In today’s fast-paced, digital-first world, financial scams have evolved to look more sophisticated than ever. Rohan & Ramesh were discussing investments over chai the other day when Rohan said, “All these Ponzi and pyramid schemes sound the same to me.”

Rakesh chuckled, “You’re not alone. Most people think they’re interchangeable, but trust me, they’re like cousins with very different personalities.”

That conversation made Rakesh realise, many investors, especially in India, get lured into scams simply because they don’t understand how they work. So, let’s break it down to understand Ponzi scheme vs pyramid scheme.

What Are Ponzi and Pyramid Schemes?

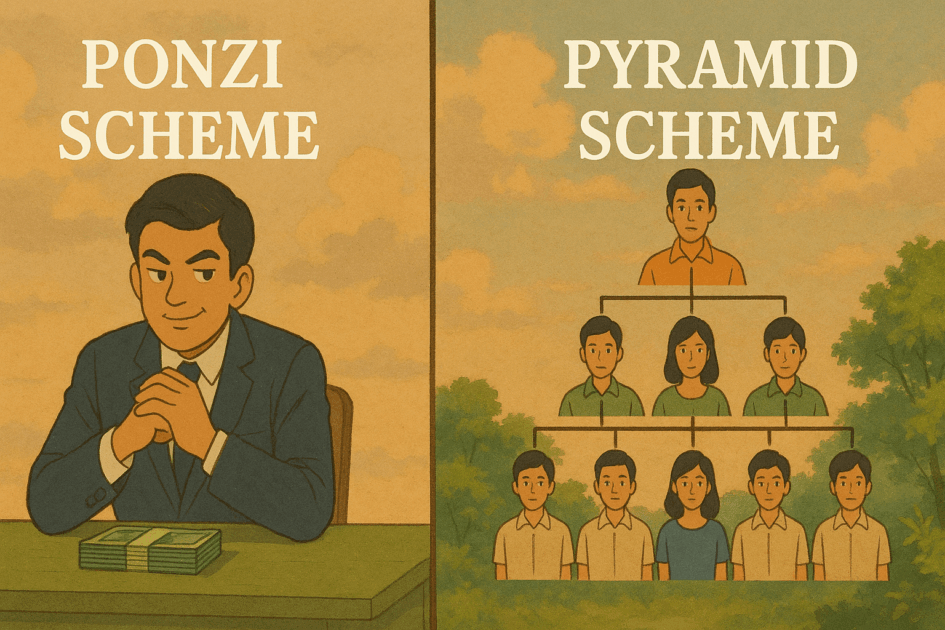

Think of both Ponzi and pyramid schemes as deceptive networks designed to trap investors, but with slightly different entrances.

At their core, both rely on fresh money from new investors to pay returns to older ones.

But the way they operate, the way they lure people in, and how they eventually collapse, that’s where the differences lie.

What is a Ponzi Scheme?

A Ponzi scheme is like a con game disguised as an investment plan. Here, there’s usually one central figure or a small group at the top who promises high returns.

These returns are not made through any genuine business or investment; instead, they come from the money of newer investors.

“Imagine this,” Rakesh told Rohan, “someone says, ‘Invest ₹1 lakh today and get ₹1.5 lakh in six months.’ Sounds amazing, right?

But ask them how it works, and you’ll get vague replies like ‘We have tie-ups with big MNCs’ or ‘We do high-frequency trading.’”

Rakesh further added, “Let me give you examples to help you understand how does a ponzi scheme work.”

Case 1: Falcon Invoice Discounting Scam (Telangana, 2025)

This was one of the most recent and shocking Ponzi schemes in India.

The Falcon group claimed to offer returns up to 22% by connecting investor funds with large companies like Amazon and Britannia.

Between 2021 and 2025, they collected around ₹1,700 crore from nearly 7,000 investors.

In the beginning, people got their payouts. “One of my old college friends even said, “Bhai, mujhe toh paisa mila. Safe hai,” Rakesh added.

But as the number of investors grew, and newer ones stopped coming in, the whole thing collapsed.

The authorities arrested two people, while the mastermind, Amardeep Kumar, vanished into thin air.

Case 2: Torres Jewellery Scam (Mumbai, 2024)

In this case, luxury and glamour were the bait. Torres Jewellery promised extraordinary returns by investing in gold, silver, and even Moissanite jewellery.

Investors were offered not just profits, but also luxury cars, iPhones, and even real estate.

One victim recounted, “They gave me a gift hamper during Diwali. I felt like I was investing with Tata or something!” Eventually, it all crumbled, and over 3,700 people were left in the lurch.

What is a Pyramid Scheme?

Now, pyramid schemes work a little differently. These aren’t about passive investment; they’re more about aggressive recruitment. Here, you earn not just by buying into the scheme, but by bringing others on board.

So instead of just putting money in and waiting for returns, you have to convince friends, family, even strangers, to invest and become a part of the network.

You earn a cut from their investment, and they’re encouraged to recruit others too.

“It’s like multi-level marketing,” Rohan said.

“Exactly, except without a real product or with a fake one,” I replied. “They keep selling hope, not value.”

Case 3: BZ Financial Services Scam (Gujarat, 2024)

Bhupendrasinh Zala ran what looked like a professional financial service with 17 branches across Gujarat. But underneath it was a classic pyramid. Between 2020 and 2024, he collected over ₹440 crore from about 11,000 investors.

People were told, “Get 3 more people and double your money.” The trap was cleverly laid. But when fresh recruits dried up, payouts stopped. Zala was finally arrested in 2024.

Case 4: Valmiki Corporation Scam (Karnataka, 2024)

While this case had government angles, the funnel-like structure mirrored a pyramid setup.

Out of ₹18.7 crore meant for tribal development, around ₹8.8 crore was siphoned off to ghost accounts. The money moved in layers before vanishing.

The scam came to light only after the tragic suicide of an official, who left a note exposing the web of corruption.

So, What’s the Real Difference?

Let’s simplify it with a comparison table:

| Aspect | Ponzi Scheme | Pyramid Scheme |

|---|---|---|

| Revenue Source | Returns from new investors’ money | Money from recruiting new participants |

| Investor Role | Mostly passive, just invest and wait | Active recruiter; must enroll others to earn |

| Product/Service | Usually, none or fake investment opportunities | Often involves a product, but the focus is on recruitment |

| Sustainability | Collapses when new investments stop | Collapses when the recruitment chain breaks |

| Growth Model | One central operator handling funds | Multi-level, participant-driven growth |

Red Flags to Watch Out For

Hope, Ponzi scheme vs pyramid scheme helped you in understanding the difference.

Let’s now talk about the way of how to identify Ponzi scheme or a pyramid scheme. Well, it is simple, you just need to be a little more aware and ask questions instead of falling into the greed of earning huge returns.

- Unrealistic Returns: Anything that promises more than a 12-15% annual return with no risk should raise eyebrows.

- No Clear Business Model: If you can’t explain what the company does in one sentence, it’s probably a scam.

- Emphasis on Recruitment: If you’re being rewarded more for bringing people in than for any product sold, be cautious.

- Lack of Transparency: If they dodge questions or give vague answers about how profits are made, take a step back.

How to Report a Ponzi Scheme?

If you have been unfortunate and lost money in either of Ponzi or a pyramid scheme, then the first thing you must do is to report the scam.

Multiple online portals provide a provision to report such a case; however, if you are confused and unable to find the solution, then register with us now and get full assistance in filing the case and in proper follow-ups. Remember, this would eventually increase the chance of getting recovery of losses.

Stay Vigilant

Fraudsters rely on trust, urgency, and sometimes even glamour to pull people in. They promise the world but deliver disaster. That’s why understanding the details of a Ponzi scheme vs a Pyramid scheme isn’t just academic — it’s a shield against losing your savings.

The next time someone offers you an “exclusive” opportunity, remember what I told my friend:

“If it sounds too good to be true, it probably is. Always ask — where exactly is the money coming from?”

Talk to people, do your research, and always stay alert. If something feels off, it probably is.