Money decisions quietly influence almost every aspect of life. From personal security and confidence to long-term opportunities, even one financial choice can leave a lasting impact. As markets become faster and more complex, investors increasingly look for structured guidance instead of relying on instincts or emotional reactions.

Digital investment platforms have emerged to meet this demand, offering research-based insights and organized strategies. Smart VERC positions itself in this space as a disciplined equity research platform focused on long-term investing. Many investors approach such services with optimism, curiosity, and the expectation of clarity.

When money is involved, trust is built gradually. Clear disclosures, processes, and accountability matter just as much as performance claims. Understanding how an advisory or research platform operates is essential before depending on it for financial decisions.

Smart VERC Review

Smart VERC is an equity research and stock advisory platform that emphasizes disciplined, long-term investing rather than short-term trading.

The firm is led by Dr. Anil Kumar Asnani, who oversees its research philosophy and investment framework. Smart VERC is registered with the Securities and Exchange Board of India (SEBI) as a Research Analyst under registration number INH000000420.

The platform primarily caters to investors who prefer structured guidance, defined holding periods, and research-backed reasoning.

Its services are subscription-based and clearly positioned around equity research, not guaranteed returns or speculative trading.

Smart VERC generally presents itself as a long-term, valuation-driven research platform. The focus is on patience, consistency, and understanding businesses rather than chasing short-term market movements.

Smart VERC offers multiple research products designed for different investment horizons:

- Smart Gains: Weekly stock recommendations with holding periods ranging from 3 months to 24 months, aimed at medium-term investors.

- Smart Gems: Long-term stock ideas intended to be held for two to five years, suitable for investors focused on wealth creation over time.

- Smart AllCap Portfolio: A diversified equity portfolio spanning market capitalizations, designed with a long-term outlook extending toward 2040.

Each product includes an explanation of the investment rationale, intended holding period, and relevant disclosures, helping investors understand the context behind each recommendation.

Smart VERC Educational Presence

Smart VERC’s services are accessible through its website and mobile application, available to active subscribers.

The platform provides alerts for new recommendations, access to historical research, and updates on price movements in a straightforward interface. This structure encourages consistency and reduces impulsive decision-making.

The firm maintains a modest online presence, with its YouTube channel being the most active. The content focuses on explaining market trends, discussing equity ideas, and highlighting the importance of long-term thinking.

The tone is educational rather than promotional, avoiding aggressive claims or daily trading tips.

Smart VERC User Experience

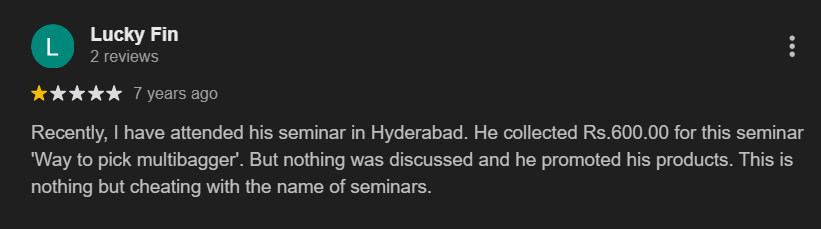

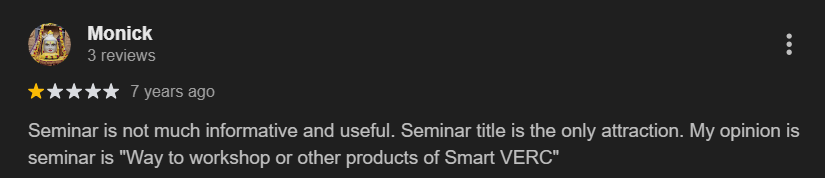

Some users have shared concerns about their experience with paid seminars and workshops conducted under the Smart VERC brand. According to publicly available reviews, attendees felt that certain seminars did not deliver the educational value promised in their titles.

In a few cases, investors reported paying seminar fees with the expectation of learning specific investment strategies, such as identifying high-growth or “multibagger” stocks.

However, they claimed that the sessions focused more on promoting Smart VERC’s paid products and services rather than providing detailed or actionable learning content.

Other attendees described the seminars as limited in depth and usefulness, stating that the session titles appeared more attractive than the actual material covered. Some reviewers felt that the seminars functioned largely as an introduction to workshops or subscription offerings, rather than standalone educational events.

These experiences highlight the importance of clear communication and expectation setting in paid financial education programs. When investors sign up for seminars, they typically expect structured learning aligned with the advertised topic. Any gap between promotion and delivery can lead to dissatisfaction, even if the underlying research or advisory services operate within regulatory boundaries.

When to File SEBI Complaint Against an Advisor?

Investors usually begin by trusting the advisory or research process and expecting clarity, timely communication, and adherence to agreed terms. However, issues may arise over time that go beyond normal market fluctuations.

A formal complaint may be considered when concerns remain unresolved despite seeking clarification directly from the platform.

An investor may think about filing a complaint in SEBI if:

- The research or advisory service provided does not align with what was stated in the subscription agreement or disclosures.

- There is a lack of clear communication regarding recommendations, updates, or changes in strategy.

- Important disclosures, reports, or explanations promised during onboarding are not shared.

- Fees, subscription terms, or service scope differ from what was originally agreed upon.

- The investor feels that regulatory obligations, disclosures, or professional standards are not being followed.

- Repeated follow-ups fail to result in clear responses or resolution.

Filing a complaint is not about reacting to market losses alone. It is meant to address issues related to process, transparency, communication, or compliance with regulatory standards. SEBI provides a structured grievance mechanism to ensure such concerns are formally reviewed and documented.

Conclusion

Smart VERC positions itself as a research-driven equity platform focused on long-term investing and disciplined decision-making. Its SEBI registration, defined product offerings, and emphasis on education contribute to its credibility as a structured research service.

At the same time, equity investing requires awareness, patience, and realistic expectations. Understanding the role of research, execution, a