“I just got ₹5,000 cashback from Flipkart! Check this QR code; you might get lucky too!”

It was a message from Rakesh’s college buddy, Rohan. The screenshot showed a successful UPI transaction, complete with a ₹5,000 credit. Tempted, I scanned the QR code.

A few taps later, my phone buzzed, not with a credit, but a debit. ₹10,000 vanished from my account.

Rakesh called Rohan immediately.

“Rohan, did you send me that QR code?”

“What QR code? I haven’t messaged you in weeks.”

That’s when it hit Rakesh, and he realized that he had lost money in the scam.

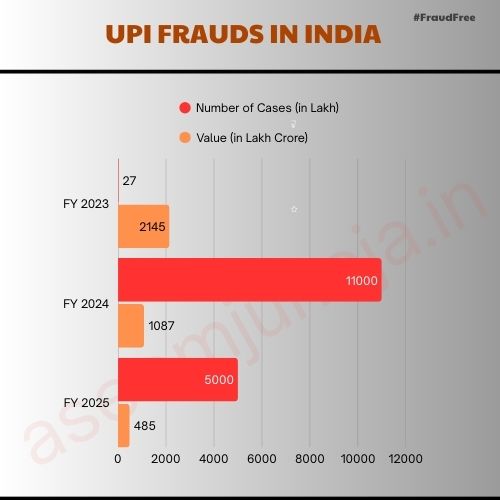

The Alarming Surge in UPI Frauds

India’s digital payment landscape has witnessed explosive growth.

In FY24, UPI processed over 131 billion transactions worth ₹20,00,000 crore.

By September 2024, FY25 had already seen 85.6 billion transactions amounting to ₹12,20,000 crore.

However, this surge has been accompanied by a rise in fraud. Since FY23, Indians have reported 2.7 million UPI fraud cases, resulting in losses of ₹2,145 crore.

In FY24 alone, there were 1.34 million cases with losses totaling ₹1,087 crore. By September 2024, FY25 had already recorded 632,000 incidents, amounting to ₹485 crore in losses.

The Scammer’s Playbook: Tactics and Tricks

Scammers have become increasingly sophisticated, employing various tactics:

- Fake Payment Screenshots: Sending doctored images showing successful transactions to trick victims into believing they’ve received money.

- “Friend in Need” Scams: Impersonating friends or relatives in distress, requesting urgent financial help.

- Malicious QR Codes: Sharing codes that, when scanned, lead to unauthorized debits instead of credits.

- Screen Monitoring Apps: Encouraging users to install apps that record screen activity, capturing sensitive information like UPI PINs.

- Collect Request Frauds: Sending payment requests disguised as refunds or offers, leading victims to authorize payments unknowingly.

Real-Life Victims: Stories Behind the Numbers

45-year-old homemaker from Lucknow received a call from someone claiming to be from her bank, alerting her to unauthorized transactions.

In a panic, she shared her UPI PIN to “secure” her account. Minutes later, ₹25,000 was gone.

On the other side of the country, in Kolkata, a small business owner was lured by an investment scheme promising high returns. After transferring ₹50,000 via UPI, the contact vanished, and the website was taken down.

These stories are not isolated incidents; they represent a growing trend affecting individuals across the country.

High-Profile Case Study of UPI Frauds: The Bajaj Electronics Scam

In September 2024, a gang exploited UPI to defraud Bajaj Electronics, a Hyderabad-based electronics retail chain, of ₹4 crore.

The modus operandi involved visiting showrooms, selecting appliances, and making payments via UPI.

The accomplice, based in Rajasthan, would initiate the payment, and after the goods were delivered, file chargeback complaints, leading to the reversal of funds.

This coordinated effort resulted in significant financial loss for the company.

Why Scammers Succeed: The Underlying Factors

Several factors contribute to the success of these scams:

- Lack of Awareness: Many users are unaware of the various tactics employed by scammers.

- Emotional Manipulation: Scammers often create a sense of urgency or fear, prompting victims to act without thinking.

- Technological Sophistication: The use of advanced technologies, including AI and deepfakes, makes scams more convincing.

- Inadequate Cybersecurity Measures: Some users do not have adequate security measures in place, making them vulnerable.

Staying Safe: Tips for Users

To protect oneself:

- Verify Before Trusting: Always confirm the identity of the person you’re transacting with.

- Guard Personal Information: Never share your UPI PIN, OTPs, or other sensitive details.

- Be Cautious with QR Codes: Only scan codes from trusted sources.

- Report Suspicious Activity: If you suspect fraud, report it immediately to your bank and the cybercrime helpline.

How to Report UPI Frauds?

If you fall victim to a UPI fraud, then act quickly.

Register with us and get assistance in reporting the complaint on the different platforms and guidance in the recovery of losses.

Conclusion

The digital revolution has brought unparalleled convenience, but it also demands heightened awareness.

As we embrace digital payments, staying informed and cautious is our best defense against the ever-evolving tactics of scammers.