Shri Money is presented as a stock market research service operated by Punit Kumar, a SEBI-registered Research Analyst.

Shri Money primarily offers research alerts and trading ideas, particularly focused on intraday and derivatives trading.

The platform positions these alerts as “reference research,” leaving execution decisions to the user.

Many users encounter Shri Money through its online presence, webinars, or promotional content that highlights market expertise and analytical insights.

For retail traders, especially those still learning the markets, this positioning can create the impression of guided learning or structured support, even though the service itself is centered on signals and trade ideas rather than formal education.

Over time, however, questions have been raised about how Shri Money’s services are marketed versus what is actually delivered, and whether users clearly understand the difference between learning to trade and receiving research alerts.

These concerns make it important to examine the platform more closely, including its service structure, communication practices, and alignment with regulatory expectations.

Punit Kumar Research Analyst

Punit Kumar is a registered Research Analyst (RA) and operates Shri Money, a platform known for providing market insights and research-based perspectives for retail traders.

The platform operates under the domain shrimoney.com and positions itself as a place where traders can understand the markets better with the help of structured research.

In short, Punit Kumar, operating Shri Money, uses the platform for providing:

- A stock research firm offering analysis and research services to clients.

- Helping users make better trading decisions with clearer insights.

- Specialising in Intraday Options Trading research.

- Focusing on quality stock and F&O research, and aiming to improve the overall trading experience for their users.

For many retail traders, this looked like a straightforward research platform, something that promised guidance, analysis, and structured learning for day-to-day trading activity.

Over time, some users started sharing experiences online about inconsistencies, unmet expectations, or confusion regarding the nature of services being offered.

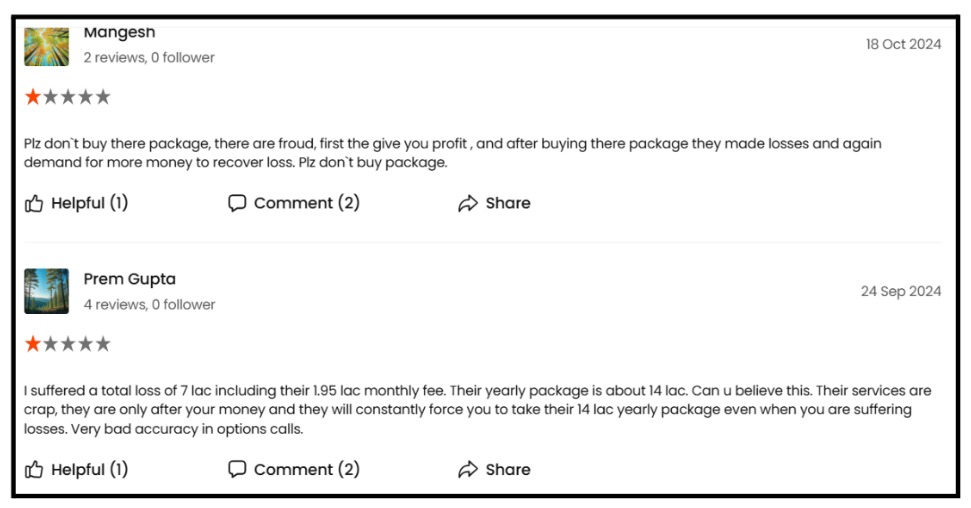

Shri Money Complaints

Let’s get straight, the platform that seems to be trustworthy and backed by SEBI is not reliable.

Wondering on what basis we are making this statement?

Well, just have a look at some of the reviews given by its users.

These conversations didn’t accuse anyone; they simply revealed uncertainty among users trying to understand their rights, limitations, and what is or isn’t allowed in the financial ecosystem.

Not only this, but the adjudication order has been passed against Punit Kumar for certain violations.

Let’s understand in more detail.

Shri Money SEBI Order

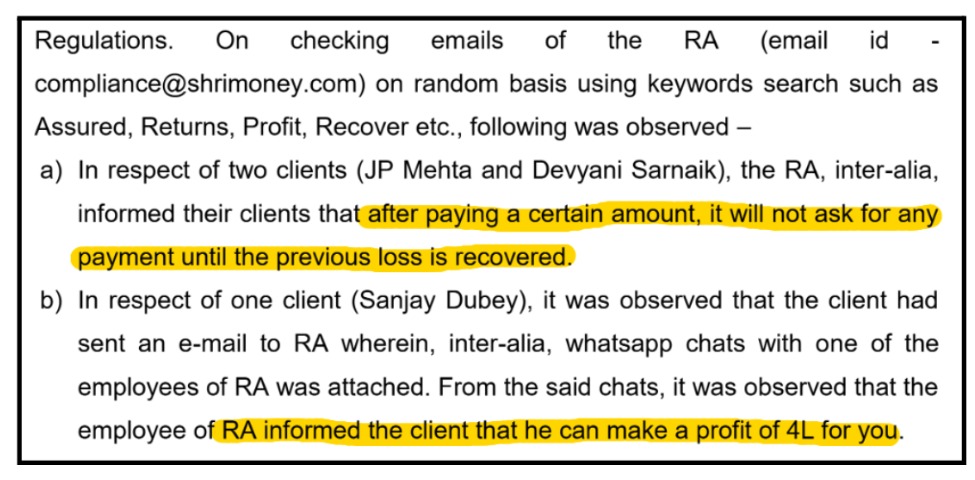

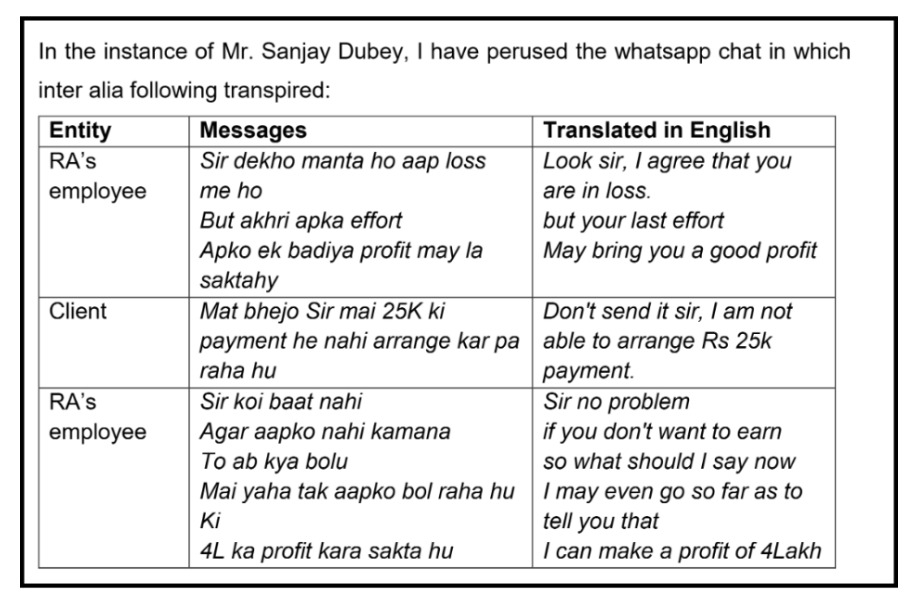

SEBI inspected Punit Kumar, proprietor of Shrimoney, a SEBI-registered Research Analyst. The inspection covered the period April 01, 2022, to February 13, 2024.

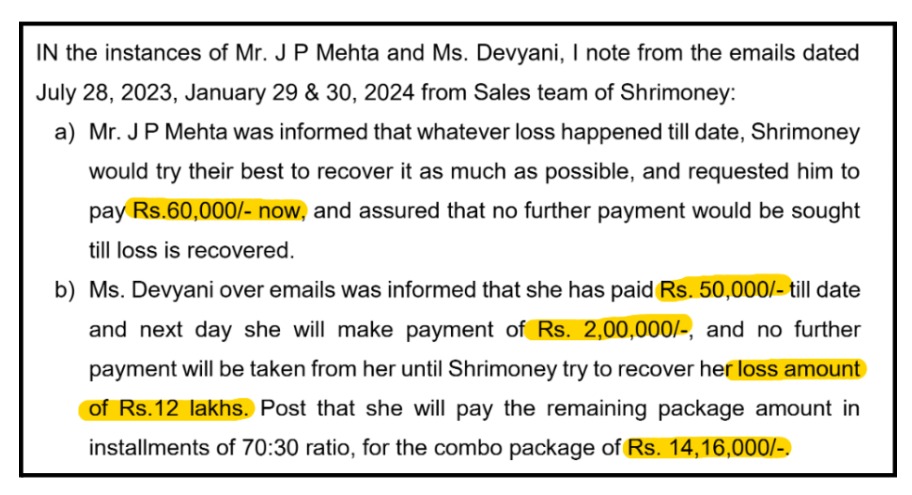

Based on its review, SEBI accused the Research Analyst of giving assurance related to profit/loss recovery.

Where employees were making profit promise-like statements, providing recommendations on WhatsApp, failing to include mandatory disclosures in research reports, and not maintaining a rationale for research recommendations.

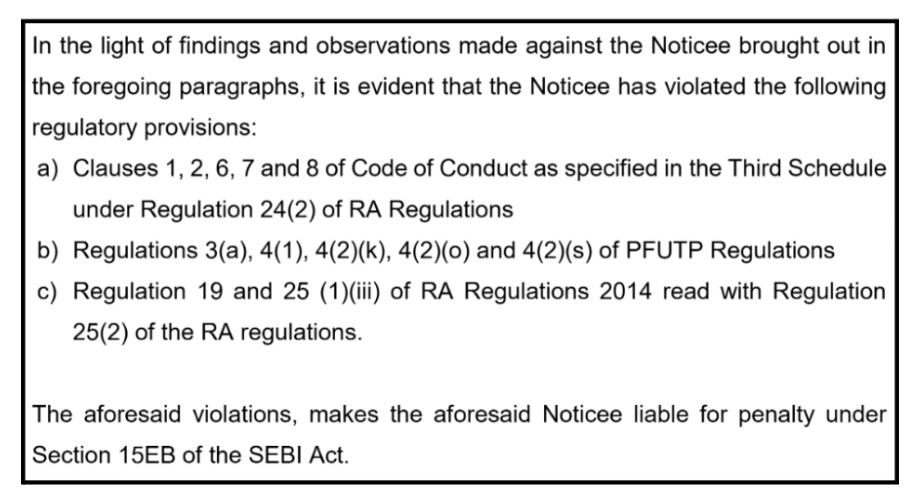

The findings suggested possible violations related to:

- Profit assurance style communication, inappropriate sales practices.

- Compliance failures in research reporting and misuse, or lack of internal monitoring systems.

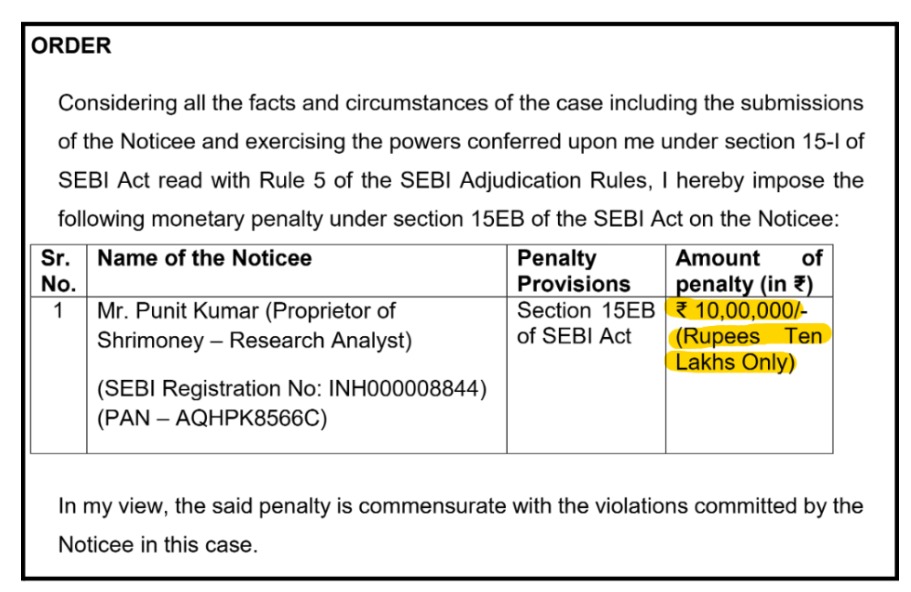

This triggered adjudication proceedings under Section 15EB.

After evaluation, SEBI concluded that several regulatory violations had occurred and imposed a ₹10,00,000 monetary penalty under Section 15EB of the SEBI Act.

A few rules examined by SEBI were:

- PFUTP Regulations: These cover misleading statements, fraudulent inducement,mis-selling, and advice designed to influence investor decisions.

- SEBI Act Section 12A(a)–(c): Regulates manipulative and deceptive practices.

- Research Analyst Regulations: SEBI reviewed non-compliance with Regulation 19, i.e, mandatory disclosures in research reports, Regulation 25(1)(iii), i.e, rationale for recommendations, and Code of Conduct clauses 1, 2, 6, 7, 8 (professionalism, honesty, diligence)

What does this SEBI order highlight:

- Clear communication between research analysts and clients.

- Avoiding statements that sound like profit assurance.

- Maintaining proper disclosures in research reports.

- Documenting the rationale behind the advice.

- Ensuring employees follow compliant communication channels.

Many users continue to follow Shrimoney’s content without any problems. Others, based on online discussions, simply wanted more clarity around service boundaries and compliance.

So the safest path is always:

- Check registrations.

- Read disclaimers.

- Avoid depending solely on online promises.

- Review SEBI directions whenever they are issued.

How to Protect Yourself in Such Cases?

If you’re confused about how to file a report or don’t know where to start, register with us now.

Our team will personally guide you through the complaint process, help you collect valid proof, and ensure your case is properly filed online.

Here’s how we help you:

1. Documentation Assistance

We make sure your case stands on solid ground.

Our team helps you collect, organise, and structure all the essential documents, trade statements, ledgers, contract notes, screenshots, emails, call logs, and more. Strong evidence means a stronger case.

2. Drafting Your Complaint

Writing a complaint the right way is crucial.

We prepare clear, professional, and fully compliant drafts tailored to the formats required by NSE, BSE, SEBI SCORES, and SMART ODR.

Your complaint is presented correctly, so it isn’t rejected or misunderstood.

3. Platform Filing Support

Submitting on platforms like SCORES or SMART ODR can feel overwhelming.

We guide you through the entire process and make sure every detail is filled in properly, helping you avoid unnecessary delays or errors.

4. Escalation Guidance

If the issue can’t be resolved at the broker level, we show you exactly what to do next, whether it’s approaching NSE/BSE, initiating IGRP, or preparing for arbitration.

You’ll always know the right escalation path.

5. End-to-End Case Management

Once you’re registered, we track your case from start to finish.

We remind you of deadlines, help you respond to regulator queries, and ensure nothing is missed along the way.

6. Support During Counseling & Arbitration

If your matter moves into counseling or arbitration, we help you prepare detailed statements, compile evidence, and get ready with confidence.

You’ll never feel unprepared or alone during crucial hearings.

Conclusion

Punit Kumar and Shrimoney reflect a situation where many things worked well for users in the beginning, with regular market insights, structured research content, and a platform that helped new traders understand market movements with more confidence.

Even today, a large number of users continue to consume the content without facing direct issues.

But SEBI’s inspection and order show that a few important compliance gaps did exist during the review period.

SEBI’s observations also remind users to stay aware of their rights, understand the limits of what research analysts can offer, and pay attention to communication style, disclaimers, and compliance standards.

Everything may appear smooth on the surface, but a few regulatory red flags show why traders should stay cautious, read disclosures carefully, avoid relying on profit-oriented assurances, and verify the registration and compliance status of any market research service they use.

Staying informed helps users make safer decisions, especially in a market where trust, transparency, and proper processes matter just as much as trading knowledge.