Imagine it’s late at night, your phone buzzes with a low balance alert and rent due tomorrow. You start scrolling your phone and come across an application called the True Balance Loan app. You read the description and find out that it is legal in India.

So, without any hesitation, you open the app, tap a few buttons, and boom, instant cash lands in your account. Sounds like a lifesaver, right?

But what, if that quick fix turns into a nightmare of endless calls, hidden fees, and debts you can’t shake off?

In a world where banks say no to small loans, this app promises quick and easy loans, but at what cost?

With over 80 million downloads and flashy ads everywhere, it is important to know if the True Balance Loan app is trustworthy or not. Is it a legit helper or just another fintech playing with your money?

So stick around, because by the end, you will know exactly if it’s worth the risk, or if you should swipe left.

What is a True Balance Loan App?

True Balance loan app is a fintech app from Gurugram-based Balancehero India Private Limited. It was started in 2014 by Korean founder Cheol-won (Charlie) Lee.

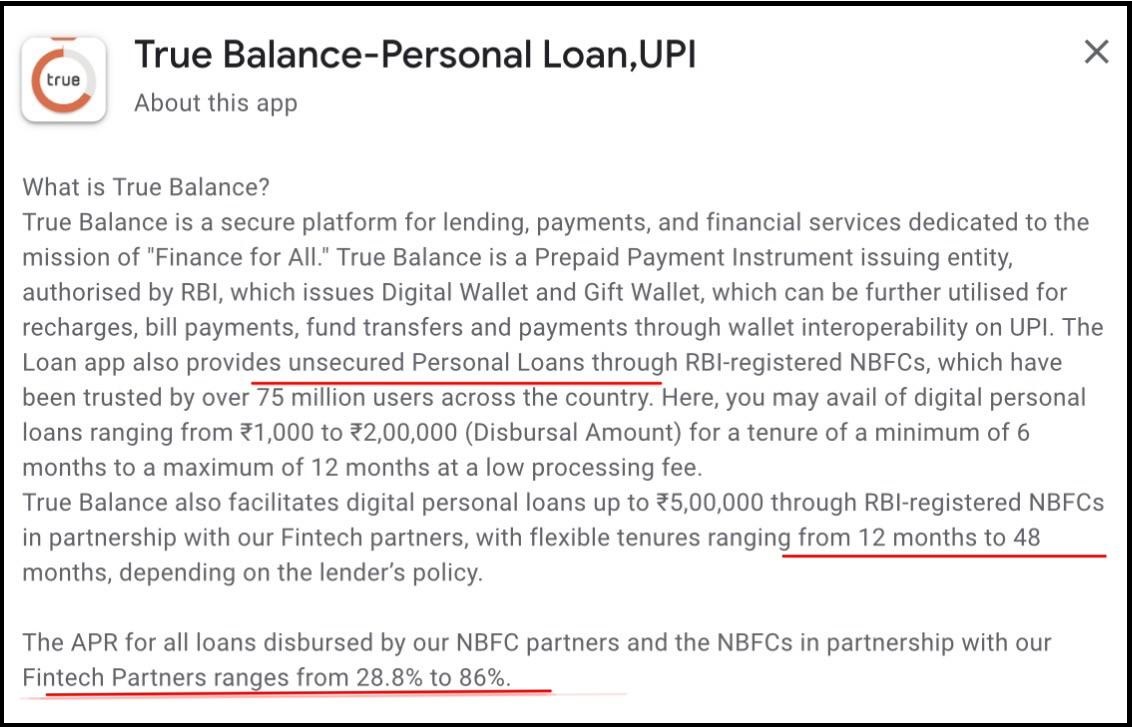

It shows itself as a one-stop solution for quick cash. It grants personal loans from ₹1000 to ₹5 lakh, UPI payments, mobile recharge, bill payment, and even a digital wallet.

Everything is 100% online. This doesn’t need any paperwork hassle. Just upload your KYC bank statement and selfies for instant approval.

The app doesn’t lend the loan directly; instead, it hooks you up with RBI-registered NBFCs like True Credit Pvt. Ltd.

If a person borrows ₹10,000 for six months at 2.4% monthly interest, dil pay back ₹11,550 after fees and GST.

Sounds simple, right? But read on for the catchers!

Is True Balance Loan App Safe?

True Balance loan app is a real app. It is available on Google Play and App Store. There are no complaints about it being fake or a fly-by-night scam.

But “real” doesn’t mean flawless. It is a legal operation indeed, but it cannot be called risk-free.

The application is saved from outright scams because it has RBI ties, but that does not mean that the application is fully reliable. There are various red flags associated with the application.

Imagine you need ₹20,000 for an emergency. True Balance loan app says approved. But after fees, you get ₹17,000. Six months later, you need to pay back ₹32,000 because their APR hits 60-86%.

It is mentioned on their own site description that their APR ranges from 28.8% to 86%. These are not Bank loans at 12 to 24% APR. True Balance charges 2 to 4 times more because they are unsecured.

Lenders cover default with your wallet. True Balance’s FY23, bad debts alone cost ₹155 crore, which is around 42% of expenses. Thus, the customer pays double the amount they borrowed.

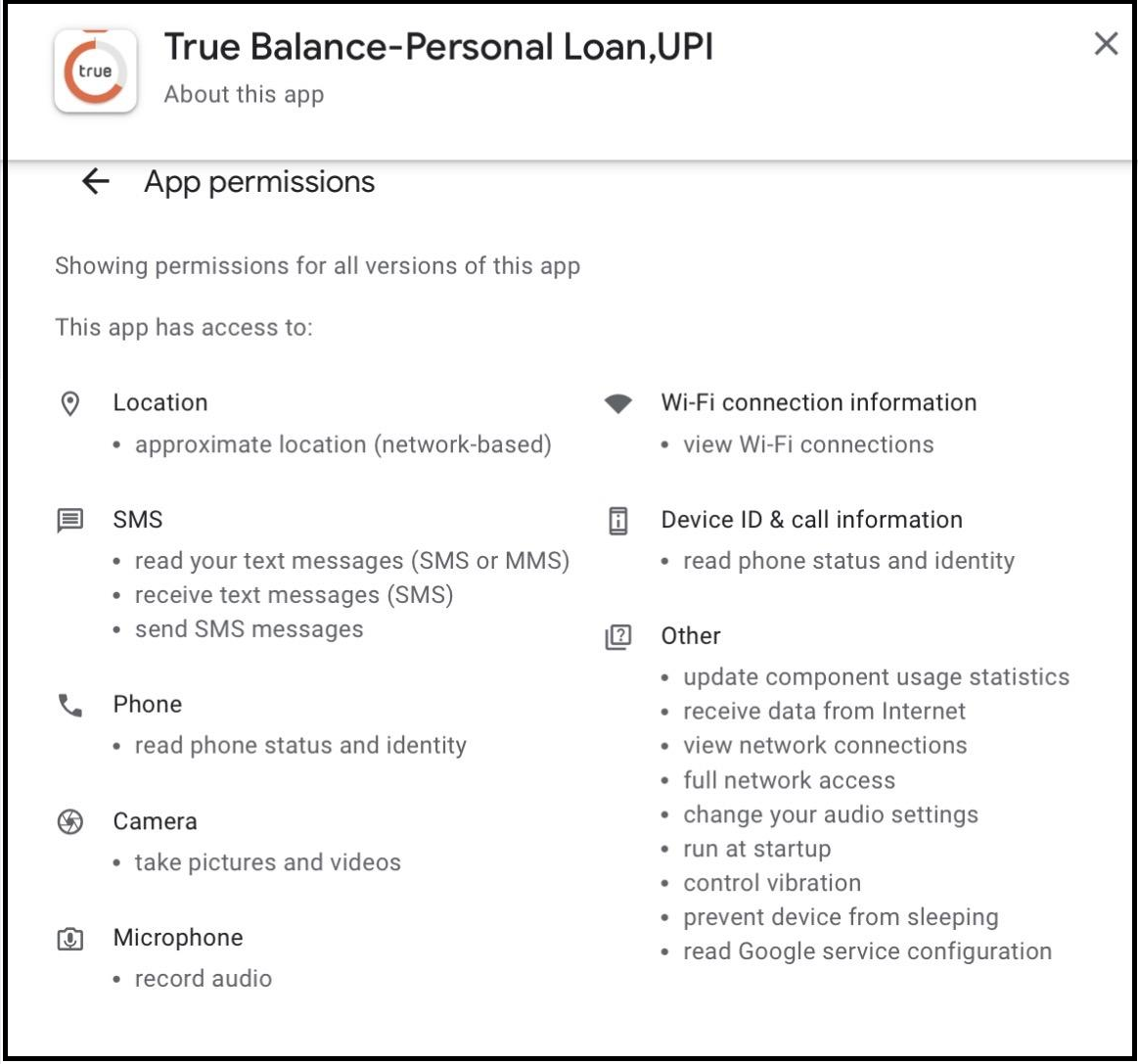

The app collects excessive information that is not required for its functioning. According to the DPDP Act, any app can collect data that is not required.

If you see various reviews have been published calling this app, just as a means of data collection. Collecting personal information can be harmful since it can be used against you.

True Balance Complaints

Reviews of the application paint a split picture. While some users have had quick wins and pleasant user experiences, others have experienced headaches.

Most of the users have been shocked by the deduction amounts and forced tenure for repayment. Remember when they said you can choose your loan repayment tenure yourself?

Users have also reported that they have received harassment calls, even after they had repaid the amount fully. They still get calls from members, pushing new loans.

Many users have issues related to interests. Monthly 2 to 4% interest shown in the app description sounds cute, but in reality, it is insanely high.

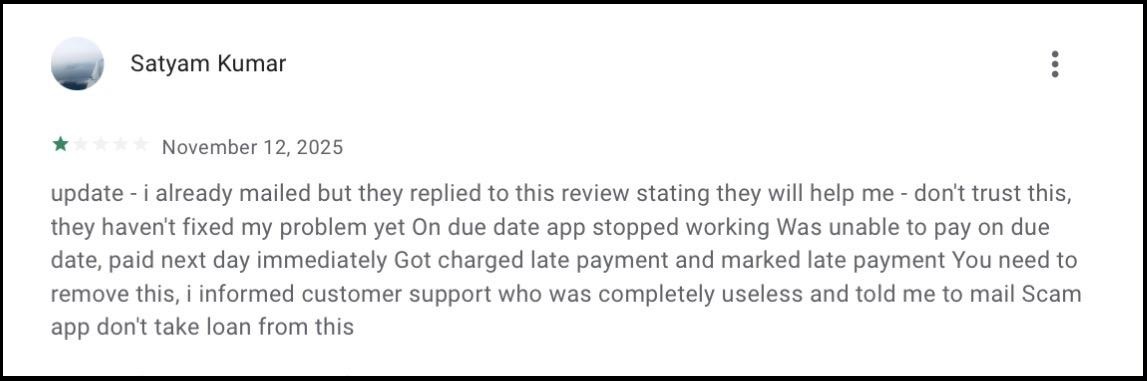

Complaint 1: App Stopped Working & Late Charges

Satyam Kumar’s review highlights a situation where the app suddenly stopped working on the due date.

Despite reaching out to customer support, he was charged late fees immediately, and the support was unhelpful.

Many users overlook how critical app reliability is when dealing with financial services.

A single technical glitch can trigger automated penalties or additional fees. Always check if the platform has robust customer support, fallback options, or ways to report system failures.

Even small failures in automation can lead to significant financial consequences.

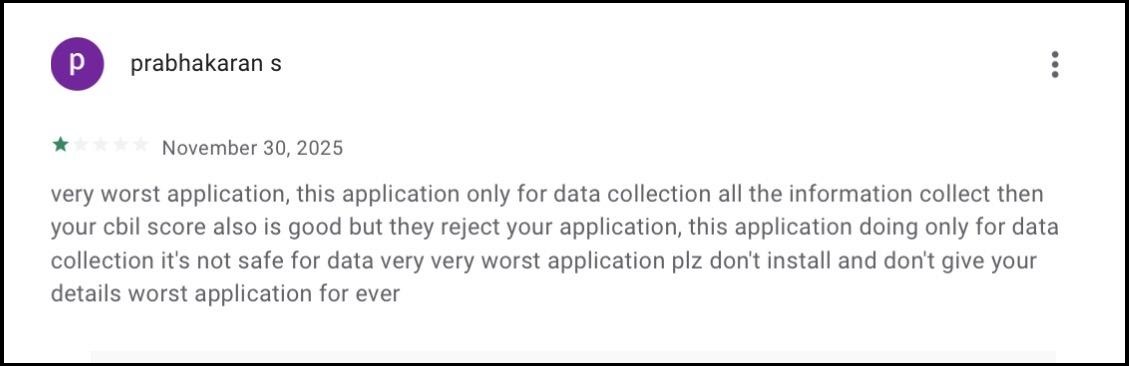

Complaint 2: Data Collection Only, Applications Rejected

Prabhakaran points out that the app collects personal information but often rejects applications, making it unsafe.

Data privacy is a huge concern.

Many users ignore the risk of sharing sensitive details like PAN, Aadhaar, and income information with platforms that might not have secure processes.

Before providing personal details, verify the platform’s data protection policies and whether it has credible regulatory oversight.

Misuse of personal data can lead to identity theft, even if you never take out a loan.

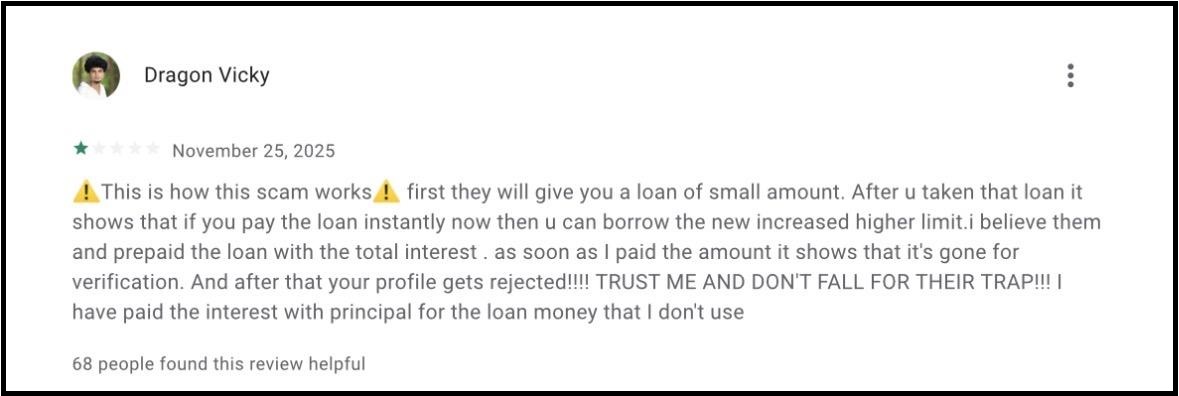

Complaint 3: Small Loan Trap & Rejected Profile

Another victim explains a trap where a small initial loan is given, but after repayment, higher amounts are offered.

The borrower pays interest upfront, and the profile is then rejected, leaving them with losses.

This is a classic psychological trap. Borrowers often focus on “small initial loans” and ignore the risk of prepayment or hidden interest clauses.

Users should carefully read all terms, including repayment structures and rejection criteria, before accepting any loan.

Early repayments do not always protect you if the platform’s logic can block future transactions.

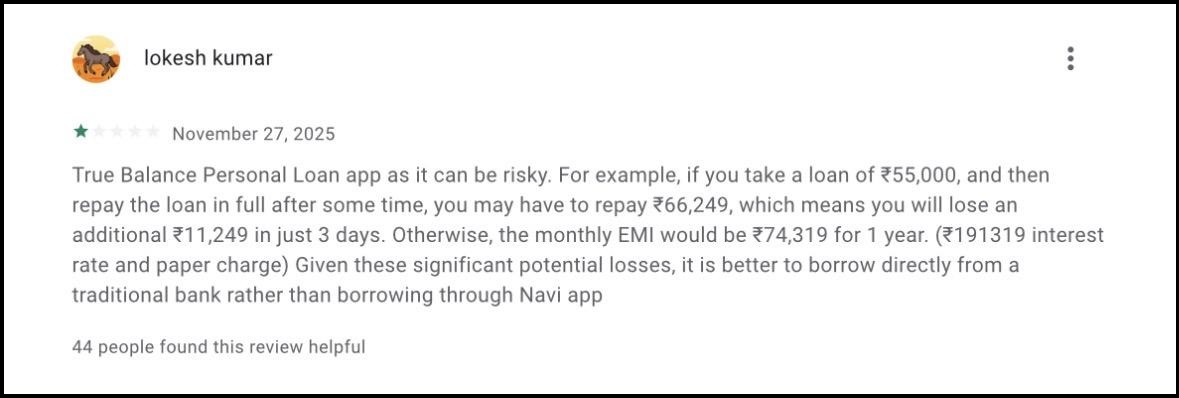

Complaint 4: Risk of Overpayment & High Interest

Lokesh Kumar warns that the app can overcharge, with interest and penalties quickly ballooning a ₹55,000 loan into more than ₹66,000 in just 3 days.

Many borrowers underestimate cumulative interest and hidden charges. Users should always calculate the total repayment under worst-case scenarios and compare it with traditional lenders.

Quick loans might look attractive, but they can create debt spirals. Monitoring the fine print is crucial before tapping “accept” on any loan offer.

How to Report Loan Frauds in India?

If you have been a victim of the True Balance Loan app or a similar app, you can still get your money back. All you need to do is:

- Collect all the evidence, such as screenshots, transactions, calls and other related information.

- Alert your Bank to freeze cards and accounts and block all the transactions.

- You can visit a cybercrime portal and file a cyber crime complaint there or visit your local police station with evidence.

- You can visit the RBI Sachet portal and report the unethical practices there since it is linked to its NBFC partner.

- Share your issue on a community forum so that other users can be aware of this app.

Need Help?

We understand that it becomes very frustrating when all our hard-earned money just vanishes in seconds. In case you are confused about how to report such loan app scams online, register with us now.

We will guide you with the process and help you in filing your complaint online.

Conclusion

True Balance Loan app might appear shiny on the outside, but it has some real issues that cannot be ignored. It promises quick cash, but the hidden interest rates and high APR rates can empty your pocket easily.

You must calculate total payback, borrow a tiny amount and repay fast. It might be RBI-approved, but it is better to borrow loans from banks or top NBFCs.

Even if an app appears to be legitimate, don’t put your money at risk. Always verify and calculate costs to avoid shocks later.