Most traders sign up with a broker expecting seamless trading, fast assistance, and a platform they can trust. Moneylicious Securities positions itself exactly this way.

It operates as a SEBI-registered stockbroker that offers equity trading, investment products, and basic market services through its online platform.

Many traders use it for day-to-day buying and selling, opening demat accounts, and managing portfolios.

But like every broker, the real experience depends on what customers go through outside the marketing promises.

Few traders have shared concerns, and these complaints don’t define the entire platform, but they do raise important questions for anyone planning to trade with Moneylicious Securities.

Moneylicious Securities

Moneylicious Securities Private Limited (MSPL) is an Indian stockbroking company that offers retail broking across multiple exchanges and segments, and it is also known as the entity behind the technology-led trading platform “Dhan.”

Moneylicious Securities was founded in 2012 and operates as a SEBI-registered stockbroker with memberships on major Indian exchanges, including NSE, BSE, and MCX.

Moneylicious Securities Complaint Details

As per 2025-26 data, Moneylicious Securities has 979,483 active clients, and out of these, 121 complaints were recorded.

This means only 0.012% of their active users raised issues.

The broker has resolved 84.30% of the complaints, indicating that most cases were addressed successfully, though a few still need attention.

Types of Complaints Against Moneylicious Securities

Type I: Non-receipt / delay in payment

This happens when traders don’t receive their payout on time or face delays in getting their funds. It typically indicates issues with settlement or processing on the broker’s side.

Type II: Non-receipt / delay in securities:

Clients raise this when the broker delays delivering shares to their demat account. It often occurs due to settlement errors or delays in the back office.

Type IV: Unauthorized Trading

These complaints involve trades executed without the client’s consent or the misuse of their funds or shares. It indicates a serious breach of trust or security.

Type V: Service-related

This category covers slow support, unresponsive customer care, platform issues, or delays in resolving queries. It reflects general service inefficiencies.

Type V: Closing out / squaring up

These arise when the broker squares off a client’s position without proper notice or prematurely. It usually affects traders during margin shortfalls or system-triggered actions.

Type VIII: IPO related

Clients face issues during IPO applications, such as blocked funds not being released, application errors, or failure to process bids.

Type IX: Others

Any complaint that doesn’t fit the above categories, technical glitches, account issues, or miscellaneous errors, falls under this section.

Moneylicious Securities Arbitration Cases

Despite its good reputation, there are some arbitration cases at NSE.

Let’s take a look at that:

Case 1: Technical Glitch & Delayed Order Execution

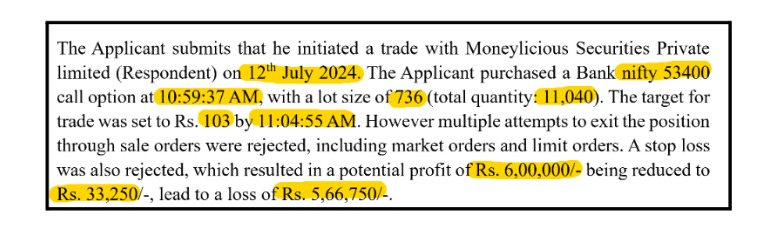

This case involves an arbitration matter between Bharat Bhaychandbhai Vaghari and Moneylicious Securities Private Limited, where the trader’s sell orders on 12 July 2024 failed due to a technical glitch from 11:04 AM to 11:19 AM.

This case was represented by our team, and we handled the entire arbitration process on behalf of the client. From preparing the documents to presenting the facts, we ensured the claim was argued clearly and effectively.

He expected a target exit at ₹103, but due to repeated order rejections, his trade exited at ₹53.02, reducing potential gains.

When the system rejects legitimate sell orders at 11:04, 11:05, and again until 11:19, it signals a failure of the trading infrastructure.

The arbitrator also notes that the broker claimed a BSE technical issue but provided no evidence to support this.

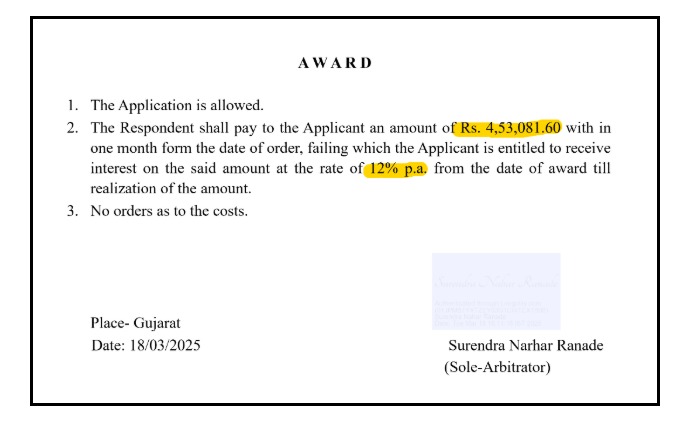

Penalty Imposed

The arbitrator concluded that the broker failed to provide timely execution and awarded ₹4,53,081.60 as compensation, payable within one month, with 12% interest if delayed.

Key Takeaway

This raises safety concerns for traders because any technical breakdown during high volatility trades can instantly impact prices.

Case 2: Loss of ₹2,17,967.13 From DHAN App Technical Issues

When trading apps freeze, crash, or fail to respond at crucial moments, the results can be financially devastating.

But are brokers legally responsible when a trader faces losses due to alleged app glitches?

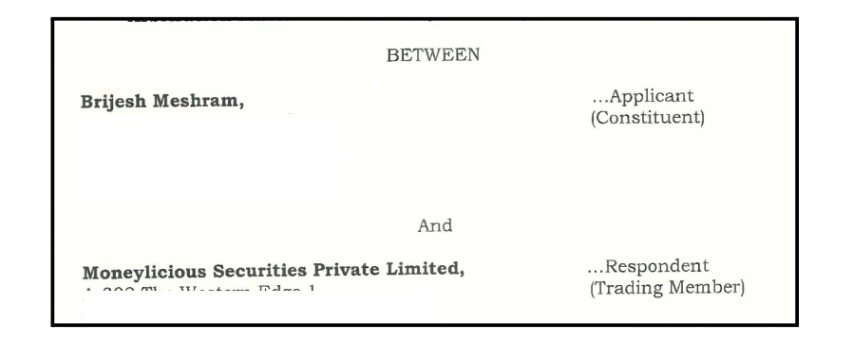

This arbitration case between Brijesh Meshram and Moneylicious Securities Pvt. Ltd. (Dhan App) sheds important light on that question.

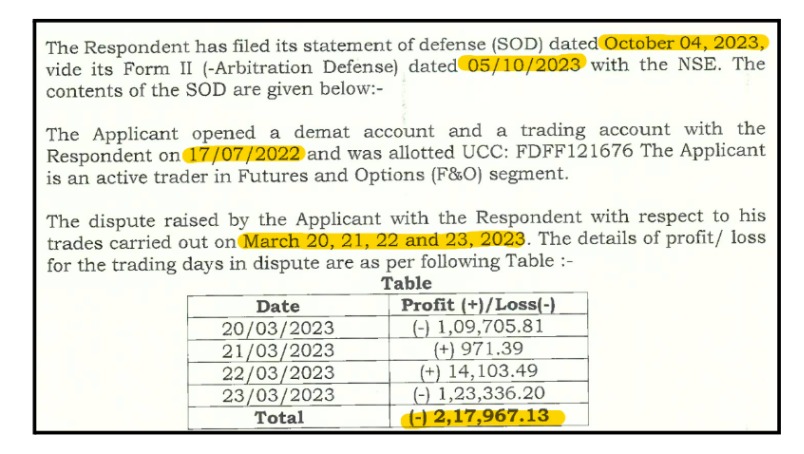

Brijesh Meshram, an active F&O trader, claimed that the Dhan trading app malfunctioned on four consecutive days from March 20, 21, 22, and 23, 2023.

According to him, the app:

- Hung during live trades

- Stopped working despite a stable internet

- Prevented him from square-off or close-out

- Caused him to incur heavy losses

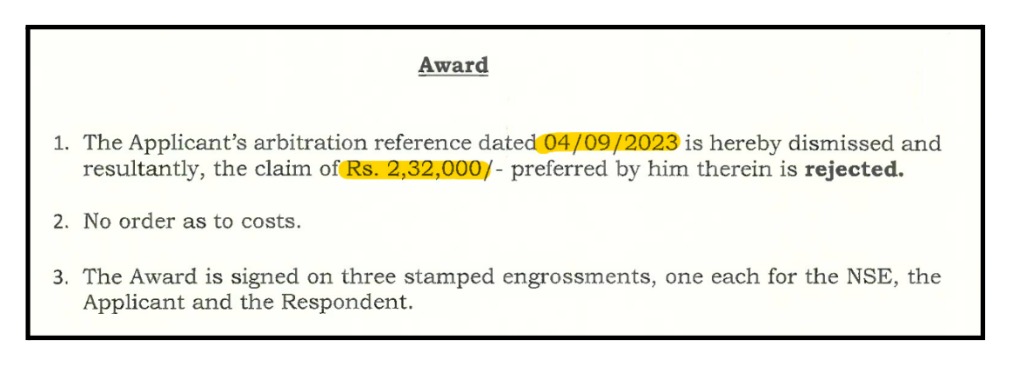

Based on these issues, he filed an arbitration claim asking for ₹2,32,000 as compensation.

Penalty Imposed

Without concrete evidence, the law concluded that the loss amount of ₹2,17,967.13 seems directly linked to disrupted trades.

The Respondent also argued that the Applicant did not raise complaints immediately and waited for 15 days, which weakened the credibility of the claim.

Because no technical evidence, IBT clause violations, or exchange side errors were proven, the arbitrator rejected the claim entirely and dismissed the arbitration application on 04th September 2023.

Key Takeaway

This highlights a key safety concern: delayed reporting makes it difficult for traders to prove system failure later.

From a risk standpoint, this case demonstrates how trading app issues, whether it be real or assumed, can lead to large losses, but only verifiable records can hold a broker liable.

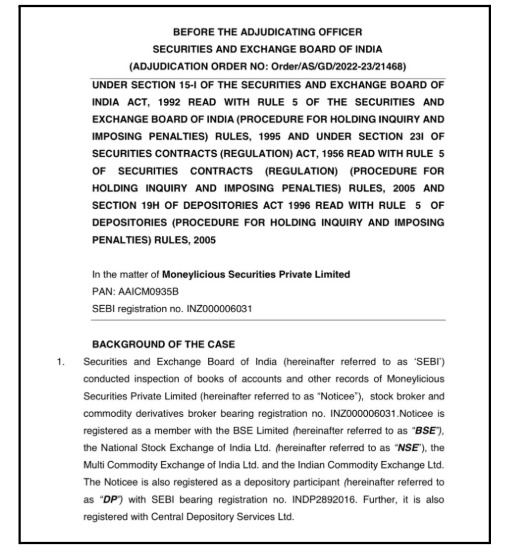

SEBI Orders against Moneylicious

Apart from these, there are SEBI orders against this broker.

SEBI regularly keeps a check on its registered brokers and checks if they are following the rules or not.

SEBI’s Rs 3 Lakh Penalty on Moneylicious Securities

SEBI passed this order after inspecting Moneylicious Securities Pvt. Ltd. (a broker and DP) and finding compliance gaps from April 2018 to Oct 18, 2019. The goal was to protect clients’ money and ensure correct reporting and the minimum financial strength of the broker.

Why SEBI Did?

SEBI inspected the broker’s records and found signs that client funds were not properly protected/handled, and that required reporting was incorrect.

Based on inspection findings, SEBI started adjudication and issued a show-cause notice, then passed a penalty order.

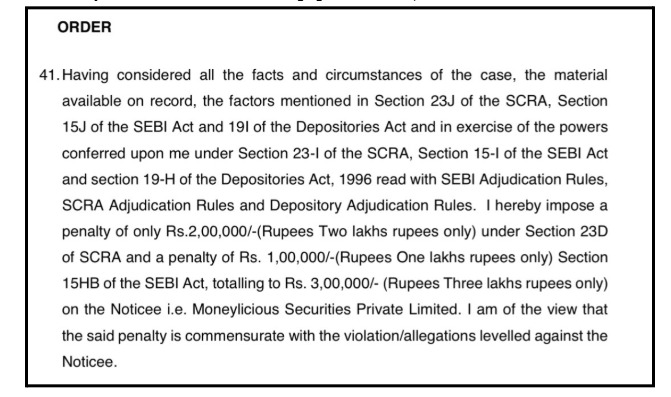

Key violations found

- Misuse of client funds in the equity segment: on 17 out of 38 sample days, available funds were less than clients’ credit balances (a red flag showing possible client money usage).

- Non-segregation of client funds: SEBI found 1611 transfers between client bank accounts and non-client accounts, which violated segregation rules.

- Incorrect weekly enhanced supervision reporting: wrong figures were reported to the exchange for a sample date (Sept 27, 2019).

- Net worth non-compliance/incorrect net worth reporting: Broker reported net worth above Rs 1 crore, but NSE’s calculation showed about Rs 0.49 crore (below the requirement).

What SEBI Did?

SEBI imposed penalties totaling Rs 3,00,000 (Rs 2,00,000 under SCRA + Rs 1,00,000 under SEBI Act).

Some charges were not sustained (e.g., commodity-segment misuse attributed to another entity, and the “interest levy” issue wasn’t established as charging was not shown).

Key learnings:

- Never allow client money to mix with the broker’s own funds; segregation is mandatory.

- Compliance reporting must be accurate, as wrong reporting itself is a violation.

- Brokers must maintain a minimum net worth and calculate it correctly, including required deductions.

How To File A Complaint Against Your Broker?

Facing trouble with a broker can feel overwhelming, especially when you don’t know how to file a report or what regulators expect.

Register with us, and we’ll guide you gently through the entire journey from gathering proof to submitting your case online.

Here’s the kind of help you receive:

- Building Your Evidence File: We help you gather and organise everything that strengthens your complaint trade sheets, ledgers, contract notes, screenshots, email trails, and call logs.

- Creating a Strong Complaint Draft: Our team prepares clear, professional, and regulator-compliant complaint drafts tailored specifically for NSE, BSE, SEBI SCORES, and SMART ODR. So your issue is understood the first time.

- Support With Online Filing: Whether it’s SCORES or SMART ODR, we help you file your complaint accurately so nothing gets rejected.

- Guiding You Through Escalation: If the issue isn’t fixed at the first step, we show you how to move to IGRP or arbitration and explain each stage in simple terms.

- Managing Every Step for You: Once you register with us, you’re not alone. We track your case, remind you of deadlines, and help you respond to queries from regulators or exchanges, so nothing slips through the cracks.

- Preparation for Hearings: If your case reaches counseling or arbitration, we help you prepare statements and supporting documents so you feel confident, organised, and ready to present your side.

Conclusion

Moneylicious Securities has faced several complaints ranging from service delays to more serious issues highlighted in SEBI’s inspection, such as fund mismanagement and reporting irregularities.

While many traders continue to use the platform without problems, the documented complaints and regulatory actions show that users should stay alert, monitor their accounts, and raise issues early.

Understanding these risks helps traders make safer decisions, especially when choosing a broker for long-term investing or active trading.