In the relentless search for financial freedom, many aspiring traders look for mentors-someone who can simplify the stock market’s complexity and help them skip years of trial and error.

And this is exactly where groups like Trader Mentor School (TMS) enter the picture.

Promoted as a premium mentorship platform by individuals claiming to be seasoned experts, TMS has attracted the attention of many new traders.

But is this “mentorship” genuinely helpful-or hiding something deeper?

Let’s break it down.

Trader Mentor School Login

Before trusting any trading mentor or financial school, the login and onboarding process is a key indicator of credibility. In the case of Trader Mentor School, this is where caution is necessary.

The platform does not provide a clear or official login or registration process on its website.

There is no visible sign-up page, no structured onboarding flow, and no public explanation of how users are meant to enrol.

Several users report being added manually after private Zoom calls, which is a major red flag for any financial or educational service.

If you’ve seen images claiming to show a Trader Mentor School login dashboard, treat them carefully. Screenshots alone do not prove the existence of a secure system. Such visuals are often used to create trust without offering real transparency.

A legitimate platform should have a clear login page, documented terms, and a secure user-managed account system.

When access is informal and unclear, users have little protection if something goes wrong. If the login process itself isn’t transparent, it’s best to pause and verify before placing trust, money, or personal details.

Trader Mentor School Strategy

The group claimed to use a special expiry-based option-selling strategy, presenting it as a consistently profitable system.

Here’s what they allegedly promised:

- 10–12% profit every month

- Even an average person could make 6–8% monthly returns

- Zero risk and stable income

- Returns “guaranteed” through expert scanners

However, these claims directly violate SEBI regulations.

As per the SEBI Master Circular, no person, group, or entity is allowed to guarantee returns in the securities market. These rules exist to protect investors from manipulative schemes and unrealistic profit promises.

They also connected users through Zoom calls, where they showcased supposed profits from other students’ common tactics used in misleading mentorship schemes.

Trader Mentor School Legit or Not?

When evaluating a financial mentorship platform, legitimacy depends on transparency, regulation, and accountability. Trader Mentor School fails on all three fronts.

Here are the biggest red flags:

1. Guaranteed Returns

This is the strongest red flag. Any guarantee of monthly profits, especially 6–12%, violates SEBI rules and is a sign of deceptive financial practices.

2. No SEBI Registration

No SEBI registration number, no regulatory license, no compliance disclosures.

This means the group is operating without legal authorisation.

3. Manipulated Reviews

Some positive reviews floating online may be fabricated or selectively showcased.

When losses occur, they do not take responsibility.

4. High-Pressure Sales

Users were allegedly pushed into paying high fees with scare tactics and limited-time offers.

Given all these factors, the legitimacy of Trader Mentor School becomes extremely questionable.

Trader Mentor School Scam

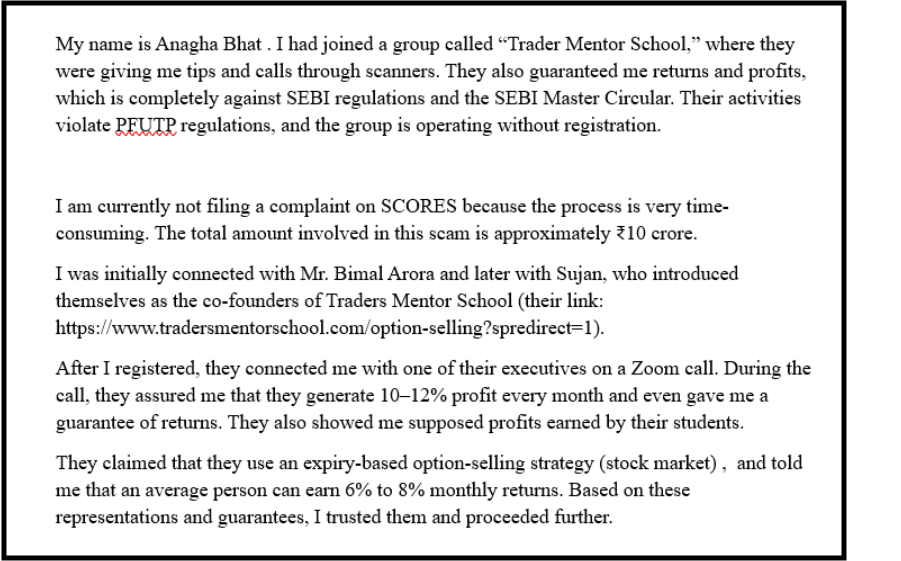

Nothing exposes a fraudulent system more clearly than the testimony of someone who personally went through it.

In this case, Anagha Bhat shared a detailed account of her experience with Trader Mentor School (TMS), and her story reflects many classic signs of a well-orchestrated financial scam.

Here is a deeper look at the key elements of her experience and why they are alarming:

1. High-Pressure Zoom Calls to Manipulate Decisions

Anagha was connected to an “executive” through Zoom.

This is where most of the manipulation took place.

During these calls:

- They showed unverified, fabricated profit screenshots

- Claimed their students “consistently earn 6%–12% per month”

- Used sales psychology to push her into making quick decisions

- Extracted personal details (profession, background, income level) to customise the pressure

Zoom calls are commonly used by scam groups because they create a sense of personalisation and urgency while leaving no written trace.

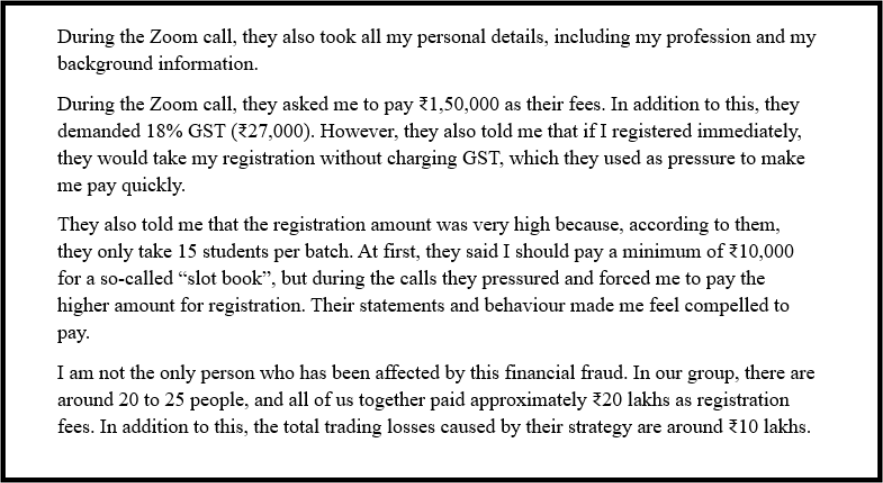

2. The Scarcity Tactic: “Only 15 Students Per Batch”

She was told they only accept 15 students per batch and must pay a minimum of ₹10,000 to “book a slot.”

Then, during calls, she was pushed into paying the full ₹1.5 lakh.

This is classic fear-of-missing-out (FOMO) marketing, widely used by fraudulent schemes to force quick decisions.

Real educational institutions never force students into paying high fees immediately.

3. Multiple Victims: 20–25 People Lost Money Together

This is not an isolated incident.

According to her report:

- 20–25 people collectively paid around ₹20 lakhs in registration fees

- Trading losses from their so-called strategy amounted to ₹10 lakhs

- The total money involved in the alleged scam is nearly ₹10 crore

This indicates a large-scale, coordinated operation, not a simple misunderstanding or bad mentorship.

Why This Matters for Every Trader

Anagha’s experience highlights a painful truth:

Unregulated mentorship platforms can easily misuse trust, manipulate emotions, and drain savings.

Her case reveals several critical lessons for traders:

- False returns create false hope.

- Psychological manipulation is real.

- Unverified profit screenshots mean nothing.

- Lack of SEBI registration is not a small issue-it’s the core danger.

- Losses in trading + losses in fees = double financial damage.

- Many victims stay silent.

How to Report an Online Scam

1: Report to Cyber Crime Reporting Portal

-

File a complaint describing the scam clearly and in sequence.

-

Upload key evidence such as:

-

Payment proofs or transaction IDs

-

Screenshots of chats, calls, or emails

-

-

A clear report helps authorities evaluate the case properly.

2: Contact the Cyber Crime Helpline for Urgent Action

-

Use the helpline if money has already been transferred.

-

Officials can help with:

-

Flagging suspicious transactions

-

Advising on immediate next steps

-

3: Visit the Nearest Cyber Crime Police Station

-

Approach your local cybercrime police station for serious or high-value losses.

-

Carry essential documents like:

-

Bank statements or receipts

-

Screenshots of communication or promotional material

-

4: Act Early and Preserve Evidence

-

Do not delay reporting once you identify a scam.

-

Early action improves documentation and helps protect others.

Need Help?

If you’re unsure how to move forward or feel overwhelmed by the reporting process, you don’t have to handle it alone. By register with us, you get step-by-step guidance tailored to your situation.

We help you understand what evidence is needed, organise your documents clearly, and submit complaints through the correct legal and cybercrime channels.

The focus is on making the process simple, accurate, and stress-free, so you can take informed action with confidence.

Conclusion

Trader Mentor School may appear attractive to new traders, but several warning signs cannot be ignored.

The lack of a transparent login process, the absence of SEBI registration, and repeated promises of guaranteed monthly returns raise serious credibility concerns.

Such assurances are not only unrealistic in the stock market but also violate regulatory norms meant to protect investors.

User experiences pointing to high-pressure sales tactics and significant financial losses further suggest that this is not a reliable mentorship platform.

Genuine trading education never guarantees profits; it focuses on skill, discipline, and risk awareness.

Before trusting any mentor or paying high fees, always verify regulatory compliance and stay away from anyone promising easy, fixed returns.