If you’ve ever searched for stock market tips or financial guidance online, chances are you’ve come across Profit Vista Financial Research.

Today, countless Profit Money Adviser firms promise to help you “earn more” or “trade smarter.” But the real question is, “How reliable are their claims?”

So, before you hand over your hard-earned money, it’s worth understanding who they are, what they offer, and what kind of reputation they hold.

What makes this topic even more interesting is how these research firms can shape your investment journey.

Whether you’re a beginner just learning the ropes or an experienced trader seeking extra insight, the right advice can make a big difference.

So, let’s take a close look at Profit Vista Financial Research, starting with what they do and looking closely at how they handle customer complaints.

About Profit Vista Financial Research

Profit Vista Financial Research is a financial advisory firm based in India that offers stock market tips, investment suggestions, and trading calls.

They claim to help investors make profitable decisions in equity, commodity, and derivatives markets. Like many financial research companies, their main goal is to guide clients using what they describe as “accurate market analysis.”

As per the information available, Profit Vista Financial Research is registered with the Securities and Exchange Board of India (SEBI) under registration number INA000002678.

This means they are authorized to provide financial advice within certain guidelines and are bound by SEBI’s regulatory framework.

Being registered is often a good sign as it shows that the company is being monitored and has some level of accountability under Indian law.

But sometimes you need to look beyond the registration numbers into the real complaints by real users. It helps decide if you should consider their advice or just move on!

Profit Vista Financial Research Complaints

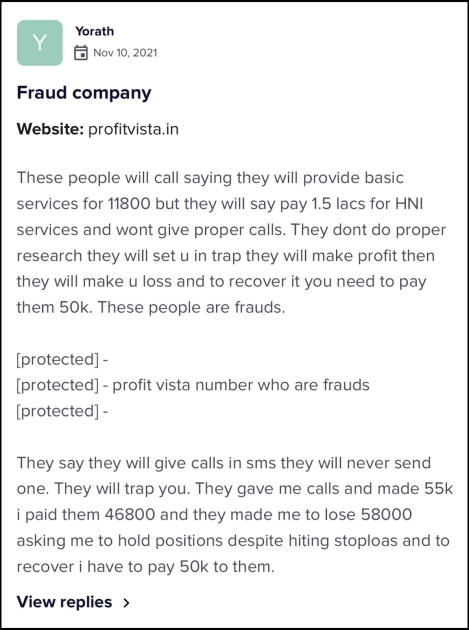

Several online reviews from past clients paint a worrying picture of how Profit Vista dealt with them.

One user says the team first pitched a low‑cost basic plan, then quickly pushed a much more expensive “premium” or HNI service, without delivering useful or timely calls.

The reviewer claims that after losses, the company asked for even more money to “recover” the amount, which is a classic pressure tactic that can trap an already stressed investor.

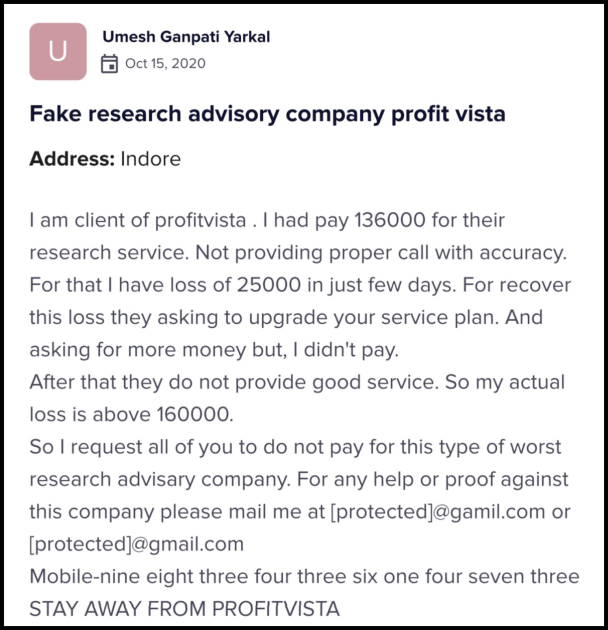

Another reviewer from Indore mentions paying a large fee for research services, only to face poor‑quality calls and further losses.

According to this client, when the account went into the red, the answer from the adviser was not a refund or honest review of mistakes, but a suggestion to upgrade to an even higher plan and pay more.

This kind of pattern i.e., losses followed by upselling, matters because it shows the focus can shift from genuine advice to extracting extra fees from worried clients.

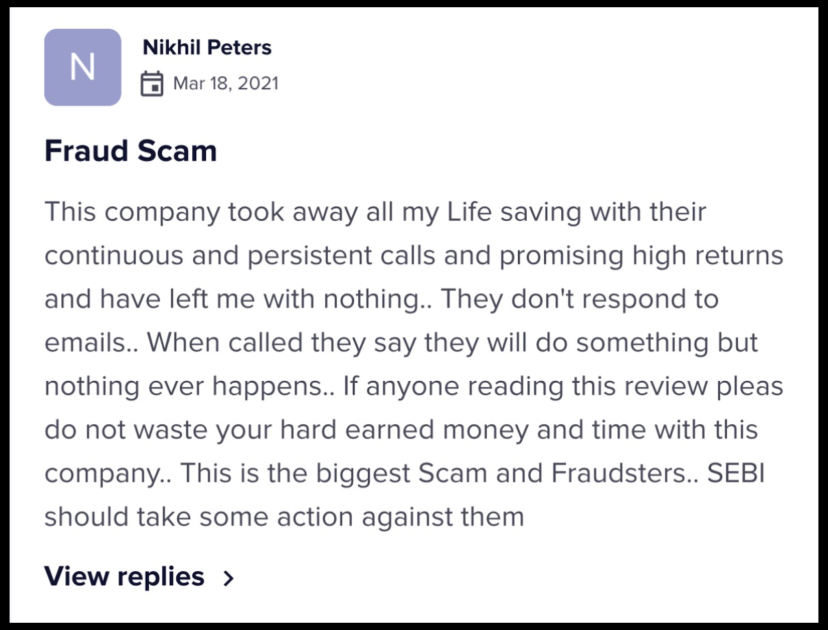

One person writes that repeated calls and big promises slowly pulled in their entire savings.

After that, they allege that emails and follow‑ups were ignored, and nothing meaningful was done to help them recover.

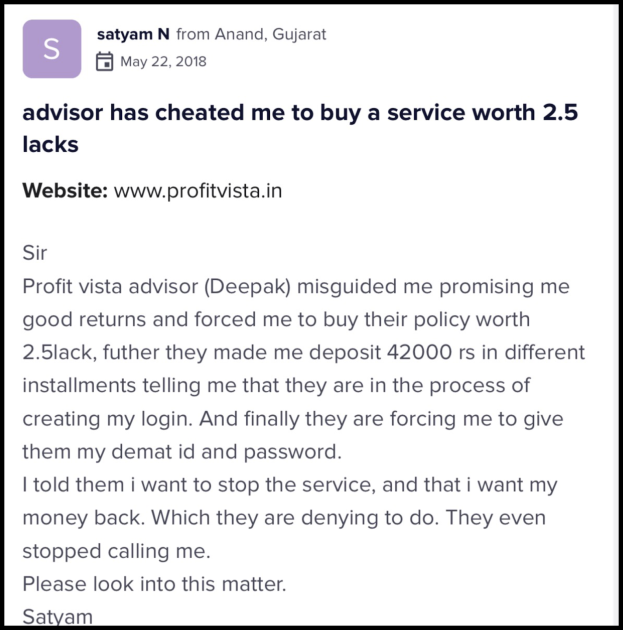

Another complaint describes being pushed into buying a very costly package and even being asked for sensitive login details like demat credentials, which is a major red flag for any investor.

These reviews together highlight the need to be extremely careful with any adviser who uses hard sales tactics, asks for large upfront fees, or pressures you to share confidential information.

Profit Vista SEBI Order

No financial firm is without its share of feedback. For Profit Vista Financial Research, some clients have raised concerns.

Complaints generally revolve around issues such as poor service, excessive charges, or misguidance in trading calls.

When you see such allegations, it becomes important to know how these disputes are handled and what actions, if any, have been taken by authorities.

That’s why we’ll now look into two important areas that tell you how such cases progress and get resolved.

The Securities and Exchange Board of India (SEBI) has the power to investigate and take action against research or advisory firms that violate regulations.

If SEBI finds irregularities such as unregistered activities, mis-selling, or unethical behavior, it can suspend or cancel their license.

SEBI Slaps 6-Month Ban on Profit Vista

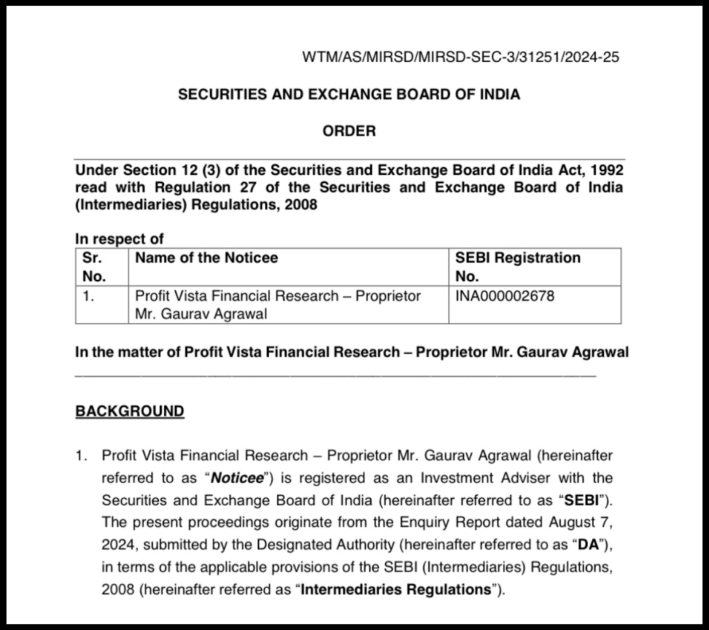

This case is about Profit Vista Financial Research, run by Gaurav Agrawal, who is registered with SEBI as an Investment Adviser.

SEBI inspected the firm for the period April 2020 to September 2021 and found several red flags.

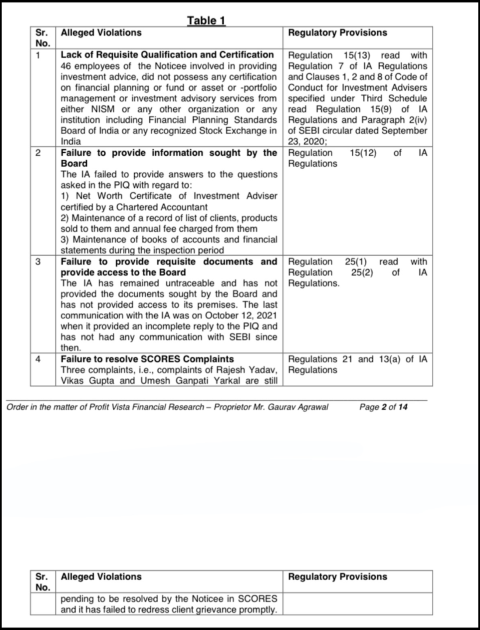

During inspection, SEBI noted that 46 employees working in sales and support did not have the required qualifications and NISM‑type certifications even though they were treated as “persons associated with investment advice” under SEBI rules.

The firm also did not give SEBI full information and documents like client lists, advice records, fees, accounts, and net worth certificate, and the office was found shut when SEBI’s team visited.

On top of that, some investor complaints on SEBI’s SCORES platform were not closed for a long time, which triggered a deeper inquiry.

What SEBI did?

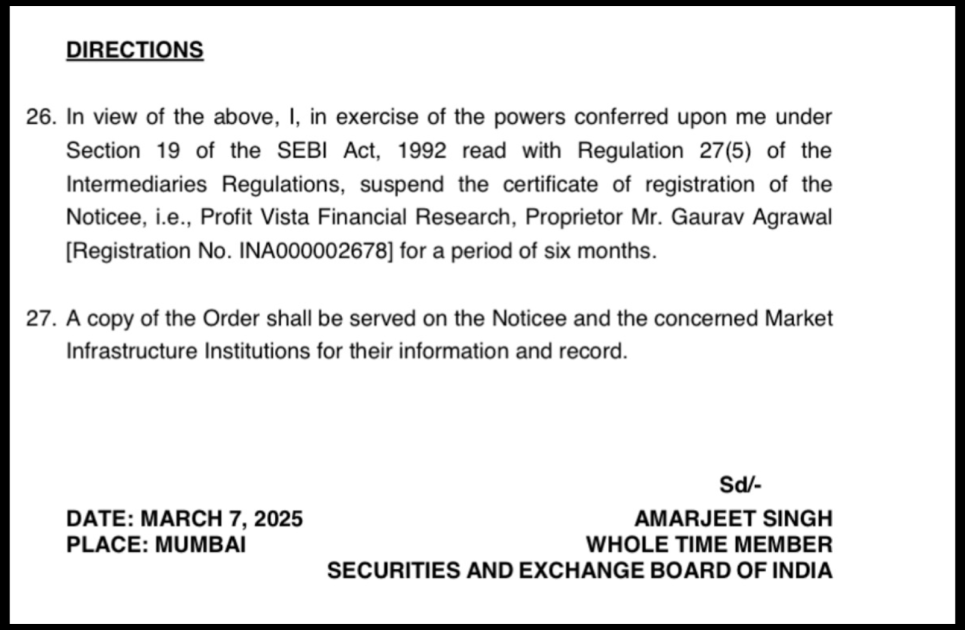

SEBI appointed a Designated Authority (DA), who issued a show‑cause notice, took replies, held a hearing, and then recommended suspension of Profit Vista’s registration for six months.

After giving one more chance to respond and another hearing, SEBI’s Whole Time Member agreed that two violations were clearly proved: unqualified staff involved in advisory‑related roles and failure to cooperate with inspection and provide documents.

SEBI noted that delays and gaps in information were serious lapses, especially for a regulated adviser who must keep SEBI informed even if they shut operations.

Finally, SEBI ordered suspension of Profit Vista Financial Research’s Investment Adviser registration for six months.

Key learnings for other investors

- Always check if a firm is registered with SEBI and whether its registration is active or suspended.

- Ask who is actually advising you and whether they are qualified and certified, not just the owner.

- Prefer advisers who keep proper records, respond to SEBI, and close complaints on time.

- Use SEBI’s SCORES platform if you have issues; regulators do act when patterns of non‑compliance appear.

How to File a Complaint Against Profit Vista Financial Research?

If you have had a bad experience with Profit Vista Financial Research and are unsure how to take action, you don’t have to handle it alone.

By registering with us, you get step‑by‑step support so your complaint is filed properly and reaches the right authorities.

You can focus on your money while we help with the process and paperwork, like:

1. Help with documents

To make your case strong, you need proof. We assist you in collecting and arranging all records related to Profit Vista Financial Research such as:

- Trade and holding statements from your broker

- Ledger and payout reports

- Contract notes and payment receipts

- Email trails, WhatsApp chats, SMS alerts, and screenshots of calls or offers

- Audio call recordings (if available) and any signed agreements or invoices

Everything is organized in a clear sequence so that it becomes easy for regulators or exchanges to understand what exactly went wrong. This helps reduce disputes over facts and strengthens your claim.

2. Writing your complaint

Many genuine cases get delayed just because the complaint is not written clearly. We help you:

- Draft a simple, well‑structured complaint in plain language

- Clearly show the timeline: how Profit Vista contacted you, what they promised, what you paid, and how losses or issues happened

- Match the format and word limits needed by SEBI SCORES, SMART ODR, or the relevant exchange / forum

This improves the chances that your complaint will be accepted quickly, rather than being returned for corrections.

3. Filing and escalation

Once your draft and documents are ready, we guide you on:

- Where to file first (adviser, broker, SEBI SCORES, SMART ODR, or exchange grievance cell, depending on the nature of your case)

- How to fill each field correctly on the online forms so nothing important is missed

- When and how to escalate if Profit Vista does not respond, gives an unsatisfactory reply, or ignores timelines

You always know what the “next step” is instead of feeling stuck.

4. Tracking, hearings, and arbitration

Complaints can sometimes be resolved through counseling, mediation, or arbitration. We stay with you through that journey by:

- Tracking response deadlines and reminders

- Helping you reply to any questions raised by SEBI, the exchange, or the platform

- Preparing a simple “case file” with your story, evidence list, and claim amount

- Guiding you on how to present your side calmly and confidently if a hearing or arbitration session is scheduled

By signing up with us, you reduce the risk of technical mistakes, missed deadlines, or weak documentation.

You get a clear action plan against Profit Vista Financial Research, while we handle the process details so you can focus on getting fair relief and moving forward.

Conclusion

Profit Vista Financial Research may appear to be a promising option for market guidance, but as with any financial advisor, you should approach with care.

Always double-check the firm’s SEBI registration, read client reviews, and never commit large sums upfront.

Remember: your money deserves the same research and diligence that firms promise to provide you.

If handled wisely, financial research can be your stepping stone to steady returns but only when trust, transparency, and regulation go hand in hand.