Before we talk about scams, let’s get one thing straight: The real Mudra Loan is a government-backed scheme under the Pradhan Mantri Mudra Yojana (PMMY).

It helps small businesses, shop owners, vendors, and entrepreneurs borrow money through banks, NBFCs, and micro-finance institutions.

And here’s the most important part:

There is NO official “Mudra Loan App” released by the Government of India.

Mudra loans are not issued through mobile apps, WhatsApp links, Instagram ads, or “instant online approval” platforms. You can only apply through:

- Banks

- NBFCs

- Microfinance institutions

- Official bank portals

So when you see apps claiming:

- “Instant Mudra Loan 50,000–10 lakh”

- “PM Loan Approval in 2 Minutes”

- “Government Loan App”

It’s a giant red flag.

PM Mudra Yojana Review

The Pradhan Mantri Mudra Yojana (PMMY) was launched to support India’s small entrepreneurs, people who run shops, stalls, services, and small-scale businesses that often struggle to get bank loans.

The scheme offers loans up to ₹10 lakh, without demanding heavy collateral, which sounds like a big relief for first-time borrowers.

Now the scheme, which was launched to provide relief to the middle class actually become a reason for stress.

Wondering why?

Scammers have misused this scheme for their own benefit.

Since people trust government schemes, scammers have created fake apps that look professional.

They use the Indian flag, PM’s photo, or government logos, but behind the scenes, they are designed to steal money and personal data.

Let’s get into the details of how this scam is operated.

Mudra Loan App Scam

As mentioned, scammers create fake apps using the “Mudra” name. They promise instant loan approvals.

Here’s what usually happens:

1. Fake “Processing Fees”

They ask you to pay ₹499, ₹999, or even ₹3,000 as:

- File charges

- Verification fee

- GST

- Insurance

- Once you pay, they disappear.

2. Data Theft

These apps demand:

- Aadhaar

- PAN

- Bank statements

- Selfie/video KYC

- Contacts access

- Gallery access

This data is later misused or sold.

3. Loan Harassment

Some apps charge high interest, and if you delay repayment by even a day, they begin:

- Threatening calls

- Abusive messages

- Contacting your family

- Sharing morphed photos

- Blackmailing users for more money

4. No RBI Approval

Most fake Mudra apps are completely unregulated.

Real Mudra loans must come through RBI-approved banks and NBFCs.

The ₹140 Crore Mudra Loan Scam Breakdown

What was meant to be a government-backed loan scheme for small businesses turned into a massive trap for thousands of people across India.

According to multiple reports, a well-organised fraud network has been running a ₹140 crore scam by misusing the name of the PM Mudra Yojana.

The arrested suspects operated in over 15 states, creating a nationwide web of deception.

Their method was simple but dangerously convincing; they produced fake loan approval letters, complete with forged bank logos, official-looking seals, and even fabricated signatures.

As reported by Daijiworld, victims were asked to pay anywhere between ₹5,000 to ₹50,000 as “processing fees,” “GST charges,” or “insurance deposits.”

One victim from Karnataka shared his experience:

“I received a very professional-looking approval letter. They asked me to pay ₹15,000 as GST charges before the loan could be released. The moment I paid, they blocked my number.”

This scam highlights how fraudsters are exploiting people’s trust in government schemes, using polished documents and scripted calls to appear legitimate.

The attackers rely on urgency, fear, and the promise of quick, collateral-free loans, mirroring the real Mudra scheme but with one critical difference: no actual loan ever arrives.

A PIB Fact Check alert warns the public about a fake Mudra loan approval letter circulating online, falsely claiming loan approval in exchange for insurance charges.

Mudra Loan Scam Complaints

Case 1: Pune Businessman Trapped by “Instant Mudra Loan” Scam

“I needed ₹3 lakh urgently for my business. Saw an ad for instant Mudra loans. They approved my application within hours. Demanded ₹12,000 as processing fee.

After I paid, they asked for another ₹20,000. That’s when I realised something was wrong.”

Case 2: Chennai Woman Duped Through Fake Pre-Approved Loan Documents

“They called me directly. Said my loan was pre-approved. Sent documents on WhatsApp. Everything looked official. I transferred ₹5,500. The next day, their number was switched off. Lost my hard-earned money.”

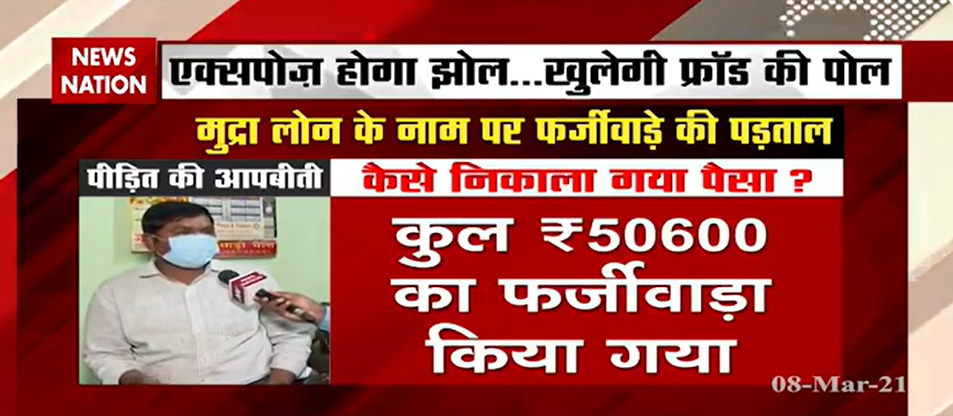

Case 3: News Report Exposes Fraudsters Using Fake GST Charges to Cheat Mudra Applicants

How To Protect Yourself From PM Mudra Loan Scams?

Every scam comes with some warning signs.

Here, too, you will find some red flags that help you to protect yourself from falling into the trap of scammers:

- Upfront fee demands: Legitimate banks never ask for advance payments

- WhatsApp approvals: Official loans don’t come through messaging apps

- Too-good-to-be-true promises: Instant approvals without documentation

- Unverified apps: No official Mudra loan app exists on the Play Store

- Pressure tactics: Fraudsters create urgency to force quick decisions

Moreover, genuine Mudra loans are processed through recognised banks.

They follow proper verification procedures. Meanwhile, these fake apps skip all regulatory checks.

How to Report Loan Frauds in India?

If you’ve encountered such scams, report them immediately:

- File a cyber crime complaint: Click “Report Cybercrime.” File a detailed complaint with transaction screenshots. Keep your acknowledgement number safe.

- Report at RBI Complaint Management System: Register your complaint under “Frauds/Cyber Frauds.” Provide complete details, including bank transaction IDs.

- Lodge a complaint at the Local Police Station: File an FIR immediately. Carry all evidence: screenshots, bank statements, WhatsApp chats. This creates an official record.

Need Help?

Facing issues with loan app scams?

Register with us. We help victims navigate the reporting process and connect with proper authorities to recover losses.

Don’t suffer in silence; take action today.

Conclusion

PM Mudra Yojana is a legitimate government scheme designed to empower small entrepreneurs.

But it operates only through authorised banks and NBFCs. The government has made this clear repeatedly. Any app or website claiming direct Mudra loans is fraudulent.

The scale of these scams is alarming. Fraudsters have already duped victims of crores of rupees.

They exploit people’s trust in government schemes. Moreover, they target those who need financial help the most.

Remember, legitimate banks never ask for upfront fees. They don’t send approval letters through WhatsApp.

They follow proper documentation and verification processes. If something feels too easy or too good, it probably is.

Always verify before sharing personal information or making payments. Visit bank branches physically. Check official government portals.

Don’t let urgency cloud your judgment. Taking a few extra hours to verify can save you thousands of rupees.

Stay alert. Stay informed. Protect yourself and your hard-earned money.