Have you ever spotted a trade in your account that you didn’t actually make? Or noticed your brokerage charges were higher than expected?

If so, don’t brush it off; these could be warning signs of unauthorised trading by your broker or advisor.

Such practices can cause serious financial losses, long disputes, and shake your trust in the market.

With more people entering the stock market every day, staying alert to issues like unauthorised trading is crucial.

Knowing the risks early can help you protect your investments and avoid major financial or legal problems.

Let’s dive deeper to understand what unauthorised trading really is, the risks it carries, and how to spot these illegal practices before it’s too late.

Unauthorised Trading Meaning

Unauthorised trading happens when a stockbroker or advisor makes trades in your account without your permission.

This is a clear violation of SEBI rules.

Yet, many brokers manage to get away with it because most investors aren’t aware of their rights, and they often notice these trades only after losses have already accumulated.

These trades are often executed to generate higher brokerage fees.

Brokers may place positions under the guise of recommendations, which can lead to significant losses.

In these situations, investors typically discover the problem only after a substantial portion of their capital has been lost.

If you have a trading account, it’s crucial to know your rights and understand both legal and illegal practices in the market.

Awareness is the first step to protecting yourself from financial or emotional distress.

SEBI Regulations on Unauthorised Trading

For every market participant, SEBI has stringent rules to prevent fraudulent activities and to protect traders from unauthorized trading practices.

If someone trades in your account without your consent, there are unauthorized trading penalties in place for such actions.

Here are some of the regulations of SEBI related to trade practices that you must be aware of:

- Brokers must obtain written consent before executing trades on a discretionary basis.

- Every trade must be backed by clear communication, such as emails, recorded calls, or written approvals.

- Investors have the right to report unauthorized trades through SEBI’s online grievance redressal system, SCORES.

- Stringent penalties, including hefty fines and license revocations, are imposed on brokers involved in unauthorized trading.

Now, to ensure that your broker does not cheat or commit any kind of fraud by executing unauthorized trades, it is important for you as well to be aware.

Let’s now get into the details of the signs that help you identify such trade practices.

Unauthorised Trading Risk

Unauthorised trading happens when trades are placed in your account without your consent, often leaving you exposed to unexpected losses and regulatory risks.

Knowing the risks helps investors protect their capital and act quickly.

Key risks you should watch for:

- Financial Losses: Trades executed without your knowledge may not align with your strategy or risk tolerance, causing losses that could have been avoided.

- Lack of Accountability: If trades are unauthorised, brokers might not take responsibility for losses or explain the decisions.

- Hidden fees: Extra brokerage or hidden costs can accumulate silently, eating into your returns.

- Emotional Stress: Discovering unexpected losses or account activity can lead to anxiety, poor decision-making, and mistrust in the market.

- Regulatory Violations: Brokers committing unauthorised trades violate SEBI rules, exposing themselves to fines, license suspensions, or legal action.

- Difficulty in Recovery: Without proper documentation, it becomes harder to claim refunds or initiate fraud recovery if the trades are linked to misused advisory models.

Being aware of these risks helps you stay in control. Regularly monitor your account, verify trades, and maintain all communication with your broker in writing.

Unauthorised Trading Complaint

Investors often trust brokers and SEBI-registered research analysts with their hard-earned money, expecting guidance, transparency, and regulated practices.

However, not all trades in your account may be authorised, and unauthorised trading remains a serious risk.

Unauthorised trading can be carried out both by stock brokers and research analysts.

While research analysts provide advice and recommendations, they can sometimes influence decisions that lead to losses. Stock brokers, on the other hand, can engage in unauthorised trading for reasons like generating higher brokerage fees or “churning” client accounts.

We have received multiple complaints relating to such unauthorised trading.

Here are a few notable cases that highlight how these practices occur and why vigilance, documentation, and independent oversight are critical for every investor.

Unauthorised Trading by Stock Broker

These problems happen when brokers put their own profits ahead of the client’s interests, making trades without permission.

Often, they “churn” accounts, placing unnecessary trades just to earn higher commissions, breaching the investor’s trust.

1. Sharekhan Unauthorised Trading

Ravi and Neha (names changed) were active traders with Sharekhan.

One day, while reviewing their account, they noticed Futures & Options trades they didn’t remember placing.

Alarmed, they reached out to the brokerage and filed complaints, hoping for a resolution.

Initially, the arbitration process ruled in their favor, acknowledging the losses from these unapproved trades.

But later, the Bombay High Court overturned the decision, stating that procedural lapses alone don’t automatically prove unauthorized trading if strong evidence is lacking.

2. Profitmart Securities Unauthorised Trading

In the Profitmart Securities complaint, an investor believed he could turn a small sum into much larger profits after aggressive promises from the broker.

After paying nearly ₹47,000 in service costs and another ₹5,000 upfront, he funded his trading account.

But things turned south when trades far larger and riskier than what he understood were placed without proper consent.

Instead of steady gains, his account suffered significant losses, leading to frustrations and doubts about transparency and whether the broker followed basic regulatory expectations.

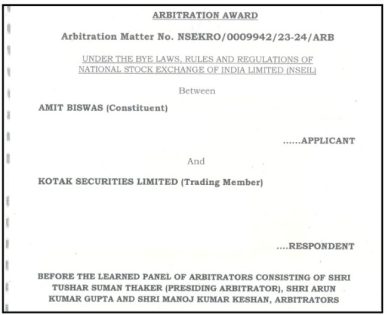

3. Kotak Securities Unauthorised Trading

In 2018, a trader named Aman (name changed) decided to restructure his trading setup with Kotak Securities, trusting promises of active support, margin assistance, and controlled risk.

He initially invested ₹7–9 lakh and moved most of his shares into a Demat account managed by the brokerage, believing trades would only happen with his permission.

But over time, Aman noticed trades happening without proper approvals. His account suffered massive losses, totaling ₹1.45 crore.

Complicating matters, liens were placed on his securities, account access was restricted, and certain shares and capital gains bonds weren’t released, even when court orders demanded it.

During arbitration, the case revealed multiple violations: trades executed without written permission, questionable use of Power of Attorney, and advisory calls that influenced decisions without proper documentation.

Despite the evidence, the arbitration concluded without any financial recovery.

At this point, many users wonder: what to do if your broker trades without permission?

The key is to act quickly and report the trades.

Unauthorised Trading by SEBI Registered Advisories

Even if an advisory is officially registered, some use their credentials to promote risky strategies or promise “guaranteed” returns, which goes against SEBI’s rules.

They often pressure investors into decisions, creating stress and fear of missing out, which can quickly eat into your money while making it seem like professional guidance.

1. Wealth Trade Research

An inexperienced investor was approached by Wealth Trade Research, represented by Shailender and Ujjwal.

Tempted by promises of “guaranteed returns,” the investor started with ₹20,000.

Persistent WhatsApp calls pressured him to deposit more funds. Trades were suggested without stop-loss strategies or risk management, and the investor suffered nearly ₹1 lakh in losses.

The case highlights red flags: informal communication channels, misleading profit claims, and advice given without proper risk profiling.

The representatives appear to have misused the firm’s SEBI registration, offering unregistered investment advice.

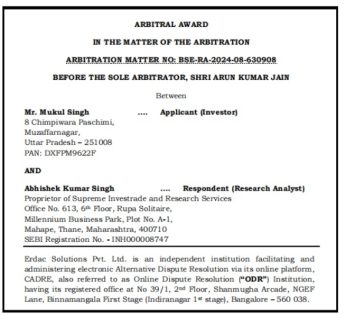

2. Supreme Investrade

An investor, Mukul Singh, paid ₹70,000 to Supreme Investrade, trusting their SEBI registration. When his trade started losing, the firm advised him to hold the position instead of exiting early.

The losses grew to ₹40,000, despite his intention to limit risk.

Arbitration found that the advice contributed to additional losses and awarded Mukul ₹25,000 compensation.

Ultimately, these stories serve as a clear warning: even trusted brokers and SEBI-registered research analysts can be involved in unauthorised trading.

Staying alert, keeping detailed records, and making independent decisions are your best defenses to protect your investments and avoid unexpected financial losses.

How to Identify Unauthorised Trading in Your Account?

As a beginner, it could be difficult to understand trading accounts and other activities related to them, but by just checking a few things, you can protect yourself from getting scammed.

Here are some of the signs that make it easier for you to catch unauthorised trading:

- Receiving an SMS or email about a trade you have not executed.

- A significant shift is in the funds available in the trading account.

- Lack of communication from the broker side or vague justifications for trading activities in your account.

How to Prevent Yourself from Unauthorised Trading?

There is an old saying that prevention is better than a cure, and hence, little alertness and awareness can prevent you from facing bigger consequences.

Here are the ways to prevent yourself from unauthorised trading:

- Regularly monitor the ledger statements of your trading account.

- Use secure trading platforms and enable two-factor authentication.

- Maintain written communication via email or recorded messages for every trade approval.

- Choose SEBI-registered brokers with a strong compliance record.

How to File a Complaint Against Unauthorised Trading?

If you’ve noticed any unauthorized trades or suspicious activity in your trading account, it’s important to act promptly.

Gather all evidence before filing a complaint against such stock market frauds.

You can start by contacting your broker to raise the issue and request a detailed explanation.

If the response is unsatisfactory or you don’t get a reply, take the following steps:

- File a complaint in SCORES: Submit your grievance with supporting documents such as account statements, emails, chat logs, and trade confirmations.

- Monitor SEBI complaint status: Regularly log in to SCORES to track the progress and respond quickly if SEBI requests additional information.

- Keep thorough records: Maintain copies of all communication, receipts, and evidence for future reference or escalation if needed.

Taking prompt and organized action increases the chances of resolving your complaint efficiently.

Need Help?

If you’re still confused or not sure how to proceed, you can register your complaint with us.

Our expert team will guide you step by step, helping you organize evidence, file the grievance properly, and follow up to recover any losses.

Conclusion

Unauthorized trading is a growing concern, and investors must remain cautious to protect their capital.

By staying informed, monitoring accounts, and reporting suspicious activities, retail traders can minimize risks and ensure a safer trading environment.

SEBI’s regulations are in place to curb these malpractices, but investor awareness plays a key role in tackling unauthorized trading effectively.

Have you ever experienced unauthorized trading? If yes, then fill in the details in the form below and let our team help you in getting refund for your losses.