What happens when trust turns into betrayal, and promises of high returns lead to financial devastation? Raju Sohanda is fighting a relentless battle against Neumec Estate Developer LLP, a Mumbai-based builder accused of scamming his mother and countless others with fraudulent investment schemes.

Despite threats and legal hurdles, Raju’s determination has uncovered the depth of this scam where the scammer made verbal promises and ruined many victims financially by promising them high returns on their investments.

His journey, marked by resilience, exposes the harsh realities of real estate investment fraud and the urgent need for justice.

How Builder Allegedly Cheated Raju’s Mother?

As per Raju, it all started back in 2013 when Raju’s mother came across one of the builders, Rajesh Ghevarchand Jain of Neumec Estate Developer LLP, through a known and trusted person.

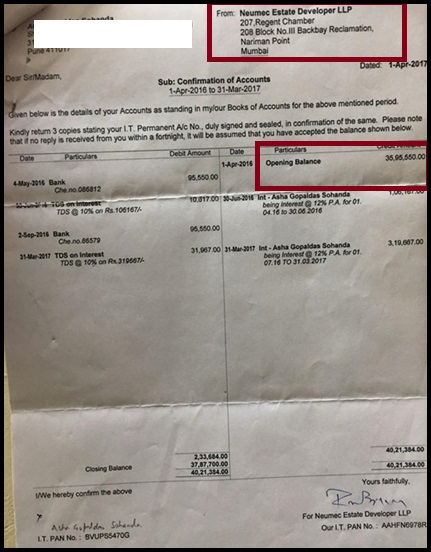

The builder offered a high-return investment scheme, asking her to invest in his real estate project and earn a guaranteed 12% return annually.

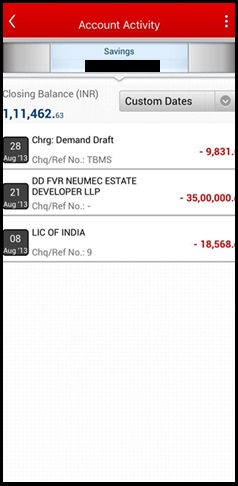

She found it a better investment option in comparison to banks. Trusting both the intermediary and the builder’s track record, Raju’s mother invested ₹35 lakh, hoping for a secure financial future.

For the first few months, everything went well. The builder provided interest on the invested amount as promised and also provided a statement of account.

Gradually, he started delaying payments and by 2020 he finally stopped making any further payments.

What Legal Steps Did Raju Take Against the Builder?

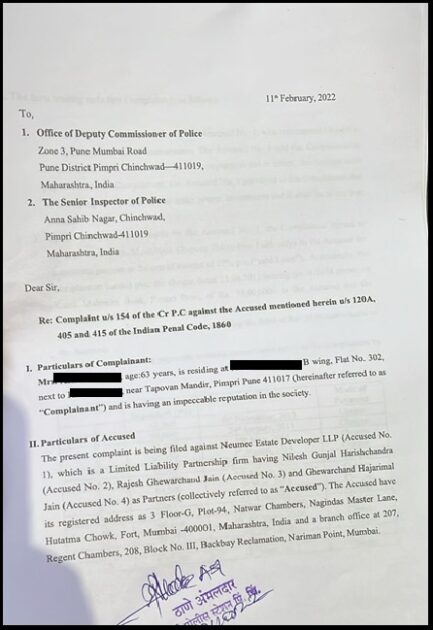

As per Raju (the victim’s son), after the builder stopped paying any return and refused to pay the invested amount, he reached out to the builder to discuss the same. However, instead of getting any positive response or refund, Raju came across many challenges:

- Raju said that when after multiple efforts, finally he got the chance to meet the builder, instead of refunding the amount the builder offered him the proposal to buy a flat that would cost him around ₹1- ₹1.2 crores. In short, he asked them to pay more money.

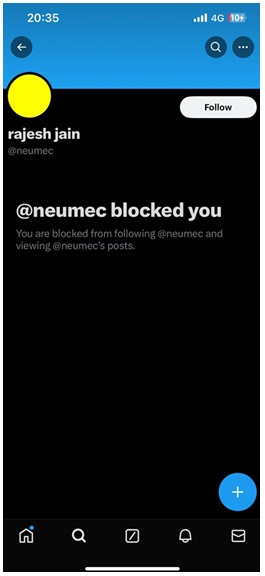

- Raju continued to contact the builder and finally warned them of the legal actions. This turned out against Raju as he received multiple threat calls from the company. Finally, the builder blocked him leaving no way for him to communicate further.

- As per Raju, that threat couldn’t stop him and he proceeded further and filed an FIR in the local police station. However, the deal and agreement were done based on trust. Hence there was no written agreement of this the FIR was rejected.

- He then took a judicial help. For FIR revision, Raju then went to the court and fought for justice for the last 1.5 years. However, even after so many summons, the builder didn’t appear in any hearings.

How Another Case Against the Builder Inspired Hope in Raju?

While Raju was fighting for justice he came across the news of Dr. Bharati Patil. She got scammed by the same builder and lost ₹90 lakh.

Luckily her FIR got lodged. Builder who tried and still trying to prove this as a Civil Case instead of a Criminal Case reached out to the High Court for bail. However, observing the scope of the scam the court passed a no-prearrest bail order against them.

Further, the builder reached out to the Honorable Supreme Court. Before the Supreme Court gave the judgment they submitted the verdict to refund the whole amount in 6 weeks to Dr. Bharati.

Encouraged by Dr. Patil’s success, Raju escalated the case. He filed an intervention petition with the Supreme Court, highlighting the scam’s scope and the numerous victims who might have felt powerless to come forward.

His petition sought justice for his mother and for others who had been similarly misled and intimidated by such fraud builders.

Recognizing the significance of the case and the potential for more hidden victims, the Supreme Court responded swiftly and provided a hearing date in January 2025.

Will Justice Prevail Against Fraudulent Builders?

This landmark decision brought hope to Raju and countless others who might have lost hope to get a refund of their hard-earned money.

Now, in this case, a scammer (the builder) is aware of all the loopholes and trying harder to prove the case to be a Civil Case to protect himself against any criminal charges.

However, further investigation revealed numerous cases against the company.

This includes one of the news articles published in The Times of India where IDFC First Bank seized a 1-acre property after Neumec Estate Developer LLP, defaulted on a loan. This highlights the widespread scams and criminal activities linked to the company and its associates.

After receiving this complaint against the company and the associated builder, we also reached out to them and sent an email. However, the email was left unanswered at the time of publishing this story.

Seeing the scale of the fraud, the petition filed by Raju might lead to meaningful change, gaining more momentum if additional victims step forward to voice their experiences and demand justice.

In the darkness of more than a decade, Raju got a ray of hope.

His fight is not limited to getting a refund of his mother’s investment but more to get and provide justice to many more victims who got trapped in the evil investment scheme of the builder.

For anyone tempted by high-return promises, Raju’s story serves as a cautionary tale. Scams often play on trust, persuading investors to skip essential documentation and rely solely on verbal agreements.