Have you ever wondered that your investment opportunity might be a masterfully crafted illusion designed to drain your bank account?

In the last few months, a sophisticated investment fraud using the name “Polen Capital” has left Indian investors reeling. Victims have lost massive sums of money through apps, websites, and WhatsApp groups.

The worst part?

It looks so real that even careful investors are falling for it.

If you’ve received an invitation to join a “Polen Capital” investment group or downloaded an app promising extraordinary trading returns, you’re walking into a carefully designed trap set by ruthless cybercriminals.

In this blog, we’re breaking down exactly how this scam works, who’s behind it, and most importantly, how you can protect yourself before you become another statistic.

Understanding the Polen Capital Scam

Polen Capital isn’t new to the investment world. The legitimate company is a respected global investment management firm based in the USA, specializing in growth equity investing.

However, fraudsters have weaponized this trusted name to execute one of the most elaborate investment scams operating in India today.

The problem isn’t just a single fake website or app. What makes this scam particularly dangerous is that it operates through multiple channels simultaneously like:

- Fake websites like `polencapital-aml.mzgw(.cc)`

- A deceptive app called “PCAM.pro”

- Coordinated WhatsApp groups where scammers pose as investment experts

This tells you something important: the scammers operating Polen Capital are not amateurs. They’re sophisticated criminals with international reach.

The fraudsters have literally cloned the legitimate Polen Capital Investment Funds company details, copying their address, business description, and even their professional image to fool unsuspecting investors.

They’ve taken the legitimacy of a real company and twisted it into a weapon.

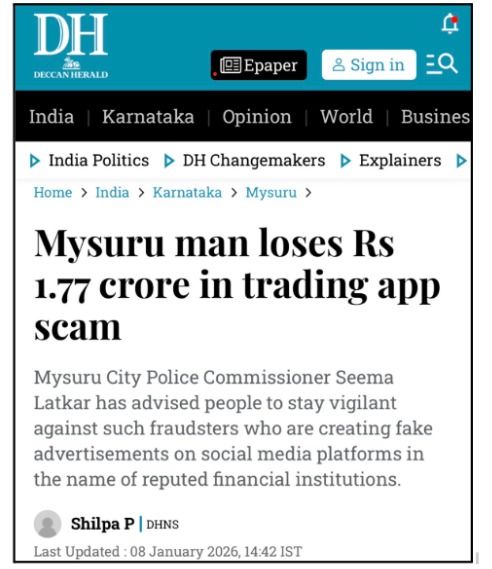

Real Case: How a Man Lost Rs 1.77 Crore to Polen Capital Scam?

Let’s put a human face to this scam because numbers alone don’t capture the devastation these fraudsters cause.

In December 2025, a 54-year-old man from Mysuru became the victim of what would become a heartbreaking case of financial fraud orchestrated through Polen Capital’s fake operations.

Here’s how it unfolded.

The victim was invited to join a WhatsApp group where a man named Magnananda Sharma promised to teach group members the secrets of share market trading.

The pitch was irresistible: learn to earn extraordinary profits from the stock market through “specialized training.”

After the initial group setup, another scammer named Meera appeared, claiming to be a representative of Polen Capital. She introduced a specific investment mechanism that sounded legitimate: investing as “Qualified Institutional Buyers” (QIBs) in Indian and US markets.

Here’s where the scam became diabolically clever. Meera explained that foreign institutions cannot maintain bank accounts in India, so investors needed to deposit their money into accounts of “various local companies.”

The victim, trusting the explanation, began transferring funds via RTGS to these accounts.

As the deposits arrived, they appeared in the fake Polen Capital app as “top-up capital.” The app displayed false profit calculations and by December 31, 2025, the victim’s account showed a staggering total value of Rs 15,49,74,164.168 (over Rs 15.49 crore!).

Imagine seeing your Rs 1.77 crore investment multiplied to Rs 15.49 crore in your account. The victim must have felt like a financial genius.

Then came the moment of truth. When the victim decided to withdraw his “profits,” the scammers demanded payment of Capital Gains Tax to private accounts.

That’s when reality hit. There were no profits, no investments, and certainly no institutional trading. It was all smoke and mirrors.

The victim had lost Rs 1.77 crore entirely, and the scammers simply disappeared with his money.

Why Government Authorities Are Now Sounding the Alarm?

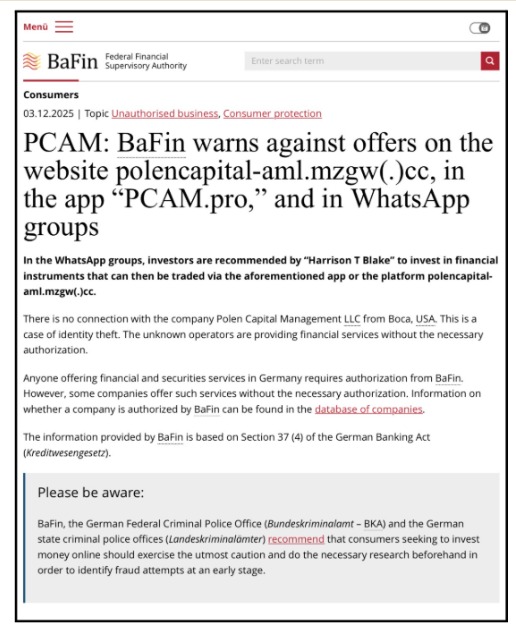

This isn’t a small scam operating under the radar. It has been flagged by multiple international financial authorities.

When multiple countries’ regulatory bodies warn about the same scheme, it means the scammers are operating at scale, victimizing people across borders.

The SEBI (Securities and Exchange Board of India) issued a formal advisory in August 2025 warning investors against exactly these types of schemes.

The regulatory body explicitly stated that resident Indian investors are prohibited from investing through the FPI route, and any app, group, or individual claiming to offer such access is operating illegally.

The German BaFin authority has also warned consumers specifically about the polencapital-aml.mzgw(.cc) website and the PCAM.pro app, confirming that these entities have no authorization to provide financial services.

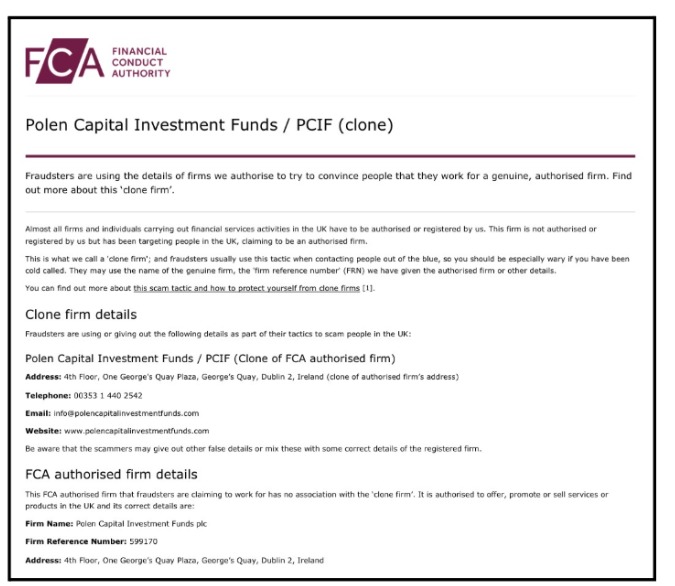

The UK’s Financial Conduct Authority (FCA) has flagged “Polen Capital Investment Funds / PCIF” as a clone firm that is illegally using the details of an FCA‑authorised company to scam investors.

The notice clearly warns that anyone contacted by this entity especially through unsolicited calls or messages should treat it as a scam. They must always verify permissions using the FCA register before parting with money.

How to Report Investment Scams?

If you’ve already invested money with Polen Capital or similar fake trading apps, here’s what you need to do immediately:

1. File an FIR (First Information Report)

Visit your nearest police station or use the cybercrime.gov.in portal to file an official complaint.

Don’t delay this step; the sooner you report, the better the chances of authorities tracking the scammers.

2. File a complaint with SEBI

File a complaint on SEBI’s official website or through their dedicated grievance portal.

SEBI takes these cases seriously and has been actively investigating fraudulent trading schemes.

3. Approach Your Bank

Inform your bank about the fraudulent transfers. In some cases, if the money hasn’t been withdrawn by the scammers yet, banks can freeze accounts or reverse transactions.

4. File a Cyber Crime Complaint

Use the national cybercrime helpline or visit their official website.

You can also contact your local police’s cyber cell with all transaction details and communication records.

5. Document Everything

Preserve screenshots of the app, WhatsApp conversations, website archives, transaction receipts, and any communication from the scammers.

This evidence is crucial for investigation.

6. Register With Us

If you are confused about how to file a complaint against fraud or scam, you can register with us. We are a team that specialises in money loss to scams or frauds.

We have helped several people recover their lost money. Our team of experts will guide you in every step and make sure that you get a satisfactory result.

Conclusion

The Polen Capital scam represents a sophisticated evolution of investment fraud.

Scammers today aren’t trying to convince you through poorly written emails but they’re building relationships, creating community, and leveraging psychological manipulation to lower your defenses.

The good news?

Once you know the patterns, you can avoid these traps.

Never invest in opportunities that promise extraordinary returns without proportional risk. Verify everything directly with regulatory bodies not through links provided in messages.

Most importantly, remember that legitimate investment platforms never ask you to invest through personal accounts or unofficial groups, and they always provide easy withdrawal mechanisms.

In a world where scammers are becoming smarter every day, being paranoid isn’t a flaw but it’s financial wisdom.