If you’ve ever searched online for easy ways to exchange money, trade crypto, or buy USDT quickly, you may have come across PaisaChange.

On the surface, it looks sleek and professional, a digital exchange promising fast transactions, good rates, and a smooth interface.

But here’s the uncomfortable truth many miss: PaisaChange increasingly appears to be less of a trusted platform and more of a carefully dressed financial risk.

With mounting user complaints and several independent security-checkers flagging serious concerns, this “exchange service” might be exactly the kind of online scheme you should steer clear of.

Before you consider sending any money or crypto their way, ask yourself: “Is PaisaChange trustworthy?”

Based on a growing body of feedback from users and cyber-fraud analysts, the answer leans heavily toward no.

PaisaChange Review

PaisaChange is an online platform that claims to offer fast digital currency exchange services, mainly converting INR to USDT and vice versa.

If you visit the website, it appears sleek and professional, clean interface, quick exchange options, and a simple form where you enter the amount you want to convert.

At first glance, it looks like just another modern e-currency service stepping in to make crypto transactions easier.

But the closer you look, the more things stop adding up.

PaisaChange is not a registered financial service, not a licensed money exchanger, and not regulated by any Indian authority. For something handling people’s money, that’s a major concern.

What raises more eyebrows is the way the platform operates.

Many users say the website allows deposits easily, but when it comes to withdrawing money, suddenly new rules appear.

People report being told they must increase their deposit, meet new “requirements,” or pay extra fees they were never informed about.

Some even say the website simply stops responding once their funds are stuck.

So while PaisaChange presents itself as a fast, easy currency exchange service, the overall behaviour described by its users suggests something entirely different.

Before you put your capital on the platform, check its legitimacy.

Is PaisaChange Legit?

This is the big question almost every user has when they first come across PaisaChange: is it actually legit, or is it just another online trap?

And honestly, once you start looking closely at how the platform operates, the doubts only grow stronger.

To begin with, PaisaChange markets itself as a digital currency exchange service where you can convert INR to USDT and vice versa.

But here’s where the problems start: there is no verified company information, no licensing, and no regulatory approval anywhere on the website.

Any platform handling money in India must disclose its legal entity, registered office, and compliance details, yet PaisaChange offers none of that.

Then comes the issue of transparency. Legitimate exchanges are extremely clear about fees, limits, processing times, and withdrawal conditions.

PaisaChange, on the other hand, keeps these details vague. Many users report that they only learn about extra fees or impossible withdrawal conditions after depositing money, never before.

Another major red flag is the platform’s digital footprint. Scam-analysis tools repeatedly flag PaisaChange as high risk.

The domain is also very new, which usually indicates instability or a lack of long-term legitimacy. Reliable financial service providers simply don’t pop up and disappear like this; they build trust over time.

And perhaps the strongest indicator of all: there is no official recognition, certification, or compliance listing from any Indian authority, not from the RBI, not from SEBI, not from any state financial regulator.

Without those, a platform has no legal standing to offer currency services in the first place.

When you put all these pieces together, lack of company details, no regulation, unclear fees, a suspicious domain, and numerous independent warnings, it becomes extremely difficult to consider PaisaChange a legitimate platform.

In other words:

If you’re wondering whether PaisaChange is a safe or legally approved exchange, the simple and honest answer is No — it does not meet the standards of a legitimate financial service in India.

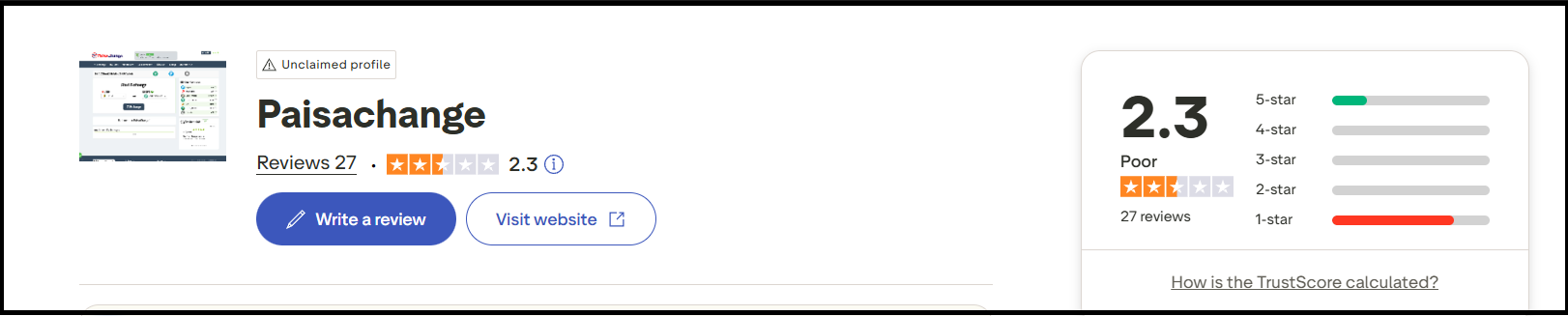

PaisaChange Complaints

Before trusting any online platform—especially one involving money, it’s important to look at genuine user experiences.

Reviews shared online about PaisaChange reveal a worrying pattern of inconsistent service, withdrawal issues, and possible scam-like behaviour.

Here are some common complaints users have raised:

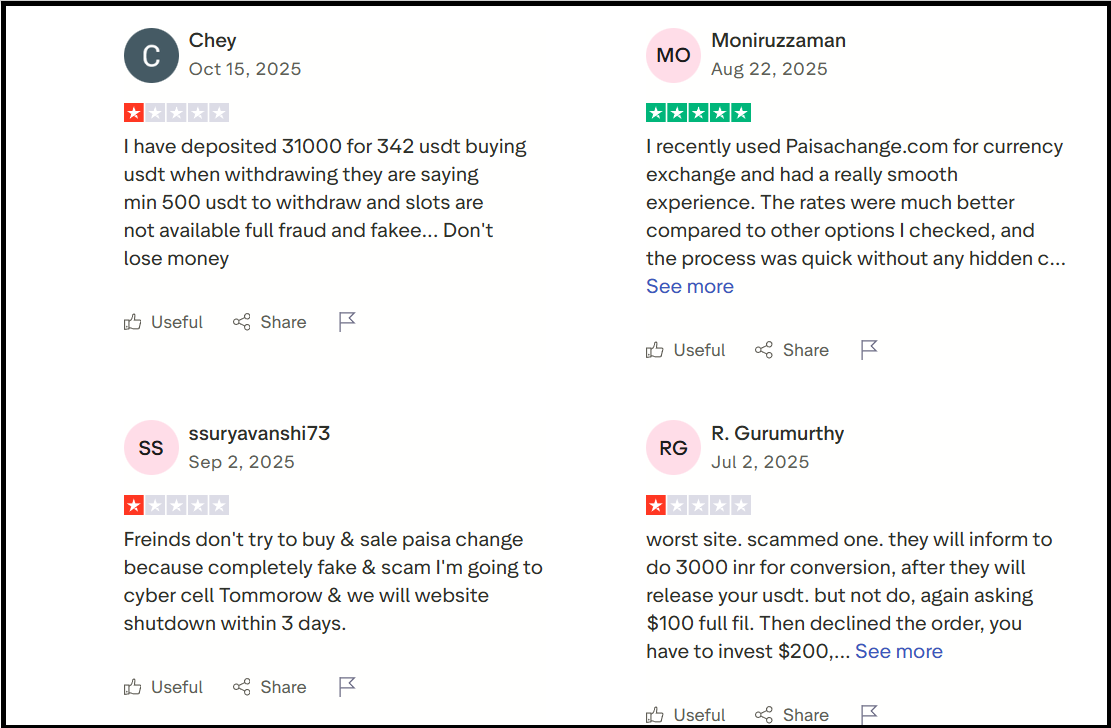

1. Withdrawal Problems & Sudden Extra Charges

Several users claimed that after depositing money or buying USDT, the platform demanded unexpected additional fees before allowing withdrawals.

One user reported depositing ₹31,000, only to be told later that they must add another 500 USDT to withdraw—slots were “unavailable,” and the money became stuck. Many called it fraud and warned others not to trust the site.

2. Scam Accusations & Reports to Cyber Cell

Another reviewer warned people not to buy or sell through PaisaChange at all, calling the website completely fake and scammy.

They even mentioned planning to report it to the cyber cell, claiming the platform would be shut down soon due to fraudulent activity.

3. Repeated Payment Demands

A common pattern in scam platforms is asking users to pay repeatedly before receiving their funds.

One user said PaisaChange asked them to deposit ₹3,000 for conversion, then again demanded $100, and later insisted on additional investments before releasing funds.

This cycle left them convinced they were being scammed.

4. Mixed Reviews: Some Positive, But Not Enough

There was also one positive review where a user said they had a smooth, hassle-free experience with competitive rates.

However, a single positive review cannot outweigh multiple serious red flags, especially when money is involved.

Overall Warning

The majority of the feedback points to:

- Blocked withdrawals

- Unexpected charges

- Suspicious behaviour typical of scam websites

- Users escalating complaints to cybercrime authorities

If you’re considering using PaisaChange, these reviews make one thing clear: Proceed with extreme caution, or better yet, stay away entirely.

How to Report Online Scams?

If you have invested and are experiencing withdrawal issues, you must act immediately. The faster you report, the higher the chance of freezing the fraudster’s bank account:

- File a Cyber Crime Complaint.

- Immediately notify your bank (or the payment app, like UPI) and report the transaction as fraudulent.

- For larger losses, file a First Information Report (FIR) at your local police station, providing all collected evidence.

Need Help?

If you’re feeling overwhelmed or unsure about what to do next, you’re not alone.

Cases involving online fraud can be stressful, especially when you’re trying to protect your money and deal with threatening messages or unresponsive platforms.

Register with us to get step-by-step assistance.

We help you organise your evidence, guide you through filing a proper complaint on the National Cyber Crime Reporting Portal, and support you in coordinating with your bank so you have the best chance of stopping unauthorised transactions or recovering your funds.

Our team makes the process easier, clearer, and less stressful, so you don’t have to handle everything on your own.

Conclusion

The ultimate decision of the PaisaChange review is that the danger is much greater than any potential, mostly fake, benefit.

Platforms that provide incredible returns and functions without a clear RBI or SEBI authorisation are money traps.

To the question, “Is PaisaChange safe?”, it can be a risky platform based on the evidence. So, you need to be very careful.

Keep in mind at all times: real, safe financial instruments will not make the outrageous claim of doubling your money overnight. Be wise with your investments, maintain regulation, and ensure your online security.