Trying to pull your earnings from TRG? Hitting walls at every turn?

Here’s what nobody tells you: TRG’s withdrawal feature was never meant to work.

The entire platform was engineered as a money trap. Right now, the site’s dead. Gone. Thousands of Indian users are left staring at blocked accounts.

TRG Earning App Login

Thousands of hopeful users constantly searched for the “TRG Earning App“, but here is the catch: no such app ever existed.

You won’t find it on the Google Play Store or the Apple App Store. It was always just a website, masquerading as a high-tech platform.

That is your first and biggest clue. Legitimate earning platforms undergo rigorous security and business verification to be hosted on official app stores.

Scammers, however, prefer “sketchy” websites; they are cheaper to build, easier to hide, and can be shut down overnight once the pockets are full, leaving users staring at a broken link.

TRG Withdrawal Problem

Let us walk you through exactly how TRG trapped your money. This isn’t speculation; this is the documented pattern.

Step 1: The Bait, Small Wins That Hook You

Early investors? They got paid. ₹2,000 here. ₹3,000 there. Nothing huge, but enough.

This wasn’t generosity. It was a strategy. Those small payouts made you think: “This works. Time to go bigger.”

Meanwhile, fake screenshots flooded WhatsApp groups. Photoshopped profits. Made-up success stories. All designed to make you invest more.

The referral system sealed it. Get your friends in, earn commissions. Classic pyramid scheme tactics. Illegal under Indian law, by the way.

Step 2: The Dashboard Illusion

Once you’re hooked, your dashboard starts showing crazy numbers. ₹2,40,000. ₹3,50,000. Maybe higher.

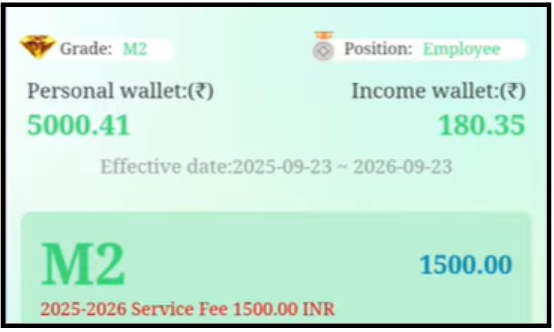

Screenshots from actual victims show the interface. Everything looked legitimate. Progress bars. Grade levels (M1, M2). Position status. Income wallets showing impressive figures.

But here’s the kicker: Those numbers were pure fiction. Database entries with zero backing. Your real money already left the building.

Step 3: The Service Fee Bomb

This is where it gets really dirty. Screenshots reveal the smoking gun.

M1 Grade users faced: “2025-2026 Service Fee 600.00 INR”

M2 Grade users got hit harder: “2025-2026 Service Fee 1500.00 INR”

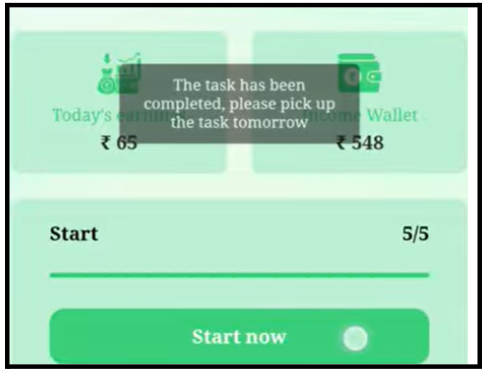

The interface messages read: “The task has been completed, please pick up the task tomorrow” alongside these fees.

Pay one fee, another pops up. An endless loop engineered to drain your bank account.

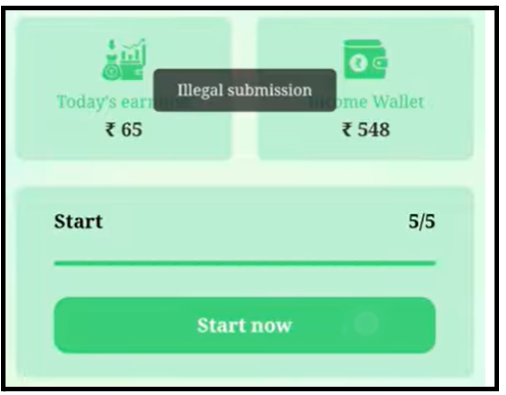

Step 4: The “Illegal Submission” Lockout

Screenshot evidence shows another weapon in their arsenal: “Illegal submission” warnings

Users reported seeing this message flash on their screens when attempting withdrawals.

No explanation. No way to fix it. Just a permanent barrier to your funds.

Step 5: Total Account Freeze

After you paid the fees (because you believed you had to), something predictable happened.

Your account is locked completely. Customer service? Vanished. Support tickets? Ignored. Phone numbers? Disconnected.

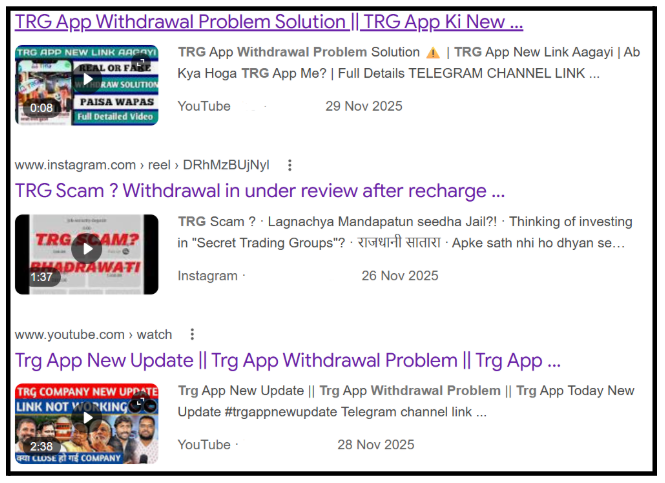

YouTube channels started posting warnings: “TRG Withdrawal Problems.”

Final Stage: The Disappearing Act

November 2025. The website stopped loading. No announcement. No explanation. No refund plan.

Classic exit scam. They collected enough; now they’re gone. Every scam ends this way.

Is TRG Safe or Not?

Looking back, the major red flags were everywhere, but scammers are professionals at masking greed as “opportunity.” If you are still asking, “Is it safe?”, these red flags provide a definitive answer.

-

Pre-Payment for Withdrawals

Legitimate platforms auto-deduct taxes from your withdrawal. They don’t ask you to pay taxes separately before releasing funds. That’s not how finance works anywhere.

-

The Yearly Service Fee Scam

M1 users: ₹600. M2 users: ₹1,500. These “annual service fees” made it seem official. But check the dates: 2025-2026. They were planning a full year ahead while knowing they’d vanish in months.

-

Impossible Returns

“7 Din Mein Paisa Double” (Double Your Money in 7 Days). Billboards. Ads. WhatsApp messages. This slogan alone should’ve been enough.

No legitimate investment doubles in a week. Not stocks. Not mutual funds. Not real estate. Only scams make these promises.

-

No Actual App

Search the Play Store or App Store for “TRG earning app.” Nothing. Because it never existed. Just a website they could nuke at any moment.

-

The Task Completion Mirage

“The task has been completed. Please pick up the task tomorrow.” This message kept you engaged daily while your money sat trapped.

This message was shown every time you tried to withdraw to delay the withdrawal process.

Smart psychological tricks make you feel productive while stealing from you.

How To Report Against TRG?

Don’t just accept this. You have options. The sooner you act, the better your chances.

Option 1: National Cybercrime Helpline

Available 24/7. Free call. They connect you directly to your state’s cybercrime cell.

Tell them everything. Have your transaction records ready.

Option 2: File Online at Cybercrime Portal

India’s official cyber complaint portal. Here’s the exact process:

- Click “Report Other Cyber Crime”

- Select category: “Financial Fraud”

- Upload screenshots, bank statements, and payment receipts

- Submit and save your complaint number

You’ll need that complaint number for everything that follows.

Option 3: Visit Your Local Cyber Police Station

In-person filing carries weight. Bring everything:

- Bank statements showing all TRG transactions

- Screenshots of dashboard, fee demands, and error messages

- Payment confirmations for “service fees” and “taxes”

The more documentation, the stronger your case.

Need Help?

Are you a victim of TRG Company? Have you lost money on this fraudulent platform? Withdrawal seems impossible?

You’re not alone. Hundreds of victims share your experience. Together, we can hold them accountable.

Register your complaint with us. We help victims by:

- Connecting you with cybercrime legal experts specialising in investment fraud

- Guiding you through the complaint-filing process with the authorities

- Organising your evidence professionally to strengthen your case

- Tracking your case progress until recovery efforts are complete

- Maximising fund recovery chances through proper legal channels

Don’t delay. Every day allows scammers to move funds and erase evidence.

Act now. Report immediately.

Conclusion

TRG was never a legitimate platform experiencing technical glitches; it was a calculated theft operation from day one.

Every “error” and “update” was part of the broader TRG Scam architecture.

The withdrawal problems weren’t bugs. They were featured. Designed to trap your money while extracting more through endless fee demands.

The dashboard shows ₹2,102.00 in your personal wallet and ₹105.00 in income. Fake numbers on a screen. The M1 and M2 grades with annual service fees? An elaborate theatre to make theft look professional.

The “illegal submission” warnings? Psychological manipulation to make you feel guilty for trying to access your own money.

The platform is dead. The scammers moved on. But your action now matters. Don’t let them win completely.