Imagine waking up to notifications telling you that you’ve just earned ₹549 by referring a friend, ₹260 by watching an ad for 30 seconds, and ₹15,000 just for reaching a certain “level” on an app.

Sounds too good to be true, right?

Well, that’s exactly what PeakPlus India is promising to its users who are waiting with bated breath for the app to launch on January 22, 2026.

But here’s the catch!

Before you get excited about easy money landing in your bank account, let’s talk about something that most people conveniently ignore:

“The warning signs that scream this might be yet another money trap designed to keep your money locked while promising unrealistic returns.”

The Indian investment app market has seen countless apps promise the world and deliver absolutely nothing.

Some block withdrawals indefinitely, some demand referrals before allowing you to access your own money, and some simply disappear once they’ve extracted enough from their users.

PeakPlus India seems to be following the exact same playbook, and if you’re considering joining, you need to understand what you’re actually signing up for before it’s too late.

What is PeakPlus India?

PeakPlus India is a mobile application that claims to offer multiple ways to earn money.

These ways include:

- watching ads

- inviting friends

- rating other apps

- answering quizzes

- participating in various tasks

- Joining telegram and WhatsApp groups

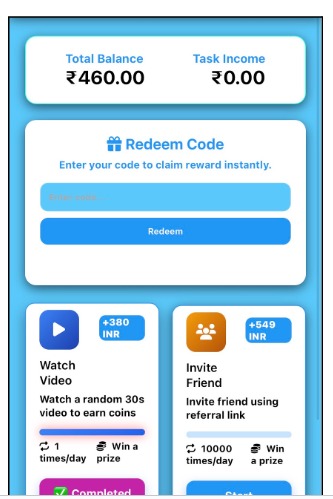

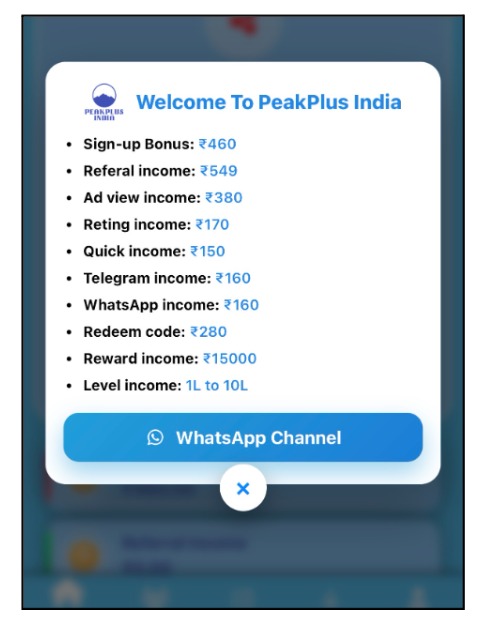

The app hasn’t officially launched yet but it’s already generating buzz on social media and telegram channels with promises of a ₹460 sign-up bonus just for downloading it.

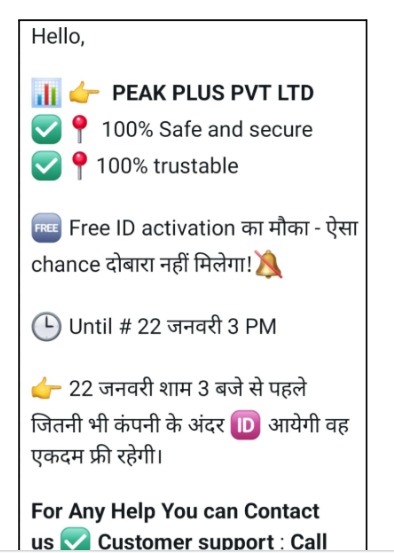

They’re marketing themselves as “100% safe and secure” and “100% trustworthy,” using all the right words to sound legitimate while providing absolutely zero evidence of actual regulatory compliance or legitimate business operations.

The company claims to be Peak Plus PVT LTD and is promoting itself heavily through WhatsApp and Telegram channels with flashy marketing materials and income breakdowns.

Their referral system promises ₹549 for every friend you bring in, and the more people you refer, the higher your earning potential.

They’ve also cleverly structured their earnings in a way that makes you feel like you’re genuinely accumulating wealth.

You get notifications showing you’ve earned here and there but the real test comes when you try to withdraw that money.

Will it actually reach your bank account, or will you find yourself stuck in the same withdrawal limbo that thousands of users are facing with similar apps?

How Does PeakPlus Work?

PeakPlus India works like a typical refer‑and‑earn style earning app where almost everything revolves around tasks and team building.

A new user first registers on the website or app using a mobile number, after which a welcome bonus (like ₹460–₹480) appears in the in‑app wallet to create the feeling of instant profit.

The registration is completely free for users who register before 22nd January 2026. After that the registrations will be paid.

Inside the dashboard, users see different “income types” and earn hundreds. Each type shows fixed rupee rewards for completing very simple actions.

Daily work mainly means watching short videos, sharing promotional links, joining the official Telegram channel, and applying redeem codes that the company posts to unlock extra bonuses like ₹280.

However, the biggest earning claim comes from referrals: users get around ₹549 per direct referral and special rewards like ₹15,000 for completing 110 direct joins.

So, the app constantly pushes people to grow a team instead of just doing tasks.

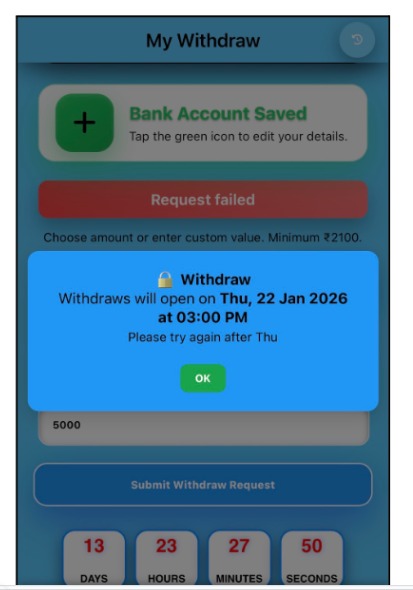

The money shown in the wallet is not automatically withdrawable; users must reach a minimum withdrawal slab (around ₹2,100 or more) and can request bank transfer only in specific withdrawal windows that the app announces in advance.

On January 22, 2026, PeakPlus India will officially launch, and that’s when we’ll get to see if the app actually follows through on its promises or if it becomes another cautionary tale in the long list of failed investment scams.

Will users actually be able to withdraw their money?

Will the promised earnings materialize, or will users be left asking “Where’s my money?” like thousands of others before them?

We’ll be monitoring this closely and will update this blog with real user experiences and withdrawal success rates.

If you decide to join, do it at your own risk and with the understanding that your money might be locked up indefinitely.

PeakPlus India Red Flags To Watch Out For

While navigating through this application and trying it ourselves, we noticed certain red flags that cannot be sidelined.

So before you think of enrolling yourself into their program, just have a look at these red flags.

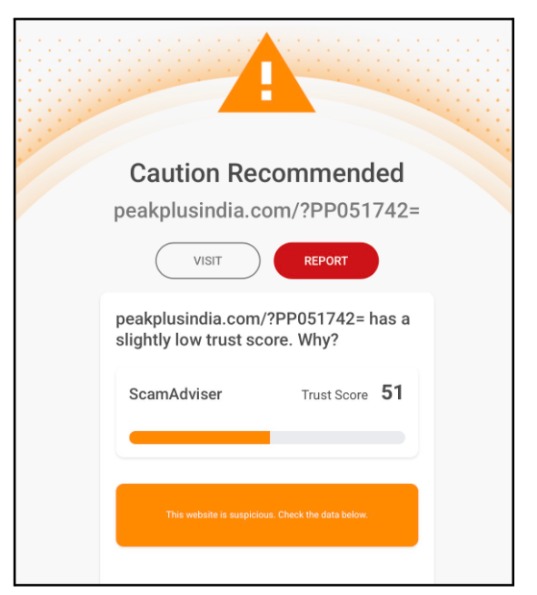

1. Website Registered Just Recently

The domain peakplusindia.com has been registered very recently, which means it’s a brand new website.

ScamAdviser, a platform that checks website legitimacy, has flagged it as having a “slightly low trust score.”

The website has very few visitors, and there’s virtually no online footprint or community history to verify the company’s claims.

A legitimate investment platform would have years of operational history, regulatory documentation, and genuine user reviews.

Not a website that’s just been set up weeks before the launch.

2. Withdrawal Locks and Restricted Access

The screenshots you can see show a major red flag: the app explicitly states that “Withdrawals will open on Thu, 22 Jan 2026 at 03:00 PM” with a countdown timer.

This is a classic scam tactic!

When an app artificially restricts when you can withdraw your own money, it’s essentially holding your funds hostage.

Legitimate payment apps and investment platforms never lock withdrawals with random time restrictions.

This feature alone is used by fraudsters to buy time as they keep your money locked, attract more users, and collect more deposits before eventually disappearing or claiming “technical issues.”

3. Suspiciously High Income Promises with Minimal Effort

The app promises you can earn the following income:

- ₹15,000 just by reaching a certain level

- ₹260 for watching a 30-second video

- ₹280 for joining Telegram and whatsapp

- ₹549 just for inviting one friend.

- ₹460 for signup bonus

- ₹280 from redeem code

When you add up all these micro-earnings, PeakPlus is essentially saying you can make thousands of rupees per day if you’re active.

No legitimate business model works this way. Even if it did, everyone would be rich, and the company would be bankrupt within days.

This kind of promise is designed to make you feel you’re getting rich quick while actually losing your own money or being forced to invest more.

4. Heavy Emphasis on Referral Income (Classic MLM Red Flag)

The entire earning structure of PeakPlus revolves around referrals. You earn more when you refer friends, who earn more when they refer to their friends.

They have no limit per day for referrals but they do have a limit for other earning methods.

This is the exact structure of multi-level marketing (MLM) schemes, which are notoriously unsustainable. In MLM structures, only those at the very top make money, while the rest are constantly pressured to recruit more people.

Eventually, the pyramid collapses, and most people lose their investment.

The fact that PeakPlus is heavily promoting Telegram and WhatsApp sharing is a textbook MLM indicator.

5. No Regulatory Compliance or Official Licensing

PeakPlus claims to be “100% safe and secure” without showing any proof.

There’s no mention of SEBI registration, RBI compliance, or any legitimate regulatory body oversight.

In fact, the Reserve Bank of India (RBI) identified over 600 illegal lending and earning apps between 2020 and 2021, many of which made similar claims.

A legitimate fintech app would proudly display its regulatory certifications and compliance information. The absence of this is a massive warning sign that you’re dealing with an unregulated platform.

6. The App Hasn’t Even Launched Yet, But Withdrawals Are Already Restricted

Here’s the strangest part: the app hasn’t officially launched yet, but users are already seeing withdrawal restrictions and “request failed” messages.

This suggests that either the app’s infrastructure is poorly built, or the restrictions are intentionally coded in to make it difficult for users to ever actually withdraw their money once the app goes live on January 22.

7. No OTP for Registration

When you try to create an account, the app asks you for the following information:

- Name

- Mobile Number

- Email Id

- Password

- Referral Code

Nothing wrong here until you press that register button. One can log in without any OTP. Even if you put numbers of your contacts and any email ID, you can still register as there is no verification.

Well, this is not a sign of a legitimate app. This is a huge red flag and one should be aware of it.

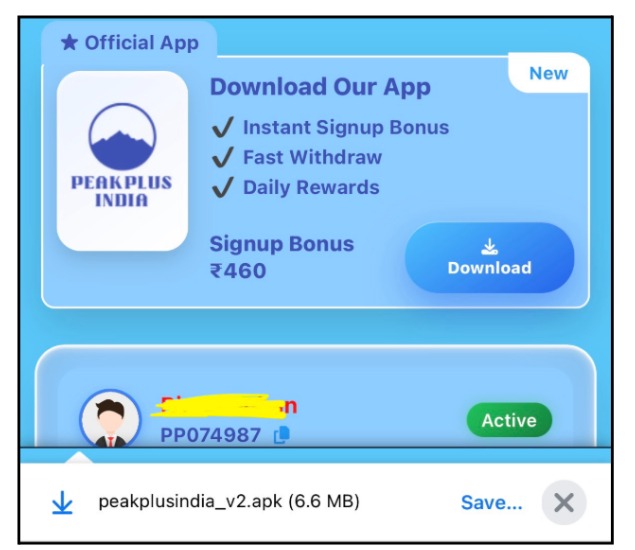

8. APK File For Downloads

This is a classic tactic of scam apps. They are not available for download on Play Store or App Store.

Similar problems can be seen in this case. The app is available for download, but through an APK file. This is not safe to download because your privacy is at stake.

Scammers can hack your phone and steal your data to blackmail you. So, always be skeptical when an app is not available for download on official downloading platforms. This is a huge red flag.

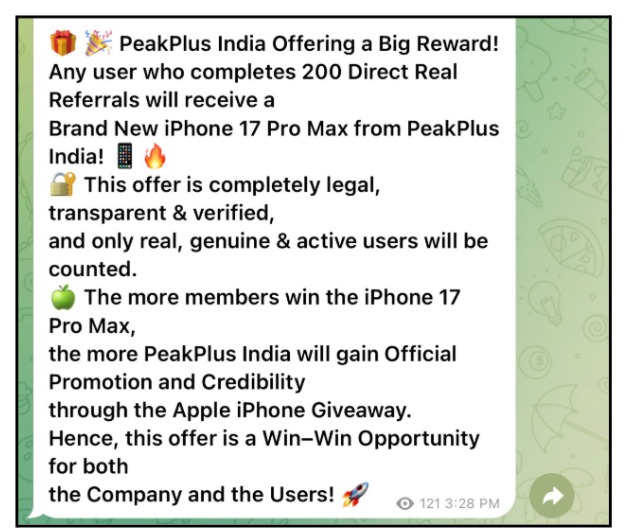

9. Luring Rewards

Through their telegram and whatsapp channels, peakplus offers exciting opportunities to earn rewards. These opportunities are only for people who participate in referral programs.

The focus on referral programs is an indicator that the app wants more and more people to join it.

But why?

Just to fool them or is it really a genuine earning opportunity?

What To Do If You Are Being Scammed?

If you encounter any suspicious app or believe you’ve been scammed, here’s what you can do:

- File a cyber crime complaint: File a complaint at cybercrime.gov.in or call the National Cyber Crime Helpline.

- RBI and SEBI Complaints: File a complaint with SEBI and RBI through their official complaint portals.

- Google Play Store/App Store: Report the app directly through the platform where you downloaded it.

- Local Police: File an FIR at your nearest police station if money has been defrauded.

Need Help?

If you have been a victim to any fraud and are worried about your hard earned money, don’t panic.

Just register with us now.

We are a team that specialises in recovering money, lost to scams and frauds. Our team handles your issues with care and provide assistance in every step of filing complaint.

Conclusion

PeakPlus India looks like it’s following the playbook of dozens of similar scams that have preceded it.

The unrealistic earning promises, the PeakPlus withdrawal restrictions, the lack of regulatory compliance, and the heavy MLM structure all point toward this being another app designed to exploit people’s desire for quick money.

Before you spend even a minute on this app, ask yourself one simple question: if the app is so profitable for users, how does the company make its money?

If you can’t answer that question clearly, you probably shouldn’t be trusting them with yours.

Stay informed, stay skeptical, and remember: if something sounds too good to be true, it almost always is.