Just type “stock market advisory services” on Google and you will find plenty of websites claiming to offer authentic and reliable services.

But are all of those SEBI-registered & trustworthy?

And even if they are SEBI-registered Research Analysts, are they following regulations properly?

Well, it’s hard to say that, as many novice traders are unaware of the regulations and therefore get trapped in their fake promises easily.

Here is one such case where Govind (name changed) got trapped in one such advisory service and lost ₹46,500 in fees and another ₹63,000 in trading tips.

Following is the complete story of how it all got started, and later how our team helped him recover the lost amount.

The Call From SEBI-Registered RA

It all began with one call from the SEBI-registered Research Analyst who called Govind after he put his number on their website.

The person on the call claimed himself a SEBI-registered RA and told him about their plan worth ₹55,000. But Govind did not have enough funds and was also not sure of their reliability in terms of tips & recommendations.

On this RA offered him the demo call. That call went well, and Govind earned a profit of ₹9,000.

As per the deal, Goving transferred the whole profit to RA as a fee amount.

But as per the condition, Govind transferred all the money to RA’s UPI account. Govind then agreed to take their services but requested to pay the fees in installments.

RA agreed and asked that they work on a trading account handling with profit sharing. This means the profit on every trade would be shared 50-50 between them.

Initially, Govind paid ₹10,000 and the rest of the ₹36,000 as a profit share.

Unfortunately, Govind was not aware that RA was misguiding him.

RA who knowingly violated SEBI regulations by giving demo calls and working in a profit-sharing mode.

The Beginning of Losses

Things continued like this till Govind started making a loss on almost every tip shared by RA. Finally, one day, Govind ended up losing all his capital worth ₹63,000.

Govind called RA. But he got the same reply that most of the advisories gave on failure, “Add more funds and we would help in recovering losses.”

Disappointed, Govind was left with no choice.

But luckily, he came across our FraudFree platform and filed his complaint there.

How Our Team Helped Govind in Recovering ₹46,500 from RA

Our team understood the whole case and, to report the complaint, asked for all the proof. Unfortunately, Govind didn’t have an invoice as the company claimed that no invoice would be issued until the complete payment was made.

But based on phone calls, UPI ID, and WhatsApp chat, our team helped him to draft a complaint against stock advisory. Our team mentioned the points that how RA misled him and violated certain regulations.

After a few days, Govind received a call from RA. RA on the call asked Govind to take the Cyber complaint back, and they would refund the amount of the fees.

Cyber Complaint, Wait, What?

But neither Govind nor our team reported this to the Cyber Police.

Later, we understood that someone else might have reported a complaint against the same advisory on Cyber Crime.

This further ensures that they were involved in misleading clients and their tips and wrong advice not only led to the loss of Govind but might to other traders as well.

They then asked Govind to send an email mentioning the withdrawal of the complaint.

However, we stuck to our point and didn’t provide anything in writing until the promised amount was credited to Govind’s account.

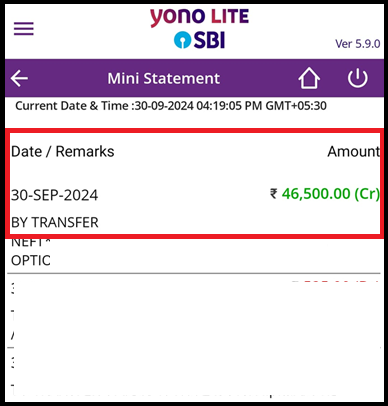

Finally, Govind received the payment of ₹46,500. However, Govind didn’t get the whole amount but this incident taught him an important lesson.

It helped him know that one must not follow anyone’s recommendation blindly and must focus on understanding the stock market.

What to Check While Choosing Registered Advisory Services?

Now to stay protected and to avoid any kind of losses due to advisory services always check a few things like:

- Ask and verify the registration number on the SEBI website.

- Check the client testimonials, if any, or check for any registered complaint against the RA on the SEBI’s website.

- Avoid taking services, if RA offers profit sharing or another kind of model to charge fees.

- If RA is giving the demo, sharing PnL of clients, or promising assured returns, clearly say NO to their services.

- Careful check for the terms & conditions document and read it carefully to avoid any confusion or losses later.