Way2Wealth is a name that often comes up in conversations that start similarly:

“I was just trying to learn trading.”

“someone added me to a group,” or

“They said profits were guaranteed if I followed their calls.”

Because the brand sounds established and professional, many investors are left unsure whether they are dealing with an official service of Way2Wealth and is their services are completely legit & safe.

If you’re feeling confused, you’re not alone.

This blog breaks down what investors should verify, explains recent regulatory actions involving Way2Wealth, and outlines practical steps to take if you face issues or suspect misconduct.

Way2Wealth Review

Way2Wealth Brokers Pvt. Ltd. is a registered brokerage firm operating in India’s securities market and is subject to regulatory oversight by SEBI and stock exchanges.

Based on publicly available exchange data, the firm’s client base and complaint statistics over recent financial years are as follows:

| Financial Year | Number of Active Clients | Complaints Registered | % of Complaints w.r.t active clients |

| 2021-22 | 28024 | 7 | 0.02% |

| 2022-23 | 25086 | 9 | 0.03% |

| 2023-24 | 25086 | 1 | 0 |

| 2025-26 | 22785 | 5 | 0.02% |

Overall, the number of complaints remains low in proportion to the active client base. The complaints recorded during these periods were largely service-related, including:

- Excess brokerage charges

- Non-execution of orders

- Incorrect execution of orders

- System or technical issues

- Other general service-related concerns

Such issues are commonly observed across brokerage platforms and typically relate to operational execution, communication gaps, or system performance rather than allegations of market manipulation.

Now, when it comes to the management of Way2Wealth, its operations are supported by experienced professionals handling key functions such as risk management, operational controls, due diligence, and process compliance.

Sandhya Vadiraja is a senior financial services professional based in Bengaluru and has been associated with Way2Wealth Brokers Pvt. Ltd. since 2017.

Over the years, she has held leadership roles, including Assistant Vice President – Operations, Vice President – Operations, and currently serves as Senior Manager.

Her work focuses on operational management, risk oversight, and internal controls, areas that play a critical role in brokerage compliance and investor protection.

SEBI Orders Against Way2Wealth

SEBI is India’s capital markets watchdog, and its orders help investors understand how brokers and intermediaries are expected to operate.

It keeps a check on them regularly so that investors like you can be protected.

SEBI has filed some orders against Way2Wealth:

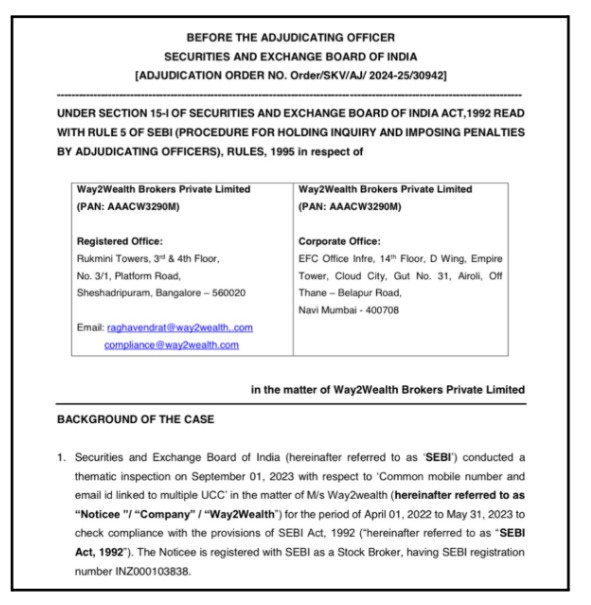

SEBI Order 1: SEBI Inspected Way2Wealth for Client Contact & Trade Records

This order was about SEBI checking whether Way2Wealth followed proper client-KYC and trade-confirmation rules, and in the end, SEBI did not prove the violations, so the case was disposed of (closed) without penalty.

What was the order?

- SEBI passed an Adjudication Order after a thematic inspection (focused check) for the period April 1, 2022, to May 31, 2023.

- The inspection mainly looked at issues like:

- Same mobile/email linked to multiple client codes without proper consent

- Mismatches in client contact details

- Missing running-account settlement preference

- If pre-order evidence captured the price/market-rate properly.

What SEBI did?

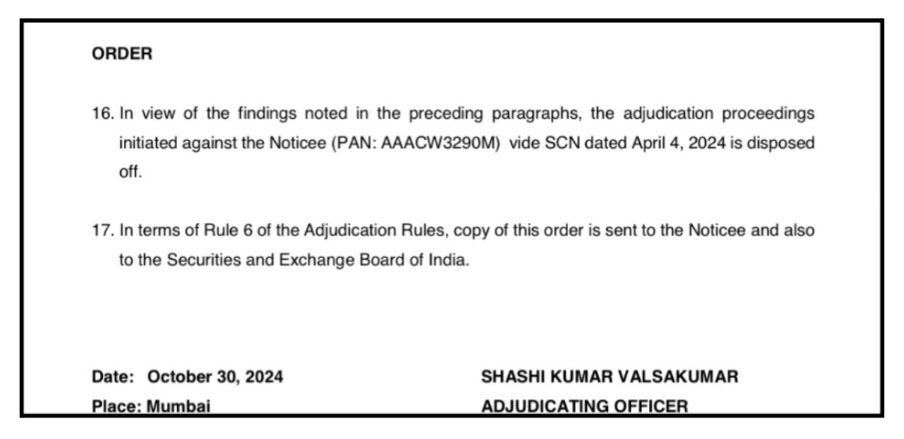

SEBI issued a Show Cause Notice (SCN) and gave Way2Wealth a hearing, then evaluated documents like KYC forms, audit logs, consent letters, and order evidence.

On each allegation, SEBI accepted Way2Wealth’s explanations/documents and concluded the violations were not proved (including on the pre-order confirmation issue).

SEBI formally closed the proceedings initiated through the SCN dated April 4, 2024, via the order dated October 30, 2024.

How does it affect an investor?

- There is no punishment or restriction in this order, so customers shouldn’t assume SEBI found fraud here. SEBI closed the case because it couldn’t establish the violations.

- The order still highlights why investors should insist on proper records (correct KYC details, correct phone/email, and clear order confirmations), because such gaps can create disputes later.

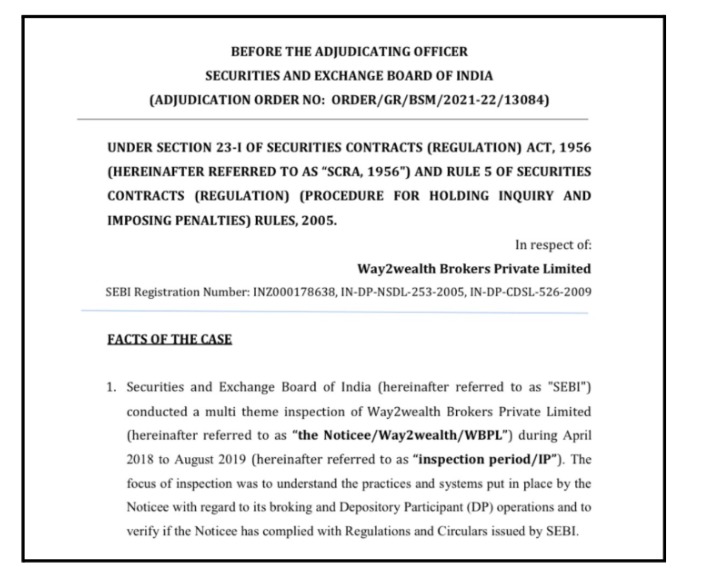

SEBI Order 2: INR 3,00,000 Penalty on Way2Wealth

This order was about a serious compliance issue. SEBI concluded that Way2Wealth misutilised funds of “credit balance” clients (clients who had money lying with the broker) and imposed a monetary penalty.

What was the order?

SEBI passed an Adjudication Order based on a multi-theme inspection covering April 2018 to August 2019 (broking + DP operations). Way2Wealth used money from some clients to meet obligations of other clients and/or for its own purposes, and also used client funds toward proprietary margin obligations.

What SEBI did?

SEBI analysed bank balances, collateral, and client ledger balances across sample days to check whether client money was properly segregated.

SEBI imposed a penalty of Rs. 3,00,000 and instructed payment within 45 days, warning of recovery action if unpaid.

How does it affect an investor?

The biggest investor takeaway: if a broker uses one client’s money for another client (or for itself), it increases risk, especially during market stress, when withdrawals/pay-outs may get delayed.

This order is a reminder for investors to keep limited idle balances with brokers and to monitor ledger statements, payouts, and settlement practices closely.

It also signals that SEBI treats client fund segregation as a serious rule, and violations can lead to enforcement action and penalties.

What to Do If You Have an Issue with Stock Broker?

If you’re facing issues with your broker and don’t know where to begin, you can register with us, and we’ll guide you through every step of the process.

Here’s what we specifically help you with:

- Documentation Assistance

We help you gather, organise, and structure all the necessary documents, trade statements, ledger reports, contract notes, call logs, screenshots, and emails, so your case is backed with solid evidence. - Drafting Your Complaint

Our team prepares clear, well-formatted complaint drafts that fit the exact requirements of NSE, BSE, SEBI SCORES, and SMART ODR.

This ensures your complaint is understood properly and not rejected due to formatting issues. - Platform Filing Support

Whether it’s SCORES or SMART ODR, we guide you through the submission process and ensure every detail is filled in correctly to avoid delays. - Escalation Guidance

If your complaint needs to be escalated beyond the broker, we show you the right path, whether it’s going to the exchange or preparing for the next stage. - Case Management from Start to Finish

Once you’re registered with us, we track your case, remind you of deadlines, and help you respond to any queries asked by regulators or exchanges. - Support During Counselling & Arbitration

If your case moves to counselling or arbitration, we assist you in preparing your statements and documents so you feel confident and ready.

By registering with us, you don’t have to struggle with complicated procedures, drafting confusion, or paperwork stress.

We make the process smoother, clearer, and faster, so you can focus on recovery while we handle the technical work.

Conclusion

SEBI’s actions against financial intermediaries are not random-they are meant to protect investors and ensure transparency.

Cases involving Way2Wealth highlight why compliance, due diligence, and ethical conduct are non-negotiable in the securities market.

Before investing or trading, check registrations, understand products clearly, and never ignore red flags.

In the trade market, informed decisions are your strongest protection.