.

1. Fund Addition & Transaction Issues

Users have reported problems while adding funds, with transactions showing successful on their end but not reflecting in the app, and no response from customer support.

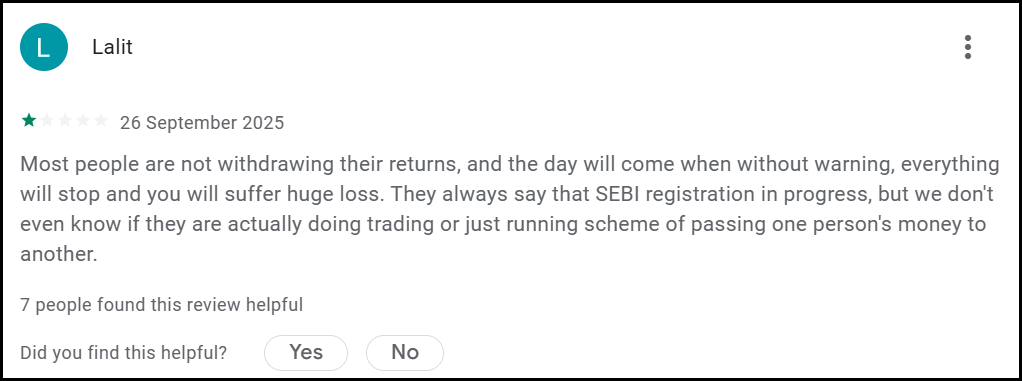

2. Withdrawal & Returns Concerns

Several users face difficulties withdrawing their returns, with warnings of potential losses due to a lack of transparency in operations. This raises concerns regarding the authenticity of the app.

3. Customer Support & Transparency

The app’s customer service is reportedly unresponsive, and users doubt the authenticity of trading practices and SEBI registration.

How to Report MahaTrade App?

If you’ve been affected by MahaTrade or suspect fraudulent activity, follow these reporting channels:

- To file a SEBI complaint against fraudsters, send an email to them.

- Draft complete case.

- Attach proof

2. File a Complaint in Cyber Crime

- Register at cyber cybercrime portal.

- Draft your complaint

- Upload evidence.

- Submit & save the acknowledgement number.

Need Help?

If you are facing issues with MahaTrade or similar platforms, register with us immediately.

Time is critical in fraud cases. Complaints filed within 3-7 days have much higher recovery rates than delayed reports.

Don’t delay – Your quick action could save your investment.

Conclusion

MahaTrade operates without visible SEBI registration, displays multiple red flags characteristic of High Yield Investment Programs, and makes promises that violate fundamental investment principles.

According to Scamadviser’s analysis, the platform scores only 11/100 on trust metrics, with hidden ownership and HYIP characteristics.

Indian investors must remember: legitimate brokers are mandated to display SEBI registration numbers starting with “INB” on their websites. MahaTrade provides no such credentials.

The promise of guaranteed 15-20% monthly returns through AI trading contradicts both market reality and regulatory guidelines.

According to NiftyTrader’s research on AI trading scams, such platforms have cost Indian investors over ₹20,000 crore in 2024 alone.

Before investing in any trading platform, verify SEBI registration at the official SEBI website, check for NSE/BSE membership, and remember: if returns seem too good to be true, they almost certainly are.

Protect your hard-earned money by choosing only SEBI-registered, transparent brokers with verifiable credentials.