In recent years, online trading and investment platforms have rapidly grown across India. Many websites now claim to offer AI-based trading bots, crypto management tools, or guaranteed profit schemes.

Among them is Trustigo Technology (trustigo.in ), a platform that promotes itself as an innovative, high-return trading solution.

But before trusting your hard-earned money, it’s important to ask: Is Trustigo really safe and genuine, or just another scam in disguise?

What Is Trustigo Technology?

Trustigo Technology claims to be a smart trading platform that helps users earn profits through automated trading.

The website highlights terms like “algorithmic trading,” “intelligent profit models,” and “guaranteed returns.”

However, when you explore the site deeper, there’s no clear information about who owns the company, where it’s registered, or which financial body regulates its services.

In short, it looks professional on the surface, but lacks the legal backing expected from a legitimate trading company.

Trustigo Modus Operandi

Users online have shared similar stories about how the platform allegedly operates.

Here’s how the pattern usually looks:

- People discover Trustigo through social media ads or Telegram groups.

- The platform promises “guaranteed profits” of 8–10% daily.

- Users are asked to deposit money or pay a subscription fee to start trading.

- For the first few days, small profits might appear to build trust.

- Soon after, withdrawals stop working, and support stops replying.

- Eventually, accounts are blocked or deleted, leaving users with losses.

These are classic signs of a scam operation designed to attract quick deposits and disappear once enough money is collected.

Is Trustigo Technology Registered and Licensed?

A quick background check reveals that Trustigo Technology is not registered with SEBI (Securities and Exchange Board of India) or any recognized financial authority.

It doesn’t appear in the MCA (Ministry of Corporate Affairs) business database either.

That means it operates without regulatory approval, a major red flag for any trading or investment platform.

Real companies display their registration numbers and regulatory certificates clearly, but Trustigo hides this information completely.

Is Trustigo Technology Safe or Not?

If you’ve come across Trustigo Technology and felt tempted by its promises, stop for a moment and take a closer look.

The platform raises several red flags that no smart investor should ignore.

Something feels off?

You’re right.

Here’s what makes Trustigo look unsafe:

- No SEBI or RBI registration: A financial platform operating without any recognized Indian regulatory license is a huge red flag. Legit companies proudly display their registrations; scammy ones hide them.

- No physical address or company verification: If you can’t trace where the company actually exists, imagine trying to chase your money later.

- “Guaranteed daily income” promises: Whenever you see words like guaranteed, fixed daily return, or risk-free earnings, treat it as an alarm bell. Real investments don’t work like that.

- Website filled with vague details and poor grammar: Professional companies invest in clarity. Scams rely on confusion.

- Domain registered only in 2024: New websites with big claims? That’s a classic pattern among short-lived scam platforms that vanish after collecting money.

- No founder identity, no clear support contact: If the people behind the platform remain invisible, your money may disappear the same way.

When a platform hides its identity, skips regulatory approvals, and makes flashy promises, it’s usually because it doesn’t want you to know what’s really happening behind the scenes.

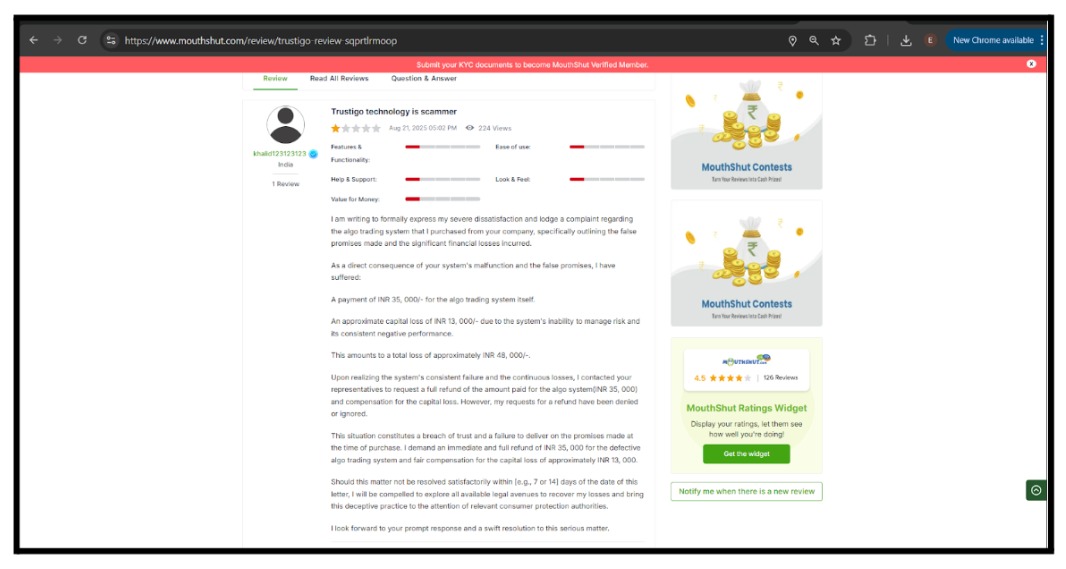

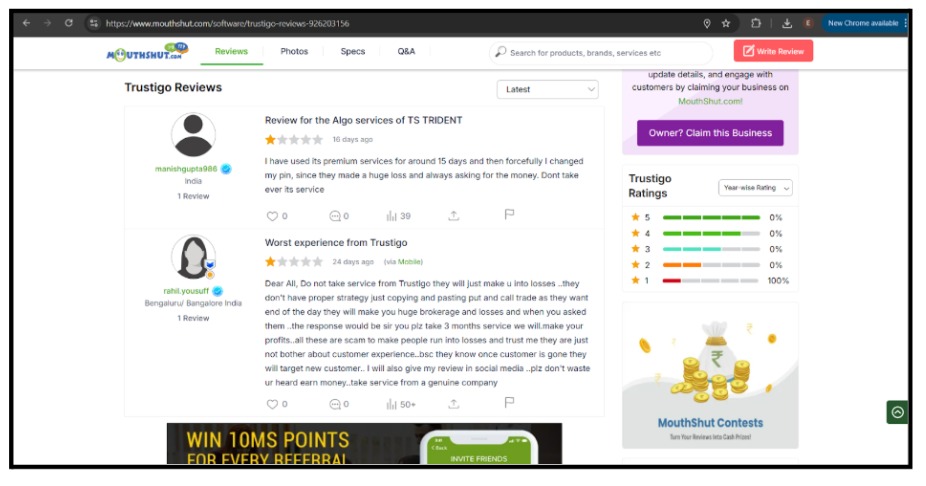

Trustigo Technology Complaints

Several users on scam reporting forums and review sites have complained about Trustigo.

The most common issues include:

- Money is not being credited or refunded.

- No response after investing.

- Blocked Telegram or WhatsApp accounts.

- Fake transaction proofs shared by “agents.”

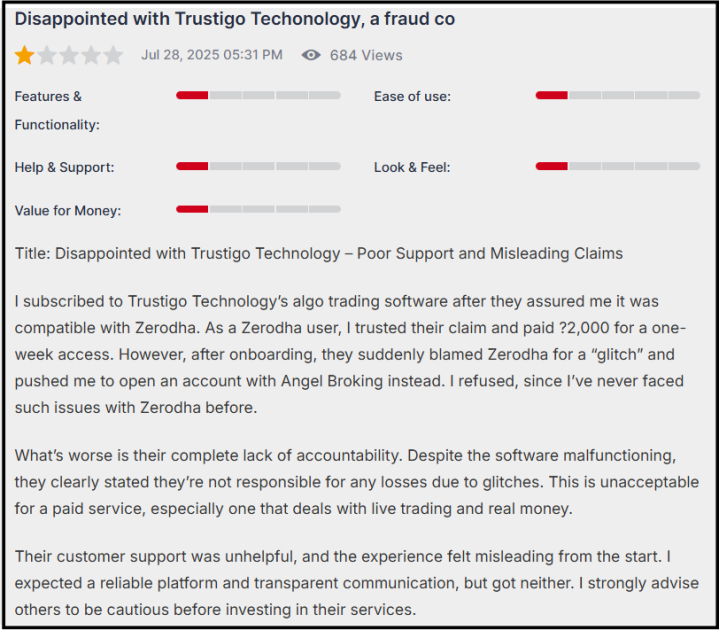

A few victims also claimed they were promised guaranteed returns and mentorship, only to realize later that the entire system was fake.

The review highlights several concerning points consistent with other user complaints.

The user was allegedly assured the algorithmic trading software was compatible with Zerodha, but was later pushed to use a different broker, Angel Broking, after a supposed “glitch”.

Users are strongly advised to be cautious and avoid investing in their services.

How to Report Investment Scams?

If you suspect you’ve been defrauded by Trustigo or a similar platform:

- File a cyber crime complaint.

- Report the incident to your local police station.

- Contact your bank immediately for a chargeback or account freeze

- Gather all screenshots, receipts, and communication for evidence

- Warn others online by posting reviews or reports on scam alert sites

Need Help?

If you want someone to walk you through the entire complaint process, step by step, you can simply register with us.

We help you gather the right evidence, prepare your case, and file official reports through the proper legal channels, so you’re never left guessing what to do next.

Conclusion

Trustigo Technology markets itself as a trading innovation but operates with zero transparency or regulation.

With unrealistic profit claims and user complaints piling up, it shows multiple signs of being a high-risk and potentially fraudulent platform.

Before investing in any online trading website, always verify the registration, read reviews, and never believe in guaranteed profits.

Your awareness is your best protection against online investment scams.