When people search for Money Bells Research, they are usually looking for reliable stock or options guidance in a market full of noise and mixed advice.

The name is closely associated with Sagar Goel, a SEBI-registered research analyst, who often gives traders a sense of confidence.

With claims of “precision calls” and a regulated status, Money Bells Research can appear like a credible option for retail investors seeking structured market insights.

Before subscribing, it’s important to pause and ask a basic question: Does this analyst actually fit my risk tolerance and expectations?

Investor awareness blogs like this exist to help you make that judgment with facts, not hype.

We look at background details, complaint patterns (if any), regulatory history, and real-world lessons that matter to retail traders.

Even analysts with a clean profile deserve careful evaluation, because ignoring small gaps can still lead to unnecessary losses.

In this blog, we help you decide whether Money Bells Research services are worth your money. We break down his offerings, review complaints, check SEBI records, scan relevant news, and share practical takeaways.

About Sagar Goel Research Analyst

Sagar Goel is a SEBI-registered research analyst with registration number INH100009901 and the founder of Money Bells Global Research Services Pvt. Ltd., based in Delhi.

With over 15 years of experience in the financial markets, he specialises in technical analysis, equity and derivatives trading, and portfolio management.

Sagar Goel holds certifications such as CMAP and an MBA, and he is NISM qualified, which adds credibility to his analytical approach.

His firm, Money Bells Research, offers a range of research packages, including All-in-One Royal, Option Elite, and Model Portfolios, catering to both retail and institutional investors seeking disciplined, data-driven market insights.

The services are delivered through Telegram and email, focusing on providing actionable recommendations with risk management in mind.

Sagar Goel’s background and SEBI registration make him a recognised name among traders looking for structured research and market guidance.

Beyond his professional qualifications, Sagar Goel is known for his commitment to transparency and compliance.

Money Bells Research emphasises independent research, clear disclosures, and a grievance redressal system that aligns with SEBI’s investor protection guidelines.

His approach combines technical expertise with a focus on investor education, positioning his firm as a resource for traders who value both research quality and regulatory adherence.

Reading about Sagar Goel research analyst, you might be surprised at first glance and think, “This looks like a solid choice!”

But hold up before you dive in, take a look at some complaints of his firm, Money Bells Research, and regulatory notes to get the full picture.

Money Bells Research Complaints

When investors search for “Sagar Goyal / Money Bells complaints”, what they actually want to know is very simple: have any serious disputes, SEBI actions, or bad reviews already warned others before them?

So let’s begin with the Google Reviews.

When you look for Google reviews or general public feedback for “Money Bells Global Research Services Pvt. Ltd.”, you do not see a big pile of star ratings like you might for a popular broker or app.

The company’s main presence is its own website, an about page, FAQ, blogs, and some social pages such as Facebook and Instagram.

The official Facebook page for “Money Bells Research Analyst” itself openly shows “Not yet rated (0 Reviews)”, meaning there is no crowd-sourced rating history to rely on there.

As an investor, the lack of real Google review volume cuts both ways. On one hand, you do not see floods of 1‑star complaints raising doubts, which is reassuring.

On the other hand, you also do not have a large, independent base of user experiences to cross‑check the success or failure of their recommendations.

In such a situation, the smartest approach is to treat their claims as unproven marketing and to test them with very small amounts, or even just track their free content for a while, before committing serious money.

On the news side, Money Bells Research and Sagar Goel have already come under media attention due to the SEBI penalty.

A notable example is a Moneylife article titled along the lines of “Money Bells Global Research Services Penalised Rs7 Lakh for Regulatory Violations”, which reports that the firm was penalised after SEBI’s inspection for violations linked to how its services were represented to investors.

Even though the full text is paywalled, the snippet itself makes one critical point for you: it mentions that the firm “falsely advertised high and assured returns”, which directly contradicts the cautious, no‑guarantee language now used on its website.

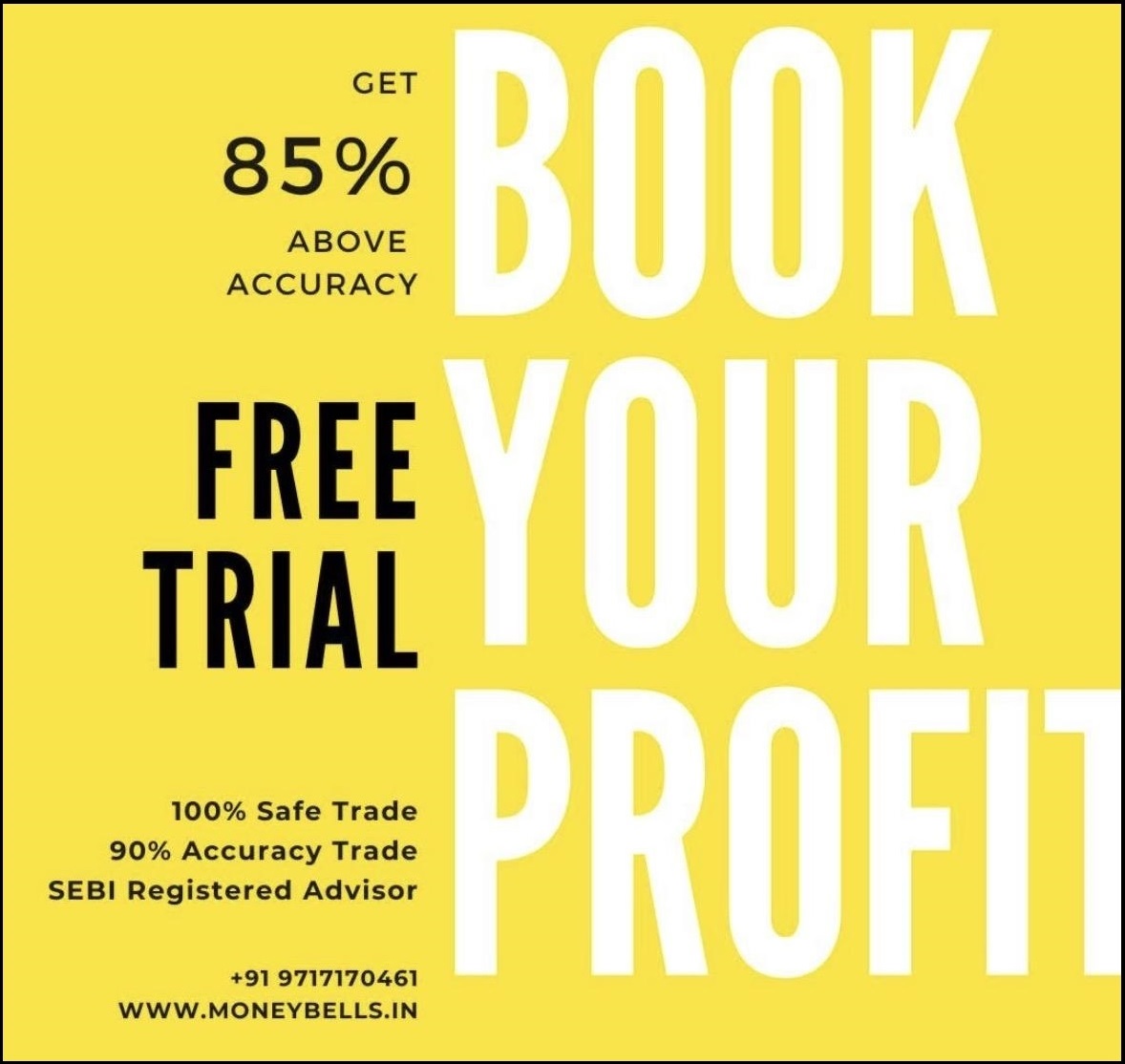

Moneybells published such posts on their social media handles. It shows accuracy rates that lure the users. This is strictly banned by SEBI for a research analyst.

If a research analyst or research firm has already been called out by SEBI, then the safe way to read any future promotion is with a sceptical eye.

Rather than asking, “Can this service make me big profits?”, a better question is, “Given the SEBI order and this history, how much risk am I taking if I follow every call blindly?”

Money Bells Research SEBI Orders

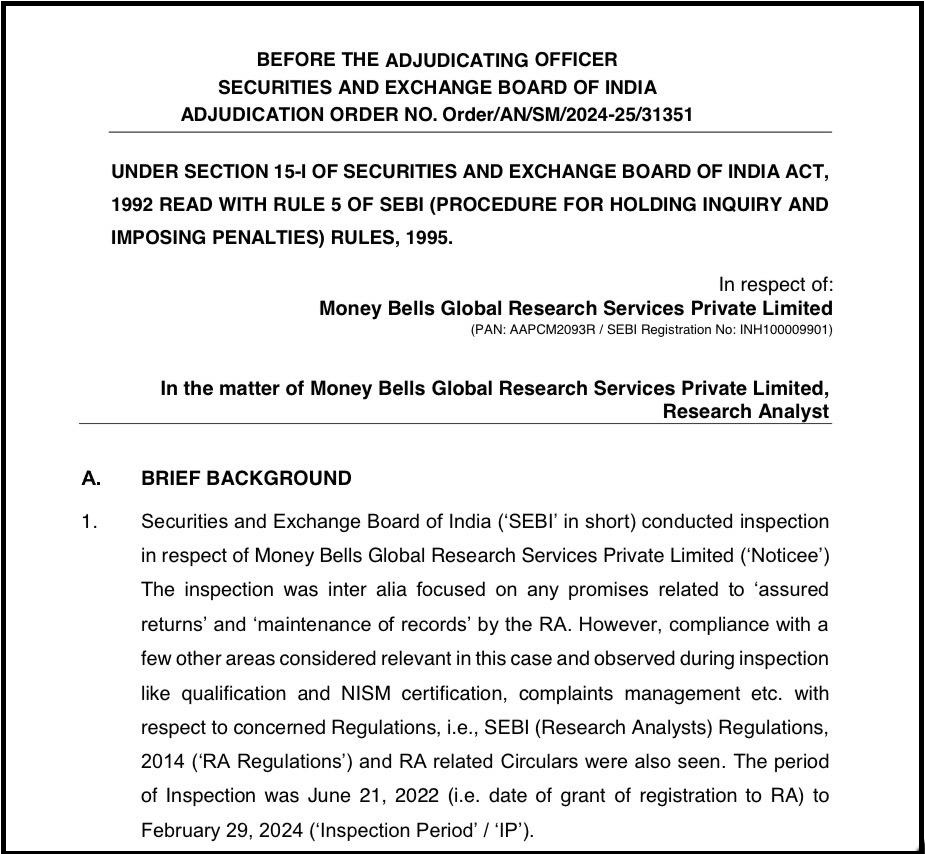

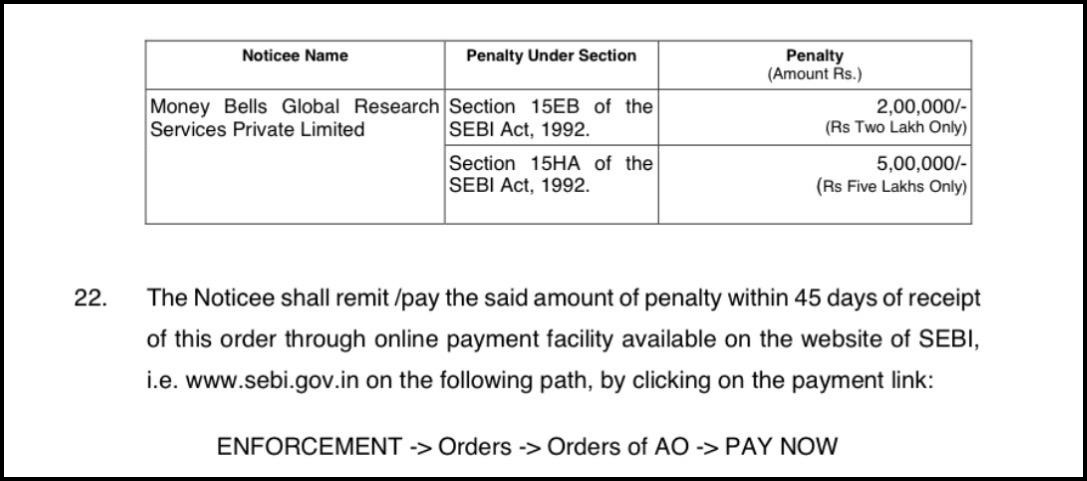

The biggest regulatory red flag you must know about is that SEBI has already passed an adjudication order specifically in the matter of Money Bells Global Research Services Private Limited (Research Analyst) dated 28 March 2025.

SEBI’s order hit Money Bells for misleading social/website claims like “85-90% accuracy” and “no profit no charges,” which are clear return assurances and are banned for RAs.

They skipped rationales for unexecuted calls, temp RA periods, plus net worth shortfall per audit.

What makes this even more credible is that Money Bells Research itself admits to this penalty on its own disclosure page.

In the “Disclosure” section, the company clearly states that a monetary penalty of ₹7,00,000 (seven lakhs) was imposed by SEBI after an inspection. S

SEBI inspected this SEBI‑registered research analyst, found regulatory violations serious enough to impose the penalty, and the firm had to disclose this to clients as part of its compliance and transparency obligations.

For you, the learning from this SEBI action is that even a properly registered research analyst with polished branding and detailed compliance pages can still cross lines on how research is marketed or delivered.

So, you should treat this as a caution flag and not as a routine, harmless event.

Before trusting any such service with large subscription fees or basing all your trades on its calls, you should always read the SEBI order yourself and ask, “Are they actually changing their practices after this penalty, or only changing the wording on the website?”

How to Report Money Bells Research?

If problems arise with advice from Sagar Goel and from the services of Money Bells Research, then practical steps exist to safeguard your investments and pursue a resolution.

Start by gathering solid proof right away.

1. Collect All Evidence

Document everything thoroughly, including emails, chat logs, recommendation reports, portfolio statements, screenshots of misleading advice, and call recordings if available. Strong evidence forms the backbone of any successful claim against faulty research or investment tips.

2. Register Your Complaint

File your grievance through the analyst’s official support channels to create a clear record. This ensures all facts are captured accurately without missing key details.

3. Assistance with Documentation and Drafting

Seek expert help to craft a polished formal complaint that outlines the issue precisely and attaches all proof. A structured submission boosts the odds of quick and fair handling.

4. Escalate to Regulatory Channels

SCORES (SEBI Complaints Redress System): Lodge your Sagar Goel Research Analyst complaint online via SEBI’s portal for official intervention.

5. File a Complaint in SMART ODR

For lingering disputes, move to the Online Dispute Resolution platform, which speeds up mediation between investors and analysts.

6. Representation in Counselling and Arbitration

Expert support guides you through counselling meetings and arbitration hearings, presenting your case effectively to defend your financial interests.

These actions empower you to handle the matter confidently, making sure authorities view your Sagar Goel Research Analyst complaint seriously for better results.

If you register with us, you don’t have to struggle with complicated procedures, drafting confusion, or paperwork stress.

We make the process smoother, clearer, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

Sagar Goel, Research Analyst, serves many investors seeking reliable guidance on stocks and markets. Yet, errors in recommendations can occur, impacting savings meant for family security or future goals.

Real cases show refunds and corrections happen when complaints are filed promptly with evidence.

Act fast if facing issues with Sagar Goel, Research Analyst, or similar advisors; delays only complicate recovery.

If navigating complaints seems overwhelming, professional help simplifies the path forward.