In today’s digital age, online investment platforms and trading mentors have become increasingly popular, promising quick profits and financial freedom. Among these names, Trade With Jazz has attracted a lot of attention for its aggressive marketing and claims of high returns through stock market “tasks” and trading opportunities.

However, before you decide to trust your money with any such platform, it’s crucial to pause and look deeper.

Recent reports and official communications suggest that Trade With Jazz may not be what it appears to be.

Behind the glossy social media posts and success stories lies a pattern that mirrors several investment frauds seen in recent years, schemes that lure investors with fake promises, only to vanish once enough money has been collected.

In this article, we’ll break down who Trade With Jazz really is, how the scheme allegedly operates, what the NSE press release revealed, and most importantly, how you can protect yourself from falling into similar traps.

Trade With Jazz Review

One of the main issues of TWJ Associates Pvt. Ltd., which was also known as “Trade with Jazz,” was that they pretended to be a multi-sector enterprise, but in fact, they were focused on financial services.

Operated by Mr. Narvekar and Bhavika Patel, the platform is attracting users in the name of a high-return investment scheme without any registration or authorization.

As per the report, they were illegally raising money and giving investment advice and plans, which is very tightly regulated and a violation of the law.

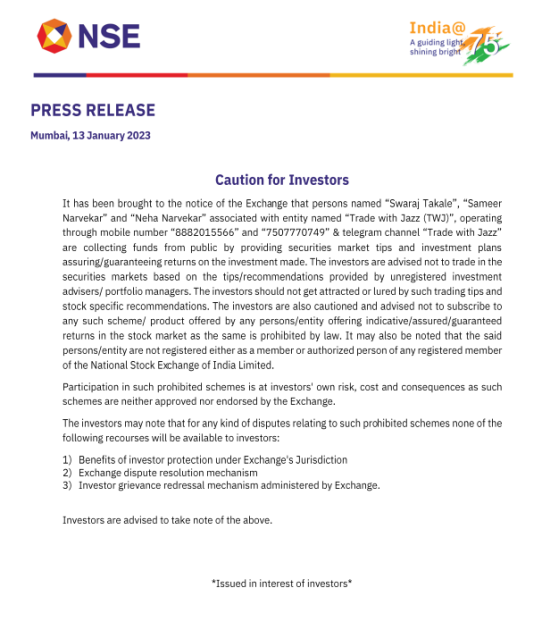

Furthermore, the National Stock Exchange (NSE) has cautioned the investors that people connected with “Trade with Jazz” are not registered as members or authorized persons of the exchange.

Is TWJ Investment Scheme Fake?

The TWJ scam seems to be the most prominent one among large-scale financial frauds.

The story of the TWJ scam that followed the same basic plot has already become somewhat of a legend in the financial fraud community.

Here are the main red flags uncovered by investigators:

- “Double Return” Scheme: The most frequent tactic of the scammers reported by the victims was to promise extremely high, guaranteed, or even double returns on investments. In the real financial world, there is no guarantee of high returns. This is a characteristic of a Ponzi or pyramid scheme.

- High returns as bait: Victims are usually told of extremely high returns, for example, 3% to 5% per month, on TWJ investment. This is a classic sign of a Ponzi scheme; the money of new investors is used to pay off the older investors, creating an illusion of profit until the whole scheme collapses.

- Regulatory Problems: These types of organizations are often not properly registered with top-level financial regulators (like SEBI in India or the FCA in the UK) for the services they declare to provide. If a company that promises to manage your money is not regulated, you have almost no investor protection.

- NSE Warning (Trade With Jazz): The National Stock Exchange of India (NSE) has formally warned the public about individuals linked to the entity “Trade with Jazz (TWJ)”. It said that these people were not registered as members or authorized persons, and yet they were collecting money by giving market tips and promising returns, which is banned by law. The scam was primarily traced to Maharashtra, with major complaints emerging from Pune and nearby regions such as Chiplun.

How to Report the TWJ Scam?

If you suspect or confirm you’ve been a victim of the TWJ scam or any similar investment fraud, you must act with urgency.

Time is crucial for potentially tracing funds.

- Immediate Police Complaint: File a First Information Report (FIR) with your local police station, specifically the Cyber Crime or Economic Offenses Wing (EOW).

- File a Cyber Crime complaint: For citizens in India, immediately report the fraud on the National Cyber Crime Reporting Portal. This system is designed to alert banks in real-time to put fraudulent funds on hold.

- File a Complaint in SEBI: Since the fraud is linked with a fake investment scheme, it is important to notify SEBI. You can file a complaint by sending an email with all the proof attached.

- Contact Your Bank: Inform your bank about the fraudulent transfer. They can initiate a chargeback request or help freeze the destination account if the money hasn’t moved yet.

Need Help?

Filing a police or cybercrime report can feel daunting, especially when you’re stressed.

Register with us, and our expert team will help you to report it online on your behalf and guide you with the recovery process.

Conclusion

The TWJ scam is an excellent lesson: when an investment opportunity appears too good to be true, it is almost always too good to be true.

The creation of legitimate wealth is time-consuming, risky, and this is always clearly expressed.

Always keep in mind to never pay to secure a job and ensure that the company has the credentials before you hand over any money by checking the same through official and impartial sources.

Be intelligent, listen to yourself, and secure your economic future!