If you’ve recently heard about Mindstay Assets Management Private Limited offering high monthly fixed returns, you’re not alone. Several investors across India have raised concerns about missed payouts, unresponsive communication, and questionable agreements, prompting fears of a possible investment fraud.

This article compiles public complaints, investor experiences, and red flags surrounding Mindstay Assets Management to help others make informed decisions.

Mindspace Asset Management Review

Mindspace Asset Management is described by investors as a firm offering investment opportunities with fixed monthly returns, often marketed as low-risk and high-yield.

According to investor accounts:

- Investments were accepted under fixed payout agreements

- Monthly returns of around 3% were promised

- Agreements were executed on ₹100 stamp paper

- Investors were assured of regular monthly income and capital safety

However, multiple investors now report that these commitments have not been honored.

Mindspace Asset Management Complaints

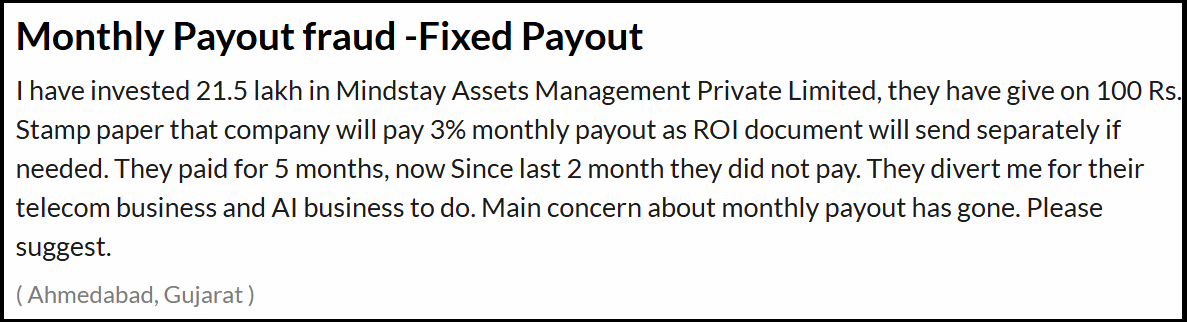

One investor from Ahmedabad, Gujarat, publicly reported the following:

- An investment of ₹21.5 lakh was made with Mindspace Asset Management

- The company committed to a 3% monthly payout

- Payments were made regularly for the first five months

- For the last two months, no payouts were received

- Repeated follow-ups resulted in delays, diversions, and no clear resolution

The investor stated that instead of addressing the missed payouts, the company diverted conversations without providing a concrete repayment timeline.

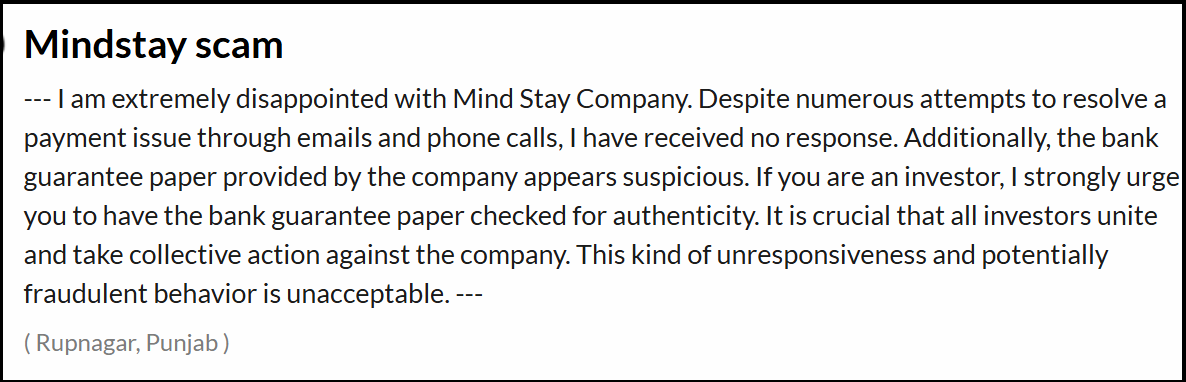

Another investor from Punjab raised similar concerns:

- The investor reports multiple unsuccessful attempts to resolve payment issues through emails and phone calls, receiving no response from Mindspace Asset Management.

- The company’s lack of communication after accepting investment funds raises serious concerns about transparency and accountability.

- A bank guarantee document provided by the company is described as suspicious, prompting the investor to urge others to verify its authenticity independently.

- Bank guarantees are typically used to assure investors of fund security; doubts regarding their legitimacy significantly undermine trust.

- The continued silence from the company despite repeated follow-ups suggests the issue may not be an isolated delay.

- The investor has called for collective action among affected investors, indicating the possibility of a broader, systemic problem.

Red Flags of Mindspace Asset Management Investment Scheme

Several investor complaints and publicly shared experiences suggest that the investment scheme promoted by Mindspace Asset Management carries multiple warning signs.

While the company may present its offering as a fixed monthly payout opportunity, the structure, promises, and post-investment conduct reported by investors raise serious concerns.

These red flags are commonly associated with high-risk or potentially fraudulent investment schemes and should not be ignored.

1. Fixed High Monthly Returns

A promised 3% monthly return (approximately 36% annually) is extremely high and uncommon in legitimate, regulated investment products. Such guarantees are widely considered a major warning sign.

2. Payment Stoppage After Initial Period

A pattern reported by investors includes:

- Timely payouts initially

- Sudden stoppage of payments

- No formal written explanation or repayment plan

This pattern is often associated with cash-flow–dependent or unsustainable schemes.

3. Weak or Questionable Documentation

- Agreements executed on low-value stamp paper

- Promises that “ROI documents” or additional paperwork would be shared later

- No clarity on regulatory approvals or investor protections

Such documentation may be insufficient for enforcing investor rights.

4. Lack of Communication

Investors report:

- Calls and emails are going unanswered

- No official response to payment default concerns

- Delays without written confirmation or accountability

Poor communication after collecting funds is a serious red flag.

How do Investment Scams Work?

Several elements suggest that Mindstay Technology may operate using MLM or Ponzi-like structures:

- Referral & Recruitment Focus: Investors and participants are encouraged to bring in others to earn commissions or profit-sharing rewards.

- High Returns Promised: Profit-sharing programs promise high monthly returns, often funded by the investments of new participants.

- Deceptive Training Programs: Job seekers are asked to buy courses that are allegedly required for roles. Some of these courses link to external websites that appear legitimate but are not official.

- Delayed or Non-payment: Trainers and investors report receiving partial or no payments, despite contractual agreements.

In short, while Mindstay Technology presents itself as a tech and training company, the actual model raises red flags typical of investment scams.

Is Mindstay Technology Operational Now?

Yes. Mindstay Technology is still active as a registered OPC in Bengaluru. Being operational doesn’t mean it’s safe. Many reported cases indicate ongoing issues with payments and transparency.

How to Spot Investment Scams?

Watch out for these red flags before investing:

- High Returns, Low Risk – Promises of quick, guaranteed profits are suspicious.

- Pressure Tactics – Urgency or limited-time offers are classic scam moves.

- Referral-Based Schemes – Earnings mainly from recruiting others? Likely MLM/Ponzi.

- Lack of Transparency – Vague contracts, unclear revenue sources, or hidden terms.

- Unverified Websites – Check official registration; fake-looking websites are common.

- Poor Support – No responses to queries or complaints is a warning.

- Unsolicited Offers – Random calls or messages promising easy money are risky.

Always verify with MCA, SEBI, or financial advisors before investing.

How to Report Investment Scams?

If you’ve fallen victim to a scam involving Mindstay Technology or Mindstay Assets Management, you’re not alone. Multiple investors have reported issues such as non-payment of promised returns and unresponsive customer service.

If you believe you’ve been defrauded, consider the following actions:

1. Gather Evidence:

Collect all relevant documents, including contracts, bank statements, emails, and screenshots of communications.

2. File a Complaint with Authorities:

- Ministry of Corporate Affairs (MCA): Report the company for fraudulent activities.

- Securities and Exchange Board of India (SEBI): If the scam involves investment schemes, lodge a complaint.

- File a complaint in Cyber Crime: File a complaint online at the Cyber Crime Portal.

- Local Police: File an FIR for financial fraud.

Need Help?

If you’ve been affected by Mindstay Technology, you can register with us for legal assistance and guidance to recover your funds.

Conclusion

While Mindstay Technology is operational, multiple red flags, unpaid trainers, and complaints from investors suggest caution. Whether it’s investment promises, recruitment programs, or referral schemes, the risks are real.

Always perform due diligence, verify credentials, and consult professionals before engaging with such companies. Protect your money, your career, and your peace of mind.